Moody's 5% 30-Year Yield: Implications For Selling US Bonds

Table of Contents

Understanding the Moody's 5% 30-Year Yield Announcement

A 5% yield on a 30-year Treasury bond is a noteworthy event. Historically, such yields have been uncommon, reflecting a period of significant economic shifts. This high yield is a result of several interacting factors:

- Inflation: Persistently high inflation rates have forced the Federal Reserve to implement aggressive interest rate hikes.

- Interest Rate Hikes: These hikes increase the cost of borrowing, directly influencing bond yields. Higher rates make existing bonds less attractive, driving up yields on newly issued ones.

- Economic Outlook: Uncertainty about the future economic outlook contributes to investor demand for higher yields to compensate for perceived risk.

Key Impacts of the 5% Yield:

- Impact on long-term borrowing costs: Higher yields translate to increased borrowing costs for governments and corporations issuing long-term debt.

- Attractiveness to investors seeking fixed income: The 5% yield makes US Treasury bonds more attractive to investors seeking a steady stream of income in a volatile market, although this depends on individual risk tolerance.

- Comparison to historical yields: Comparing this yield to historical averages provides context, illustrating the current market's significant shift.

- Moody's rating and its influence on investor confidence: Moody's rating reflects the perceived creditworthiness of the US government. A positive rating bolsters investor confidence, even amid high yields.

Implications for Selling US Bonds in the Current Market

The 5% yield on 30-year US bonds presents both challenges and opportunities for those considering selling. The increased yield affects various bond types differently:

- Treasury bonds: These directly reflect the 5% yield, becoming more attractive to income-seeking investors.

- Corporate bonds: Corporate bond yields will likely adjust to reflect the increased cost of borrowing in the current environment, increasing the risk of default.

- Municipal bonds: These bonds may become less attractive compared to the higher yields offered by Treasury bonds.

Challenges and Opportunities:

- Increased competition from higher-yielding alternatives: Investors may shift their portfolios towards other assets offering similar or higher yields.

- Potential for price fluctuations due to market volatility: Interest rate changes and economic uncertainty can create price volatility in the bond market.

- Strategies for optimizing bond sales in this environment: Timing the sale strategically is crucial to maximize returns and minimize losses. This requires close monitoring of the market and economic indicators.

- The role of timing and market analysis in successful bond sales: Careful market analysis and strategic timing are critical for successful bond sales in the current environment.

Strategies for Mitigating Risk When Selling US Bonds

Navigating the current bond market requires a proactive approach to risk management. Investors and institutions should consider:

- Diversification of investment portfolio: Spreading investments across different asset classes reduces exposure to the risks associated with a single asset class like bonds.

- Hedging strategies to mitigate interest rate risk: Various hedging techniques, such as using derivatives, can protect against losses stemming from interest rate fluctuations.

- Consultations with financial advisors: Seeking professional advice tailored to individual circumstances is vital for making informed decisions.

- Understanding the implications of capital gains taxes: Capital gains taxes can significantly impact the net proceeds from bond sales. Careful tax planning is crucial.

Future Outlook and Predictions for US Bond Market

Predicting future trends in the US bond market is challenging, but the current 5% yield on 30-year Treasuries provides some insights:

- Forecasting future yields: Future yields will depend on inflation, economic growth, and Federal Reserve policy. A shift in any of these factors could significantly impact bond yields.

- Analyzing the potential impact of economic factors: Factors such as inflation, economic growth, and geopolitical events can influence the demand for US bonds, thereby affecting yields.

- Identifying potential investment opportunities: Despite the challenges, the current market offers potential investment opportunities for savvy investors who can assess risks accurately.

- Long-term implications for the US economy: Sustained high yields could impact long-term borrowing costs, affecting government spending and economic growth.

Making Informed Decisions About Your US Bond Sales

The Moody's 5% 30-Year Yield significantly impacts the landscape for US bond sales. Understanding the factors influencing yields, mitigating potential risks through diversification and hedging, and having a long-term perspective are critical. The current market presents both challenges and opportunities. Before making any major decisions regarding your US bond sales, carefully consider the implications of the Moody's 5% 30-Year Yield and seek professional financial advice. Thorough research and consultation are essential for navigating this dynamic market and making informed decisions about your investments.

Featured Posts

-

Calendrier Pro D2 Analyse Des Chances De Maintien Pour Valence Romans Et Su Agen

May 20, 2025

Calendrier Pro D2 Analyse Des Chances De Maintien Pour Valence Romans Et Su Agen

May 20, 2025 -

Analyzing The Risks Of The Philippine Typhon Mid Range Missile System

May 20, 2025

Analyzing The Risks Of The Philippine Typhon Mid Range Missile System

May 20, 2025 -

Glen Kamara Ja Teemu Pukki Avauskokoonpanossa Friisin Paeaetoes Heraettaeae Keskustelua

May 20, 2025

Glen Kamara Ja Teemu Pukki Avauskokoonpanossa Friisin Paeaetoes Heraettaeae Keskustelua

May 20, 2025 -

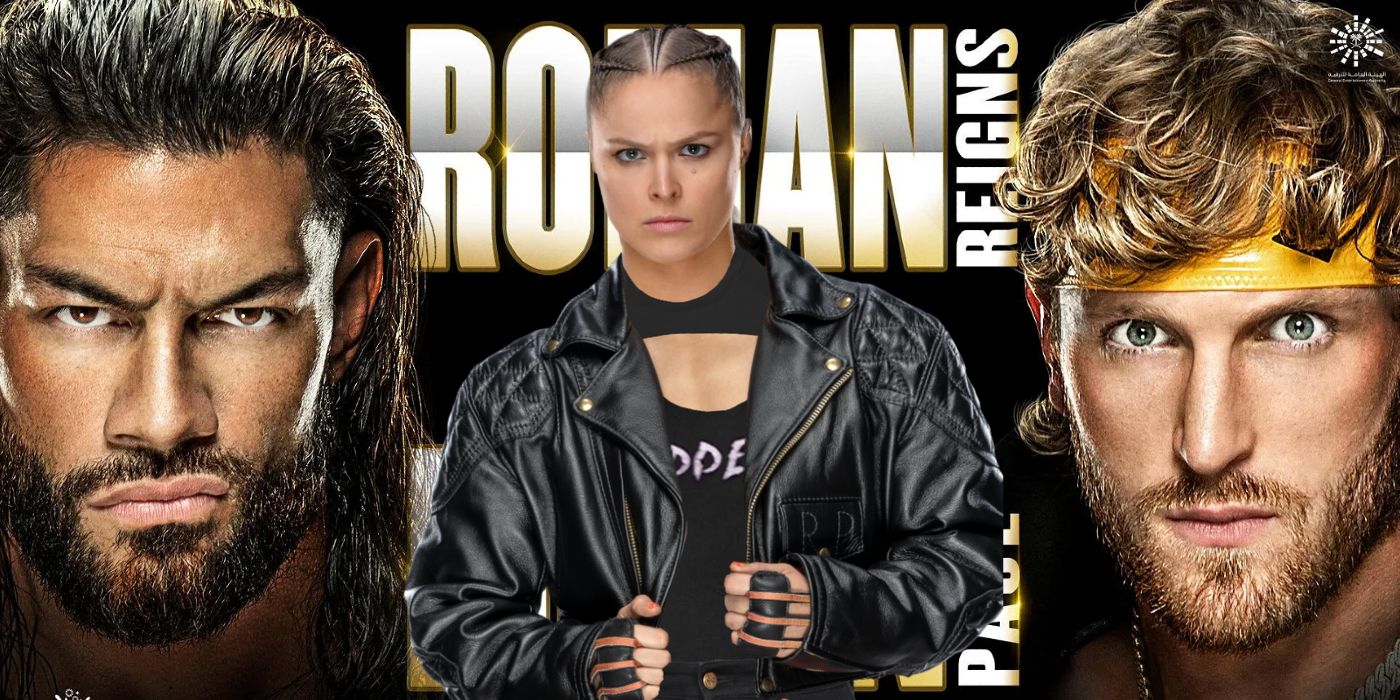

Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

May 20, 2025

Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

May 20, 2025 -

Arsenals Pursuit Of Matheus Cunha Wolves Star Targeted Under New Director

May 20, 2025

Arsenals Pursuit Of Matheus Cunha Wolves Star Targeted Under New Director

May 20, 2025