Nike Q3 Results: Jefferies Predicts Impact On Foot Locker's Short-Term Performance

Table of Contents

Jefferies' Key Predictions Regarding Foot Locker's Performance

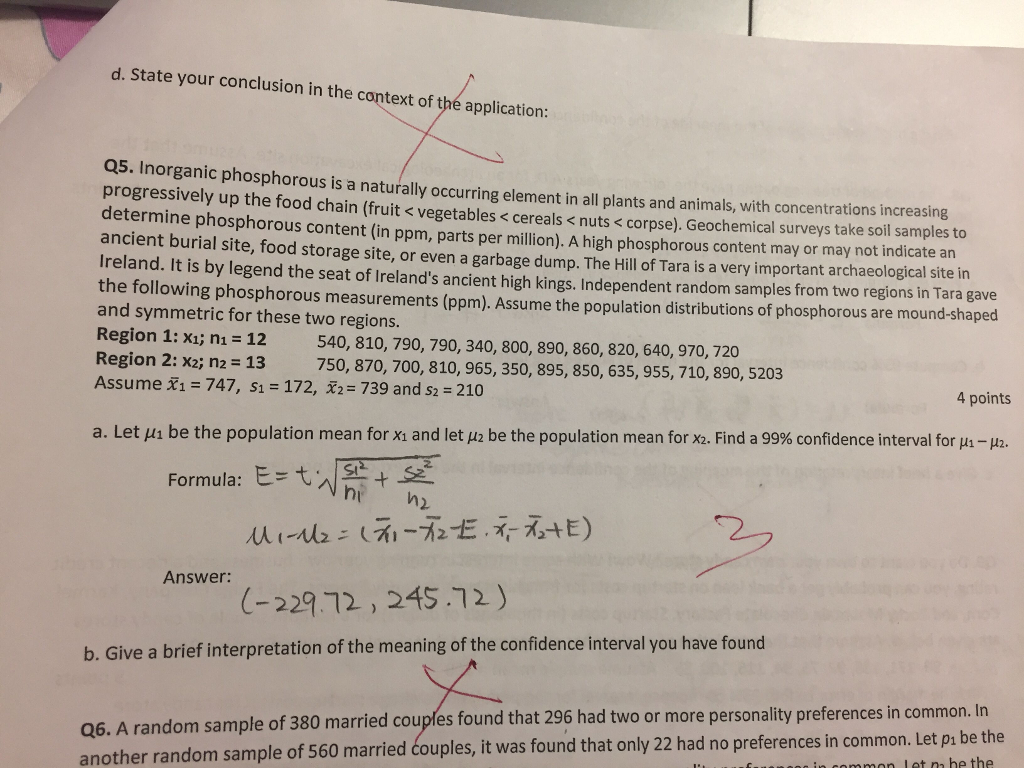

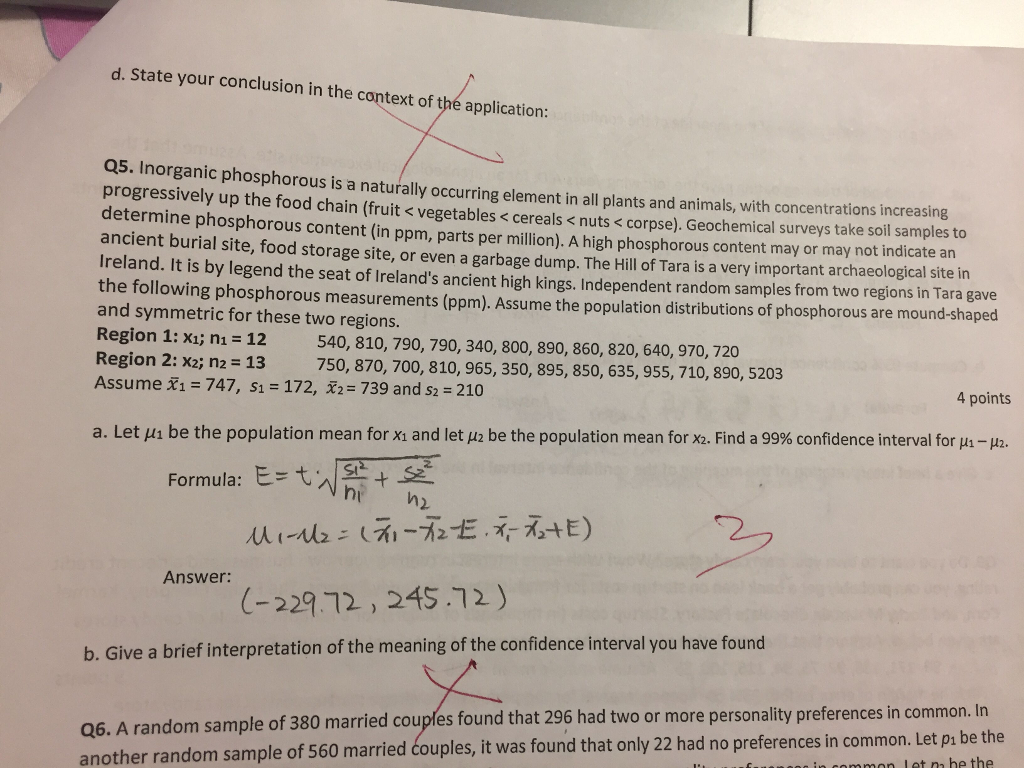

Jefferies' recent report offers a cautious outlook for Foot Locker's short-term performance following the release of Nike's Q3 earnings. Their analysis hinges on the interplay between Nike's inventory levels, pricing strategies, and the overall consumer demand for athletic footwear. The prediction focuses primarily on the next two quarters, offering a nuanced view beyond simple stock price movements.

-

Key Takeaways from Jefferies' Report: Jefferies predicts a moderate decline in Foot Locker's same-store sales growth for the next two quarters, citing concerns over Nike's elevated inventory levels. They also forecast a slight compression of Foot Locker's gross margins due to the potential need for increased promotional activities to clear excess inventory.

-

Reasoning Behind the Predictions: Jefferies' analysis highlights that Nike's higher-than-expected inventory levels suggest a potential slowdown in consumer demand or a need for more aggressive pricing strategies from Nike itself. This could directly impact Foot Locker's ability to maintain optimal profit margins, necessitating potential markdowns to remain competitive.

-

Specific Metrics Used: Jefferies' analysis incorporates key metrics like Nike's reported inventory turnover rate, Foot Locker's historical sales data, and industry benchmarks for gross margins in the athletic footwear sector. Their models factor in the projected impact of Nike's pricing decisions on Foot Locker's overall sales and profitability.

Analysis of Nike's Q3 Results and their Potential Impact

Nike's Q3 earnings report revealed a mixed bag of results. While overall revenue showed growth, certain key metrics raise concerns for its retail partners like Foot Locker. The key areas impacting Foot Locker include Nike's inventory levels, gross margins, and the overall demand signal within the athletic footwear market.

-

Significant Increases/Decreases: Nike reported a significant increase in inventory compared to the same period last year. While this could reflect strong future demand, it also suggests a potential need for price adjustments to move this inventory. Gross margins, while remaining healthy, showed signs of slight compression.

-

Reasons Behind the Performance: Analysts attribute the increased inventory to various factors, including some potential supply chain disruptions earlier in the year and potentially less-than-anticipated consumer demand in certain product categories. The impact of macroeconomic factors, like inflation and recessionary fears, may also be playing a role.

-

Impact on Foot Locker's Supply: The increased Nike inventory could lead to increased pressure on Foot Locker to accept more inventory than ideal, potentially straining its own inventory management capabilities and increasing the risk of markdowns. This dynamic could significantly impact Foot Locker's short-term profitability.

Impact on Foot Locker's Inventory and Pricing Strategies

The implications for Foot Locker are significant. Nike's increased inventory and potential for price reductions put pressure on Foot Locker's own inventory management and pricing strategies.

-

Nike Supply Chain Influence: Foot Locker's ability to source key Nike products may be affected by Nike's efforts to manage its own high inventory. This could result in delays or changes in product availability for Foot Locker.

-

Markdown Risk: Foot Locker may need to implement more promotional activities and price reductions to compete effectively, potentially impacting their gross margins. The risk of increased markdowns to clear excess Nike inventory is a major concern highlighted by Jefferies.

The Broader Context: Overall Market Trends and Consumer Behavior

Understanding the broader context is crucial in assessing the impact of Nike's Q3 results on Foot Locker. Several market trends and consumer behaviors need consideration.

-

Shifts in Consumer Preferences: Changing consumer preferences, such as a shift towards certain product categories or brands, could impact both Nike and Foot Locker's performance. A decrease in demand for specific Nike products could exacerbate the inventory issues.

-

Competitive Landscape: The competitive landscape in the athletic footwear market is highly dynamic. Competition from other brands, both established and emerging, could influence consumer choices and affect sales for both Nike and Foot Locker.

-

Macroeconomic Factors: Inflation and recessionary fears are impacting consumer spending patterns. This could lead to reduced discretionary spending on non-essential items like athletic footwear, affecting both companies.

Conclusion

Jefferies' predictions suggest a challenging short-term outlook for Foot Locker, primarily driven by Nike's elevated inventory levels and the potential need for increased promotional activities to clear excess stock. Nike's Q3 results, combined with broader market trends and consumer behavior, paint a complex picture. Understanding these interconnected factors is crucial for investors and industry analysts alike. Stay informed about the evolving relationship between Nike and Foot Locker. Continue following for updates on Nike Q3 results and their ongoing impact on Foot Locker's performance. Further analysis on Nike Q3 results and their impact on retail partners is available [link to relevant resources, if applicable].

Featured Posts

-

Paysandu 0 1 Bahia Reporte Completo Del Partido

May 15, 2025

Paysandu 0 1 Bahia Reporte Completo Del Partido

May 15, 2025 -

Understanding The Controversy Nhl Fans React To New Draft Lottery System

May 15, 2025

Understanding The Controversy Nhl Fans React To New Draft Lottery System

May 15, 2025 -

Yak Zaprositi Dzho Baydena Na Sviy Zakhid

May 15, 2025

Yak Zaprositi Dzho Baydena Na Sviy Zakhid

May 15, 2025 -

Chicago Cubs Pitcher Cody Poteet Wins First Spring Training Abs Challenge

May 15, 2025

Chicago Cubs Pitcher Cody Poteet Wins First Spring Training Abs Challenge

May 15, 2025 -

Jalen Brunsons Return Knicks Pistons Playoff Push

May 15, 2025

Jalen Brunsons Return Knicks Pistons Playoff Push

May 15, 2025