Meta's Future Under A Trump Administration

Table of Contents

Regulatory Changes and Increased Scrutiny

A Trump administration could significantly alter the regulatory landscape for Meta, leading to increased scrutiny and potential legal challenges.

Section 230 Reform

Section 230 of the Communications Decency Act shields online platforms from liability for user-generated content. A Trump administration has signaled a desire to reform or even repeal this section. This could have profound implications for Meta:

- Increased legal costs: Meta could face a surge in lawsuits related to user-posted content, requiring substantial legal resources for defense.

- Potential for biased content moderation accusations: Decisions about content moderation could become highly politicized, with accusations of bias from both sides of the political spectrum.

- Impact on free speech debates: The debate over Section 230 is deeply intertwined with free speech principles, and any changes could have far-reaching consequences for online discourse.

Data Privacy Legislation

Under a Trump administration, the existing data privacy regulations, or lack thereof, might remain largely unchanged, leading to continued concerns. However, shifts in enforcement priorities or a more relaxed approach could also affect Meta:

- Increased compliance costs: While major changes aren't expected, maintaining compliance with existing regulations, such as those around data breaches and user consent, still demands significant resources.

- Potential fines for data breaches: Even without new laws, stricter enforcement could lead to increased fines for data breaches, impacting Meta's profitability.

- Impact on targeted advertising revenue: While not directly targeting data privacy, changes in enforcement could inadvertently affect Meta's ability to engage in targeted advertising, a core revenue stream.

Antitrust Concerns

Meta's market dominance in social media has already drawn significant antitrust scrutiny. A second Trump term could reignite these concerns, potentially leading to:

- Potential break-up scenarios: The administration could push for a break-up of Meta, forcing the separation of Facebook, Instagram, and WhatsApp.

- Limitations on mergers and acquisitions: Future acquisitions by Meta could face stricter regulatory hurdles, limiting its growth potential.

- Impact on innovation: Increased antitrust scrutiny could stifle innovation within Meta, potentially slowing the development of new products and services.

Political Advertising and Election Integrity

Political advertising and election integrity are crucial areas where a Trump administration's policies could significantly impact Meta's operations.

Campaign Advertising Policies

Meta's policies regarding political advertising would likely face renewed scrutiny under a Trump administration. This could involve:

- Impact on campaign spending: Changes to ad transparency requirements could affect how campaigns allocate their advertising budgets.

- Potential for increased scrutiny of political ads: Increased audits and investigations into the accuracy and targeting of political ads are a strong possibility.

- Challenges in combating disinformation: Combating the spread of disinformation and foreign interference in elections remains a major challenge for Meta, and a Trump administration's approach could impact these efforts.

Election Interference Concerns

A Trump administration might take a different approach to addressing concerns about election interference compared to previous administrations:

- Increased collaboration with law enforcement: Closer collaboration between Meta and law enforcement agencies could lead to increased surveillance and data sharing.

- Potential for stricter content moderation: Pressure to remove content deemed to interfere with elections could lead to stricter content moderation policies.

- Balancing free speech with security: Striking a balance between protecting free speech and ensuring election security will remain a crucial challenge.

Impact on Meta's Stock and Investment

The potential return of a Trump administration could significantly influence investor sentiment and Meta's financial performance.

Investor Sentiment

A Trump presidency could affect investor confidence in Meta's stock in several ways:

- Potential stock price fluctuations: Uncertainty surrounding regulatory changes and political advertising policies could lead to significant stock price volatility.

- Changes in investor risk appetite: Investors may become more risk-averse, leading to a decrease in investment in Meta's stock.

- Impact on long-term investment strategies: Long-term investment strategies could be reassessed based on the perceived risks associated with a Trump administration.

Economic Uncertainty

Broader economic policies under a Trump administration could also impact Meta's financial performance:

- Impact of tax policies: Changes to corporate tax rates could affect Meta's profitability.

- Potential for increased trade tensions: Increased trade tensions could negatively impact Meta's advertising revenue and global operations.

- Effect on advertising revenue: Economic uncertainty could lead to decreased advertising spending, impacting Meta's core revenue stream.

Conclusion

A Trump administration could significantly reshape the landscape for Meta, bringing about considerable changes to regulations, political advertising, data privacy, and antitrust enforcement. The potential impact on Meta's stock price and overall financial health is substantial and uncertain. The company's ability to adapt and navigate these challenges will be critical to its long-term success.

Call to Action: Stay informed about the evolving political climate and its implications for Meta. Understanding Meta's future under a Trump administration is vital for investors, policymakers, and users alike. Continue to follow reputable news sources and analyses to stay abreast of significant developments in this crucial area.

Featured Posts

-

1 1

May 22, 2025

1 1

May 22, 2025 -

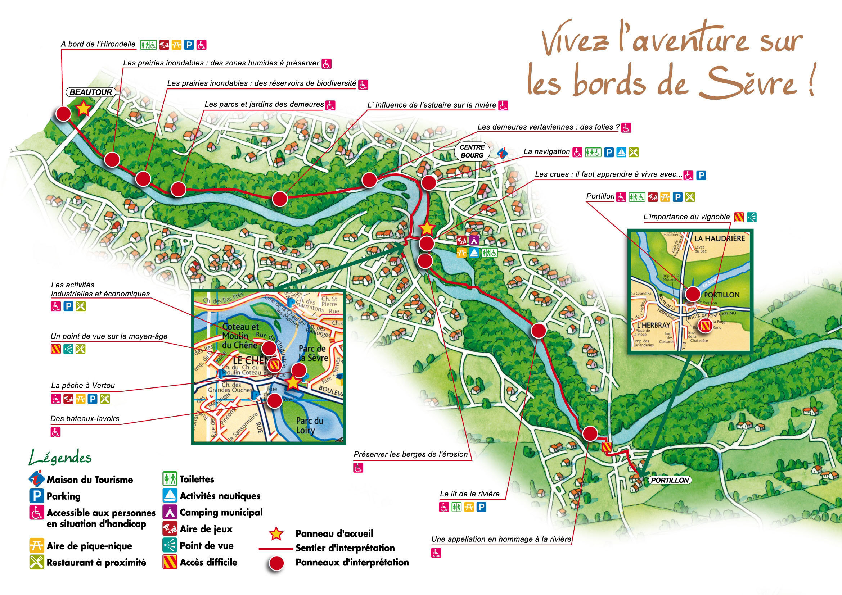

Le Developpement De Clisson A Moncoutant Sur Sevre Une Longue Histoire

May 22, 2025

Le Developpement De Clisson A Moncoutant Sur Sevre Une Longue Histoire

May 22, 2025 -

Significant Gas Price Variation Across Columbus Stations

May 22, 2025

Significant Gas Price Variation Across Columbus Stations

May 22, 2025 -

Tim Hieu Ve Duong Va Cau Noi Binh Duong Tay Ninh

May 22, 2025

Tim Hieu Ve Duong Va Cau Noi Binh Duong Tay Ninh

May 22, 2025 -

Potential Release Date For Dexter Resurrection Trailer Surfaces Online

May 22, 2025

Potential Release Date For Dexter Resurrection Trailer Surfaces Online

May 22, 2025