Minority Government Could Weaken Canadian Dollar: Analyst Warning

Table of Contents

Political Instability and Investor Confidence

A minority government often leads to slower decision-making processes and a higher risk of policy reversals. This can deter both domestic and foreign investment, reducing capital inflows and weakening the CAD. The resulting economic instability directly impacts the currency's value.

Decreased Investment

- Lengthy negotiations on budgets and key legislation: The need for consensus among multiple parties can significantly delay crucial economic policies. This uncertainty makes it difficult for businesses to plan long-term investments.

- Increased risk of snap elections: The threat of sudden elections adds to the instability, further deterring investment as businesses hesitate to commit capital in a volatile political climate.

- Potential for policy paralysis hindering economic growth: Disagreements between parties can lead to a standstill on important legislation, hindering economic growth and impacting investor confidence in the Canadian dollar.

- Reduced confidence among international investors: International investors are particularly sensitive to political risk. Uncertainty surrounding the government's direction can lead to capital flight, putting downward pressure on the CAD exchange rate.

Impact on Economic Growth

Uncertainty surrounding policy can stifle economic growth, leading to lower interest rates and a less attractive environment for the Canadian dollar. This slowdown creates a negative feedback loop impacting investor confidence and currency value.

- Reduced business investment due to uncertainty: Businesses postpone expansion and new projects, leading to slower overall economic growth.

- Slowdown in consumer spending due to economic anxieties: Uncertainty about the future can cause consumers to curb spending, further dampening economic activity.

- Potential for decreased exports, affecting the CAD: A weaker economy can lead to reduced exports, negatively impacting the demand for the Canadian dollar in the foreign exchange market.

- Negative impact on job creation and overall economic performance: A sluggish economy translates to fewer job opportunities, lower wages, and a less appealing investment destination.

Impact on the Canadian Dollar Exchange Rate

The inherent instability of a minority government translates directly into volatility in the currency markets. Fluctuations in the CAD can make it difficult for businesses to plan and operate effectively, especially those involved in international trade.

Increased Volatility

- Increased speculation in the forex market: Uncertainty surrounding government policy creates opportunities for speculation, leading to larger price swings in the CAD.

- Larger price swings in the CAD against major currencies like USD and EUR: The CAD becomes more susceptible to external shocks and market sentiment, resulting in greater volatility against major currencies.

- Difficulty in forecasting future exchange rates: The unpredictable nature of a minority government makes it extremely challenging to predict future exchange rates, increasing risk for businesses.

- Higher hedging costs for businesses involved in international trade: To protect themselves against currency fluctuations, businesses must incur higher hedging costs, impacting profitability.

Potential for Depreciation

The combination of decreased investor confidence and economic uncertainty can lead to a decline in the value of the Canadian dollar relative to other currencies. This depreciation can have far-reaching consequences for the Canadian economy.

- Capital flight as investors seek safer havens: Investors may move their capital to countries perceived as having greater political and economic stability.

- Increased imports and decreased exports impacting the trade balance: A weaker CAD makes imports more expensive and exports less competitive, potentially widening the trade deficit.

- Potential for inflation as import costs rise: Increased import costs due to CAD depreciation can contribute to inflation, eroding purchasing power.

- Negative impact on purchasing power of Canadian consumers: A weaker CAD means imported goods become more expensive, reducing the purchasing power of Canadian consumers.

Mitigating the Risks

While a minority government presents challenges, investors and the government itself can take steps to mitigate the risks to the Canadian dollar.

Diversification Strategies

Investors can mitigate the risk associated with a weakening Canadian dollar through currency diversification and hedging strategies.

- Investing in assets denominated in other currencies: Diversifying investments across different currencies reduces the overall impact of CAD depreciation.

- Utilizing forward contracts or options to hedge against CAD depreciation: Hedging strategies can help protect against losses due to currency fluctuations.

- Diversifying investment portfolios across various asset classes: Reducing exposure to a single currency or asset class is crucial in mitigating risk.

Government Policy Response

The government's response to economic challenges will be crucial in influencing the CAD's stability. A focus on fiscal responsibility and promoting economic growth can help maintain confidence.

- Maintaining a balanced budget or a sustainable fiscal plan: Demonstrating fiscal responsibility reassures investors and strengthens the CAD.

- Implementing pro-growth policies to boost investor confidence: Policies that stimulate economic growth can attract investment and support the currency.

- Clear communication and transparency regarding economic strategy: Open communication helps build trust and reduce uncertainty among investors.

Conclusion

The potential for a weakening Canadian dollar under a minority government presents significant challenges for the Canadian economy and investors. Political instability, decreased investor confidence, and economic uncertainty can lead to increased volatility in the CAD exchange rate and potential depreciation. However, strategic diversification and a responsible government response can help mitigate these risks. Staying informed about the political climate and its potential impact on the Canadian dollar is crucial for individuals and businesses alike. Understanding the potential implications of a minority government on the Canadian dollar is paramount for effective financial planning. Monitor the economic situation closely and consider employing strategies to safeguard your investments against potential currency fluctuations caused by minority government instability.

Featured Posts

-

As Festas Luxuosas De P Diddy Um Documentario Com Trump Beyonce E Jay Z

Apr 30, 2025

As Festas Luxuosas De P Diddy Um Documentario Com Trump Beyonce E Jay Z

Apr 30, 2025 -

The Remember Monday Eurovision 2025 Song Capital Breakfast Interview

Apr 30, 2025

The Remember Monday Eurovision 2025 Song Capital Breakfast Interview

Apr 30, 2025 -

New Cruise Rewards Program From Cruises Com How To Maximize Your Points

Apr 30, 2025

New Cruise Rewards Program From Cruises Com How To Maximize Your Points

Apr 30, 2025 -

Pregnancy Cravings And Global Chocolate Inflation A Cnn Story

Apr 30, 2025

Pregnancy Cravings And Global Chocolate Inflation A Cnn Story

Apr 30, 2025 -

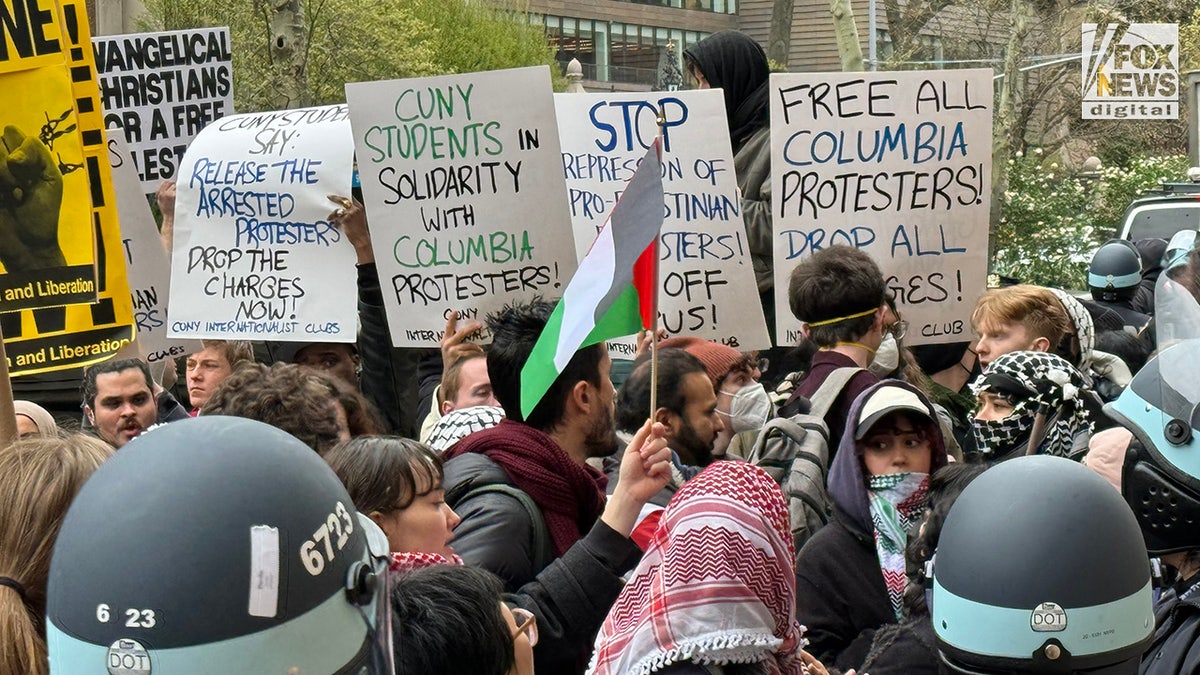

Harassment Allegations Against Pro Israel Demonstrators Nypd Investigation

Apr 30, 2025

Harassment Allegations Against Pro Israel Demonstrators Nypd Investigation

Apr 30, 2025