Meta Faces FTC: A Deep Dive Into The Instagram And WhatsApp Antitrust Case

Table of Contents

The FTC's Allegations Against Meta

The FTC's core argument centers on the assertion that Meta illegally maintained its monopoly power through anti-competitive acquisitions of Instagram and WhatsApp. They contend that these acquisitions weren't about innovation or synergy, but rather about eliminating potential rivals and solidifying Meta's dominance in the social media landscape. This alleged strategy stifled competition, limiting consumer choice and hindering innovation within the sector.

The Instagram Acquisition (2012)

Meta acquired Instagram in 2012 for a reported $1 billion. At the time, Instagram was a rapidly growing photo-sharing platform, posing a potential threat to Facebook's market share. The FTC argues that Meta's acquisition was a strategic move to neutralize this emerging competitor before it could gain significant traction.

- Key evidence cited by the FTC: Internal emails suggesting a proactive strategy to acquire potential competitors, market analysis demonstrating Instagram's rapid growth, and expert testimony highlighting the competitive threat Instagram posed.

The WhatsApp Acquisition (2014)

Similarly, the FTC alleges that Meta's $19 billion acquisition of WhatsApp in 2014 served the same anti-competitive purpose. WhatsApp, with its massive user base and secure messaging features, was another potential threat to Facebook's dominance. The FTC argues that this acquisition further cemented Meta's monopoly position.

- Key evidence cited by the FTC: Similar to the Instagram case, the FTC points to internal communications, market analyses, and expert testimony to support their claims of anti-competitive behavior. The sheer size of the acquisition is also highlighted as evidence of Meta’s intent to eliminate a significant competitor.

The Impact on Competition

The FTC argues that these acquisitions significantly stifled competition in the social media market. By eliminating potential rivals, Meta allegedly created a near-monopoly, limiting consumer choice and innovation. The lack of strong viable alternatives, according to the FTC, allowed Meta to control a vast majority of the market share and operate without the pressure of significant competition. This, they argue, negatively impacts user experience, data privacy, and overall industry growth.

Meta's Defense Strategy

Meta vehemently denies the FTC's allegations, arguing that the acquisitions of Instagram and WhatsApp were pro-competitive moves that fostered innovation and benefited users. Their defense strategy rests on several key arguments.

Arguments of Synergies and Innovation

Meta claims that integrating Instagram and WhatsApp with Facebook resulted in significant synergies and innovations. They point to the cross-platform features, increased user engagement, and improved user experience as evidence of the benefits. Examples include the ability to share content seamlessly across platforms and the integration of messaging functionalities.

Denial of Anti-Competitive Practices

Meta contends that the acquisitions did not eliminate competition. They highlight the continued success and growth of other social media platforms, such as TikTok, Twitter (now X), and Snapchat, as evidence that the market remains competitive. They argue that their success is due to providing better products and services, not through anti-competitive practices.

The Importance of Scale and Investment

Meta emphasizes that its large scale allows for significant investment in research and development, leading to product improvements and enhanced user experiences. They argue that this scale allows them to offer services that smaller competitors couldn't afford to develop, ultimately benefiting consumers.

Potential Outcomes and Implications

The potential outcomes of the Meta/FTC case range from divestiture (forcing Meta to sell Instagram and/or WhatsApp) to substantial fines and other regulatory remedies. The implications are far-reaching.

Impact on Future Acquisitions

The case sets a precedent for future tech acquisitions and mergers. A ruling against Meta could significantly increase regulatory scrutiny of similar acquisitions, potentially slowing down consolidation within the tech industry and impacting future innovation. This could lead to increased regulatory oversight of big tech companies generally.

Effect on Consumers

A forced divestiture could lead to increased competition, potentially benefiting consumers through more choices, better services, and potentially lower prices. However, it could also lead to disruption and potentially negatively impact the user experience in the short term as the platforms adapt to independence.

Global Implications

The case has significant global implications for antitrust enforcement. The outcome could influence how other countries regulate tech giants and approach similar antitrust cases, setting a global standard for managing the power of dominant technology companies.

Conclusion

The Meta/FTC case is a landmark legal battle with far-reaching consequences for the tech industry and consumers worldwide. The FTC's allegations of anti-competitive behavior raise serious questions about the power of tech giants and their impact on market competition. Meta's defense highlights the complexities of innovation, scale, and market dominance in the digital age. The outcome of this case will undoubtedly shape the future of social media and antitrust enforcement for years to come. Stay informed about further developments in this critical case of Meta facing the FTC, and learn more about antitrust law to better understand the evolving landscape of digital competition. Understanding the nuances of Meta's antitrust battle is crucial for anyone interested in the future of technology and its regulation.

Featured Posts

-

Dodgers Roberts Admits Key Hit Altered World Series Outcome

Apr 23, 2025

Dodgers Roberts Admits Key Hit Altered World Series Outcome

Apr 23, 2025 -

Europe Vs Marches Decryptage De L Analyse D Amandine Gerard

Apr 23, 2025

Europe Vs Marches Decryptage De L Analyse D Amandine Gerard

Apr 23, 2025 -

Brewers Record Breaking 9 Steal Game 6 Bases Stolen In The First Inning

Apr 23, 2025

Brewers Record Breaking 9 Steal Game 6 Bases Stolen In The First Inning

Apr 23, 2025 -

High Winds Fuel Power Outages Across Lehigh Valley

Apr 23, 2025

High Winds Fuel Power Outages Across Lehigh Valley

Apr 23, 2025 -

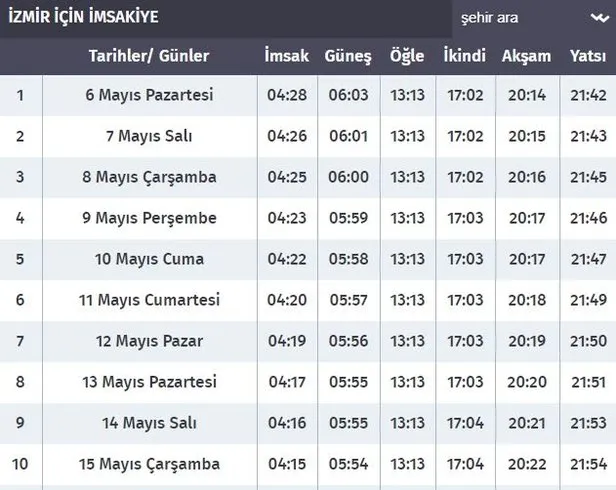

Ankara 10 Mart 2025 Pazartesi Iftar Ve Sahur Saatleri

Apr 23, 2025

Ankara 10 Mart 2025 Pazartesi Iftar Ve Sahur Saatleri

Apr 23, 2025

Latest Posts

-

Who Is Jeanine Pirro Education Net Worth And Professional Achievements

May 10, 2025

Who Is Jeanine Pirro Education Net Worth And Professional Achievements

May 10, 2025 -

Jeanine Pirro Faces Backlash Over El Salvador Prison Transfer And Due Process Comments

May 10, 2025

Jeanine Pirro Faces Backlash Over El Salvador Prison Transfer And Due Process Comments

May 10, 2025 -

Fox News Jeanine Pirro Named Trumps Top D C Prosecutor

May 10, 2025

Fox News Jeanine Pirro Named Trumps Top D C Prosecutor

May 10, 2025 -

Jeanine Pirros Biography Exploring Her Education Wealth And Career

May 10, 2025

Jeanine Pirros Biography Exploring Her Education Wealth And Career

May 10, 2025 -

Jeanine Pirro Trumps Choice For Top D C Prosecutor

May 10, 2025

Jeanine Pirro Trumps Choice For Top D C Prosecutor

May 10, 2025