Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: Key Considerations For Investors

Table of Contents

2.1 What is the NAV and how is it calculated for this specific ETF?

The Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV calculation involves several key components:

-

Asset Values: This includes the market value of all the stocks held within the ETF, reflecting the current prices of these equities on the relevant exchanges. The ETF tracks the MSCI World Index, meaning its holdings mirror this benchmark's composition.

-

Liabilities: These are the ETF's expenses, including management fees and other operational costs.

-

Currency Exchange Rates: The "USD Hedged" aspect is crucial. This means the ETF uses hedging strategies to minimize the impact of currency fluctuations between the base currency of the underlying assets (likely a mix of currencies) and the US dollar. The NAV calculation incorporates the current exchange rates and the effectiveness of the hedging strategy. This is a significant difference compared to an unhedged version of the ETF, where currency movements would directly and more significantly affect the NAV.

-

NAV Calculation: The NAV is calculated by summing the market value of all assets, subtracting liabilities, and then dividing by the total number of outstanding ETF shares. This gives you the net asset value per share.

The Amundi ETF provider updates the NAV daily, usually at the close of market trading. You can find this information on the Amundi website, major financial news platforms, and through your brokerage account. Understanding the Amundi MSCI World II UCITS ETF NAV calculation is fundamental to assessing its performance.

2.2 Factors Affecting the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors influence the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist:

-

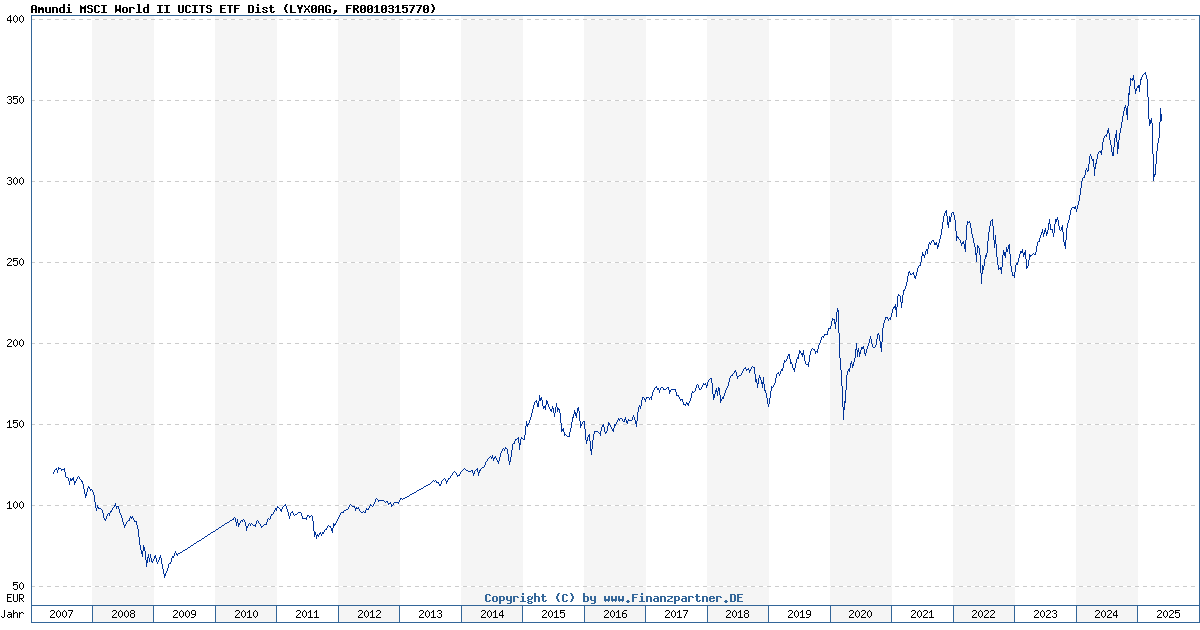

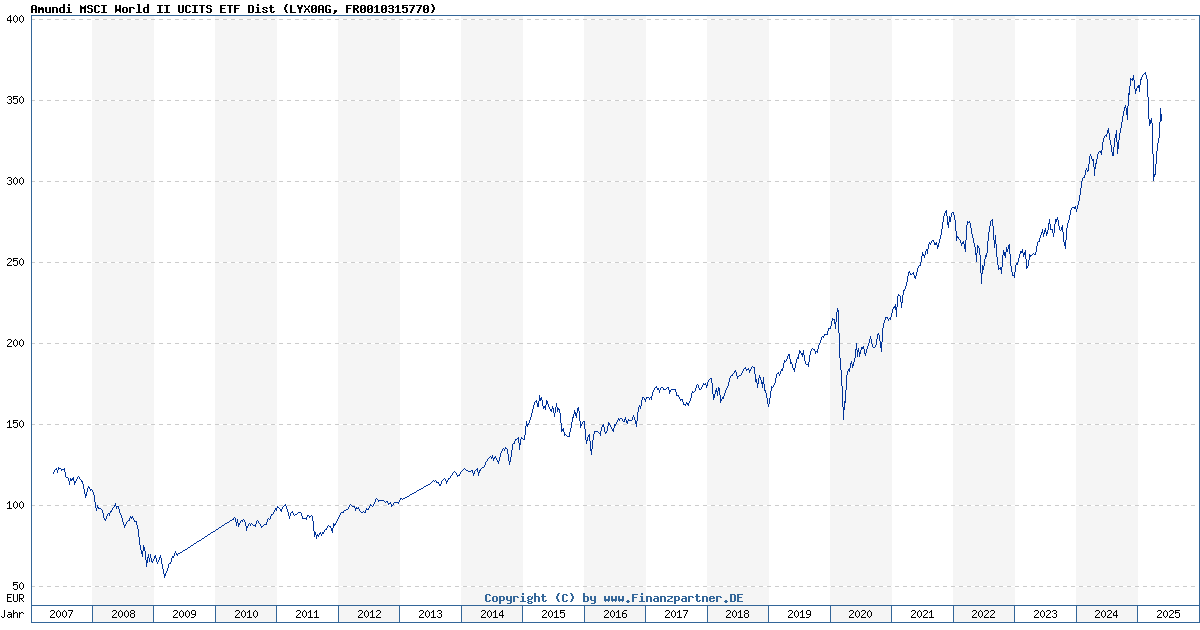

Market Performance: The primary driver of NAV changes is the overall performance of the global equity markets, as tracked by the MSCI World Index. Positive market movements generally lead to increased NAV, while negative movements result in a decreased NAV. Market volatility directly impacts the daily fluctuations of the NAV.

-

Currency Fluctuations: Despite the USD hedging, residual currency risk remains. While the hedge aims to mitigate the impact of currency exchange rate movements, it doesn't eliminate it entirely. Changes in exchange rates can still subtly influence the NAV, although less so compared to an unhedged ETF. This is an important factor in comparing this ETF to its unhedged counterparts.

-

Dividends and Distributions: The "Dist" in Amundi MSCI World II UCITS ETF USD Hedged Dist signifies that the ETF distributes dividends received from its underlying holdings to investors. These distributions reduce the NAV on the ex-dividend date, as the assets are paid out.

-

Management Fees and Expenses: The ETF’s expense ratio (management fees and operational costs) gradually impacts the NAV over time. These fees are deducted from the assets, thereby slightly reducing the NAV.

2.3 Using NAV to Make Informed Investment Decisions

Understanding the NAV is crucial for making sound investment decisions.

-

Performance Assessment: Comparing the NAV at different points in time helps you assess the ETF's performance. An increasing NAV indicates positive growth, while a decreasing NAV signals underperformance.

-

Arbitrage Opportunities: By comparing the NAV to the ETF's market price (which can fluctuate intraday), you can potentially identify arbitrage opportunities if there's a significant discrepancy.

-

Investment Strategy: The NAV, along with other performance metrics such as the total return and Sharpe ratio, should be considered when creating and evaluating your investment strategy.

-

Buy/Sell Signals: While not the sole indicator, changes in NAV, in conjunction with your risk assessment and investment goals, can serve as a signal to consider buying or selling the ETF. It should be considered alongside a broader investment strategy.

2.4 Understanding the implications of the "Dist" in Amundi MSCI World II UCITS ETF USD Hedged Dist

The "Dist" designation means that the Amundi MSCI World II UCITS ETF USD Hedged Dist distributes dividends to investors.

-

Impact on NAV: As mentioned, distributions reduce the NAV on the ex-dividend date.

-

Investor Returns: Investors receive dividend payments, contributing to their overall return.

-

Tax Implications: Investors need to be aware of the tax implications of these distributions, as dividend income is usually taxable.

-

Comparison to Accumulating ETFs ("Acc"): Unlike "Dist" ETFs, "Acc" ETFs reinvest dividends back into the ETF, leading to potential compounding growth. The choice depends on individual tax situations and investment preferences. Understanding the differences between accumulating ETF and distributing ETF is essential.

Conclusion: Making the Most of Your Amundi MSCI World II UCITS ETF USD Hedged Dist Investment Through NAV Analysis

The Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is a key metric influenced by market performance, currency fluctuations (despite hedging), dividends, and expenses. Regularly monitoring the NAV, alongside other performance indicators, allows for informed investment decisions. Understanding how the NAV reflects the underlying asset values and the implications of the "Dist" feature is crucial for optimizing your investment strategy. Stay informed about your investment by regularly monitoring the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF USD Hedged Dist holdings and conducting further research into ETF investing.

Featured Posts

-

Zoryaniy Vikhid Naomi Kempbell U Biliy Tunitsi Z Virizom V Londoni

May 25, 2025

Zoryaniy Vikhid Naomi Kempbell U Biliy Tunitsi Z Virizom V Londoni

May 25, 2025 -

Porsche 956 Tavan Sergisinin Teknik Ve Tarihsel Aciklamalari

May 25, 2025

Porsche 956 Tavan Sergisinin Teknik Ve Tarihsel Aciklamalari

May 25, 2025 -

Understanding The Disappearance A Comprehensive Guide

May 25, 2025

Understanding The Disappearance A Comprehensive Guide

May 25, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025 -

When To Fly Around Memorial Day 2025 Avoiding Crowds And High Prices

May 25, 2025

When To Fly Around Memorial Day 2025 Avoiding Crowds And High Prices

May 25, 2025