Moody's Downgrade Of US Debt: Criticism Mounts From The White House

Table of Contents

Moody's Justification for the Downgrade

Moody's rationale for the downgrade centers on several key factors highlighting weaknesses in the US's fiscal strength. The repeated debt ceiling crises, escalating government debt, and a perceived erosion of governance effectiveness all played significant roles in their decision. These issues, Moody's argues, increase the risk of a sovereign debt default, impacting their credit rating.

-

Fiscal Imbalances: Moody's cited the increasing US debt-to-GDP ratio as a primary concern. The agency pointed to projections showing a continued rise in government debt over the coming decade, fueled by rising entitlement spending and other factors. They emphasized the lack of a credible fiscal consolidation plan to address this trajectory.

-

Debt Ceiling Standoffs: The repeated near-misses on the debt ceiling, such as the intense negotiations in 2023, demonstrated to Moody's a significant risk to the timely repayment of US sovereign debt. This political brinkmanship, they argued, undermines investor confidence and erodes the predictability essential for a strong credit rating.

-

Governance Challenges and Political Polarization: Moody's highlighted the intense political polarization in Washington as a major factor contributing to the downgrade. The inability of the political parties to reach consensus on fiscal policy, leading to repeated standoffs, creates uncertainty and hinders the implementation of necessary fiscal reforms. The agency's assessment underscored the risk that this gridlock will persist, making it difficult to address the nation's growing debt.

The White House's Response and Criticism

The White House reacted swiftly and strongly to Moody's downgrade, issuing a statement condemning the agency's assessment and characterizing it as flawed and misguided. President Biden and other senior officials argued that Moody's failed to fully appreciate the strength of the US economy and the administration's efforts to address the debt.

-

Counter-Arguments: The White House countered Moody's claims by emphasizing the resilience of the US economy, pointing to strong job growth and falling unemployment figures. They also highlighted the Bipartisan Infrastructure Law as evidence of their commitment to long-term infrastructure investment.

-

Political Blame: The White House largely attributed the debt crisis to the policies of previous administrations, placing the blame squarely on Republicans, and arguing that their fiscal policies exacerbated the nation's debt problems.

-

Economic Defense: The administration's response focused heavily on defending the nation's economic strength and downplaying the potential negative consequences of the downgrade, attempting to reassure both domestic and international investors. However, the effectiveness of this approach remains to be seen, as market reactions to the downgrade were initially negative.

Economic Implications of the Downgrade

The Moody's downgrade carries significant potential economic implications for the US and the global economy.

-

Increased Borrowing Costs: The downgrade is likely to increase the interest rates the US government pays on its debt, increasing the cost of borrowing for the federal government and potentially impacting government spending.

-

Inflationary Pressures: Higher borrowing costs could also have inflationary consequences, putting upward pressure on prices and impacting consumer spending.

-

Investor Confidence: The downgrade could erode investor confidence, leading to a decline in foreign investment and potentially impacting economic growth.

-

Global Market Volatility: The downgrade is likely to create volatility in global financial markets as investors reassess their portfolios and potentially shift investments away from US assets.

Long-Term Fiscal Challenges Facing the US

The Moody's downgrade highlights the deep-seated fiscal challenges facing the United States in the long term.

-

Rising Entitlement Spending: The aging population and rising healthcare costs are driving a significant increase in entitlement spending, such as Social Security and Medicare. These programs represent a large and growing portion of the federal budget, creating significant long-term fiscal pressures.

-

Healthcare Costs: The escalating cost of healthcare is a major driver of government spending. Finding ways to control these costs will be crucial to addressing the long-term fiscal challenges.

-

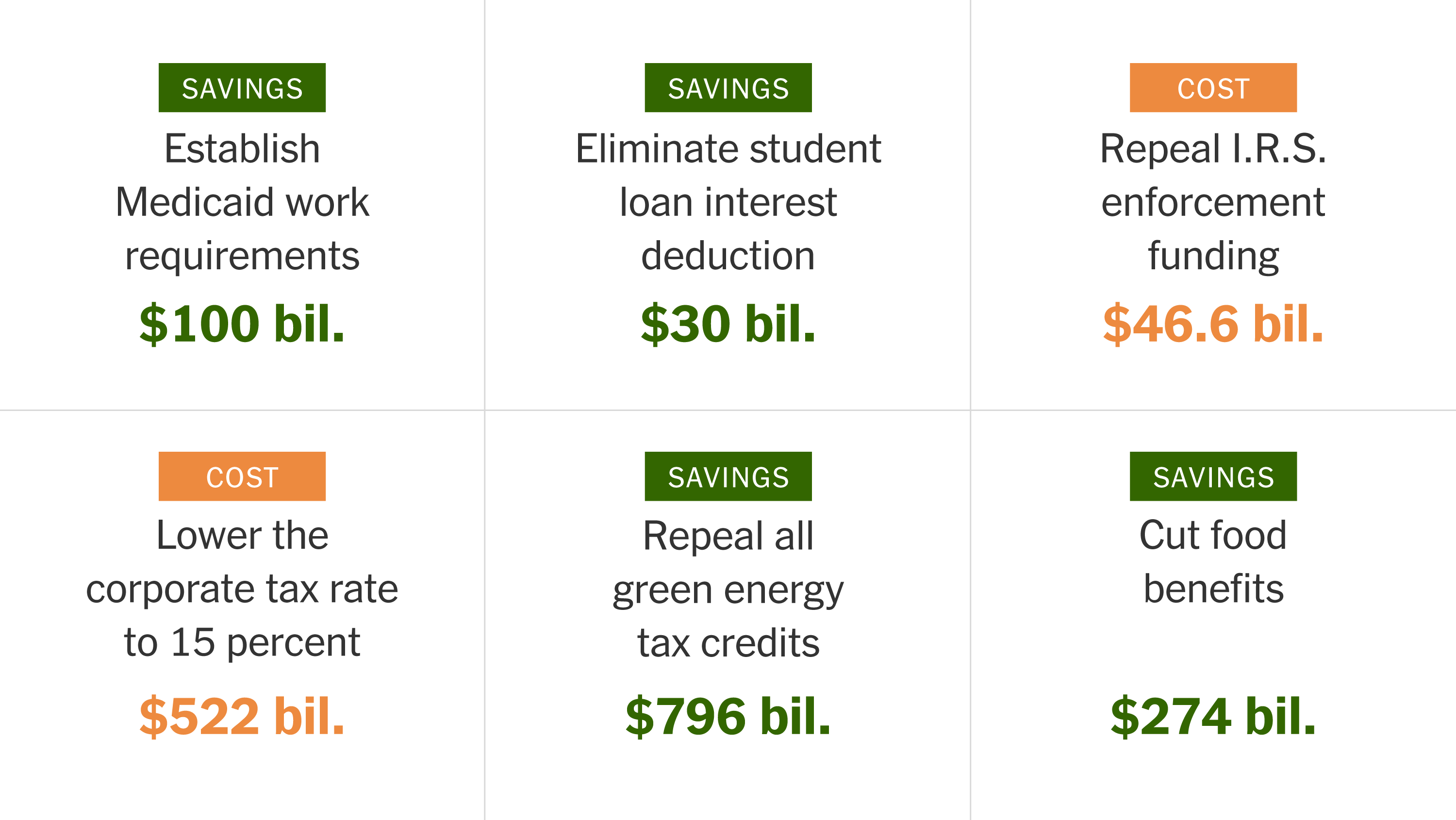

Need for Fiscal Reform: Addressing these challenges will likely require significant fiscal reforms, including potential tax increases, entitlement reforms, and a renewed focus on deficit reduction.

-

Political Obstacles: Implementing meaningful fiscal reforms will face significant political hurdles. The same partisan divisions that contributed to the debt ceiling crisis will likely make it difficult to achieve consensus on significant changes to the federal budget.

Conclusion

The Moody's downgrade of US debt is a significant event with far-reaching consequences. The White House's strong criticism highlights the political sensitivities involved, while the potential economic repercussions demand careful consideration. Addressing the underlying fiscal challenges is crucial to restoring confidence and ensuring long-term economic stability. Understanding the complexities of the Moody's downgrade of US debt and the subsequent White House response is essential for every citizen. Stay informed about the evolving situation and engage in constructive dialogue about sustainable fiscal policies to protect the nation's financial future. Learn more about the impact of the Moody's downgrade of US debt and its implications for the US economy.

Featured Posts

-

Kanye Vest I B Yanki Tsenzori Podrobnosti Rozrivu

May 18, 2025

Kanye Vest I B Yanki Tsenzori Podrobnosti Rozrivu

May 18, 2025 -

Confortos Path To Dodger Success Following In Hernandezs Footsteps

May 18, 2025

Confortos Path To Dodger Success Following In Hernandezs Footsteps

May 18, 2025 -

Lady Gagas Reaction To Bowen Yangs New Alejandro Tattoo

May 18, 2025

Lady Gagas Reaction To Bowen Yangs New Alejandro Tattoo

May 18, 2025 -

Conservative Revolt Delays Gop Tax Plan Medicaid Clean Energy At Issue

May 18, 2025

Conservative Revolt Delays Gop Tax Plan Medicaid Clean Energy At Issue

May 18, 2025 -

Spring Breakout 2025 Rosters A Detailed Breakdown By Team

May 18, 2025

Spring Breakout 2025 Rosters A Detailed Breakdown By Team

May 18, 2025