Navigating High Stock Market Valuations: Advice From BofA

Table of Contents

Understanding Current Market Conditions and High Valuations

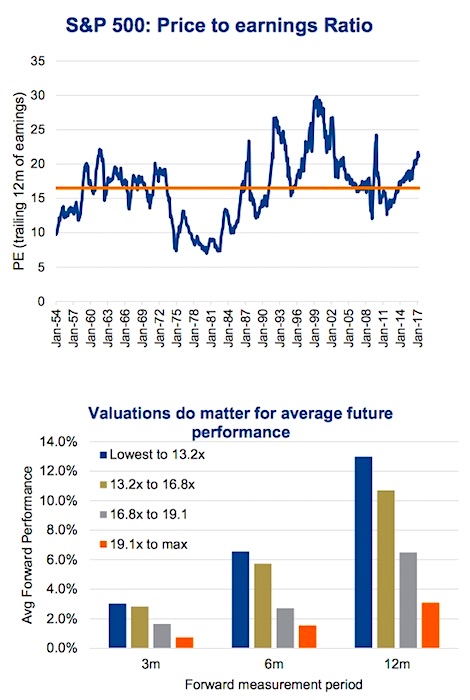

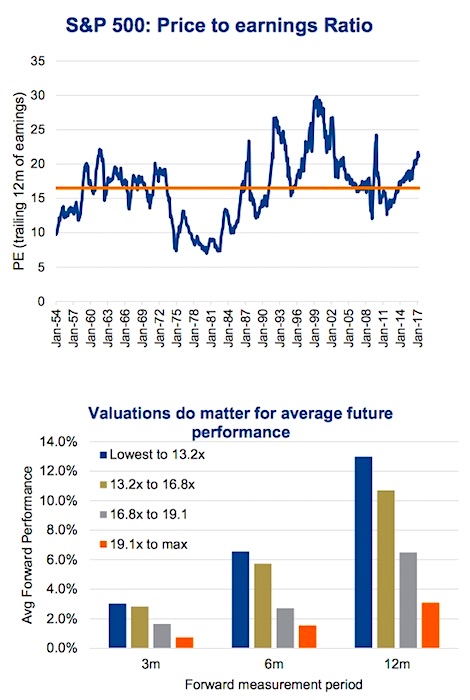

Understanding market valuation is crucial for making sound investment decisions. Market valuation refers to the overall worth of the stock market, often expressed relative to company earnings or economic indicators. Key metrics include the Price-to-Earnings ratio (P/E), which compares a company's stock price to its earnings per share, and the Shiller PE ratio (CAPE), which considers inflation-adjusted earnings over a longer period. These ratios help determine whether the market is overvalued, undervalued, or fairly valued.

BofA's perspective on current valuations is nuanced and requires careful consideration of macroeconomic factors. While specific data points change frequently, BofA's reports often analyze current P/E ratios against historical averages to assess whether the current market is unusually expensive. They may also incorporate other valuation metrics and indicators to arrive at their assessment. Their analyses typically weigh the risks of high valuations against potential future growth prospects.

Several factors contribute to high stock valuations. These include:

- Low Interest Rates: Low interest rates make borrowing cheaper for companies and increase the attractiveness of stocks compared to bonds, driving up stock prices.

- Quantitative Easing (QE): Central banks' QE programs inject liquidity into the market, increasing the money supply and potentially inflating asset prices, including stocks.

- Strong Corporate Earnings: Robust corporate earnings can justify higher stock valuations as investors anticipate future growth and profitability.

- Positive Investor Sentiment: Optimistic investor sentiment can lead to higher demand for stocks, pushing prices upwards, even if valuations appear high by traditional metrics.

Bullet points:

- Low interest rates reduce the opportunity cost of investing in stocks, encouraging higher valuations.

- QE programs increase the money supply, leading to potentially higher inflation and increased demand for assets like stocks.

- Strong corporate earnings growth supports higher stock valuations as future profits are anticipated.

- Positive investor sentiment, fueled by factors like technological innovation or economic optimism, can boost stock prices regardless of valuation metrics.

BofA's Recommended Strategies for High-Valuation Markets

Navigating high-valuation markets requires a strategic approach. BofA generally advocates for a multi-pronged strategy focusing on risk mitigation and opportunity identification.

Diversification is Key: Diversifying your investment portfolio across various asset classes is paramount in a high-valuation market. This reduces the impact of any single asset's underperformance. For instance, a diversified portfolio might include a mix of stocks (both large-cap and small-cap), bonds, real estate, and potentially alternative investments.

Focus on Value Investing: BofA often emphasizes the importance of value investing, which focuses on identifying companies trading below their intrinsic value. This approach involves thorough fundamental analysis to uncover undervalued opportunities. In high-valuation markets, value investing becomes even more crucial, as it focuses on companies with strong fundamentals that may be overlooked amidst the overall market exuberance.

Selective Stock Picking: Thorough due diligence is essential when selecting individual stocks. This involves analyzing a company's financial statements, competitive landscape, and management team. Identify companies with robust business models, sustainable competitive advantages, and strong growth potential, even if the overall market is expensive.

Consider Defensive Sectors: Defensive sectors – such as consumer staples (food, beverage, tobacco), healthcare, and utilities – tend to be less volatile than other sectors during periods of market uncertainty. These businesses usually have relatively stable demand, making them attractive investments in a volatile environment.

Bullet points:

- Examples of diversified portfolios: 60% stocks, 40% bonds; 50% stocks, 25% bonds, 25% real estate.

- Examples of value investing strategies: Analyzing price-to-book ratios, comparing earnings yields to bond yields, searching for companies with strong free cash flow.

- Due diligence process: Review financial statements, analyze industry trends, assess management competence.

- Defensive sector examples: Consumer staples (Procter & Gamble), healthcare (Johnson & Johnson), utilities (NextEra Energy).

Managing Risk in a High-Valuation Environment

Risk management is crucial during periods of high valuations.

Risk Tolerance Assessment: Before making investment decisions, it's vital to understand your own risk tolerance. Are you comfortable with potential short-term losses in pursuit of long-term growth? Various online questionnaires and tools can help you assess your risk profile.

Gradual Investment Approach: Avoid making large lump-sum investments in a volatile market. A phased approach, such as dollar-cost averaging (investing a fixed amount at regular intervals), can reduce the impact of market fluctuations.

Regular Portfolio Rebalancing: Periodically rebalancing your portfolio to maintain your desired asset allocation ensures that you don't become overly concentrated in any single asset class or sector. This helps mitigate risk and capitalize on market opportunities.

Bullet points:

- Risk tolerance assessment resources: Many financial websites offer risk tolerance questionnaires.

- Dollar-cost averaging: Investing a fixed amount each month regardless of price.

- Portfolio rebalancing: Adjusting your portfolio periodically to maintain your target asset allocation (e.g., 60% stocks, 40% bonds).

Conclusion

Successfully navigating high stock market valuations requires a thoughtful and strategic approach. By understanding current market conditions, incorporating BofA's insights on diversification, value investing, and risk management, and adopting a disciplined investment strategy, you can improve your chances of achieving your financial goals even in this challenging environment. Remember to conduct thorough research and consider consulting a financial advisor before making any investment decisions. Don't hesitate to revisit BofA's reports for the most up-to-date information on navigating high stock market valuations.

Featured Posts

-

White Houses Unexpected Choice Maha Influencer Replaces Withdrawn Surgeon General Nominee

May 10, 2025

White Houses Unexpected Choice Maha Influencer Replaces Withdrawn Surgeon General Nominee

May 10, 2025 -

Stiven King Pro Politiku Zayavi Schodo Trampa Ta Maska

May 10, 2025

Stiven King Pro Politiku Zayavi Schodo Trampa Ta Maska

May 10, 2025 -

Leon Draisaitls Injury Oilers Star Expected For Playoffs

May 10, 2025

Leon Draisaitls Injury Oilers Star Expected For Playoffs

May 10, 2025 -

Analyzing The High Potential Season 1 Character As A Season 2 Target

May 10, 2025

Analyzing The High Potential Season 1 Character As A Season 2 Target

May 10, 2025 -

Oboronnoe Soglashenie Makrona I Tuska 9 Maya Chto Izvestno

May 10, 2025

Oboronnoe Soglashenie Makrona I Tuska 9 Maya Chto Izvestno

May 10, 2025