Missed Student Loan Payments: The Potential Impact On Your Credit Rating

Table of Contents

How Missed Student Loan Payments Affect Your Credit Score

A single missed student loan payment can significantly damage your credit score. This negative mark can lead to a substantial drop in your FICO and VantageScore, both widely used credit scoring models. The severity of the drop depends on several factors, including your existing credit history and the amount of the missed payment.

- Negative impact on FICO scores: Missed payments are seriously damaging to your FICO score, potentially lowering it by 100 points or more.

- Length of time negative information remains on credit report: This negative information typically remains on your credit report for seven years from the date of the missed payment.

- Potential increase in interest rates on future loans: A lower credit score translates to higher interest rates on future loans, mortgages, and credit cards, increasing your overall borrowing costs.

- Difficulty securing loans, credit cards, or renting an apartment: Landlords and lenders often use credit scores to assess risk. A damaged credit score due to missed student loan payments can make it challenging to secure loans, credit cards, or even rent an apartment.

Different credit scoring models may weigh missed student loan payments differently, but the impact is consistently negative. Understanding how these models work is key to proactive credit management.

Understanding the Reporting Process of Missed Payments

Your student loan lender reports your payment history to the three major credit bureaus: Equifax, Experian, and TransUnion. This reporting process usually follows a delinquency cycle:

- 30-day delinquency: A missed payment for 30 days usually triggers a negative entry on your report, albeit often a less severe one.

- 60-day delinquency: Failure to pay after 60 days indicates a more serious issue and negatively impacts your credit score more significantly.

- 90-day delinquency: A 90-day delinquency is considered a major default and severely damages your credit score. This often leads to more aggressive collection tactics.

The timing of reporting varies slightly among lenders, but generally, they report missed payments after a certain number of days past due. Regularly monitoring your credit report from all three bureaus using services like AnnualCreditReport.com is vital to catch and dispute any inaccuracies.

Strategies to Avoid Missed Student Loan Payments

Proactive financial planning is crucial to avoid the pitfalls of missed student loan payments. Here are some strategies:

- Creating a realistic budget: Track your income and expenses meticulously to determine how much you can allocate to student loan repayments each month.

- Automating loan payments: Set up automatic payments to avoid the risk of forgetting due dates.

- Exploring government repayment assistance programs: Programs like income-driven repayment plans (IDR) can adjust your monthly payments based on your income, helping you manage your debt more effectively. Explore deferment or forbearance options, though be aware of their potential drawbacks, such as accruing interest.

- Contacting your lender to discuss options before missing a payment: If you anticipate difficulties making your payments, contact your lender immediately. They may offer options such as temporary forbearance or repayment plans to avoid default.

The Long-Term Effects of Missed Student Loan Payments

Multiple missed student loan payments have severe long-term consequences. These can include:

- Potential damage to credit score: Repeated delinquencies create a long-lasting negative impact, making it difficult to secure credit for years to come.

- Increased difficulty securing future loans or credit cards: Lenders perceive borrowers with a history of missed payments as high-risk, leading to rejection or higher interest rates.

- Impact on employment opportunities: Some employers conduct credit checks, and a poor credit history can negatively affect your job prospects.

- Collection agency involvement: Repeated missed payments may lead to your debt being sold to a collection agency, further damaging your credit and potentially leading to legal action such as wage garnishment.

Conclusion

Missed student loan payments have a profoundly negative impact on your credit rating, leading to a cascade of financial difficulties. The long-term effects extend far beyond a simple score decrease, affecting your ability to secure loans, rent an apartment, and even find employment. Don't let missed student loan payments damage your credit. Take control of your student loan repayments today! Explore available repayment options, create a realistic budget, and contact your lender immediately if you anticipate difficulty making your payments. If you need assistance, consider seeking professional financial advice from a credit counselor. Remember, proactive management is key to protecting your financial future.

Featured Posts

-

Previsiones Deportivas Semanales Analisis Y Predicciones De Prensa Latina

May 17, 2025

Previsiones Deportivas Semanales Analisis Y Predicciones De Prensa Latina

May 17, 2025 -

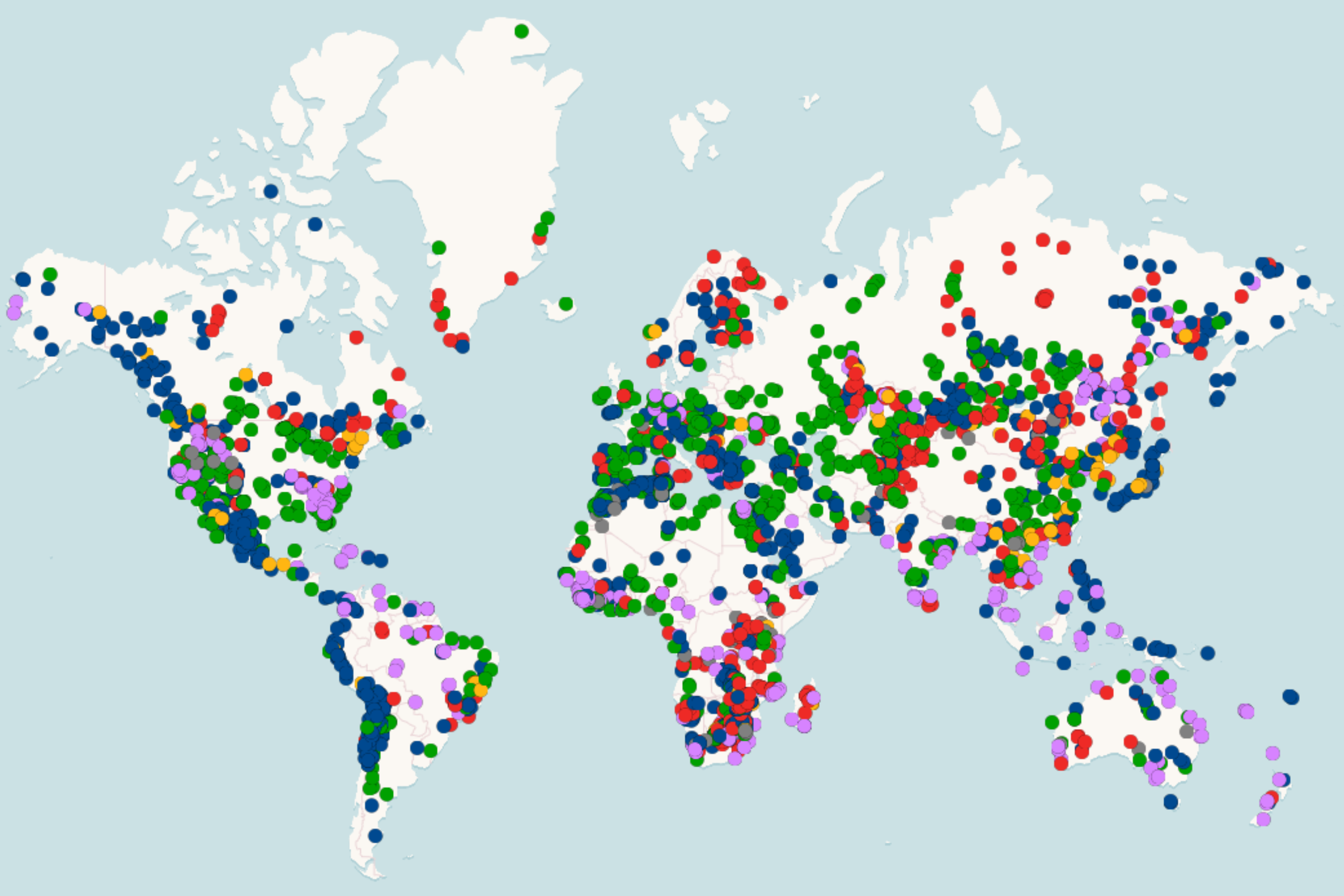

The Fight For Rare Earth Minerals A 21st Century Cold War

May 17, 2025

The Fight For Rare Earth Minerals A 21st Century Cold War

May 17, 2025 -

Kak Dubay Stal Vtoroy Moskvoy Poisk Raboty Dlya Rossiyan V 2025 Godu

May 17, 2025

Kak Dubay Stal Vtoroy Moskvoy Poisk Raboty Dlya Rossiyan V 2025 Godu

May 17, 2025 -

Rhp Bryce Miller Elbow On 15 Day Injured List For Mariners

May 17, 2025

Rhp Bryce Miller Elbow On 15 Day Injured List For Mariners

May 17, 2025 -

Understanding Tony Bennetts Vocal Style And Technique

May 17, 2025

Understanding Tony Bennetts Vocal Style And Technique

May 17, 2025