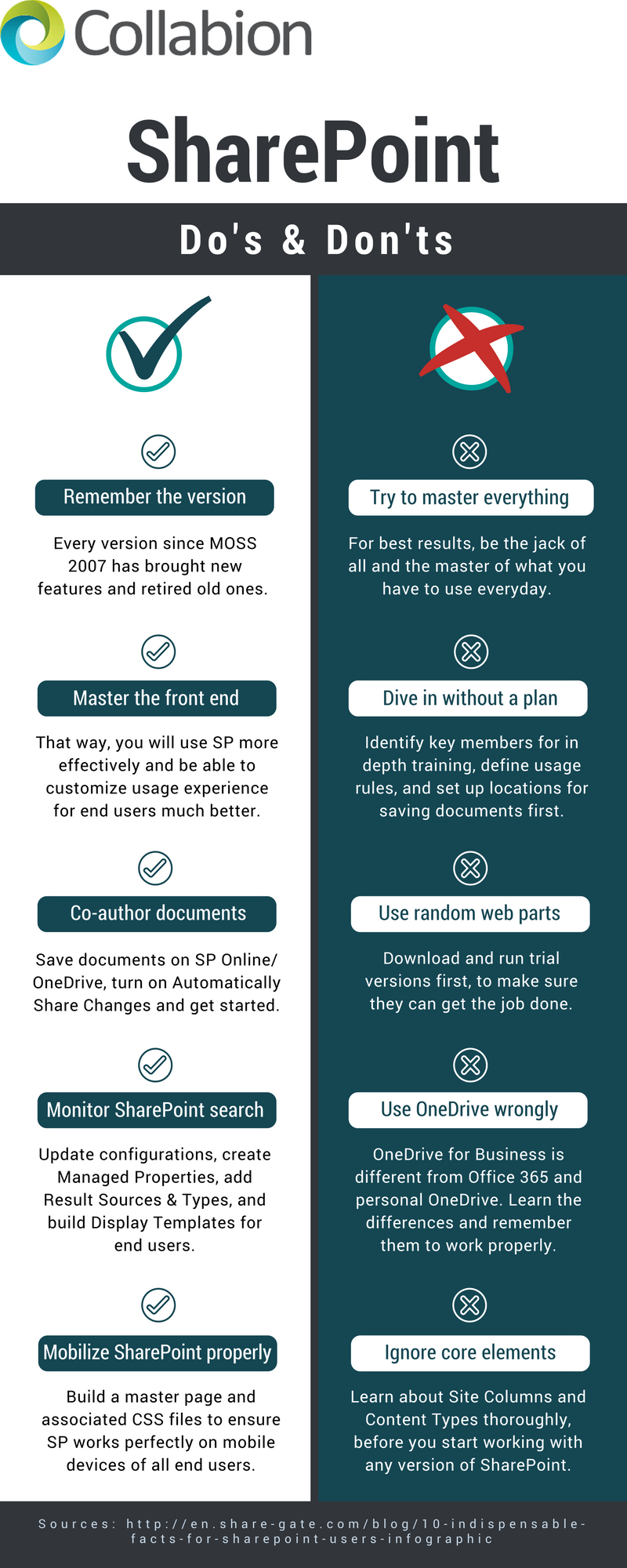

Navigate The Private Credit Job Market: 5 Do's & 5 Don'ts

Table of Contents

5 Do's to Land Your Dream Private Credit Role

Do 1: Network Strategically within the Private Credit Industry

The private credit industry thrives on relationships. Building a strong network is crucial for uncovering hidden opportunities and gaining a competitive edge.

- Leverage LinkedIn for targeted outreach:

- Join relevant LinkedIn groups like "Private Equity & Venture Capital," "Alternative Lending Professionals," and others focused on private debt or specific niches within private credit.

- Connect with recruiters specializing in private credit placements. Actively engage in discussions and share insightful comments to establish your presence.

- Attend industry conferences and events:

- Networking events offer unparalleled opportunities to connect with professionals, learn about the latest trends, and showcase your expertise.

- Prepare a concise and compelling elevator pitch to introduce yourself and your skills effectively.

- Informational interviews are key:

- Reach out to individuals working in your target roles at firms you admire. Request a brief informational interview to learn about their career paths, gain valuable insights, and expand your network.

Do 2: Tailor Your Resume and Cover Letter for Specific Private Credit Roles

Generic applications rarely succeed in the competitive private credit job market. Each application should be meticulously tailored to highlight your qualifications for the specific role and company.

- Highlight relevant skills and experiences:

- Quantify your achievements whenever possible (e.g., "Increased portfolio yield by 15%").

- Incorporate keywords from the job description to demonstrate your understanding of the requirements.

- Showcase your understanding of private credit principles like leverage ratios, debt covenants, and risk assessment.

- Showcase your understanding of financial modeling:

- Mention your proficiency in Excel, financial modeling software (e.g., Bloomberg Terminal, Argus), and other relevant analytical tools. Provide specific examples of your modeling experience.

- Demonstrate your knowledge of credit analysis:

- Highlight experience with credit underwriting, due diligence, portfolio management, and loan structuring. Detail your involvement in specific projects.

Do 3: Master the Art of the Private Credit Interview

Private credit interviews are rigorous and demanding. Preparation is paramount.

- Prepare for behavioral and technical questions:

- Practice the STAR method (Situation, Task, Action, Result) to structure your responses to behavioral questions.

- Research common interview questions specific to private credit, such as "Walk me through a credit analysis you performed" or "How do you assess risk in a private debt investment?".

- Showcase your financial acumen:

- Be prepared to discuss complex financial statements (balance sheets, income statements, cash flow statements), market trends, and risk assessment methodologies.

- Research the firm thoroughly:

- Demonstrate your understanding of their investment strategy, portfolio, recent deals, and the overall private credit market. Show genuine interest in their work.

Do 4: Highlight Your Niche Expertise Within Private Credit

The private credit market is diverse. Specializing in a particular area enhances your marketability.

- Specialize in a specific area: Focus on distressed debt, real estate finance, infrastructure finance, or another area that aligns with your interests and skills.

- Develop a strong understanding of the regulatory landscape: Familiarity with relevant regulations and compliance requirements is crucial, especially for roles involving regulatory reporting or compliance.

- Continuously upskill and stay updated on industry trends: Pursue relevant certifications (e.g., CFA, CAIA), attend webinars, read industry publications (like Private Debt Investor), and follow key industry influencers on LinkedIn.

Do 5: Follow Up After Every Interaction

Following up reinforces your interest and keeps you top-of-mind.

- Send thank-you notes after interviews: Personalize your notes, reiterate your interest in the position, and highlight key discussion points.

- Maintain consistent communication with recruiters: Follow up on application statuses and demonstrate your continued interest in the opportunities.

- Stay persistent and patient: The private credit job market can be competitive, so perseverance is crucial.

5 Don'ts for Navigating the Private Credit Job Market

Don't 1: Neglect Networking: Failing to network significantly limits your access to opportunities.

Don't 2: Submit Generic Applications: Generic applications show a lack of interest and effort.

Don't 3: Underprepare for Interviews: Poor preparation reflects poorly on your capabilities and commitment.

Don't 4: Lack Specialized Knowledge: Without niche expertise, you'll struggle to stand out from the competition.

Don't 5: Fail to Follow Up: Not following up demonstrates a lack of enthusiasm and professionalism.

Unlock Your Private Credit Career Potential

Securing a role in the dynamic private credit job market demands a strategic and proactive approach. By diligently following the "Do's" and avoiding the "Don'ts" outlined above, you'll significantly improve your chances of landing your dream job. Start applying these private credit job market strategies today! Take control of your private credit career search now! [Optional: Link to a relevant resource, such as a private credit job board or networking platform]

Featured Posts

-

Actor Michael Sheens Financial Disclosure Net Worth And Debt Explained

May 01, 2025

Actor Michael Sheens Financial Disclosure Net Worth And Debt Explained

May 01, 2025 -

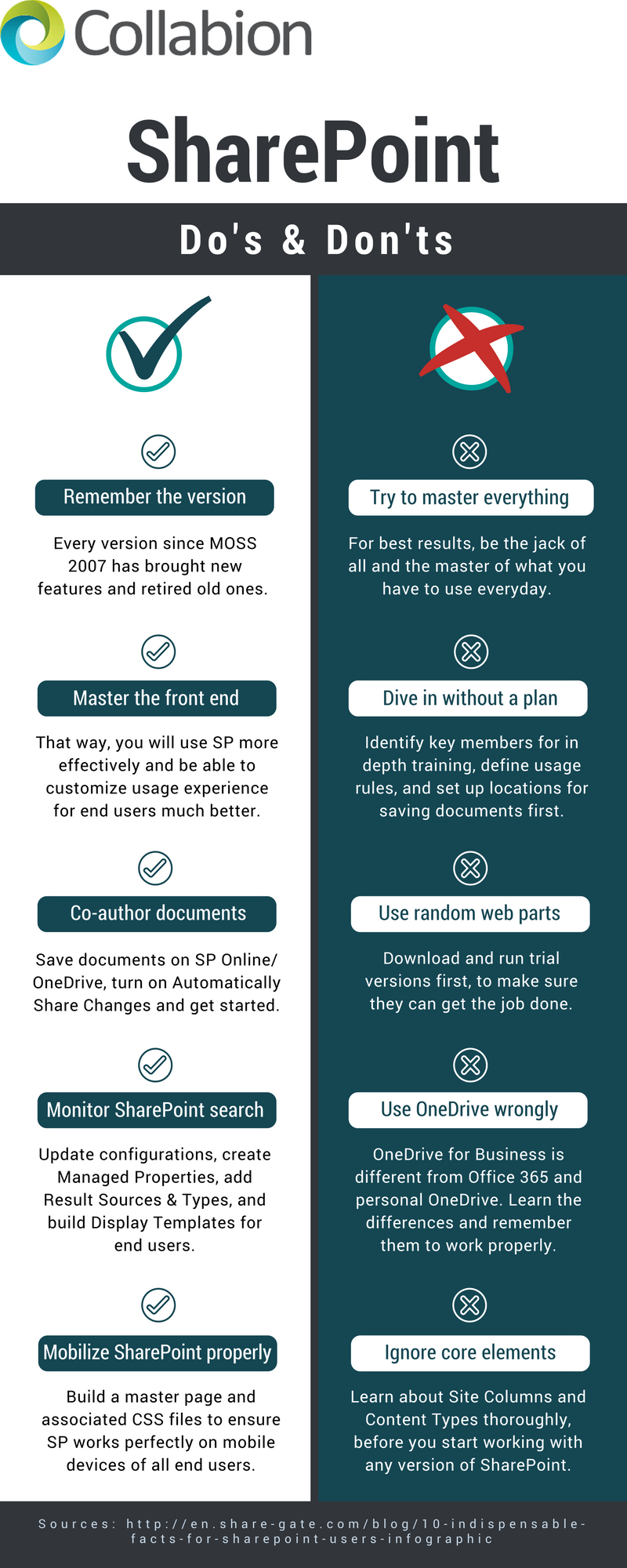

Chat Pubblicate Da Domani Becciu Complotto E Accuse

May 01, 2025

Chat Pubblicate Da Domani Becciu Complotto E Accuse

May 01, 2025 -

Englands Last Minute Victory Against France

May 01, 2025

Englands Last Minute Victory Against France

May 01, 2025 -

8xmille Aggiornamenti Sul Processo Al Fratello Di Angelo Becciu

May 01, 2025

8xmille Aggiornamenti Sul Processo Al Fratello Di Angelo Becciu

May 01, 2025 -

Legal Battle Did Channel 4 And Michael Sheen Plagiarize A Debt Documentary

May 01, 2025

Legal Battle Did Channel 4 And Michael Sheen Plagiarize A Debt Documentary

May 01, 2025