May 5th Stock Market Report: Dow Jones, S&P 500 Analysis

Table of Contents

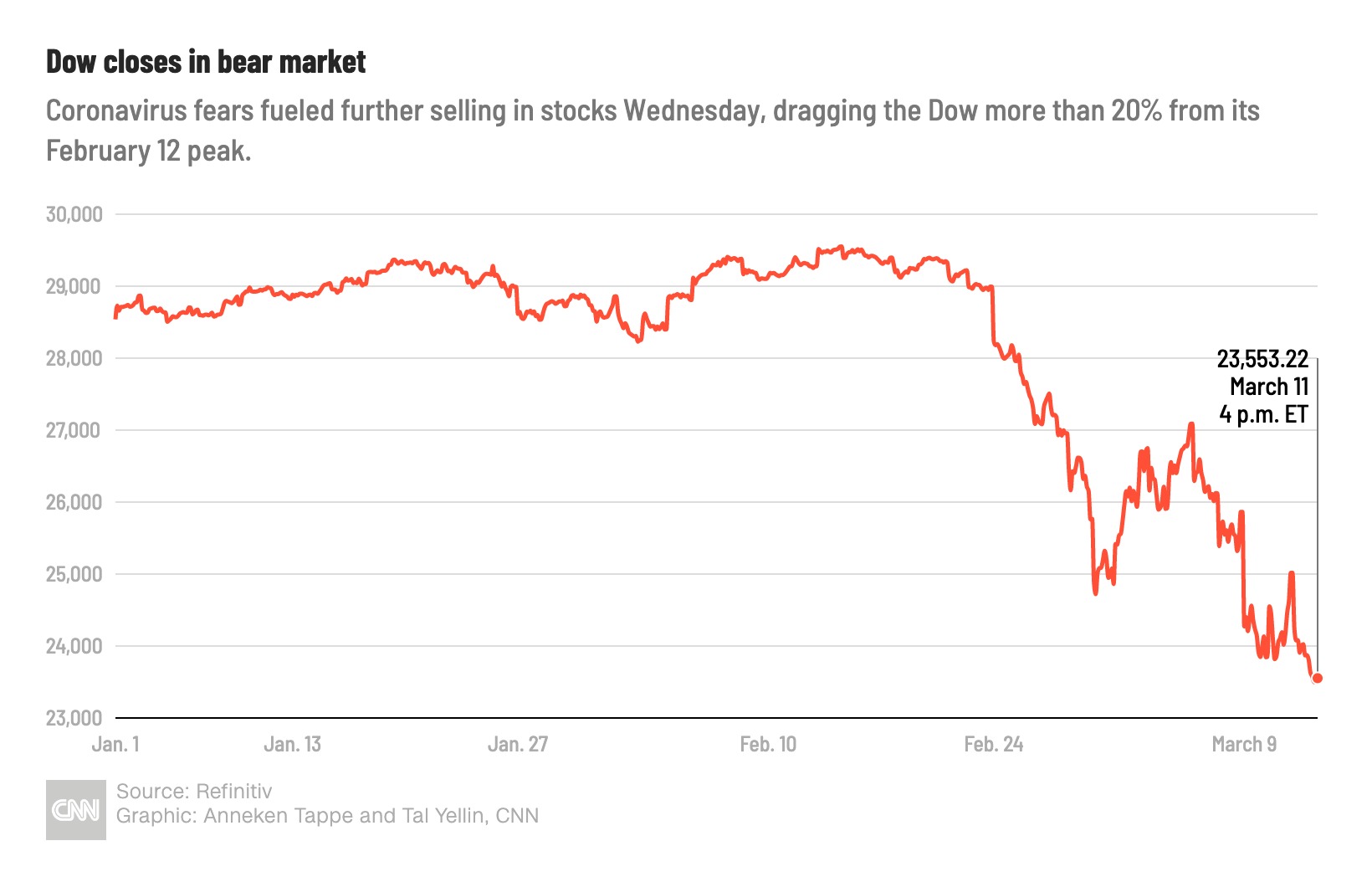

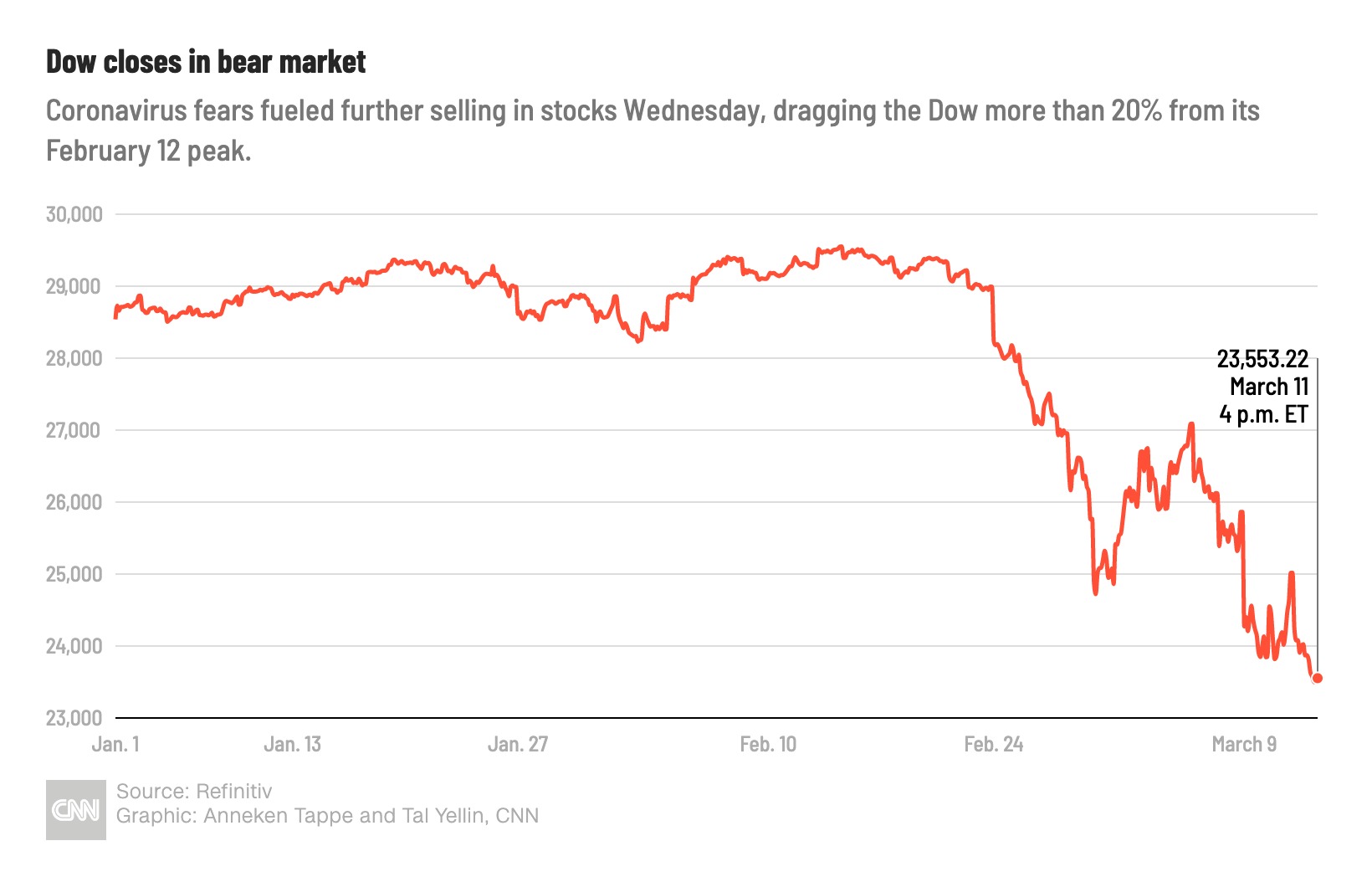

Dow Jones Industrial Average Performance on May 5th

Opening and Closing Prices:

The Dow Jones Industrial Average (DJIA) opened at 33,820.50. Despite some initial gains, it experienced a steady decline throughout the day, closing at 33,677.27. This represents a decrease of 143.23 points, or approximately 0.42%.

Intraday Volatility:

The Dow Jones saw considerable intraday volatility. After a relatively flat morning, it reached an intraday high of 33,902.15 around midday. However, the release of the inflation data triggered a sharp downturn, leading to an intraday low of 33,650.88 before recovering slightly by the closing bell.

- Potential Causes:

- Higher-than-expected inflation figures impacting investor confidence.

- Concerns about potential interest rate hikes by the Federal Reserve.

- Negative sentiment surrounding certain technology stocks.

Key Sectors Driving Performance:

The technology and financial sectors were the primary drivers of the Dow's negative performance. Concerns about rising interest rates negatively impacted financial stocks, while technology companies faced selling pressure due to ongoing worries about valuation.

- Specific Examples:

- Apple (AAPL) experienced a slight decrease, contributing to the tech sector's decline.

- JPMorgan Chase (JPM) and Bank of America (BAC) saw significant drops, reflecting the broader financial sector weakness.

S&P 500 Index Performance on May 5th

Opening and Closing Prices:

The S&P 500 opened at 4141.50 and closed at 4115.77, a decrease of 25.73 points or approximately 0.62%.

Intraday Volatility:

Similar to the Dow Jones, the S&P 500 showed significant intraday volatility, reaching a high of 4153.20 and a low of 4110.95. The afternoon downturn mirrored the Dow's trajectory.

- Correlation with Dow Jones: The S&P 500 mirrored the Dow's downward trend, indicating a broad market reaction to the economic news.

Sectoral Analysis:

The S&P 500's decline was also heavily influenced by the technology and financial sectors, reflecting a similar pattern to the Dow Jones. However, the energy sector showed some resilience due to ongoing high oil prices.

- Specific Examples:

- Microsoft (MSFT) and Alphabet (GOOGL) experienced moderate decreases, adding to the tech sector's weakness within the S&P 500.

- Energy companies like ExxonMobil (XOM) and Chevron (CVX) performed relatively well, offering some counterbalance.

Comparison of Dow Jones and S&P 500 Performance

Correlation and Divergence:

The Dow Jones and S&P 500 exhibited a strong correlation on May 5th, both experiencing significant declines driven by the same market forces, primarily the inflation data release.

Overall Market Sentiment:

The overall market sentiment on May 5th was predominantly negative, reflecting concern over inflation and the potential for tighter monetary policy. High trading volume further underscored the market's heightened volatility and uncertainty.

- Market Indicators: High trading volume, decreased investor confidence, and negative investor sentiment on social media platforms all contributed to a negative market sentiment.

Factors Influencing Market Movement on May 5th

Economic News and Data:

The unexpected surge in inflation data significantly impacted market sentiment, triggering widespread selling. Investors reacted negatively to the implications for interest rates and economic growth.

Geopolitical Events:

No major geopolitical events significantly impacted the market on May 5th.

Company-Specific News:

No single company's news dominated the market's performance on May 5th. The overall market reaction was largely driven by the macroeconomic factors.

Conclusion: May 5th Stock Market Recap: Dow Jones and S&P 500 Analysis

The May 5th Stock Market Report reveals a predominantly negative day for both the Dow Jones and S&P 500, largely driven by unexpectedly high inflation data and subsequent concerns about rising interest rates. The strong negative correlation between the two major indices highlights a broad market reaction to macroeconomic factors rather than sector-specific events. The overall market sentiment was bearish, reflecting investor uncertainty. In the coming days, investors will likely be closely watching further economic data releases and the Federal Reserve's statements for clues regarding future monetary policy. Stay updated with our daily stock market reports to stay ahead of the curve and follow our analysis of the Dow Jones and S&P 500 for insightful market commentary. Get tomorrow's May 6th Stock Market Report here! (link to relevant page)

Featured Posts

-

Diana Ross Live At The Royal Albert Hall 1973 A Concert For The Ages

May 06, 2025

Diana Ross Live At The Royal Albert Hall 1973 A Concert For The Ages

May 06, 2025 -

How To Get Sabrina Carpenter In Fortnite

May 06, 2025

How To Get Sabrina Carpenter In Fortnite

May 06, 2025 -

Celtics Vs Suns April 4th Where To Watch And Listen

May 06, 2025

Celtics Vs Suns April 4th Where To Watch And Listen

May 06, 2025 -

2025 Met Gala Confirmed Celebrities And Expected Guests

May 06, 2025

2025 Met Gala Confirmed Celebrities And Expected Guests

May 06, 2025 -

Hollywood Walk Of Fame Mindy Kalings Stylish Peplum Choice

May 06, 2025

Hollywood Walk Of Fame Mindy Kalings Stylish Peplum Choice

May 06, 2025