New Trump Tax Plan Unveiled By House Republicans

Table of Contents

Key Proposals of the New Trump Tax Plan

The New Trump Tax Plan encompasses a series of proposals designed to reshape the American tax system. Let's examine the core components:

Individual Income Tax Changes

The plan proposes substantial alterations to individual income taxes, impacting various income brackets and benefiting specific demographics differently. These changes include:

- Tax Bracket Changes: Specific details regarding proposed changes to tax brackets would need to be inserted here based on the actual plan details. For example, “[Insert specific proposed changes to tax brackets, e.g., a reduction in the highest tax bracket from 37% to 35%, or a broadening of lower tax brackets].” This will significantly impact taxpayers' annual tax liability.

- Standard Deduction Increase: “[Insert proposed changes to the standard deduction, e.g., a doubling of the standard deduction]. This increase aims to provide tax relief for low- and middle-income families."

- Child Tax Credit Expansion: “[Insert proposed changes to the child tax credit, e.g., an increase in the maximum credit amount or an expansion of eligibility criteria]. This aims to lessen the tax burden on families with children."

- Limitations and Phase-outs: The plan may include limitations or phase-outs on certain deductions or credits to offset the cost of tax cuts. “[Insert details on limitations and phase-outs, if available]”.

These tax bracket changes, coupled with alterations to the standard deduction and child tax credit, are intended to provide targeted tax cuts for families across various income levels. However, the ultimate impact will vary depending on individual circumstances.

Corporate Tax Rate Reductions

A central tenet of the New Trump Tax Plan is a reduction in the corporate tax rate. The proposed changes aim to:

- Lower Corporate Tax Rate: The plan likely includes a reduction in the current corporate tax rate. “[Insert the proposed corporate tax rate, if available].”

- Stimulate Business Investment: Lowering the corporate tax rate is intended to incentivize businesses to invest in expansion, research and development, and job creation.

- Enhance Global Competitiveness: Reducing the corporate tax rate is also designed to make American businesses more competitive in the global marketplace.

- Business Tax Incentives: The plan might incorporate additional incentives or deductions for businesses to further encourage investment and growth. “[Insert details of any proposed business tax incentives].” These business tax cuts are central to the plan’s overall economic strategy.

Tax Implications for the Middle Class

The New Trump Tax Plan’s impact on the middle class is a subject of intense scrutiny. While some proposals aim to provide middle-class tax relief, the net effect is complex and depends on various factors, including income level, family size, and specific tax deductions utilized. Analysis is needed to determine if the tax burden on the middle class will actually decrease or remain the same. Analyzing the impact on disposable income and overall financial well-being of middle-class families is crucial. Further analysis and data projections are necessary to fully understand the ramifications for this significant portion of the population.

Economic Projections and Analysis of the New Trump Tax Plan

The economic consequences of the New Trump Tax Plan are a key focus of the ongoing debate.

Projected Economic Growth

Proponents of the plan argue that the proposed tax cuts will stimulate economic growth. "[Insert projected GDP growth figures and their source]. These forecasts suggest that the plan could lead to increased job creation and higher wages." It is critical to review these forecasts carefully, considering their underlying assumptions and potential biases.

Potential Budgetary Impact

A crucial aspect of the debate revolves around the plan’s potential impact on the national debt and deficit. The proposed tax cuts will likely reduce government revenue, raising concerns about increased government spending and the sustainability of the nation’s finances. “[Insert projected changes to the national debt and deficit, if available, and their source]”. This budget deficit analysis is paramount for evaluating the long-term viability of the plan.

Criticisms and Counterarguments

The New Trump Tax Plan faces significant criticism. Opponents argue that the proposed tax cuts disproportionately benefit the wealthy, exacerbating economic inequality. Concerns have also been raised about the potential for increased tax policy debate and a lack of fiscal responsibility. Economists have offered differing opinions on the plan's effectiveness in achieving its stated goals and have presented counterarguments to the proponents' claims.

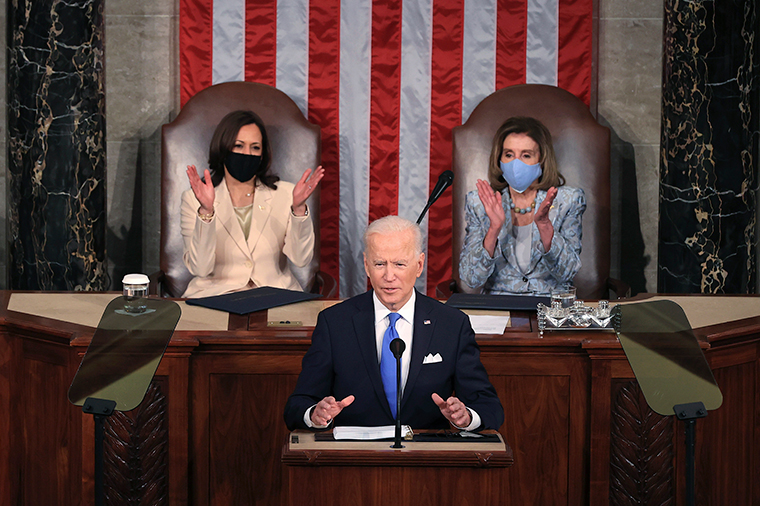

Political Ramifications of the New Trump Tax Plan

The New Trump Tax Plan has significant political implications. Its passage through Congress will depend on the alignment of various political factions and their willingness to compromise.

- The plan’s impact on the upcoming elections is likely to be significant. The political landscape could shift significantly, depending on the public response to the plan’s implementation and its tangible effects.

- Different political parties and interest groups have already expressed diverse perspectives on the plan, highlighting the potential for intense political maneuvering and debate in the coming months. Analysis of these diverse reactions is crucial to predict the likelihood of the plan’s passage.

- The success of the plan in navigating the congressional approval process will depend on several factors, including the level of bipartisan support, the effectiveness of lobbying efforts by interested parties, and the overall political climate at the time of the vote. The path to congressional approval is not guaranteed.

Conclusion: The Future of the New Trump Tax Plan

The New Trump Tax Plan proposes significant changes to the American tax system, aiming to stimulate economic growth through individual and corporate tax cuts. While proponents argue for increased investment and job creation, critics express concerns about its potential impact on the national debt and its distributional effects. The plan's success hinges on its ability to navigate the complex political landscape and deliver on its promised economic benefits. Understanding its implications for various income groups and the overall economy remains crucial. Stay informed about the ongoing debate surrounding the New Trump Tax Plan and its potential long-term effects. Visit [relevant website for updates] for further updates and analysis of this evolving tax policy.

Featured Posts

-

Roma Monza Resumen Goles Y Resultado

May 16, 2025

Roma Monza Resumen Goles Y Resultado

May 16, 2025 -

Biden Aide Urges First Couple To Avoid Political Entanglements

May 16, 2025

Biden Aide Urges First Couple To Avoid Political Entanglements

May 16, 2025 -

Did Elizabeth Warrens Defense Of Bidens Mental State Fall Short

May 16, 2025

Did Elizabeth Warrens Defense Of Bidens Mental State Fall Short

May 16, 2025 -

Peut On S Attendre A Voir Lane Hutson Comme Un Defenseur Numero 1 Dans La Lnh

May 16, 2025

Peut On S Attendre A Voir Lane Hutson Comme Un Defenseur Numero 1 Dans La Lnh

May 16, 2025 -

Boston Celtics Ownership Change Analyzing The 6 1 Billion Private Equity Deal

May 16, 2025

Boston Celtics Ownership Change Analyzing The 6 1 Billion Private Equity Deal

May 16, 2025