New X Financials After Musk's Debt Sale: A Detailed Look

Table of Contents

The Debt Sale and its Impact on X's Balance Sheet

The details of Musk's debt sale remain somewhat opaque, however, reports indicate a significant injection of capital, likely involving a mix of high-yield debt and potentially equity financing. This significantly altered X's balance sheet.

- Increased Debt Burden: The sale undoubtedly increased X's overall debt burden, potentially impacting its financial flexibility. The exact figures are not publicly available, however, analysts speculate a substantial increase in leverage.

- Credit Rating and Borrowing Costs: The increased debt load likely led to a downgrade in X's credit rating, resulting in higher borrowing costs for future investments or operations. This increased cost of capital can hinder future growth.

- Implications for Acquisitions and Investments: X's ability to pursue acquisitions or make significant investments might be constrained by its elevated debt levels. Future expansion plans may need to be reassessed given the current financial situation.

- Pre-Sale vs. Post-Sale Comparison: A thorough comparison of X's balance sheet before and after the debt sale is crucial to understanding the full extent of the financial transformation. Unfortunately, detailed pre-sale financials may not be easily accessible.

The long-term effects of this increased leverage on X's financial stability remain to be seen. Maintaining sufficient cash flow to service the debt will be paramount for X's continued operation. Any economic downturn could exacerbate the situation, putting pressure on the company's financial health.

X's Revenue Streams Post-Debt Sale: A Critical Analysis

X's revenue streams are primarily advertising, subscriptions (X Premium/Blue), and potentially emerging avenues. The debt sale's impact on these streams requires close scrutiny.

- Advertising Revenue: Recent policy changes and controversies surrounding content moderation have likely affected advertising revenue. Advertisers may be hesitant to associate their brands with a platform facing such challenges.

- Subscription Model Success: The success of X's subscription model remains a critical factor in revenue diversification. Growth in paying subscribers will be vital to offsetting potential declines in advertising revenue.

- Revenue Diversification Efforts: X is likely exploring various avenues to diversify its income streams. This could include new features, integrations, or partnerships that generate additional revenue.

- Growth or Decline: Analyzing the growth or decline of each revenue stream since the debt sale is essential to gauge the overall financial health of X. Access to precise, up-to-date financial data is essential for accurate assessment.

The future of X's revenue generation depends on navigating challenges related to advertising and building a strong, sustainable subscription base. Success requires a strategy that balances user experience with the need for robust revenue streams.

Musk's Vision and X's Future Financial Strategy

Musk's vision for X encompasses broader integration across various services, potentially including payments and e-commerce. However, the feasibility of this vision given the current financial constraints is questionable.

- Cost-Cutting Measures: Post-debt sale, cost-cutting measures are almost certain. This could involve layoffs, reduced operational expenses, or a restructuring of the organization.

- New Revenue Streams (Payments, E-commerce): Exploring payment processing and e-commerce could be viable strategies for generating new revenue. The integration of these services into the platform might offer additional value to users and advertisers.

- Long-Term Financial Strategy: Musk's long-term strategy needs to focus on balancing aggressive growth with fiscal responsibility. A sustainable revenue model is crucial for long-term success.

- Risks and Rewards: Musk's approach carries both significant risks and potential rewards. Successful execution could transform X into a massive integrated platform. However, failure to manage the debt and generate sufficient revenue could lead to serious consequences.

The long-term financial trajectory of X under Musk's leadership is uncertain. Expert opinions vary, and only time will tell if his vision aligns with the company's new financial reality.

Investor Sentiment and Market Reaction to the New X Financials

The market's response to the post-debt sale financials has been varied. Understanding investor sentiment is crucial for assessing X's future value.

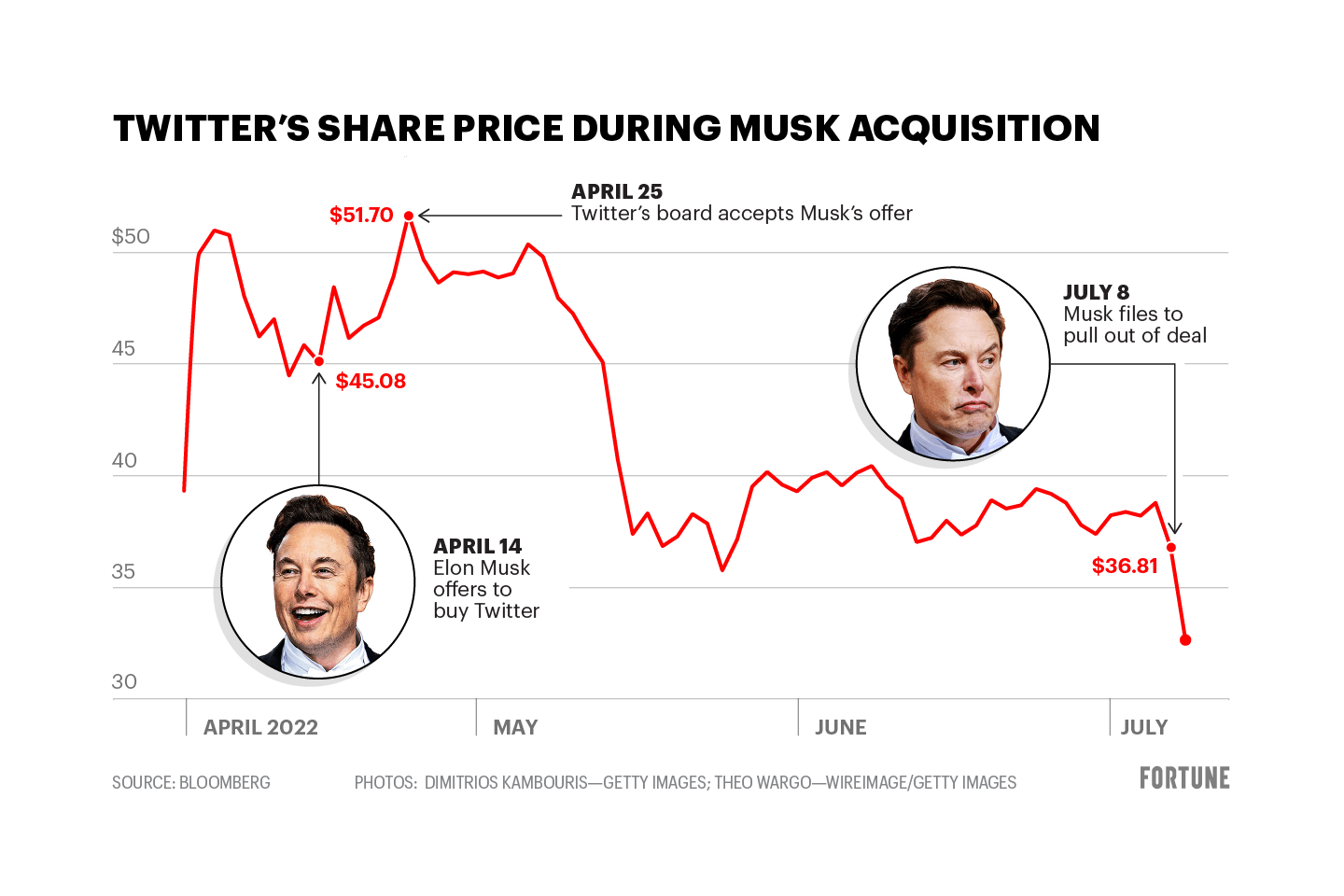

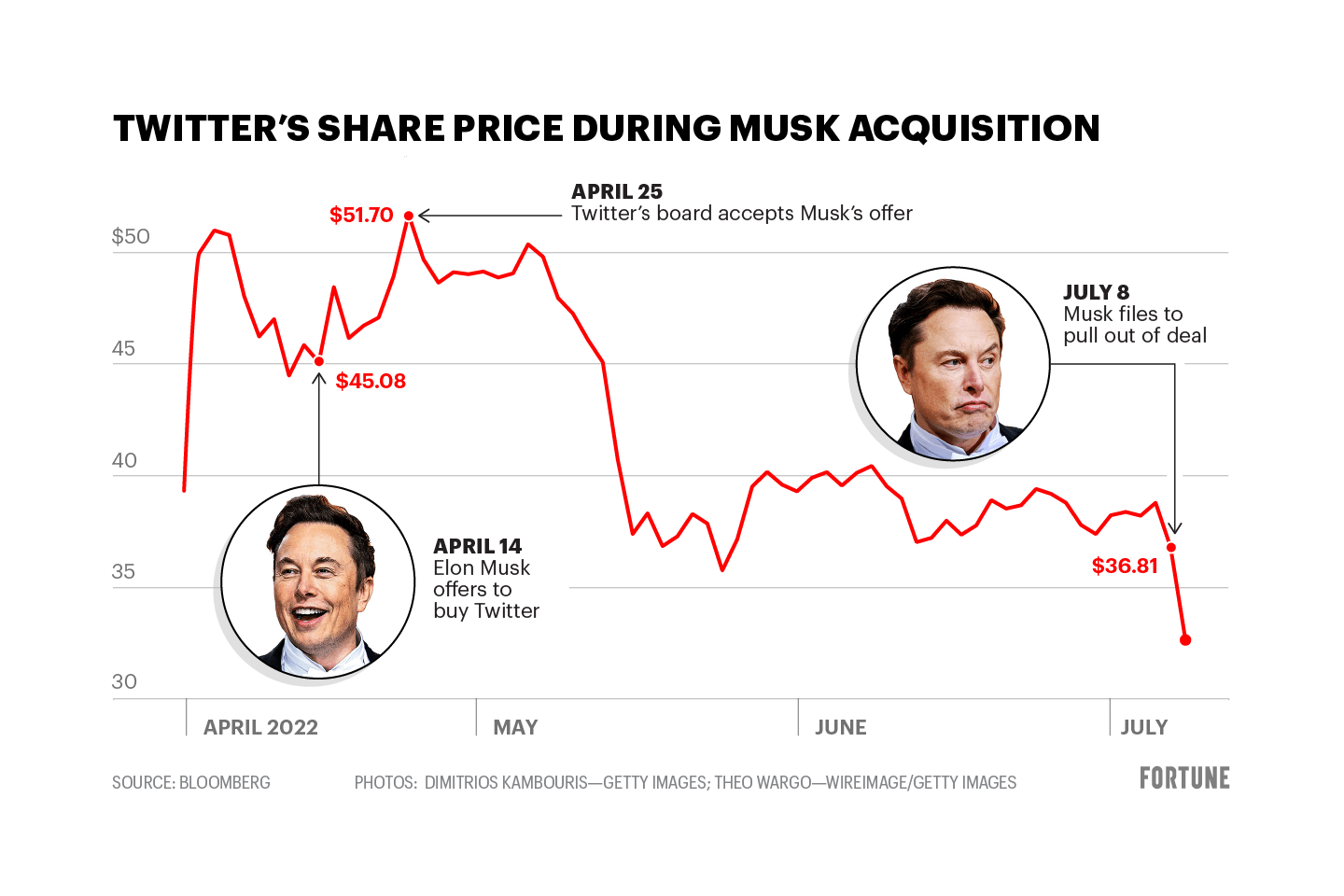

- Stock Price Fluctuations: Tracking X's stock price fluctuations provides insights into investor confidence. Sharp declines could signal concern about the company's financial health.

- Analyst Ratings and Recommendations: Analyst ratings and recommendations reflect the market's perception of X's prospects. Changes in ratings can impact investor decisions.

- Investor Confidence: Investor confidence is crucial for sustaining the value of X. Negative sentiment can lead to capital flight and further financial challenges.

- Comparison to Competitor Performance: Comparing X's performance to competitors in the social media landscape helps gauge its relative strength and potential.

The interplay of these factors creates a complex picture. Close monitoring of these metrics is vital for anyone following X's financial story.

Conclusion

Musk's debt sale has significantly altered X's financial landscape. The increased debt burden, potential impact on revenue streams, and feasibility of Musk's vision all contribute to a complex and uncertain future. X faces considerable challenges, including managing debt, diversifying revenue, and maintaining investor confidence. However, opportunities exist for growth through innovation and expansion into new markets. Careful monitoring of key financial indicators and investor sentiment is crucial.

Call to Action: Stay informed about the evolving financial landscape of X by regularly checking back for updates on the latest news and analysis of New X Financials After Musk's Debt Sale. Understanding X's financial health is crucial for navigating the ever-changing world of social media and technology investment.

Featured Posts

-

Nyt Spelling Bee Answers For April 27 2025 Find The Pangram

Apr 29, 2025

Nyt Spelling Bee Answers For April 27 2025 Find The Pangram

Apr 29, 2025 -

The January 29th Dc Air Disaster What The Ny Times Reported And What They Didn T

Apr 29, 2025

The January 29th Dc Air Disaster What The Ny Times Reported And What They Didn T

Apr 29, 2025 -

Becciu Trial Fresh Revelations Raise Questions About Fairness

Apr 29, 2025

Becciu Trial Fresh Revelations Raise Questions About Fairness

Apr 29, 2025 -

Sejarah Porsche 356 Asal Usul Dan Pabrik Zuffenhausen Jerman

Apr 29, 2025

Sejarah Porsche 356 Asal Usul Dan Pabrik Zuffenhausen Jerman

Apr 29, 2025 -

Austin City Limits Celebrating Willie Nelson And Familys Legacy

Apr 29, 2025

Austin City Limits Celebrating Willie Nelson And Familys Legacy

Apr 29, 2025