Moody's 30-Year Yield At 5%: Is The 'Sell America' Trade Back?

Table of Contents

Understanding the 5% 30-Year Treasury Yield

The 30-year Treasury yield represents the return an investor receives for lending money to the U.S. government for three decades. It's a key benchmark for long-term interest rates, influencing borrowing costs for mortgages, corporate bonds, and other long-term debt. The recent climb to 5%, a level not seen in many years, reflects several contributing factors:

-

Inflationary Pressures: Persistent inflation erodes the purchasing power of future interest payments, pushing yields higher to compensate investors for the anticipated loss. The current inflationary environment, fueled by factors like supply chain disruptions and robust consumer demand, has played a significant role.

-

Federal Reserve Monetary Policy: The Federal Reserve's efforts to combat inflation through interest rate hikes directly impact Treasury yields. Higher interest rates make existing bonds less attractive, driving down their prices and pushing yields upward. The Fed's aggressive tightening cycle is a key driver of the increased 30-year yield.

-

Global Economic Uncertainty: Geopolitical instability and concerns about global economic growth can lead investors to seek the perceived safety of U.S. Treasuries, increasing demand and pushing yields higher. However, this increased demand can be offset by fears of future economic downturns, leading to a complex interplay of factors affecting the yield.

The relationship between the 30-year yield and long-term interest rates is directly proportional. A higher 30-year yield signifies higher borrowing costs across the economy, impacting everything from home mortgages to corporate expansion plans.

The 'Sell America' Trade: A Recap

The "Sell America" trade refers to a scenario where foreign and domestic investors simultaneously sell U.S. assets, leading to capital flight and a weakening of the U.S. dollar. This phenomenon is often triggered by concerns about the U.S. economy, political instability, or more attractive investment opportunities elsewhere.

Historically, the "Sell America" trade manifests through:

-

Capital Flight: Investors withdraw funds from U.S. assets, such as stocks, bonds, and real estate, moving their investments to perceived safer havens or higher-yielding markets.

-

Currency Depreciation: As capital leaves the U.S., the demand for the dollar falls, leading to depreciation against other currencies. This makes U.S. exports more competitive but also increases the cost of imports.

A large-scale "Sell America" trade can significantly impact U.S. assets, potentially causing stock market declines, a weakening dollar, and increased borrowing costs.

Analyzing the Correlation: 5% Yield and 'Sell America' Trade Resurgence

The question arises: does the 5% 30-year yield signal a resurgence of the "Sell America" trade? The correlation isn't necessarily direct. While a high yield can attract foreign investment seeking higher returns, it can also reflect concerns about the U.S. economy, potentially prompting some investors to sell U.S. assets.

Analyzing past instances of capital flight is crucial:

-

Historical Examples and Comparisons: Past episodes of "Sell America" trades have often been associated with specific economic crises or geopolitical events. Comparing the current situation to these past events allows for a nuanced perspective.

-

Analysis of Current Market Conditions: Factors such as global economic growth, inflation rates, and investor sentiment all play a role in determining whether the high yield leads to capital flight.

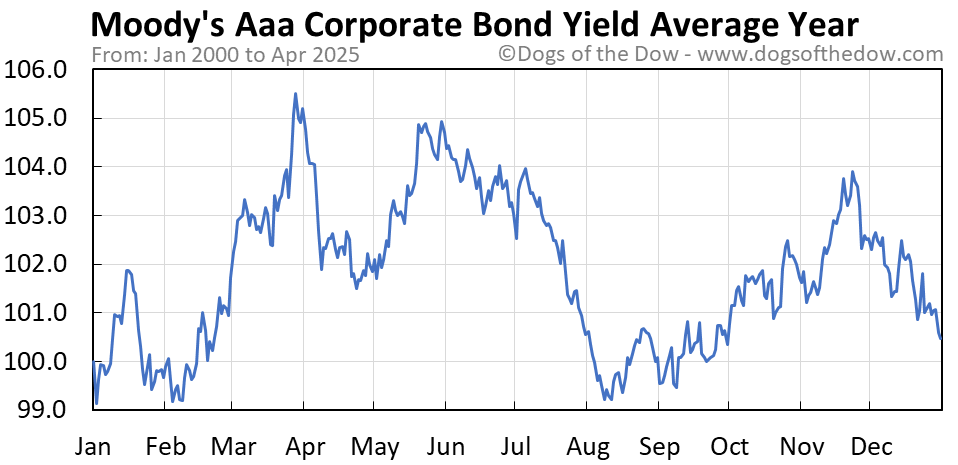

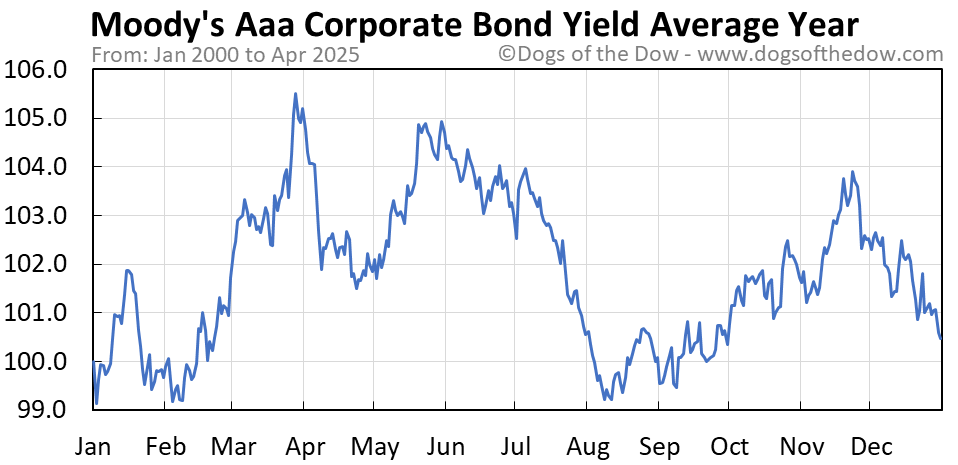

[Insert chart/graph here visualizing the correlation between 30-year Treasury yield and capital flows into/out of the US over time.]

Alternative Explanations and Factors

Attributing the rise in the 30-year yield solely to a "Sell America" trade would be an oversimplification. Several other factors are at play:

-

Global Interest Rate Hikes: Many central banks worldwide are raising interest rates, influencing global capital flows and potentially impacting the U.S. yield independently of a "Sell America" trend.

-

Supply and Demand Dynamics within the Bond Market: Changes in investor demand for long-term government bonds, unrelated to broader capital flight, can significantly impact yields.

-

Specific Economic Events: Unforeseen economic events or policy announcements can influence investor sentiment and Treasury yields, irrespective of a broader "Sell America" narrative.

Implications for Investors and the US Economy

A renewed "Sell America" trade, fueled by a high 30-year yield, would have significant consequences:

-

Impact on US Corporations: Higher borrowing costs would make it more expensive for companies to invest and expand, potentially hindering economic growth.

-

Effect on the US Dollar: A weaker dollar would increase the cost of imports and could fuel inflation further.

-

Consequences for Average American Consumers: Higher interest rates translate to more expensive mortgages, loans, and credit card debt.

For the U.S. economy, a significant outflow of capital could lead to slower economic growth, higher inflation, and potentially even a recession.

Conclusion

The relationship between the Moody's 30-year yield at 5% and a potential "Sell America" trade resurgence is complex and not directly causal. While a high yield can contribute to capital flight, other factors such as global interest rates, economic events, and investor sentiment play a significant role. The current situation demands careful monitoring and analysis to gauge the true impact on the US economy and investor behavior.

Stay informed about fluctuations in the Moody's 30-year yield and their implications for the 'Sell America' trade. Understanding these dynamics is crucial for making informed investment decisions and navigating the complexities of the global economy. The future trajectory of the 30-year Treasury yield will be a key indicator of the health of the U.S. economy and the potential for further capital flight in the coming months and years. What additional factors might trigger a more pronounced "Sell America" trade in the future?

Featured Posts

-

Behind The Scenes Wwe Hinchcliffe Segments Poor Reception

May 21, 2025

Behind The Scenes Wwe Hinchcliffe Segments Poor Reception

May 21, 2025 -

Is The Peppa Pig Theme Park In Texas Worth Visiting A Review

May 21, 2025

Is The Peppa Pig Theme Park In Texas Worth Visiting A Review

May 21, 2025 -

Saskatchewan Political Panel Examining Western Separation

May 21, 2025

Saskatchewan Political Panel Examining Western Separation

May 21, 2025 -

Bbai Stockholders Legal Action Regarding Big Bear Ai Holdings Inc

May 21, 2025

Bbai Stockholders Legal Action Regarding Big Bear Ai Holdings Inc

May 21, 2025 -

Alwlayat Almthdt Thlathy Jdyd Fy Qaymt Bwtshytynw

May 21, 2025

Alwlayat Almthdt Thlathy Jdyd Fy Qaymt Bwtshytynw

May 21, 2025