Nike's Turnaround: Foot Locker Earnings Offer Positive Insights

Table of Contents

Foot Locker's Q[Quarter] Earnings: Key Performance Indicators

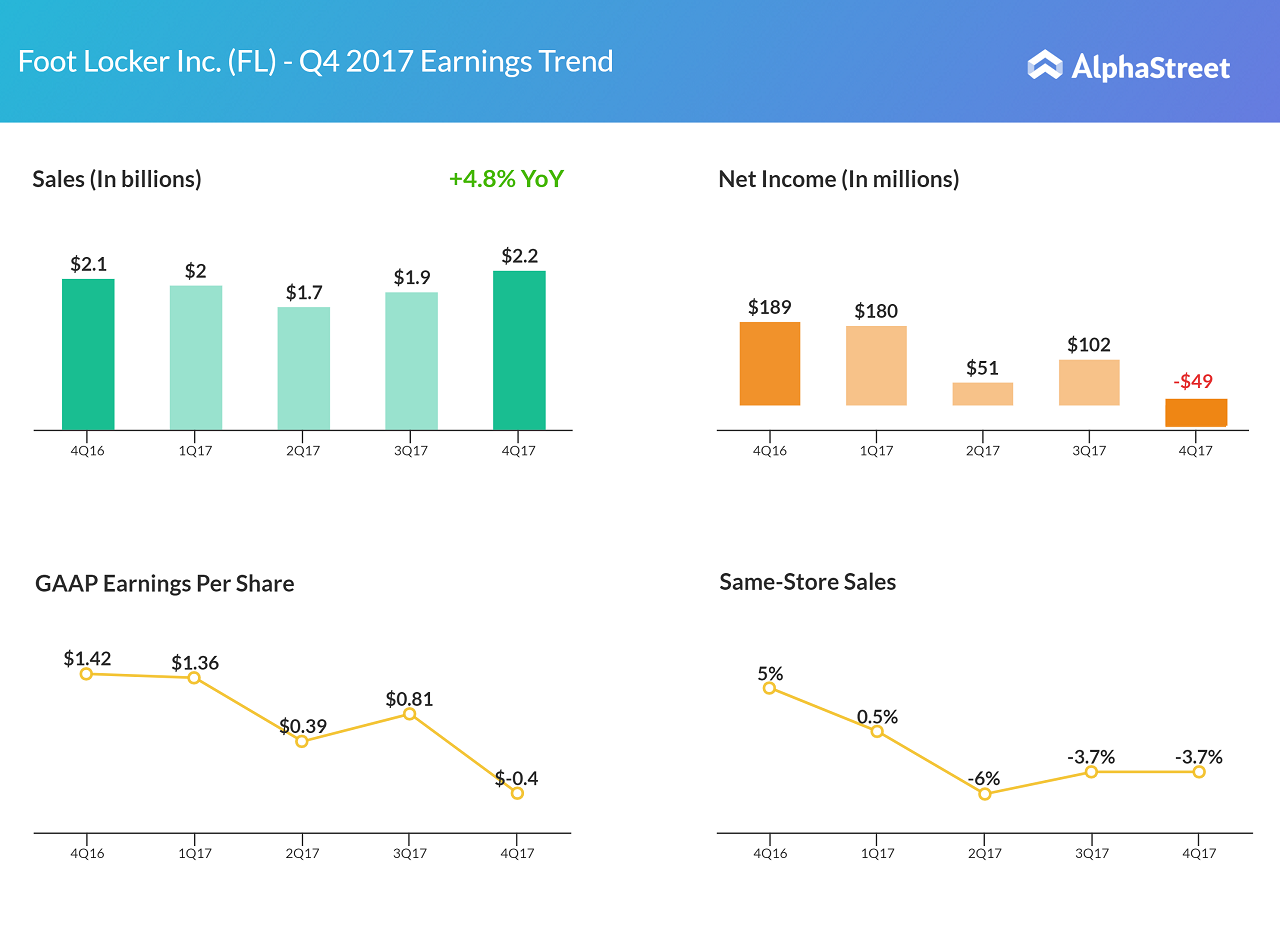

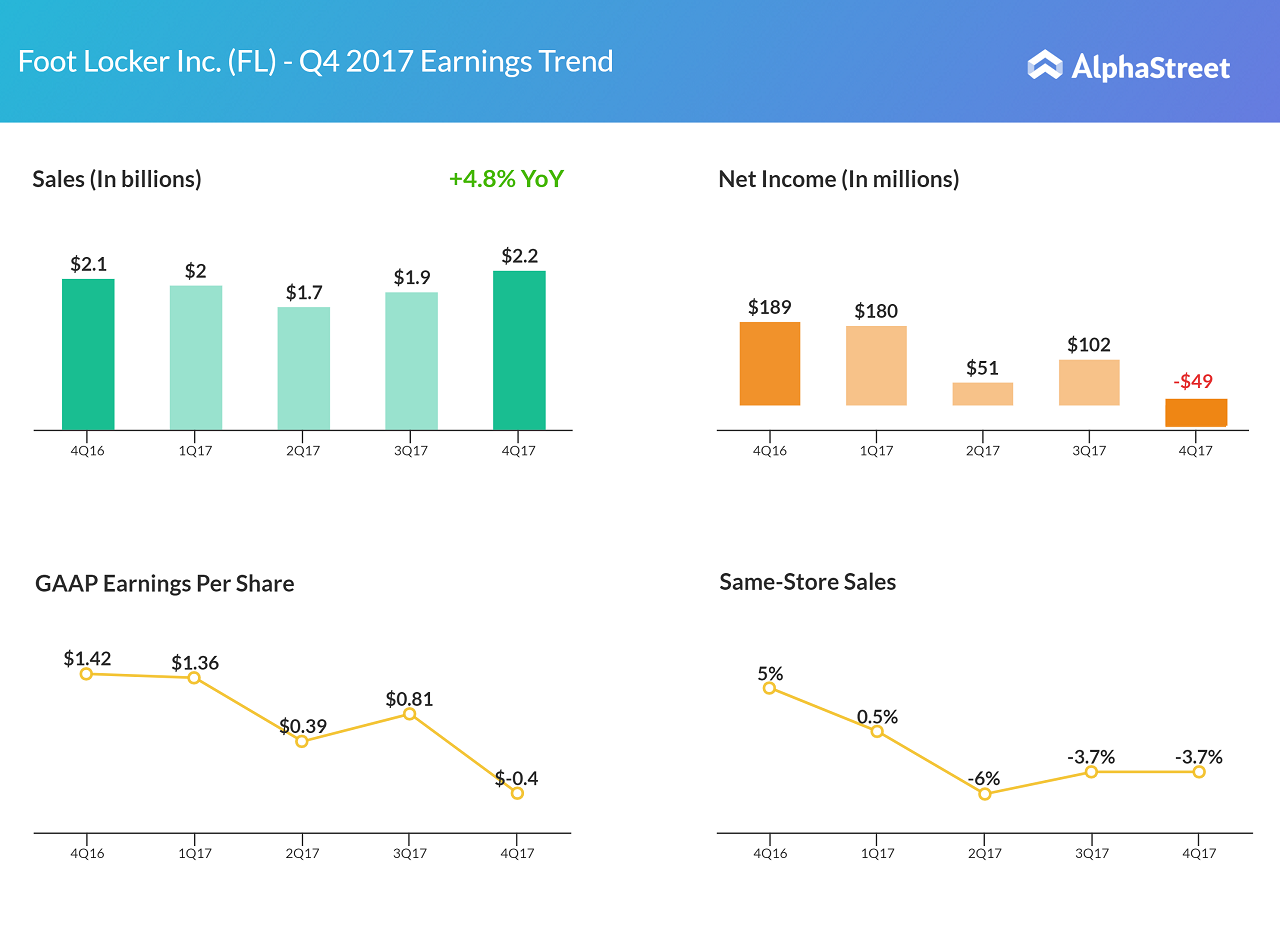

Foot Locker's Q[Quarter] earnings report offers several key performance indicators that shed light on Nike's performance. Analyzing these metrics reveals crucial information regarding sales trends, inventory management, and future growth potential.

Sales Growth and Nike's Contribution:

Foot Locker's overall sales growth in Q[Quarter] was [Insert Percentage]% year-over-year, exceeding analyst expectations. Significantly, a substantial portion of this growth can be attributed to strong performance in Nike product lines.

- Specific sales figures for Nike products: Nike sales accounted for [Insert Percentage]% of Foot Locker's total revenue, representing a [Insert Percentage]% increase compared to Q[Previous Quarter].

- Percentage growth compared to previous quarters or years: This marks a significant improvement from the [Insert Percentage]% growth seen in Q[Previous Quarter] and a [Insert Percentage]% increase compared to the same quarter last year.

- Strong-performing Nike product lines: Specifically, the [Insert Product Line, e.g., Air Max, Jordan Brand] lines experienced particularly strong sales, indicating robust consumer demand for these specific products.

Inventory Levels and Management:

Foot Locker's inventory levels are also a key indicator of Nike's supply chain health. Efficient inventory management signifies a smoother supply chain and improved demand forecasting.

- Analysis of inventory turnover rates: Foot Locker reported a [Insert Data] inventory turnover rate, suggesting improved efficiency in managing inventory compared to previous quarters.

- Implications for future Nike orders: This positive trend indicates that Foot Locker is confident in future demand for Nike products, leading to increased future orders.

- Positive signs of reduced excess inventory: The reduction in excess inventory suggests that Nike has made progress in aligning production with consumer demand, a crucial aspect of its turnaround strategy.

Analyzing the Positive Indicators for Nike

Foot Locker's positive earnings provide several encouraging indicators that suggest Nike's turnaround is gaining momentum.

Increased Demand for Nike Products:

The strong sales figures for Nike products within Foot Locker's portfolio suggest a resurgence in consumer demand.

- High sell-through rates for Nike products: High sell-through rates indicate that Nike products are moving quickly off shelves, a clear sign of strong demand.

- Consumer feedback (if available) indicating positive sentiment towards Nike: [Insert any available consumer feedback data, e.g., social media sentiment analysis, customer surveys].

- Potential reasons for increased demand (e.g., new product releases, marketing campaigns): The success of new product launches, coupled with effective marketing campaigns, likely contributed to the increased demand for Nike products.

Implications for Nike's Supply Chain and Production:

Foot Locker's performance suggests that Nike may be overcoming past supply chain challenges.

- Reduced lead times for Nike orders: Improved supply chain efficiency is indicated by shorter lead times for Nike orders, getting products to market faster.

- Improved inventory management at Nike: This, in turn, reflects improved inventory management practices within Nike's operations.

- Potential easing of production constraints: This suggests that Nike may be alleviating past production constraints, allowing them to meet increased demand more effectively.

Potential Challenges and Future Outlook for Nike

While the data from Foot Locker is encouraging, it's crucial to acknowledge potential challenges that could impact Nike's continued growth.

Macroeconomic Factors:

Global economic headwinds pose a risk to Nike's future performance.

- Potential impact of inflation on consumer spending: Inflationary pressures could reduce consumer spending on discretionary items like athletic apparel.

- Effect of macroeconomic uncertainty on future demand: Uncertainty in the global economy could affect consumer confidence and, consequently, demand for Nike products.

Competition and Market Share:

Nike operates in a competitive market, and maintaining its market share requires continuous innovation and effective marketing.

- Analysis of Nike's competitive advantages: Nike's strong brand recognition, innovative product designs, and extensive marketing efforts give it a competitive edge.

- Mention of key competitors and their market performance: [Mention key competitors like Adidas, Under Armour and their recent market performance].

Conclusion

Foot Locker's Q[Quarter] earnings paint a positive picture for Nike's turnaround. The strong sales figures for Nike products, coupled with improved inventory management, suggest increased consumer demand and improved supply chain efficiency. While macroeconomic factors and competition remain potential challenges, the overall outlook for Nike is optimistic. Stay tuned for more updates on Nike’s turnaround and continue to monitor the impact of Foot Locker's success on the overall athletic apparel market.

Featured Posts

-

How Liverpool Fc Influenced Paddy Pimbletts Ufc 314 Travel

May 15, 2025

How Liverpool Fc Influenced Paddy Pimbletts Ufc 314 Travel

May 15, 2025 -

Ere Zilveren Nipkowschijf Voor Jiskefet 20 Jaar Later

May 15, 2025

Ere Zilveren Nipkowschijf Voor Jiskefet 20 Jaar Later

May 15, 2025 -

Riscuri Sanitare Apa De Robinet Ghid Pentru Consumatori Din Romania

May 15, 2025

Riscuri Sanitare Apa De Robinet Ghid Pentru Consumatori Din Romania

May 15, 2025 -

Vont Weekend Photos April 4 6 2025 97 3 Kissfm

May 15, 2025

Vont Weekend Photos April 4 6 2025 97 3 Kissfm

May 15, 2025 -

Celtics Vs Hornets Betting Preview Predictions And Best Odds Tonight

May 15, 2025

Celtics Vs Hornets Betting Preview Predictions And Best Odds Tonight

May 15, 2025