Navigate The Private Credit Boom: 5 Do's & Don'ts For Job Seekers

Table of Contents

- Do's for Job Seekers in the Private Credit Boom

- 1. Tailor Your Resume and Cover Letter

- 2. Network Strategically

- 3. Showcase Your Understanding of Private Credit

- Don'ts for Job Seekers in the Private Credit Boom

- 1. Don't Neglect the Basics

- 2. Don't Underestimate the Importance of Culture Fit

- 3. Don't Settle for Less Than You Deserve

- Conclusion

Do's for Job Seekers in the Private Credit Boom

1. Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. In the competitive private credit market, a generic application won't cut it. You need to showcase why you are the ideal candidate.

- Focus on relevant skills and experience: Highlight experience in areas like financial modeling, credit analysis, portfolio management, legal, or compliance – all highly sought after in private credit. Did you manage a large portfolio? Did you successfully restructure debt? Quantify your achievements!

- Quantify your achievements: Use metrics to demonstrate your impact. Instead of "Managed a portfolio," try "Managed a $50 million portfolio, achieving a 15% return on investment." Numbers speak volumes.

- Keywords are key: Incorporate relevant keywords like "private credit," "direct lending," "alternative investments," "fund management," "debt financing," "leveraged finance," "distressed debt," and specific software (e.g., Bloomberg Terminal, Argus, Moody's Analytics). Applicant Tracking Systems (ATS) scan for these terms.

- Customize for each application: Don't send a generic resume. Carefully review each job description and tailor your resume and cover letter to match the specific requirements and keywords used.

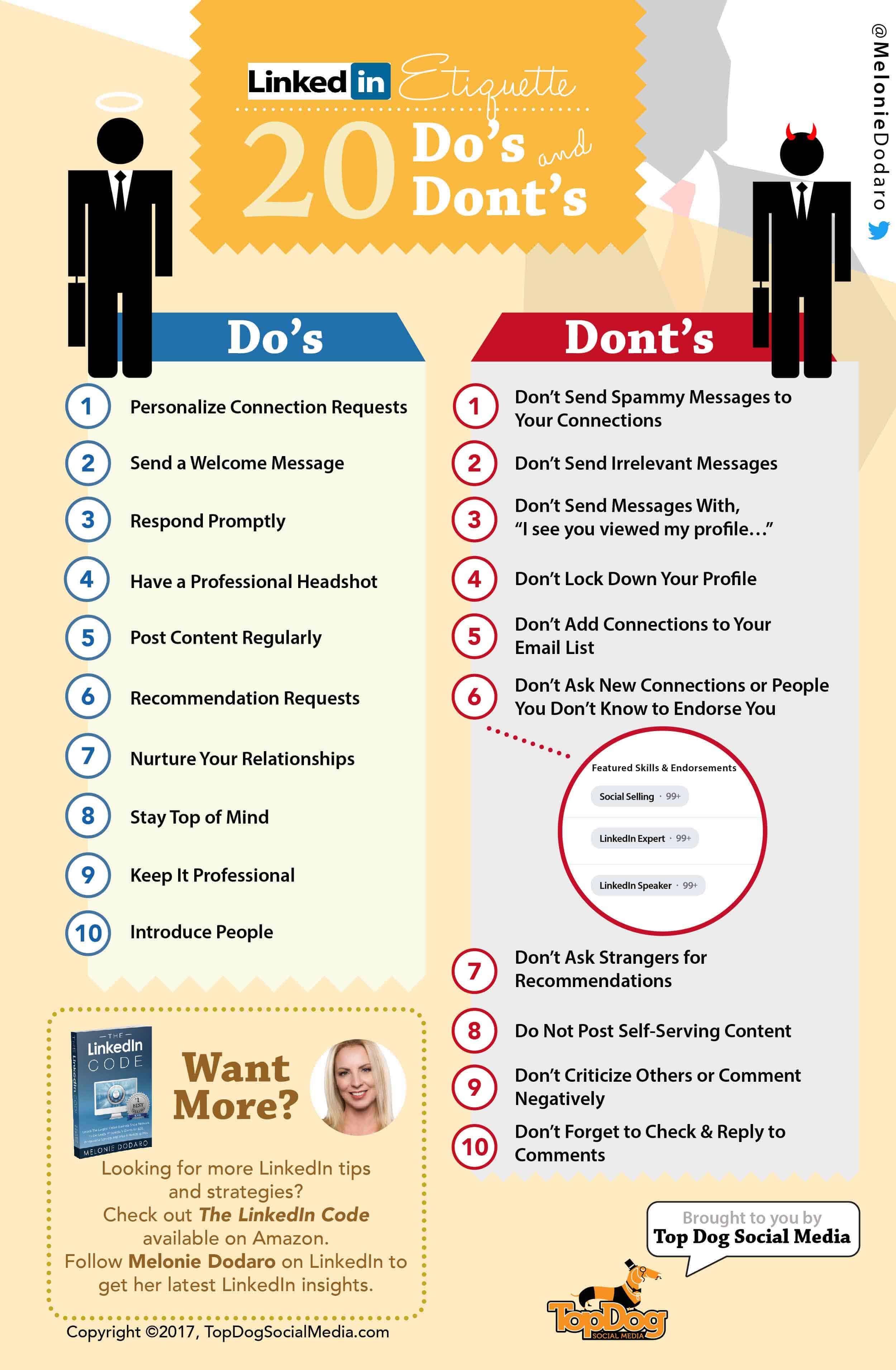

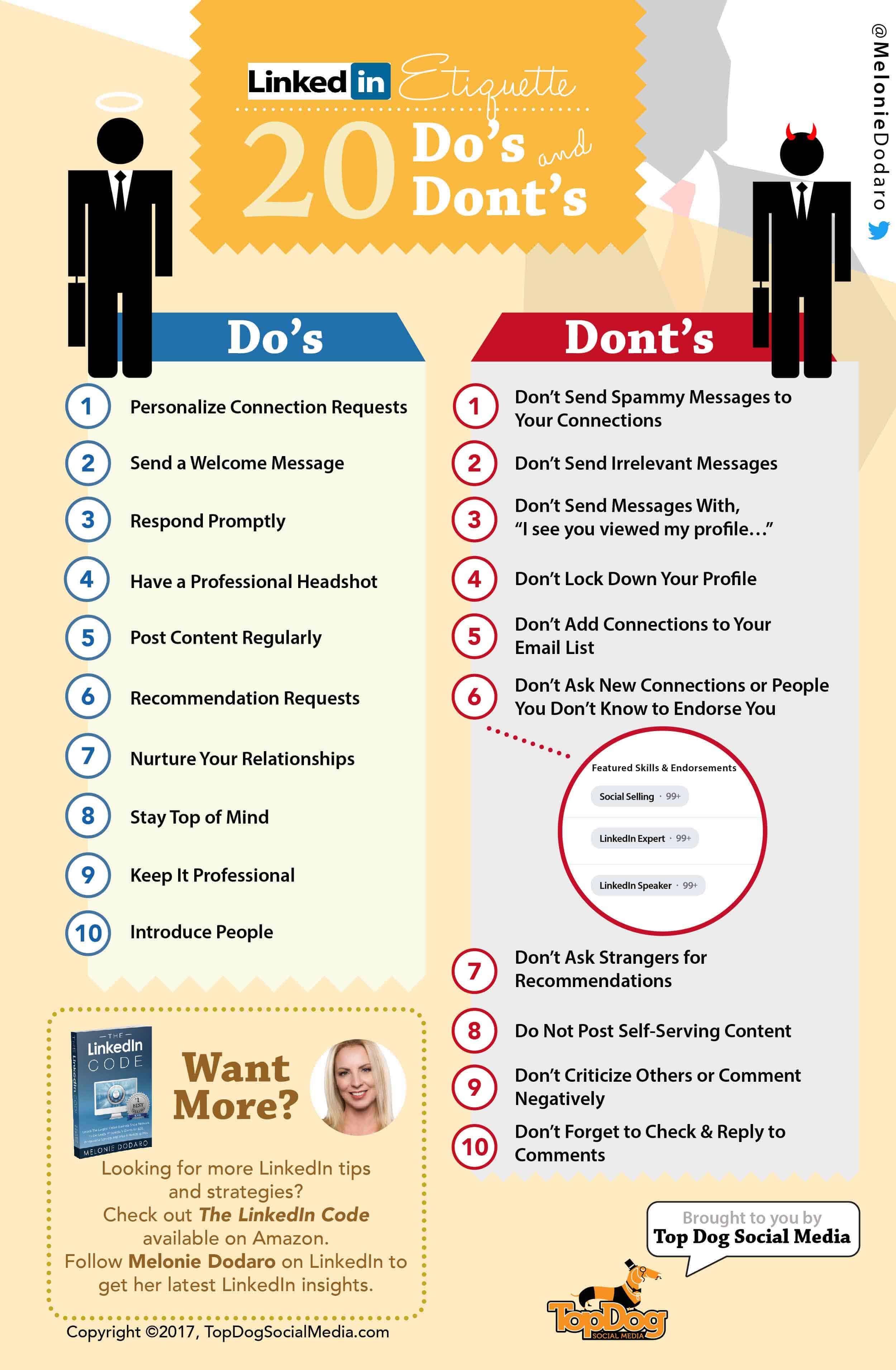

2. Network Strategically

Networking is crucial in the private credit industry. It's not just about who you know, but also about building genuine relationships.

- Attend industry events: Conferences, workshops, and networking events related to private credit, alternative investments, and finance offer invaluable opportunities to connect with professionals. Look for events hosted by industry associations or private equity firms.

- Leverage LinkedIn: Optimize your LinkedIn profile with relevant keywords and a compelling headline. Connect with people working in private credit firms and engage meaningfully with their posts and articles.

- Informational interviews: Reach out to people working in private credit for informational interviews. These conversations can provide valuable insights into the industry and help you build your network. Frame your request as a learning opportunity rather than a job search.

3. Showcase Your Understanding of Private Credit

Demonstrating a deep understanding of the private credit market is essential. Employers want to see that you're not just applying to any finance job, but that you're genuinely interested in this specific sector.

- Demonstrate your knowledge of market trends: Stay up-to-date on industry news and trends related to private credit, leveraged finance, and distressed debt. Read industry publications and follow key influencers on LinkedIn.

- Highlight relevant certifications: Consider pursuing relevant certifications such as the CFA charter, CAIA, or other industry-specific qualifications to demonstrate your commitment to the field.

- Show your analytical skills: Be prepared to discuss your understanding of credit risk, financial modeling, and investment strategies in private credit. Practice explaining complex concepts clearly and concisely.

Don'ts for Job Seekers in the Private Credit Boom

1. Don't Neglect the Basics

While understanding private credit is crucial, don't overlook the fundamentals of a successful job application.

- Resume and cover letter errors: Proofread meticulously to avoid typos and grammatical errors. These mistakes can significantly impact your chances.

- Poor communication: Ensure clear and concise communication in all interactions, from your initial application to your interviews. Practice your elevator pitch.

- Lack of preparation: Thoroughly research the firms and interviewers before any interview. Understanding their investment strategies and recent deals will show your genuine interest.

2. Don't Underestimate the Importance of Culture Fit

Private credit firms often have unique cultures. Demonstrating a good fit is essential.

- Research firm culture: Understand the firm's values and working environment. Look for information on their website, Glassdoor, and LinkedIn.

- Prepare behavioral questions: Practice answering behavioral questions that demonstrate your teamwork skills, problem-solving abilities, and work ethic. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Show your personality: Let your personality shine through while remaining professional. Authenticity is valued.

3. Don't Settle for Less Than You Deserve

Negotiating your compensation is a crucial part of the job search process.

- Research salary expectations: Understand the typical compensation range for similar roles in the private credit industry using salary websites and networking contacts.

- Negotiate your compensation package: Don't be afraid to negotiate salary, benefits, and other perks. Know your worth and be prepared to justify your expectations.

- Consider the whole package: Evaluate not just the salary but also benefits, work-life balance, and career growth opportunities. A slightly lower salary might be worth it if the overall package is superior.

Conclusion

The private credit boom offers incredible opportunities, but success requires a focused approach. By following these do's and don'ts, job seekers can significantly increase their chances of landing their dream roles. Remember to tailor your materials, network strategically, demonstrate your expertise, avoid common pitfalls, and confidently negotiate your compensation. Don't miss out on this exciting period of growth in the private credit industry. Start navigating your way to success today! Start your job search in the exciting world of private credit now!

Adrbyejanin Zijvo Mnyer Pashinyani Qaghaqakanvo Tyan Vyerlvo Tsvo Tyvo N Ishkhan Saghatyelyani Kvoghmic

Adrbyejanin Zijvo Mnyer Pashinyani Qaghaqakanvo Tyan Vyerlvo Tsvo Tyvo N Ishkhan Saghatyelyani Kvoghmic

Fortnite A Parents Guide To Safe And Responsible Gaming

Fortnite A Parents Guide To Safe And Responsible Gaming

Tracee Ellis Rosss Career Move A Stunning Transformation

Tracee Ellis Rosss Career Move A Stunning Transformation

Tracee Ellis Ross Returns To The Runway A Marni Celebration After 30 Years

Tracee Ellis Ross Returns To The Runway A Marni Celebration After 30 Years

Analiza Hrvatskog Uvoza Nafte Rast Iz Azerbajdzana I Moguce Ruske Poveznice

Analiza Hrvatskog Uvoza Nafte Rast Iz Azerbajdzana I Moguce Ruske Poveznice