Next Key Price Levels For Apple Stock (AAPL)

Table of Contents

Technical Analysis: Identifying Key Support and Resistance Levels

Technical analysis is a crucial tool for identifying key price levels in Apple stock (AAPL). By studying historical price action and using technical indicators, we can pinpoint potential support and resistance levels, offering valuable insights into potential future price movements. Understanding these levels helps investors determine optimal entry and exit points for their Apple stock investments.

- Support Levels: These are price levels where buying pressure is expected to outweigh selling pressure, preventing further price declines. A breakdown below a significant support level often signals a stronger downward trend.

- Resistance Levels: These are price levels where selling pressure is expected to outweigh buying pressure, hindering further price increases. A breakout above a significant resistance level often signifies a stronger upward trend.

Common technical indicators used in Apple stock analysis include:

- Moving Averages (MA): Such as the 50-day and 200-day MA, these provide insights into the overall trend. A price crossing above the 200-day MA is often considered a bullish signal.

- Relative Strength Index (RSI): This momentum indicator helps identify overbought (above 70) and oversold (below 30) conditions, providing potential buy or sell signals.

- Moving Average Convergence Divergence (MACD): This indicator shows the relationship between two moving averages, signaling potential trend changes through crossovers and divergences.

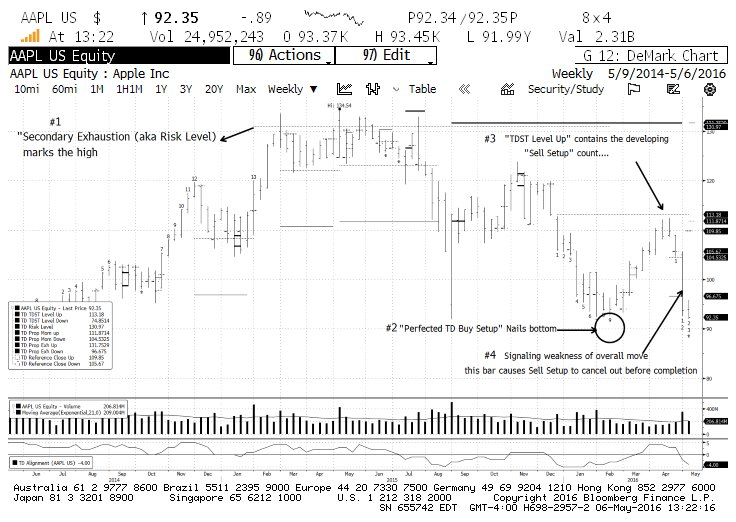

By analyzing chart patterns like head and shoulders, double tops, and double bottoms, alongside these indicators, we can identify potential breakout points and assess the likelihood of price movements in Apple stock. For example, a sustained break above a significant resistance level, confirmed by strong volume, would suggest a bullish outlook. Conversely, a breakdown below crucial support would indicate a bearish trend for AAPL. (Insert relevant chart illustrating support and resistance levels here)

Fundamental Analysis: Assessing Apple's Financial Health and Future Growth

Fundamental analysis focuses on evaluating Apple's intrinsic value by examining its financial health, revenue growth, product innovation, and competitive landscape. This provides a long-term perspective on Apple's potential for growth and profitability, which is essential for accurate Apple stock price prediction.

- Earnings Reports and Financial Statements: Consistent review of Apple's quarterly and annual earnings reports reveals revenue growth, profit margins, and overall financial strength. Positive surprises often lead to increased investor confidence and propel the Apple stock price higher.

- Product Innovation and Market Share: Apple's continued innovation in products like iPhones, Macs, iPads, and its growing services sector are critical drivers of revenue and market share. New product launches and improvements often impact Apple stock price targets positively.

- Competition and Market Landscape: Analyzing Apple's competitive landscape and market share in various segments (smartphones, wearables, etc.) is crucial. Increased competition or loss of market share can negatively affect Apple's valuation and stock price.

- Valuation Metrics: Key valuation metrics such as the Price-to-Earnings (P/E) ratio help assess whether Apple stock is trading at a fair value compared to its historical performance and industry peers. A high P/E ratio can indicate investor optimism, but it can also suggest overvaluation.

Predicting Future Price Levels: Combining Technical and Fundamental Analysis

Combining technical and fundamental analysis provides a more comprehensive Apple stock forecast and assists in projecting potential future price levels for AAPL. While no prediction is foolproof, this approach allows for a more informed assessment of risk and reward.

- Short-Term and Long-Term Price Targets: Based on the analysis of both technical indicators and fundamental factors, we can propose various price targets for Apple stock, considering both short-term (e.g., 6-month) and long-term (e.g., 1-3 year) horizons. (Insert potential price ranges here, accompanied by caveats and justifications.)

- Probability and Catalysts: The probability of reaching each target price is influenced by numerous factors, including market sentiment, investor confidence, economic outlook, and potential catalysts (such as new product releases or significant regulatory changes). Identifying these catalysts and their potential impact is crucial for refined price predictions.

- Risk Management and Limitations: It's imperative to acknowledge the inherent limitations of any price prediction. Unexpected events, changes in market sentiment, and unforeseen economic shifts can significantly impact AAPL's performance. Diversification of your investment portfolio is a crucial risk management strategy.

Conclusion

Understanding the next key price levels for Apple stock (AAPL) requires a thorough analysis of both technical and fundamental factors. By identifying key support and resistance levels, assessing Apple's financial health and growth potential, and considering market sentiment, investors can develop a more informed investment strategy. Remember that while technical and fundamental analysis provides valuable insights, price predictions always carry inherent uncertainties.

Call to Action: Stay informed about the next key price levels for Apple stock (AAPL) by regularly reviewing market analysis and adapting your investment strategy accordingly. Continue monitoring AAPL’s performance and reassessing your position based on updated information and changing market conditions. Consider diversifying your investment portfolio to mitigate risk and remember that thorough due diligence is essential before making any investment decisions related to Apple stock or any other security.

Featured Posts

-

Wednesday Coastal Flood Advisory Update For Southeast Pennsylvania

May 25, 2025

Wednesday Coastal Flood Advisory Update For Southeast Pennsylvania

May 25, 2025 -

Atletico Madrid In Geriden Gelis Basarilari

May 25, 2025

Atletico Madrid In Geriden Gelis Basarilari

May 25, 2025 -

Canada Posts Potential Strike How It Could Affect You

May 25, 2025

Canada Posts Potential Strike How It Could Affect You

May 25, 2025 -

Ultima Hora La Muerte De Eddie Jordan Conmociona Al Mundo Del Motor

May 25, 2025

Ultima Hora La Muerte De Eddie Jordan Conmociona Al Mundo Del Motor

May 25, 2025 -

The Extended Jenson Fw 22 A Comprehensive Guide

May 25, 2025

The Extended Jenson Fw 22 A Comprehensive Guide

May 25, 2025