Net Asset Value (NAV) Analysis: Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

Defining Net Asset Value (NAV)

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. For the Amundi MSCI All Country World UCITS ETF USD Acc, the NAV reflects the total value of all the global equities held within the fund, divided by the number of outstanding shares. Understanding the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial because it provides a snapshot of the intrinsic value of your investment. Unlike the fluctuating market price, the NAV offers a more stable representation of the fund's assets. This is particularly important for a globally diversified ETF like the Amundi MSCI All Country World ETF, which is structured as a UCITS ETF, adhering to the standards of the Undertakings for Collective Investment in Transferable Securities directive.

Factors Affecting the NAV of Amundi MSCI All Country World UCITS ETF USD Acc

Several factors influence the daily NAV calculation of the Amundi MSCI All Country World UCITS ETF USD Acc:

-

Underlying Asset Price Fluctuations: The primary driver of NAV changes is the performance of the underlying global equities. Daily market movements in various global stock markets directly impact the total value of the ETF's holdings. A rise in the value of these assets increases the NAV, and vice-versa.

-

Currency Exchange Rates (USD Acc): The "USD Acc" designation indicates that the ETF is denominated in US dollars. Fluctuations in exchange rates between the USD and the currencies of the underlying assets affect the NAV. A strengthening USD can lead to a higher NAV, while a weakening USD can reduce it.

-

Management Fees and Expenses: The ETF's management fees and other operating expenses are deducted from the total asset value, thus impacting the NAV. These expenses are usually small but should be considered when evaluating the overall return.

In short:

- Daily market movements of global stocks directly influence NAV.

- Changes in the USD/other currency exchange rates directly impact the NAV, given the USD Acc denomination.

- Accrual of management fees gradually reduces the NAV.

- Dividends received by the ETF from its underlying holdings are reinvested, positively affecting the NAV.

How to Find and Interpret the NAV of Amundi MSCI All Country World UCITS ETF USD Acc

Finding the daily NAV for the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward. Reliable sources include:

- Amundi's Official Website: The asset management company's website typically provides up-to-date NAV information.

- Financial News Websites: Major financial news sources often publish ETF NAV data.

- Brokerage Platforms: Your brokerage account will usually show the current NAV alongside the market price.

Interpreting the NAV involves understanding its context:

- NAV vs. Market Price: The NAV represents the intrinsic value, while the market price reflects the traded value. These values can differ slightly due to market demand and supply.

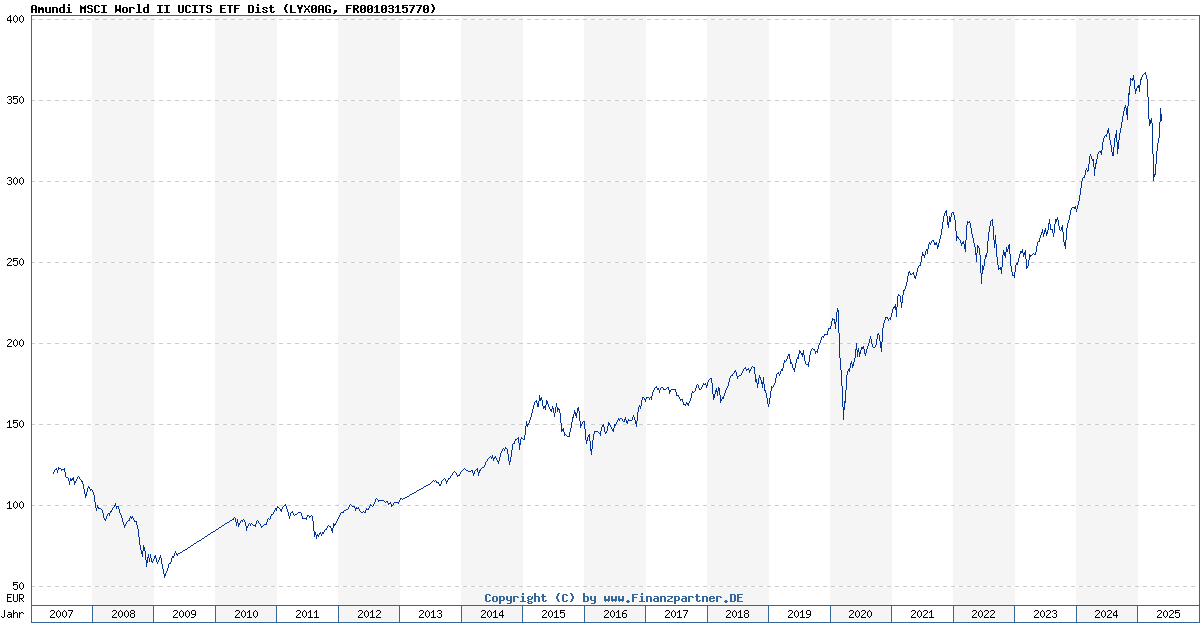

- NAV Charts and Historical Data: Analyzing historical NAV data helps in understanding long-term performance trends.

Key Considerations:

- Official sources provide the most accurate and up-to-date NAV figures.

- Understanding NAV charts helps visualize performance trends over time.

- Comparing the NAV to the market price can reveal potential buying or selling opportunities (e.g., when the market price is significantly below the NAV).

- Tracking the NAV over time provides a clear picture of the ETF's performance.

Using NAV Analysis for Investment Decisions with Amundi MSCI All Country World UCITS ETF USD Acc

While NAV is a critical factor, it shouldn't be the sole determinant for investment decisions. However, it plays a significant role:

- Identifying Undervalued ETFs: If the market price falls considerably below the NAV, it might suggest an undervaluation, presenting a potential buying opportunity.

- Tracking Long-Term Growth: Monitoring the NAV over the long term helps gauge the fund's performance and investment growth.

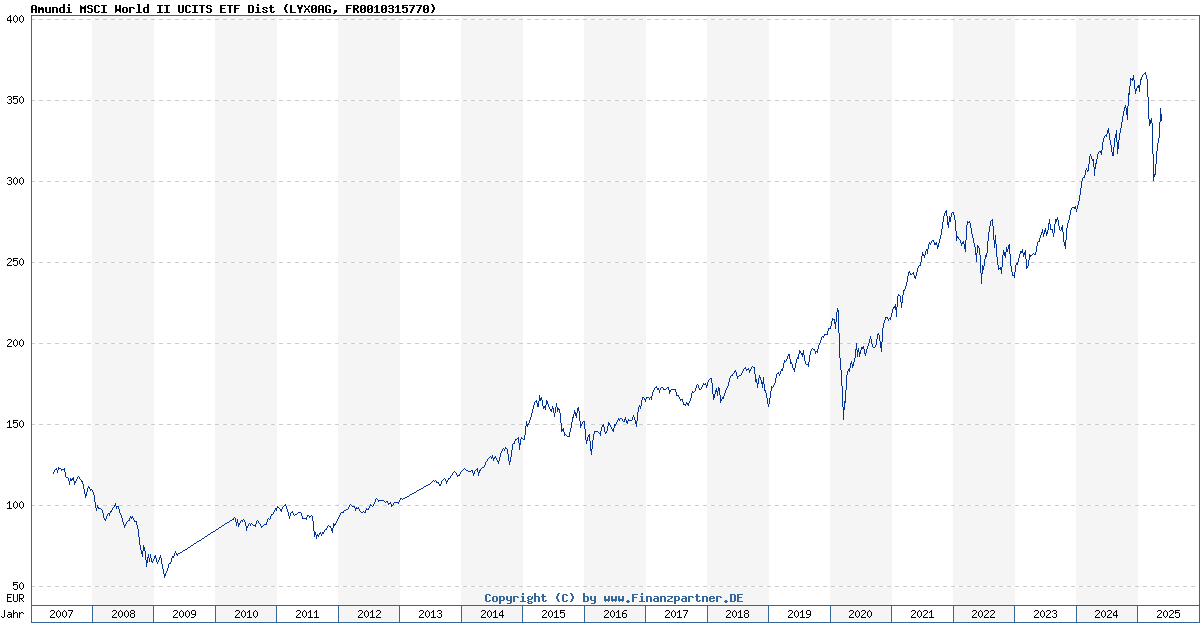

- Comparative Analysis: Comparing the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc with similar ETFs aids in making informed decisions.

Remember to consider:

- Identifying undervalued ETFs using NAV discrepancies requires careful analysis and understanding of market dynamics.

- Tracking long-term NAV growth provides crucial information about investment performance.

- Comparing the NAV with other similar MSCI All Country World ETFs helps in identifying the best investment option.

- NAV analysis is best used in conjunction with other financial metrics and your investment strategy.

Risks and Limitations of NAV Analysis for Amundi MSCI All Country World UCITS ETF USD Acc

While valuable, relying solely on NAV analysis can be misleading:

- Time Lag in Reporting: NAV is usually calculated at the end of the trading day, meaning it might not reflect real-time market changes.

- Market Volatility: Significant market volatility can create short-term discrepancies between the NAV and the market price.

- Investor Sentiment: Market price is influenced by investor sentiment, which may not always align with the NAV.

Important Points:

- NAV reporting often lags behind real-time market fluctuations.

- Market volatility can lead to temporary mismatches between NAV and market price.

- Investor sentiment and trading volume influence market prices independently of the NAV.

Conclusion: Mastering Net Asset Value (NAV) Analysis for the Amundi MSCI All Country World UCITS ETF USD Acc

Understanding Net Asset Value (NAV) is essential for anyone investing in the Amundi MSCI All Country World UCITS ETF USD Acc. While NAV provides a crucial indication of the ETF's intrinsic value, it's vital to consider it alongside other factors like expense ratios, risk profiles, and market conditions. By effectively analyzing the NAV and combining this knowledge with a broader understanding of the market, you can make more informed investment choices. Utilize the information in this guide to perform your own Net Asset Value (NAV) analysis of the Amundi MSCI All Country World UCITS ETF USD Acc and make smart investment decisions. For a deeper dive, consult financial resources and investment professionals.

Featured Posts

-

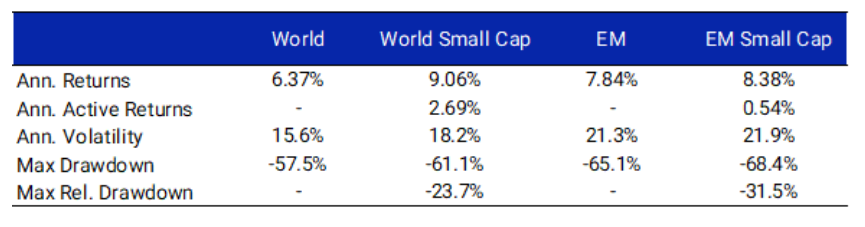

Apakah Mtel And Mbma Layak Dibeli Setelah Termasuk Dalam Msci Small Cap Index

May 24, 2025

Apakah Mtel And Mbma Layak Dibeli Setelah Termasuk Dalam Msci Small Cap Index

May 24, 2025 -

I Phone Ai

May 24, 2025

I Phone Ai

May 24, 2025 -

How To Get Bbc Big Weekend 2025 Sefton Park Tickets A Complete Guide

May 24, 2025

How To Get Bbc Big Weekend 2025 Sefton Park Tickets A Complete Guide

May 24, 2025 -

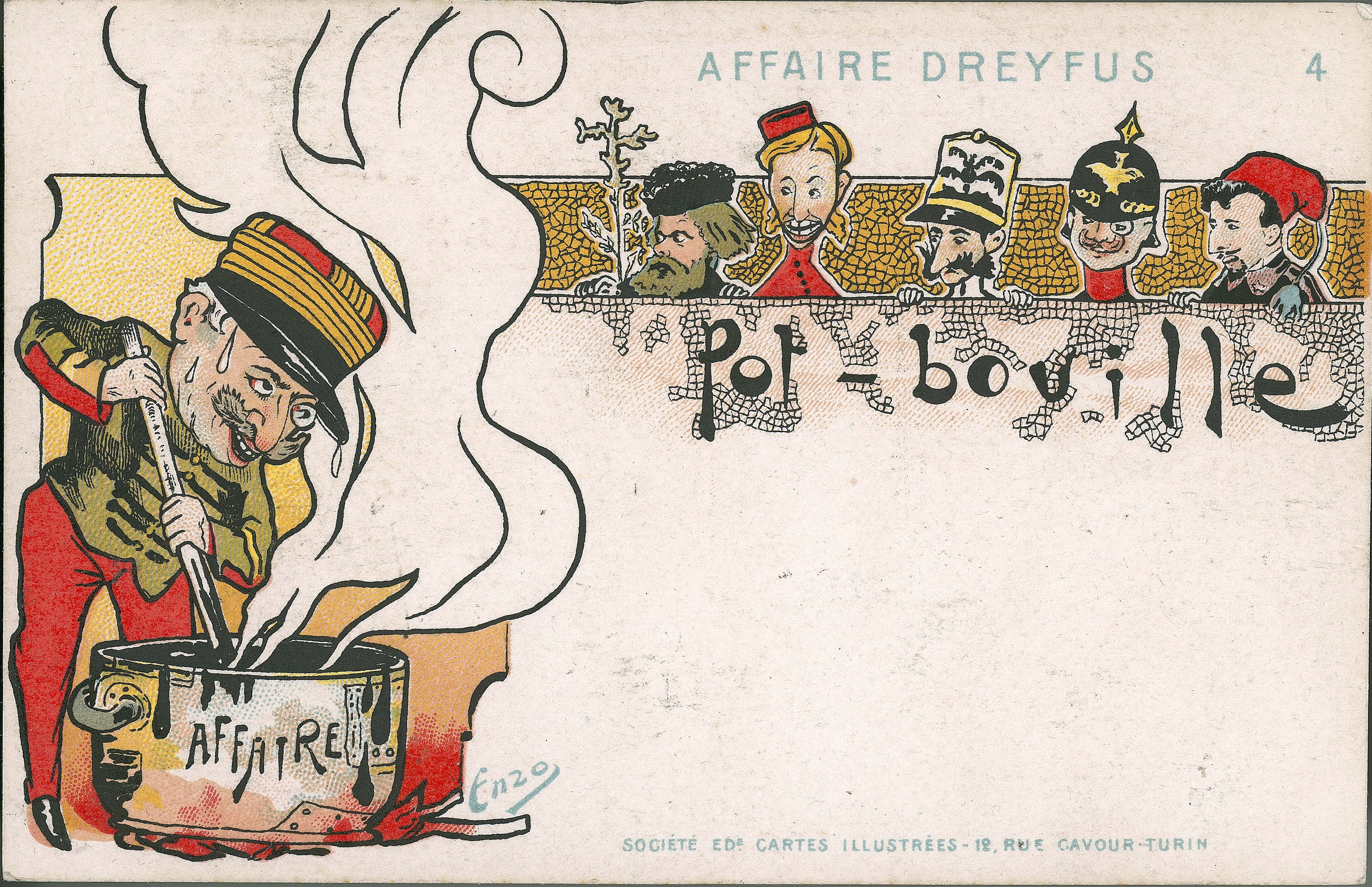

French Lawmakers Push For Dreyfus Promotion A Century After The Scandal

May 24, 2025

French Lawmakers Push For Dreyfus Promotion A Century After The Scandal

May 24, 2025 -

90 Let So Dnya Rozhdeniya Sergeya Yurskogo Geniy Paradoksov Ostroumie I Intellekt

May 24, 2025

90 Let So Dnya Rozhdeniya Sergeya Yurskogo Geniy Paradoksov Ostroumie I Intellekt

May 24, 2025