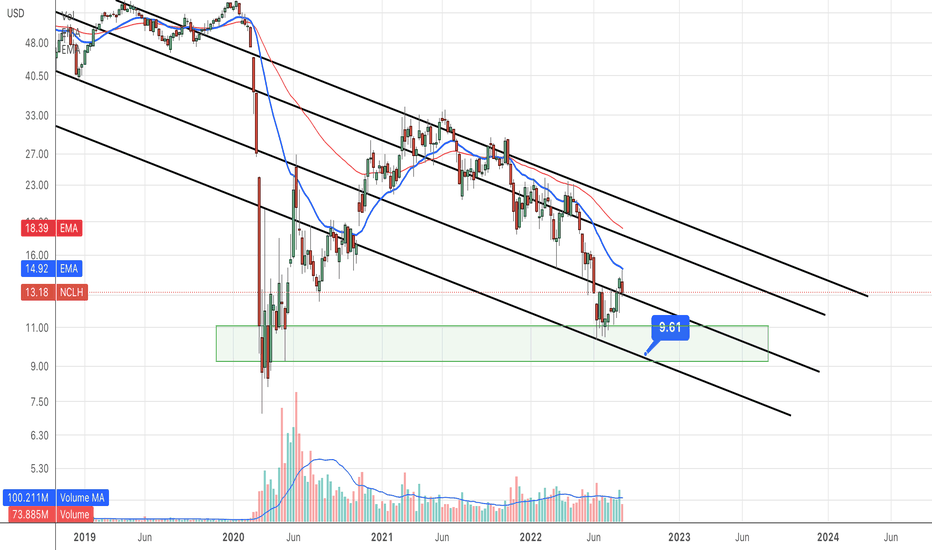

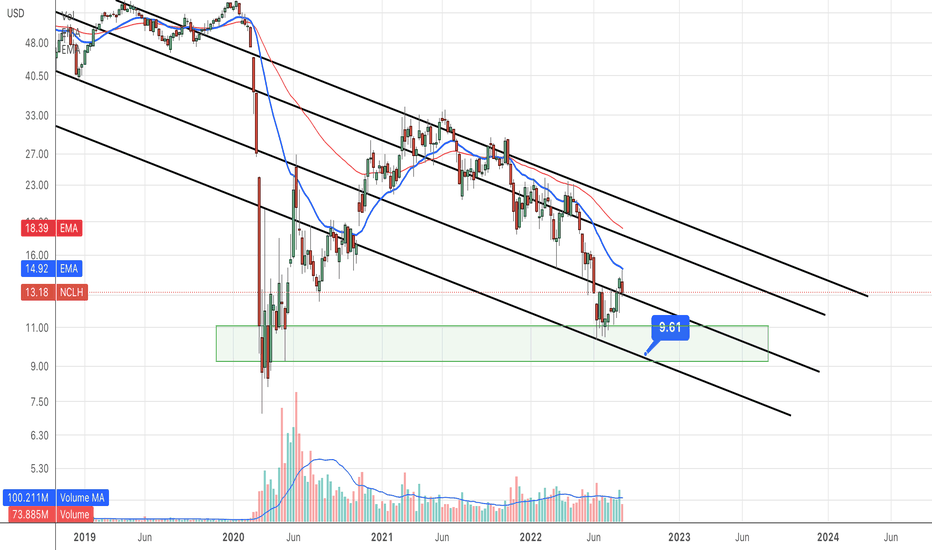

NCLH Stock: What Do Hedge Fund Holdings Reveal?

Table of Contents

Analyzing Recent NCLH Hedge Fund Positions

Analyzing recent NCLH hedge fund positions requires examining publicly available data and interpreting the trends.

Identifying Key Hedge Fund Investors

Several prominent hedge funds hold significant stakes in NCLH. Unfortunately, precise portfolio breakdowns are often confidential. However, by monitoring SEC filings (primarily 13F filings), we can identify significant institutional investors. [Insert links to reliable sources for 13F filings, if available. Otherwise, replace with a statement such as "Accessing this data requires subscriptions to financial data providers."]. Remember that these filings represent holdings at a specific point in time and may not reflect current positions.

Tracking Changes in NCLH Holdings

Tracking changes in NCLH holdings over time offers valuable insights. Analyzing recent filings allows us to observe increases, decreases, or significant shifts in NCLH ownership by major hedge funds.

- Increased Holdings: A significant increase might suggest growing confidence in NCLH's future performance and potential for growth.

- Decreased Holdings: Conversely, a reduction in holdings could indicate profit-taking or a shift in investment strategy, potentially reflecting concerns about the company's outlook.

- New Positions: The initiation of a new position by a prominent hedge fund manager often signals a positive outlook.

Notable hedge fund managers with known investment styles may also provide clues. For example, a value investor's increased stake might suggest undervalued assets, while a growth investor's involvement could indicate expectations of rapid expansion.

The Collective Wisdom of Hedge Funds

The overall trend in hedge fund holdings provides a broader picture of market sentiment toward NCLH.

- Net Long Position: A predominantly net long position (more hedge funds buying than selling) suggests a generally bullish outlook on NCLH's future performance.

- Net Short Position: A net short position (more hedge funds selling than buying) indicates a bearish sentiment, potentially reflecting concerns about the company's prospects. This information should be viewed in context with other market indicators.

The collective wisdom of these highly specialized investors provides valuable data for assessing the overall risk/reward profile of NCLH stock.

Factors Influencing Hedge Fund Decisions on NCLH

Hedge funds' investment decisions are rarely arbitrary. Several critical factors influence their approach to NCLH.

Impact of Post-Pandemic Recovery

The cruise industry's recovery from the COVID-19 pandemic significantly impacts hedge fund investments in NCLH.

- Booking Trends: Strong booking figures indicate positive consumer sentiment and a robust recovery.

- Operational Efficiency: Efficient operations post-pandemic are crucial for profitability.

- Debt Levels: High debt levels can increase financial risk and influence investment decisions.

Crucial Financial Metrics

Key financial metrics heavily influence hedge fund assessments of NCLH.

- Revenue Growth: Consistent revenue growth indicates strong market demand and business health.

- Profitability (Margins): Healthy profit margins demonstrate efficient cost management and pricing strategies.

- Debt-to-Equity Ratio: A high ratio suggests increased financial risk, potentially deterring some investors.

Analyzing these metrics provides insights into NCLH's financial health and potential for future growth.

Competitive Landscape Analysis

The competitive landscape within the cruise industry is a pivotal factor.

- Competitor Analysis: NCLH faces competition from other major cruise lines. Hedge funds analyze the relative strengths and weaknesses of these competitors.

- Market Share: NCLH's market share and its ability to maintain or increase it are critical factors.

- Competitive Advantages: Unique offerings, brand recognition, and operational efficiency can give NCLH an edge.

Interpreting NCLH Hedge Fund Holdings for Investment Strategies

While informative, hedge fund activity is just one piece of the puzzle.

Cautions and Considerations

It's crucial to remember that hedge fund activity is only one factor among many.

- Market Conditions: Overall market trends and economic forecasts play a significant role.

- Specific Business Risks: NCLH faces inherent risks, including fuel price fluctuations and geopolitical events.

- Company-Specific News: Significant news events related to NCLH can dramatically impact the stock price.

Potential Investment Implications

Understanding hedge fund activity can inform different investment strategies.

- Long-Term Investors: Long-term investors might view consistent positive hedge fund activity as a bullish signal, reinforcing their long-term outlook.

- Short-Term Traders: Short-term traders might react more acutely to short-term fluctuations in hedge fund positions, using these shifts to time their trades.

Decoding the Signals: The Takeaway on NCLH Stock Hedge Fund Holdings

Analyzing NCLH stock hedge fund holdings offers valuable insights into market sentiment and potential future performance. However, it's vital to remember that this is only one factor to consider. By combining this analysis with thorough due diligence, including an assessment of financial statements, competitive analysis, and consideration of broader market factors, you can make a more informed decision. Analyze NCLH stock holdings, understand NCLH hedge fund activity, and make informed NCLH investment decisions based on your own risk tolerance and investment goals.

Featured Posts

-

Key Performances By Judge And Goldschmidt Yankees Avoid Series Sweep

Apr 30, 2025

Key Performances By Judge And Goldschmidt Yankees Avoid Series Sweep

Apr 30, 2025 -

Thanh Pho Hue To Chuc Giai Bong Da Thanh Nien Lan Thu Vii Cap Nhat Moi Nhat

Apr 30, 2025

Thanh Pho Hue To Chuc Giai Bong Da Thanh Nien Lan Thu Vii Cap Nhat Moi Nhat

Apr 30, 2025 -

Louisvilles Storm Debris Pickup A Step By Step Guide To Requesting Service

Apr 30, 2025

Louisvilles Storm Debris Pickup A Step By Step Guide To Requesting Service

Apr 30, 2025 -

At And T Challenges Broadcoms Extreme Price Hike On V Mware Acquisition

Apr 30, 2025

At And T Challenges Broadcoms Extreme Price Hike On V Mware Acquisition

Apr 30, 2025 -

Novorozhdennym Soski S Ovechkinym Ot Kinopoiska V Chest Rekorda N Kh L

Apr 30, 2025

Novorozhdennym Soski S Ovechkinym Ot Kinopoiska V Chest Rekorda N Kh L

Apr 30, 2025