Navigating Uncertainty: Airlines Face Headwinds From Oil Supply Disruptions

Table of Contents

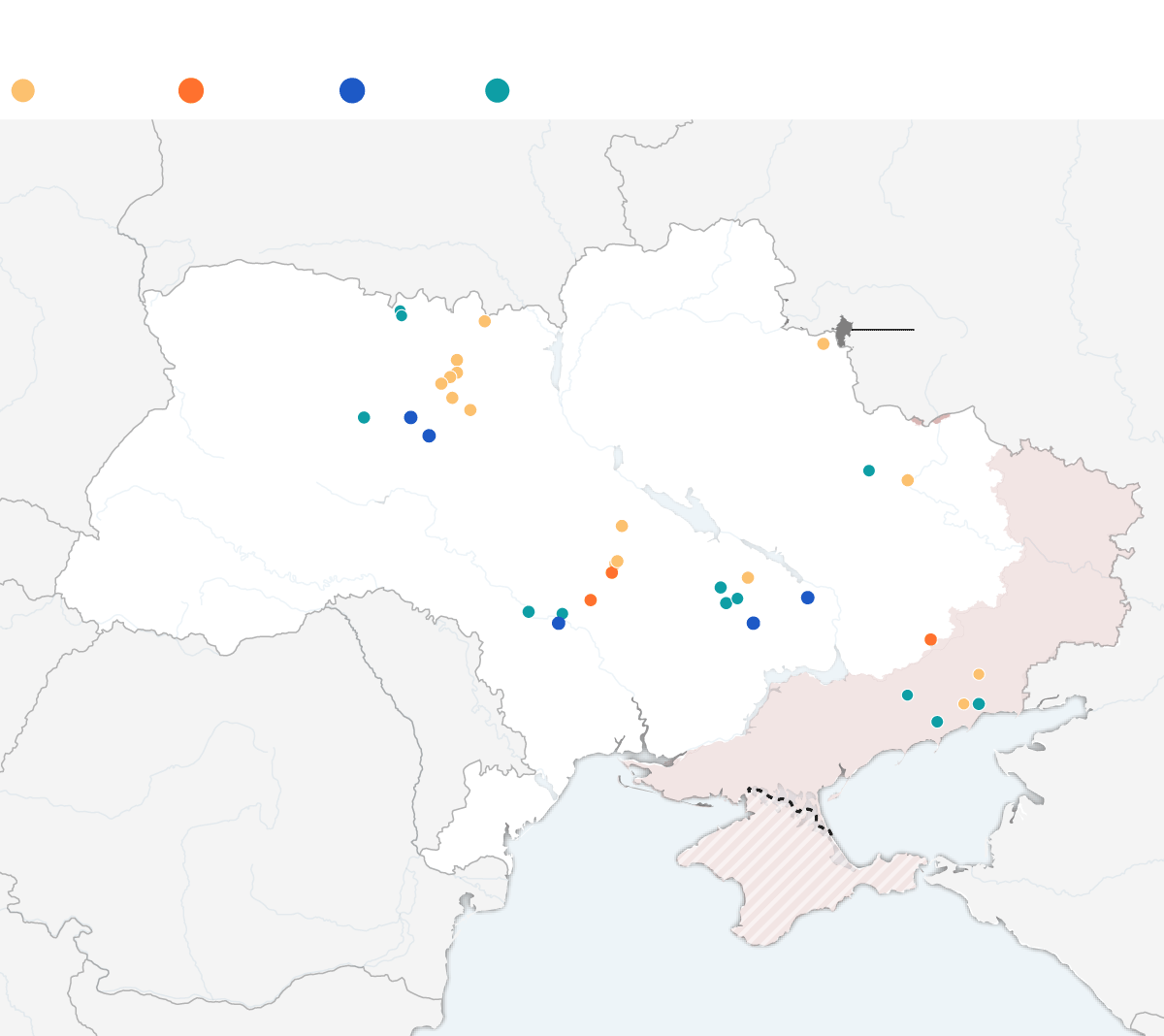

The current geopolitical landscape, marked by the ongoing war in Ukraine and fluctuating decisions from OPEC+, has created significant oil supply disruptions. These events have driven up oil prices to unprecedented levels, directly influencing the price of jet fuel, a major operational expense for airlines. The resulting uncertainty presents significant challenges, requiring airlines to adapt strategically to ensure their survival and long-term sustainability.

The Direct Impact of Rising Fuel Costs on Airlines

Increased Operational Expenses

Higher fuel prices directly translate into significantly increased operational expenses for airlines. This impact is felt across the board:

- Increased operating costs: Fuel accounts for a substantial percentage (often 20-40%) of an airline's operating budget. A sharp rise in fuel costs dramatically erodes profitability.

- Reduced profit margins: Airlines are forced to contend with significantly thinner profit margins, leaving less room for investment in growth and modernization.

- Potential for route cancellations or reductions in frequency: To mitigate losses, some airlines may be forced to cancel less profitable routes or reduce the frequency of flights on existing routes.

Smaller airlines, with less financial resilience, are particularly vulnerable to these escalating costs. They may lack the financial resources to weather prolonged periods of high fuel prices, potentially leading to bankruptcies or mergers.

Impact on Ticket Prices

Inevitably, airlines pass on the increased fuel costs to consumers through higher ticket prices. This has several cascading effects:

- Increased airfare: Passengers face significantly higher airfares, impacting their travel decisions.

- Reduced consumer demand: Higher prices can lead to a decrease in demand for air travel, particularly for leisure travelers who are more sensitive to price changes. The elasticity of demand for air travel is significant, meaning a price increase can result in a proportionally larger decrease in demand.

- Impact on different passenger segments: Business travelers, often less sensitive to price increases, may absorb higher fares more readily than leisure travelers, who may postpone or cancel trips altogether.

Strategic Responses from Airlines to Mitigate Oil Price Volatility

Airlines are actively implementing strategies to mitigate the impact of oil price fluctuations. These strategies encompass various approaches, from financial hedging to operational efficiency improvements.

Fuel Hedging Strategies

Airlines utilize sophisticated hedging techniques to protect themselves from drastic fuel price swings. These strategies, however, come with their own set of risks and benefits:

- Forward contracts: Airlines agree to purchase fuel at a predetermined price for future delivery.

- Options contracts: Airlines purchase the option to buy fuel at a specific price, allowing flexibility depending on market conditions.

- Futures contracts: Similar to forward contracts, but traded on an exchange, offering more liquidity.

The complexity of hedging involves accurately forecasting future fuel prices, which is inherently difficult. Poorly executed hedging strategies can actually exacerbate losses if market predictions are inaccurate.

Operational Efficiency Improvements

Airlines are aggressively pursuing operational efficiency improvements to reduce fuel consumption:

- Route optimization: Careful route planning and adjustments can minimize fuel burn.

- Aircraft maintenance: Proper maintenance ensures optimal aircraft performance and fuel efficiency.

- Advanced flight planning techniques: Sophisticated software helps optimize flight paths and reduce fuel consumption.

- Investing in fuel-efficient aircraft: Airlines are investing in newer, more fuel-efficient aircraft models.

Many airlines have successfully implemented fuel-saving initiatives, resulting in measurable reductions in fuel consumption per passenger-kilometer.

Exploring Alternative Fuels

The long-term solution to fuel price volatility lies in the exploration and adoption of sustainable aviation fuels (SAFs):

- Biofuels: Fuels derived from renewable biomass sources.

- Synthetic fuels: Fuels produced from non-biological sources using renewable energy.

- Hydrogen fuel cells: A promising technology for zero-emission flight, still in early stages of development.

However, scaling up SAF production and building the necessary infrastructure present significant challenges.

The Broader Economic and Social Implications

The impact of oil supply disruptions extends far beyond the airline industry itself, creating ripple effects throughout the global economy.

Impact on Tourism and Related Industries

Higher airfares directly impact the tourism industry and related sectors:

- Decreased tourism revenue: Reduced air travel leads to lower revenue for hotels, restaurants, and other tourism-related businesses.

- Job losses in the tourism sector: The decline in tourism can result in job losses across various sectors.

- Reduced economic activity in tourist destinations: Tourism is a significant contributor to the economies of many regions, and a decrease in tourism can have a profound impact.

Geopolitical Considerations

Oil supply disruptions can exacerbate geopolitical tensions and impact global trade:

- Increased reliance on specific oil-producing nations: Geopolitical instability in oil-producing regions can further disrupt supply and increase prices.

- Potential for trade disputes: Competition for dwindling oil supplies can lead to trade disputes between nations.

- Impact on global supply chains: Disruptions to the oil supply can affect global supply chains, leading to shortages of various goods and services.

Conclusion

The airline industry is facing unprecedented challenges due to oil supply disruptions and the resulting surge in fuel prices. Increased operational costs, higher ticket prices, and reduced consumer demand are creating significant headwinds. However, airlines are actively responding through fuel hedging, operational efficiency improvements, and the exploration of alternative fuels. Understanding the intricacies of oil price fluctuations and fuel price volatility is crucial for navigating the future of air travel. Supporting airlines' efforts to improve fuel efficiency and transition to sustainable aviation fuels is essential for ensuring the long-term viability of the industry and maintaining energy security for airlines. Staying informed about the impact of oil supply disruptions is vital for both the industry and the traveling public.

Featured Posts

-

Guido Fawkes Energy Policy Reform Shifts Direction

May 03, 2025

Guido Fawkes Energy Policy Reform Shifts Direction

May 03, 2025 -

Impact De La Reforme De La Loi Sur Les Partis Politiques Algeriens Le Point De Vue Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025

Impact De La Reforme De La Loi Sur Les Partis Politiques Algeriens Le Point De Vue Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025 -

Rare Earth Minerals Ukraine And The U S Announce Significant Economic Deal

May 03, 2025

Rare Earth Minerals Ukraine And The U S Announce Significant Economic Deal

May 03, 2025 -

Georgia Stanways Emotional Tribute Following Fatal Pitch Accident In Kendal

May 03, 2025

Georgia Stanways Emotional Tribute Following Fatal Pitch Accident In Kendal

May 03, 2025 -

I Diafthora Stis Poleodomies Mia Krisimi Analysi Kai I Anagkaiotita Epanidrysis Toy Kratoys

May 03, 2025

I Diafthora Stis Poleodomies Mia Krisimi Analysi Kai I Anagkaiotita Epanidrysis Toy Kratoys

May 03, 2025