Microsoft Stock: A Safe Haven Amidst Tariff Turmoil?

Table of Contents

Microsoft's Diversified Revenue Streams

Microsoft's resilience in uncertain times stems largely from its incredibly diversified revenue streams. This diversification significantly reduces its reliance on any single market, making it less susceptible to shocks.

Cloud Computing Dominance (Azure)

Microsoft's Azure cloud platform is a major driver of its growth and stability. Azure consistently demonstrates strong growth, outpacing many competitors and establishing Microsoft as a dominant force in the cloud computing market. This sector is generally considered recession-resistant, as businesses increasingly rely on cloud services regardless of economic conditions.

- Market share statistics: Azure holds a significant and growing share of the public cloud market, consistently challenging Amazon Web Services (AWS) for top position.

- Growth projections: Analysts predict continued substantial growth for Azure in the coming years, fueled by increasing enterprise adoption and expansion into new markets.

- Competitive advantages: Microsoft’s strong enterprise relationships, integration with existing software solutions like Office 365, and robust security features give Azure a significant competitive edge. Related keywords: Azure revenue, cloud computing stocks, Microsoft cloud services.

Office 365 and Productivity Software

The recurring revenue model of Office 365 forms a bedrock of Microsoft's financial stability. The subscription-based nature of this productivity suite provides predictable and consistent income streams, even during economic downturns. The growth in enterprise adoption further solidifies this revenue stream.

- Subscription numbers: Millions of businesses and individuals worldwide subscribe to Office 365, contributing significantly to Microsoft's bottom line.

- Growth in enterprise adoption: Large organizations are increasingly migrating to cloud-based productivity solutions, driving further growth in Office 365 subscriptions.

- Competitive landscape: While competitors exist, Microsoft's brand recognition and market dominance in productivity software give it a lasting competitive advantage. Related keywords: Office 365 subscribers, productivity software market, Microsoft Office.

Gaming (Xbox) and Other Diversified Businesses

Beyond cloud and productivity, Microsoft's revenue streams are diversified across other significant areas. Xbox gaming, LinkedIn professional networking, and other business segments contribute to the company's overall robustness and resilience.

- Xbox sales figures: Xbox continues to be a significant revenue generator, particularly with the growing popularity of gaming and the expansion of Xbox Game Pass.

- Other significant business segments: LinkedIn provides valuable data-driven insights and advertising revenue, further diversifying Microsoft's income streams. Related keywords: Xbox game sales, Microsoft gaming division, diversified revenue streams.

Microsoft's Financial Strength and Stability

Microsoft's financial health is another key factor contributing to its potential as a safe haven investment. Its strong balance sheet and consistent profitability allow it to weather economic storms more effectively than many other companies.

Strong Balance Sheet and Cash Reserves

Microsoft boasts a remarkably strong balance sheet, characterized by substantial cash reserves and low debt levels. This financial fortitude allows the company to navigate economic uncertainties with greater confidence.

- Cash on hand: Microsoft consistently maintains significant cash reserves, providing a financial cushion against unforeseen economic challenges.

- Debt levels: Microsoft's debt levels remain relatively low, minimizing financial risk and enhancing its stability.

- Profitability ratios: Microsoft exhibits consistently strong profitability ratios, indicating healthy financial performance and the ability to generate substantial profits. Related keywords: Microsoft financials, strong balance sheet, financial stability.

Dividend Payments and Share Buybacks

Microsoft's commitment to returning value to shareholders through consistent dividend payments and share buyback programs adds to its appeal as a stable investment.

- Dividend history: Microsoft has a long history of paying dividends, providing a steady stream of income for investors.

- Share buyback program details: Microsoft's share buyback programs demonstrate confidence in the company's future and can increase shareholder value.

- Investor returns: These programs contribute to improved returns for investors, offering both income and potential capital appreciation. Related keywords: Microsoft dividend, share buybacks, return on investment.

Microsoft Stock Performance During Previous Economic Downturns

Analyzing Microsoft's historical stock performance during past economic downturns provides valuable insight into its resilience.

Historical Data Analysis

A review of Microsoft's stock price performance during previous periods of economic uncertainty, including past trade disputes, reveals a relative degree of stability compared to broader market indices.

- Stock price charts: Examining historical stock price charts can illustrate Microsoft's performance relative to market fluctuations.

- Historical performance data: Detailed analysis of historical data shows the company’s resilience during past economic downturns.

- Comparisons to market indices: Comparing Microsoft's performance to broader market indices (like the S&P 500) highlights its relative stability. Related keywords: Microsoft stock history, historical stock performance, economic downturns.

Comparison to Other Tech Giants

Comparing Microsoft's performance during economic downturns to that of other major technology companies further emphasizes its relative stability and potential as a safe haven investment.

- Performance comparisons: Direct comparisons with other tech giants reveal Microsoft's often superior performance during periods of market volatility.

- Risk assessment: Analyzing historical data allows for a more informed risk assessment when considering Microsoft stock as part of an investment portfolio.

- Relative stability: The data suggests a comparatively lower level of volatility for Microsoft compared to some of its tech counterparts. Related keywords: Tech stock comparison, market volatility, safe haven investments.

Conclusion

Microsoft's diversified revenue streams, robust financial position, and relatively stable historical performance during economic downturns suggest its potential as a safe haven investment during times of tariff uncertainty. Its strong position in cloud computing, the recurring revenue model of Office 365, and its overall financial strength contribute to its resilience. Investing in Microsoft stock might be a prudent strategy for those seeking stability in a volatile market. However, remember that Is Microsoft Stock Right for You? is a question best answered after thorough research and consideration of your own personal investment goals and risk tolerance. Conduct thorough research and consult with a financial advisor before making any investment decisions. Considering Investing in Microsoft Stock requires careful planning and understanding of the market. Microsoft Stock: A Safe Bet? The answer depends on your individual circumstances and investment strategy.

Disclaimer: Investing in the stock market involves inherent risks, including the potential for loss of principal. This article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Tampa Bey Vyigryvaet Seriyu U Floridy Blagodarya Kucherovu

May 16, 2025

Tampa Bey Vyigryvaet Seriyu U Floridy Blagodarya Kucherovu

May 16, 2025 -

Belgica 0 1 Portugal Resumen Del Partido Y Mejores Momentos

May 16, 2025

Belgica 0 1 Portugal Resumen Del Partido Y Mejores Momentos

May 16, 2025 -

Resultado Penarol Olimpia 0 2 Resumen Completo Del Partido

May 16, 2025

Resultado Penarol Olimpia 0 2 Resumen Completo Del Partido

May 16, 2025 -

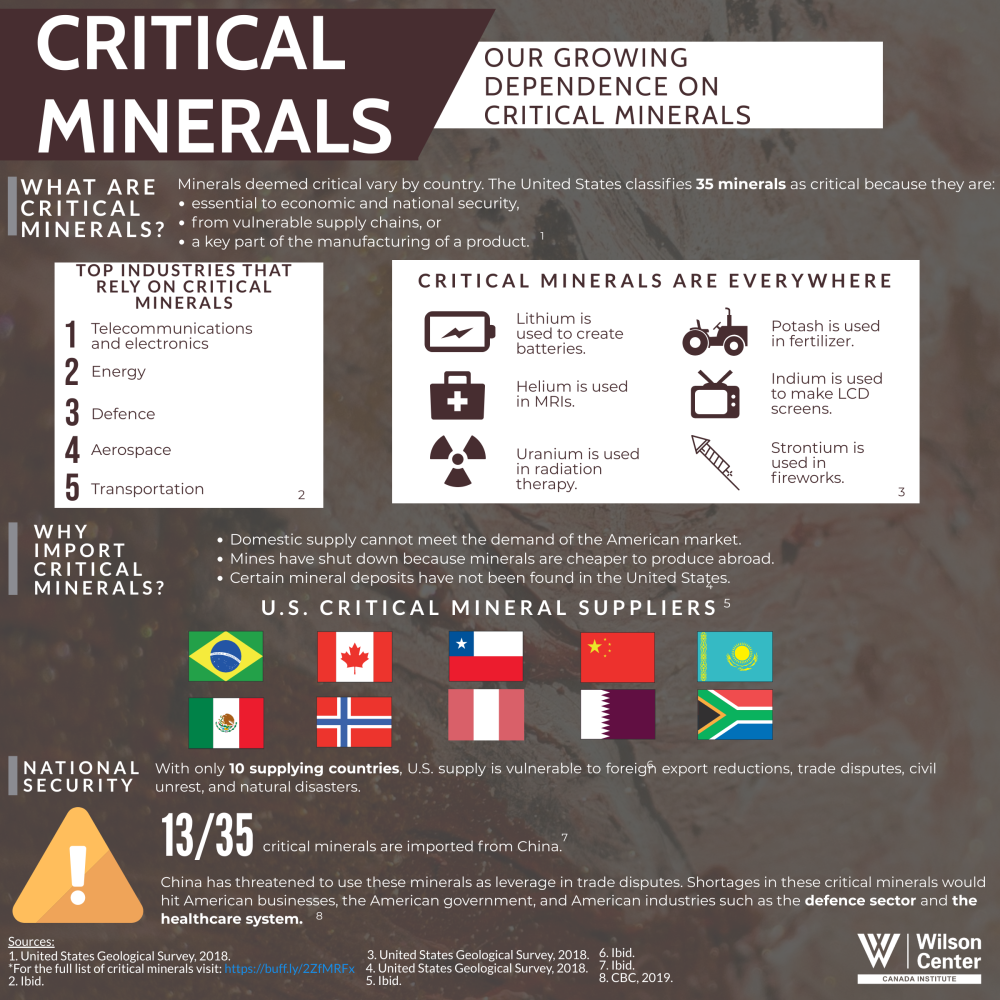

Us Dependence On Canadian Goods A Critical Analysis Of Trumps Perspective

May 16, 2025

Us Dependence On Canadian Goods A Critical Analysis Of Trumps Perspective

May 16, 2025 -

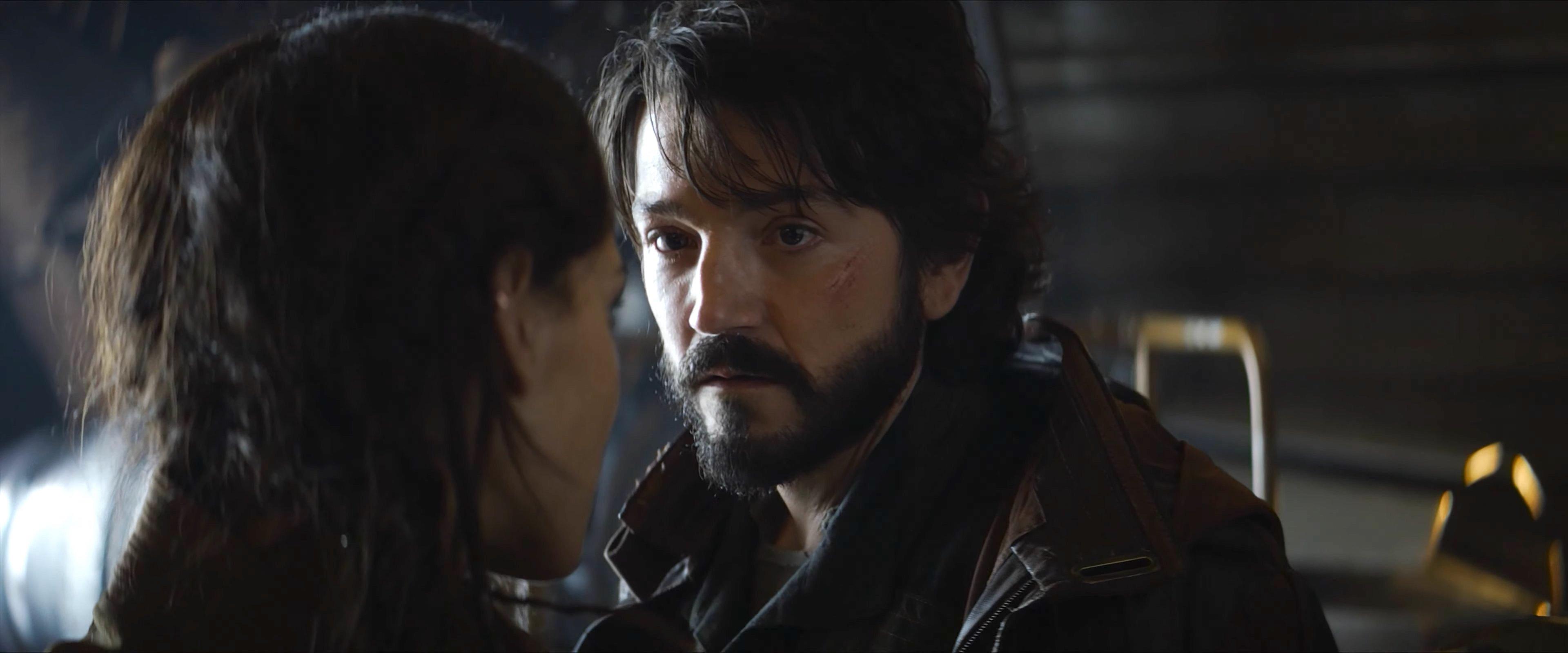

Andor Season 2 Release Date Trailer News And Confirmed Details

May 16, 2025

Andor Season 2 Release Date Trailer News And Confirmed Details

May 16, 2025