Middle Class Income: A State-by-State Breakdown

Table of Contents

Defining the Middle Class: Methodology and Challenges

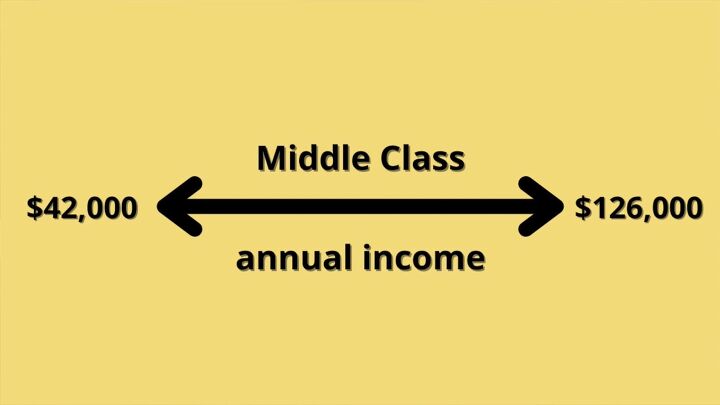

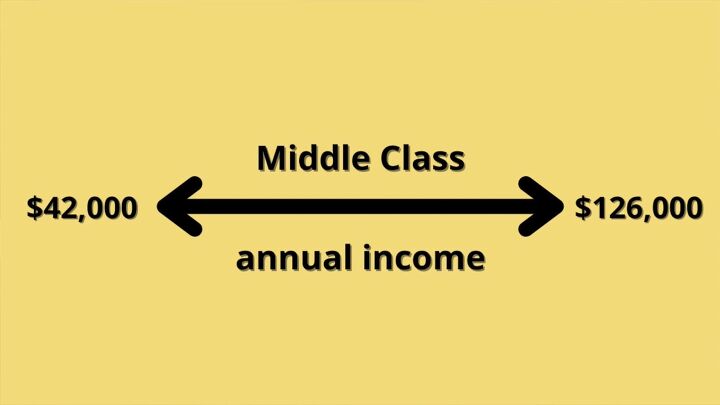

Defining the "middle class" isn't straightforward. Different methods yield different results, making comparisons complex. Understanding these nuances is essential to interpreting state-by-state income data accurately.

Defining "Middle Class":

The most common metric is median household income. This represents the midpoint of all household incomes, meaning half earn more and half earn less. However, median household income alone offers an incomplete picture. It doesn't account for household size, wealth accumulation, or the cost of living variations across states. For a broader perspective, consider the Pew Research Center's definition, which factors in income, assets, and subjective views on social class.

- Median household income: A key metric, but not the sole indicator of middle-class status.

- Limitations of median income: Fails to capture the nuances of household size, wealth, and cost of living differences.

- Alternative metrics: The Pew Research Center's broader definition provides a more comprehensive approach, incorporating assets and social perceptions.

- Cost of living adjustment: Crucial for accurate comparisons between states with vastly different living expenses.

State-by-State Income Comparison: High-Income and Low-Income States

Significant variations exist in middle-class income across the United States. Let's examine high and low-income states and the factors influencing these disparities.

High-Income States:

States with robust tech sectors, strong economies, and high concentrations of skilled labor generally boast higher middle-class incomes. However, a high average income doesn't always translate to a higher standard of living, as the cost of living can significantly impact purchasing power.

- Top high-income states (Illustrative, data needs updating): California, New York, Massachusetts, Washington, Maryland. (Note: Specific rankings change yearly; this is for illustrative purposes.)

- Economic drivers: Strong tech industries, finance, and healthcare sectors contribute significantly to higher average incomes in these states.

- Cost of living: High cost of living in many high-income states can offset the benefits of higher average incomes.

| State | Average Middle-Class Income (Illustrative) | Cost of Living Index (Illustrative) |

|---|---|---|

| California | $90,000 | 130 |

| New York | $85,000 | 125 |

| (etc.) |

Low-Income States:

Conversely, states with lower employment rates, reliance on lower-paying industries, and a less-diversified economy often show lower middle-class incomes. However, a lower income doesn't automatically equate to a lower quality of life, especially if the cost of living is significantly lower.

- Top low-income states (Illustrative, data needs updating): Mississippi, West Virginia, Arkansas, Kentucky, Louisiana. (Note: Specific rankings change yearly; this is for illustrative purposes.)

- Economic factors: Dependence on agriculture, manufacturing decline, and lower education attainment contribute to lower income levels.

- Cost of living: While income may be lower, the cost of living in some low-income states is also substantially lower, impacting the overall standard of living.

| State | Average Middle-Class Income (Illustrative) | Cost of Living Index (Illustrative) |

|---|---|---|

| Mississippi | $55,000 | 85 |

| West Virginia | $58,000 | 90 |

| (etc.) |

Factors Influencing Middle Class Income: Beyond State Lines

Beyond state-level data, various factors significantly influence middle-class income.

Education and Skills:

Education plays a crucial role in determining earning potential. Higher education levels are strongly correlated with higher income brackets. Specific job skills in high-demand industries further enhance income prospects. However, a skills gap exists, leaving many without the skills needed for higher-paying jobs.

- Education and income: A strong correlation exists between higher education levels (bachelor's degrees, advanced degrees) and higher earning potential.

- Specialized skills: Demand for skilled labor in technology, healthcare, and other specialized fields drives higher wages.

- Skills gap: A mismatch between available jobs and the skills of the workforce contributes to income inequality.

Cost of Living:

The cost of living significantly impacts the purchasing power of middle-class income. A higher income in a high-cost-of-living state may not offer a better standard of living than a lower income in a low-cost-of-living state.

- Cost of living adjustments: Essential for comparing income across states with different price levels.

- Impact on lifestyle: The same income can support vastly different lifestyles depending on the cost of housing, transportation, healthcare, and other expenses.

- Cost of living data: Resources like the Bureau of Labor Statistics and numerous online cost-of-living calculators provide useful data.

Implications for Financial Planning and Economic Policy

Understanding state-specific income data is crucial for both personal financial planning and shaping effective economic policies.

Personal Financial Planning:

State-specific income data should inform your financial planning strategies. Higher income doesn’t automatically mean more disposable income; cost of living must be considered.

- Budgeting and saving: Adapt your savings and spending plans to reflect your state's cost of living and average middle-class income.

- Debt management: Develop strategies to manage debt effectively, especially in challenging economic environments.

- Financial planning resources: Utilize online tools, financial advisors, and government resources to support your financial planning efforts.

Policy Implications:

Understanding middle-class income variations is crucial for informed policy decisions.

- Government assistance programs: Policies should target those most in need while ensuring that programs are efficient and effective.

- Tax policies: Tax structures should be reviewed to ensure fairness and support economic mobility.

- Promoting economic mobility: Policies aimed at improving education, job training, and affordable healthcare are essential for boosting economic mobility.

Conclusion:

Understanding your state's middle-class income is essential for informed financial planning and a clear picture of your economic well-being. This state-by-state breakdown highlights significant variations across the United States, influenced by a complex interplay of factors such as education, skills, and cost of living. By understanding these factors, individuals can better plan for their financial future and advocate for policies that support a strong and thriving middle class. Continue researching your specific state's average middle-class income and cost of living to make informed decisions for your family. Use this information to build a more secure financial future, using this data to inform your personal financial planning and advocacy for a stronger middle class.

Featured Posts

-

Eagles White House Celebration Jalen Hurts Absence And Trumps Comments

Apr 30, 2025

Eagles White House Celebration Jalen Hurts Absence And Trumps Comments

Apr 30, 2025 -

Is This Channing Tatums New Girlfriend From Australia

Apr 30, 2025

Is This Channing Tatums New Girlfriend From Australia

Apr 30, 2025 -

German Conservatives And Social Democrats Begin Coalition Talks

Apr 30, 2025

German Conservatives And Social Democrats Begin Coalition Talks

Apr 30, 2025 -

Chat Gpt And Open Ai The Ftc Investigation And Its Potential Impact

Apr 30, 2025

Chat Gpt And Open Ai The Ftc Investigation And Its Potential Impact

Apr 30, 2025 -

23 2025 12

Apr 30, 2025

23 2025 12

Apr 30, 2025