No Money? Effective Solutions To Address Lack Of Funds

Table of Contents

Creating a Realistic Budget and Tracking Expenses

The cornerstone of effective money management is a well-defined budget. Without a budget, it's nearly impossible to understand where your money is going, making it difficult to identify areas for improvement. A realistic budget provides a roadmap for financial stability, helping you allocate your resources effectively and achieve your financial goals.

Creating a realistic budget involves several steps:

- The 50/30/20 Rule: This popular method suggests allocating 50% of your after-tax income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

- Zero-Based Budgeting: This approach requires you to allocate every dollar of your income to a specific category, ensuring that all expenses are accounted for.

- Budget Tracking Apps: Numerous apps like Mint, YNAB (You Need A Budget), and Personal Capital can automate the process, providing insights into your spending habits and helping you stay on track.

Tips for effective budgeting:

- Categorize expenses: Clearly distinguish between needs and wants. This helps you identify areas where you can potentially cut back.

- Identify areas for savings: Analyze your spending patterns to pinpoint unnecessary expenses. Can you reduce your subscription services, find cheaper groceries, or cut back on eating out?

- Set financial goals: Establishing short-term (e.g., saving for an emergency fund) and long-term goals (e.g., buying a house) provides motivation and direction.

- Regularly review and adjust: Your budget shouldn't be static. Regularly review it and adjust it based on your changing needs and circumstances.

Exploring Income Generation Opportunities

When you're dealing with "no money," exploring additional income streams is crucial. Increasing your income can significantly alleviate financial pressure and accelerate your progress toward financial stability. There are numerous opportunities available, both short-term and long-term.

Options for increasing your income:

- Freelancing: Leverage your skills and talents by offering services like writing, graphic design, web development, or virtual assistance on platforms like Upwork and Fiverr.

- Part-time jobs: Consider a part-time job in your area of expertise or a more flexible role that fits your schedule.

- Side hustles: Explore side hustles such as pet-sitting, dog-walking, house-sitting, or tutoring. The possibilities are endless, depending on your skills and interests.

- Selling unused items: Declutter your home and sell unwanted items online through platforms like eBay, Craigslist, or Facebook Marketplace.

- Gig work: Explore opportunities like driving for ride-sharing services or delivering food.

Finding income opportunities:

- Identify your skills and talents: What are you good at? What do you enjoy doing? These are great starting points for finding income opportunities.

- Research online platforms: Numerous online platforms connect freelancers with clients. Explore these resources to find work that matches your skills.

- Consider starting a small business: If you have a business idea, explore the possibilities of starting a small-scale business.

- Explore local job boards and networking opportunities: Don't overlook traditional job boards and networking events in your community.

Managing Existing Debt Effectively

Debt can be a significant obstacle to financial stability. Effectively managing existing debt is critical when addressing a "no money" situation. High-interest debt can quickly spiral out of control, making it even more challenging to regain financial footing.

Strategies for debt management:

- Debt consolidation: Combining multiple debts into a single loan with a lower interest rate can simplify repayment and potentially save you money.

- Debt snowball/avalanche methods: The snowball method focuses on paying off the smallest debt first to build momentum, while the avalanche method prioritizes debts with the highest interest rates.

- Negotiating with creditors: Contact your creditors and try to negotiate lower monthly payments or more favorable terms. Many are willing to work with you if you demonstrate a genuine effort to repay your debts.

Understanding the dangers of debt:

- High-interest debt: Credit cards and payday loans often carry extremely high interest rates, which can rapidly increase your debt burden.

- Predatory lending: Be wary of lenders who engage in unfair or deceptive practices.

Steps to manage your debt:

- List all debts and interest rates: Create a comprehensive list of your debts, including balances and interest rates. This allows you to prioritize your repayment strategy.

- Prioritize high-interest debts: Focus on paying down debts with the highest interest rates first to minimize the total interest paid.

- Explore debt consolidation options: Consider consolidating your debts into a single loan with a lower interest rate.

- Contact creditors to negotiate lower payments: Don't hesitate to reach out to your creditors and explain your financial situation.

Seeking Professional Financial Guidance

When facing significant financial challenges, seeking professional help can be invaluable. Financial advisors, credit counseling agencies, and non-profit organizations offer resources and support to help you navigate complex financial situations.

Resources for financial guidance:

- Credit counseling agencies: These agencies can provide guidance on budgeting, debt management, and credit repair. Make sure to research reputable agencies and be aware of potential fees.

- Non-profit organizations: Several non-profit organizations offer free or low-cost financial assistance and counseling.

- Financial advisors: A financial advisor can help you develop a comprehensive financial plan, manage investments, and make informed financial decisions.

Important considerations:

- Research reputable credit counseling agencies: Ensure the agency is legitimate and has a proven track record of helping people improve their financial situations.

- Explore government assistance programs: Research government programs that may offer financial assistance.

- Consider consulting with a financial advisor: A financial advisor can provide personalized guidance and support.

- Be wary of scams and high fees: Be cautious of scams and avoid paying excessive fees for financial services.

Conclusion: Taking Control of Your Finances When You Have No Money

Addressing a "no money" situation requires a multi-pronged approach. This article has outlined key strategies for creating a realistic budget, exploring income generation opportunities, managing existing debt effectively, and seeking professional financial guidance. Proactive financial planning is essential to prevent future financial hardship.

Don't let a lack of funds control your future. Start tackling your financial challenges today by creating a budget, exploring income opportunities, and managing your debt effectively. Take control of your finances and build a brighter future! Remember, even small steps towards better money management can make a significant difference in overcoming a "no money" situation and achieving lasting financial well-being.

Featured Posts

-

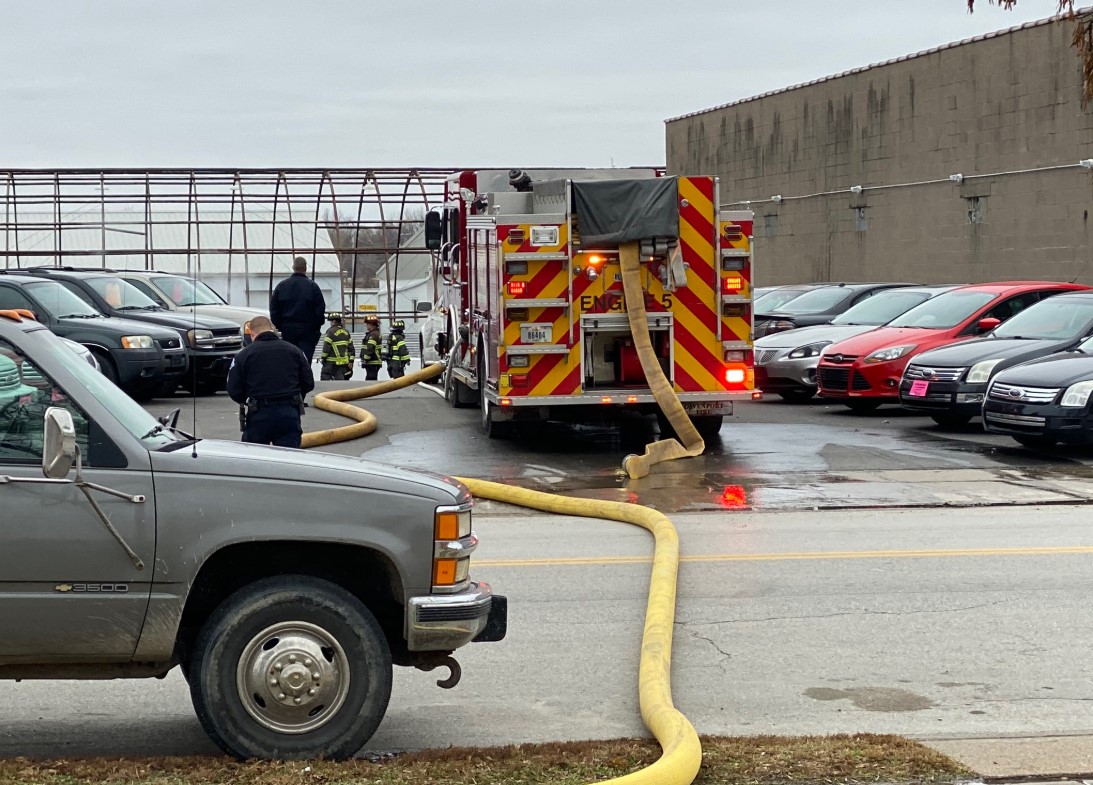

Large Fire Engulfs Used Car Dealership Crews Investigating

May 22, 2025

Large Fire Engulfs Used Car Dealership Crews Investigating

May 22, 2025 -

Legal Challenge To Racial Hatred Sentence Ex Tory Councillors Wife

May 22, 2025

Legal Challenge To Racial Hatred Sentence Ex Tory Councillors Wife

May 22, 2025 -

The Critical Role Of Middle Management Bridging The Gap Between Leadership And Employees

May 22, 2025

The Critical Role Of Middle Management Bridging The Gap Between Leadership And Employees

May 22, 2025 -

Clisson L Administration Du College Face Au Nombre De Croix Portees Par Les Eleves

May 22, 2025

Clisson L Administration Du College Face Au Nombre De Croix Portees Par Les Eleves

May 22, 2025 -

The Goldbergs A Deep Dive Into The Shows Recurring Themes

May 22, 2025

The Goldbergs A Deep Dive Into The Shows Recurring Themes

May 22, 2025