May 26 Stock Market Update: Dow, S&P 500, And Nasdaq

Table of Contents

Dow Jones Industrial Average Performance on May 26th

The Dow Jones Industrial Average (DJIA) experienced a mixed day on May 26th, ultimately closing slightly lower than its opening value. Let's break down the key aspects of its performance:

-

Daily Performance: The Dow opened at [Insert Opening Value], experienced fluctuations throughout the day, and closed at [Insert Closing Value], representing a [Insert Percentage Change]% decrease. This demonstrates a degree of market fluctuation and stock market volatility.

-

Key Movers: Several Dow components experienced significant price swings. For example, [Company Name] saw a [Percentage Change]% [Gain/Loss] due to [Reason, e.g., strong earnings report, positive industry outlook]. Conversely, [Company Name] experienced a [Percentage Change]% [Gain/Loss] following [Reason, e.g., disappointing earnings, negative regulatory news]. These individual stock movements contributed to the overall index performance and showcased considerable market volatility.

-

Sectoral Performance: The energy sector showed relative strength, while the technology sector lagged, reflecting broader market trends. Financial stocks also saw mixed performance, influenced by interest rate speculation. Understanding sectoral performance is crucial for analyzing the overall market sentiment and assessing investment strategies.

-

Technical Analysis (Optional): The Dow's 50-day moving average remained [above/below] the closing price, suggesting [bullish/bearish] momentum. The Relative Strength Index (RSI) closed at [Value], indicating [oversold/overbought] conditions. (Note: This section requires specific technical data.)

S&P 500 Index: A May 26th Market Overview

The S&P 500, a broader representation of the U.S. stock market, mirrored the Dow's volatility on May 26th, although its overall movement differed slightly.

-

Daily Performance: The S&P 500 opened at [Insert Opening Value] and closed at [Insert Closing Value], representing a [Insert Percentage Change]% [Gain/Loss]. This reflects the broader market sentiment and the overall level of stock market volatility.

-

Broader Market Trends: The S&P 500's performance underscored a general sense of uncertainty in the market. Concerns about inflation, potential interest rate hikes, and global economic growth contributed to this market fluctuation.

-

Comparison with Dow Performance: While both indices experienced volatility, the S&P 500's [Gain/Loss] was [smaller/larger] than the Dow's, indicating [divergence/convergence] in their underlying components' performances. This difference highlights the nuances of index composition and weighting.

-

Impact of Economic Indicators: The release of [Specific Economic Data, e.g., consumer confidence index, inflation figures] influenced the S&P 500's movement. [Explain the specific impact of the data release, tying it to market reactions].

Nasdaq Composite: Technology Sector Influence on May 26th

The Nasdaq Composite, heavily weighted towards technology stocks, experienced a more pronounced decline on May 26th, reflecting concerns within the tech sector.

-

Daily Performance: The Nasdaq opened at [Insert Opening Value] and closed at [Insert Closing Value], representing a [Insert Percentage Change]% [Gain/Loss]. The significant negative movement points to considerable market fluctuations in this sector.

-

Technology Sector Trends: The tech sector's performance was significantly impacted by [Specific Factors, e.g., concerns about slowing growth, profit-taking]. This showcases how specific sectors can drive overall market movements and contribute to stock market volatility.

-

Key Technology Stocks: [Company Name] and [Company Name] experienced significant price drops, contributing to the Nasdaq's overall decline. These movements underscore the impact of individual company performance on the overall index.

-

Investor Sentiment: Investor sentiment towards the tech sector on May 26th was generally [bullish/bearish], reflecting concerns about [Specific Concerns, e.g., valuation, future growth prospects]. This sentiment is reflected in the overall index performance and the level of market fluctuation.

Conclusion: Understanding the May 26 Stock Market Update: Dow, S&P 500, and Nasdaq

May 26th presented a day of mixed results for major U.S. stock market indices. While the Dow and S&P 500 experienced relatively moderate fluctuations, the Nasdaq saw a more significant decline, largely driven by sector-specific concerns. The overall market volatility was influenced by various factors, including economic data releases and broader market sentiment. Understanding these nuances is crucial for investors to make informed decisions. The fluctuations observed highlight the importance of ongoing market monitoring and diversification. Stay updated on the latest market news and learn more about Dow, S&P 500, and Nasdaq performance by following our daily stock market updates. Understanding market volatility is key to successful investing.

Featured Posts

-

Hulu Alien Franchise The Best And Worst Films To Stream

May 27, 2025

Hulu Alien Franchise The Best And Worst Films To Stream

May 27, 2025 -

Alien Invasion Earths Survival In Question

May 27, 2025

Alien Invasion Earths Survival In Question

May 27, 2025 -

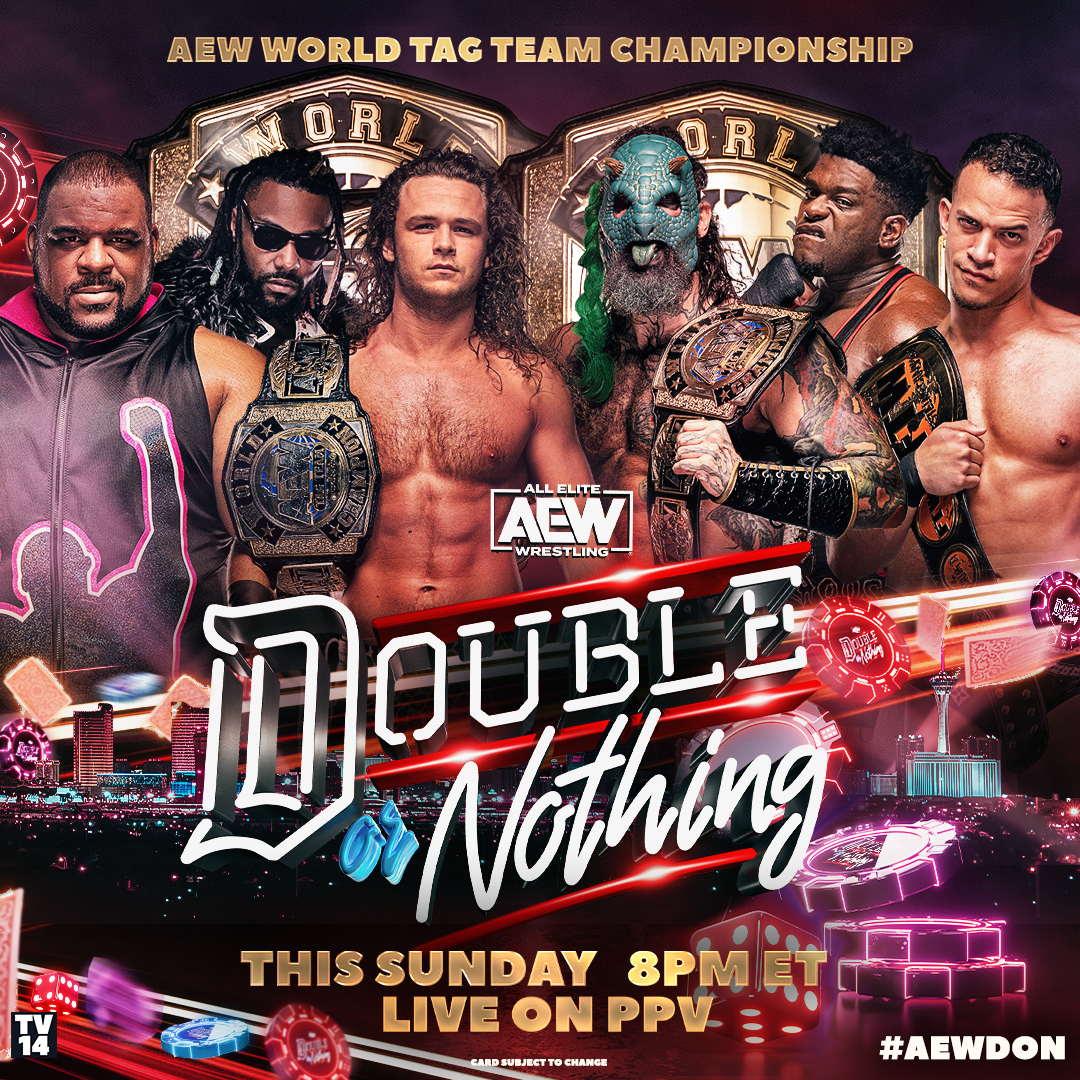

Aew Double Or Nothing 2025 Everything You Need To Know

May 27, 2025

Aew Double Or Nothing 2025 Everything You Need To Know

May 27, 2025 -

The Knives Out Franchise Beyond Daniel Craigs Involvement

May 27, 2025

The Knives Out Franchise Beyond Daniel Craigs Involvement

May 27, 2025 -

Super Bowl Snub Kanye West Blames Taylor Swift

May 27, 2025

Super Bowl Snub Kanye West Blames Taylor Swift

May 27, 2025