Musk's X Debt Sale: New Financials Reveal A Transforming Company

Table of Contents

The recent debt sale by X, formerly Twitter, under Elon Musk's leadership, has sent shockwaves through the financial world. This move, unveiling a significantly altered financial landscape, signals a pivotal shift in the company's strategy and its ongoing transformation. This article delves into the specifics of Musk's X debt sale, analyzing the implications for the future of the platform and its evolving business model. We'll examine the details of the debt sale, its impact on X's financial position, and how it fits into Musk's broader vision for the company's future.

The Details of Musk's X Debt Sale

The Amount and Structure of the Debt

The exact amount of the debt raised through Musk's X debt sale remains somewhat opaque, with official figures not consistently released. However, reports suggest a substantial sum, potentially in the billions of dollars, was secured through a combination of high-yield bonds and syndicated loans. This leveraged financing strategy indicates a significant bet on X's future prospects.

- Debt Amount: While precise figures vary across news sources, estimates suggest a range from several billion dollars upwards. Further official disclosures are needed for precise confirmation.

- Debt Type: A mix of high-yield bonds (offering higher interest rates to compensate for higher risk) and bank loans likely formed the core of the financing.

- Terms of the Sale: The specifics regarding interest rates and maturity dates remain largely undisclosed, adding to the uncertainty surrounding the financial health of the restructured company. This lack of transparency raises questions about investor confidence and the long-term sustainability of this financial strategy.

The Rationale Behind the Debt Sale

Several factors likely contributed to X's decision to raise capital through a significant debt sale. The most prominent reasons include:

- Debt Refinancing: X may have used the funds to pay down existing high-interest debt, thereby reducing its overall interest expense and improving its long-term financial stability.

- Funding Acquisitions: Musk has expressed intentions to expand X's capabilities, and a large debt sale could facilitate acquisitions of complementary businesses or technologies. This could involve payments processing capabilities or other services designed to enhance user engagement and monetization.

- Covering Operational Costs: The significant operational costs of running a global social media platform, coupled with potential revenue shortfalls, might have prompted the need for immediate capital injection.

Impact on X's Financial Position

Analysis of the Balance Sheet

The debt sale dramatically alters X's balance sheet. While providing immediate liquidity, it significantly increases its debt-to-equity ratio and leverage. This heightened financial risk is a key concern for investors and analysts.

- Debt-to-Equity Ratio: The increase in debt will likely push this ratio considerably higher, indicating a greater reliance on borrowed funds compared to equity.

- Leverage: The higher leverage increases X's vulnerability to financial shocks and interest rate fluctuations. A downturn in revenue could lead to significant financial distress.

- Liquidity: While the immediate liquidity improves, the long-term liquidity depends on X's ability to generate sufficient cash flow to meet its debt obligations.

Credit Rating and Investor Sentiment

The substantial debt issuance has likely impacted X's credit rating, potentially leading to a downgrade from credit rating agencies like Moody's or S&P. This affects investor sentiment, as a lower credit rating increases the perceived risk associated with investing in X.

- Credit Rating Downgrade: A downgrade reflects increased risk, potentially making it more expensive for X to borrow money in the future.

- Stock Price Movements: The market's reaction to the news of the debt sale likely influenced X's stock price. This volatility reflects investor uncertainty about the company's future financial health and the success of Musk's ambitious plans.

- Investor Confidence: Investor confidence is crucial for a company's long-term survival. The debt sale, combined with other controversial decisions, could negatively affect investor sentiment and make it challenging for X to secure future funding.

Musk's X Transformation Strategy

The Vision for X's Future

Elon Musk's vision for X encompasses far more than just a social media platform. He envisions a "everything app," integrating various services under a single umbrella. The debt sale could be instrumental in realizing this ambitious goal.

- Everything App Vision: This involves integrating payments, financial services, and potentially other functionalities into X.

- Future Revenue Streams: Diversifying revenue streams beyond advertising is essential. This could include subscription models, transaction fees from financial services, and partnerships with other businesses.

- Expansion Plans: Musk might use the funds to expand X's reach into new markets or offer new services, aiming for global dominance.

Integration with Other Musk Ventures

The potential for synergies between X and other Musk ventures, like Tesla and SpaceX, presents an intriguing aspect of his broader strategy. This integration could open up new revenue streams and create a powerful network effect.

- Potential Synergies: For instance, Tesla could integrate its data or services with X, allowing for personalized advertising or enhanced features for Tesla owners. SpaceX's communication technologies could also play a part in X's infrastructure.

- Existing and Potential Collaborations: While specifics remain unclear, the potential for cross-promotion and data sharing between these companies could create a powerful competitive advantage.

Conclusion

Musk's X debt sale represents a high-stakes gamble with significant implications for the future of the platform. The increased debt burden carries substantial risk, but it also potentially provides the necessary resources to execute Musk's ambitious transformation strategy. The success of this strategy hinges on efficiently utilizing the raised capital to drive user growth, diversify revenue streams, and deliver on the promise of X as a comprehensive "everything app." Understanding the details of Musk's X debt sale is crucial for anyone interested in the future of social media and tech giants. Stay informed about further developments and analysis surrounding Musk's X debt sale to remain up-to-date on this transformative moment for the company.

Featured Posts

-

Chat Gpt Developer Open Ai Under Federal Trade Commission Investigation

Apr 29, 2025

Chat Gpt Developer Open Ai Under Federal Trade Commission Investigation

Apr 29, 2025 -

Nyt Spelling Bee February 28 2025 Complete Solution Guide

Apr 29, 2025

Nyt Spelling Bee February 28 2025 Complete Solution Guide

Apr 29, 2025 -

Speedboats Record Attempting Flip At Arizona Boating Competition

Apr 29, 2025

Speedboats Record Attempting Flip At Arizona Boating Competition

Apr 29, 2025 -

100 Immigrants Detained In Underground Nightclub Raid Cnn Footage

Apr 29, 2025

100 Immigrants Detained In Underground Nightclub Raid Cnn Footage

Apr 29, 2025 -

Global Competition Heats Up The Scramble For Us Researchers Post Funding Cuts

Apr 29, 2025

Global Competition Heats Up The Scramble For Us Researchers Post Funding Cuts

Apr 29, 2025

Latest Posts

-

Missing Person Midland Athlete Vanishes In Las Vegas

Apr 29, 2025

Missing Person Midland Athlete Vanishes In Las Vegas

Apr 29, 2025 -

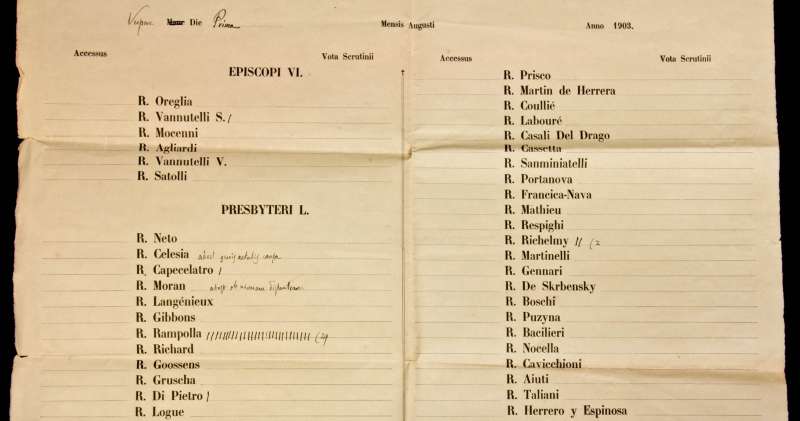

Papal Conclave Debate Over Convicted Cardinals Voting Rights

Apr 29, 2025

Papal Conclave Debate Over Convicted Cardinals Voting Rights

Apr 29, 2025 -

Wrestle Mania Missing Brit Paralympian Found After Four Day Search

Apr 29, 2025

Wrestle Mania Missing Brit Paralympian Found After Four Day Search

Apr 29, 2025 -

Brit Paralympian Missing At Wrestle Mania Found Safe

Apr 29, 2025

Brit Paralympian Missing At Wrestle Mania Found Safe

Apr 29, 2025 -

Papal Conclave Debate Over Convicted Cardinals Voting Eligibility

Apr 29, 2025

Papal Conclave Debate Over Convicted Cardinals Voting Eligibility

Apr 29, 2025