Nvidia's Concerns: Beyond The China Trade War

Table of Contents

Nvidia, a titan in the artificial intelligence (AI) chip market, enjoys unparalleled dominance. However, Nvidia's concerns extend far beyond the well-publicized challenges of the US-China trade war. This article delves into the broader geopolitical, competitive, and ethical pressures shaping Nvidia's future, painting a complex picture beyond the headlines.

<h2>Geopolitical Risks Beyond China</h2>

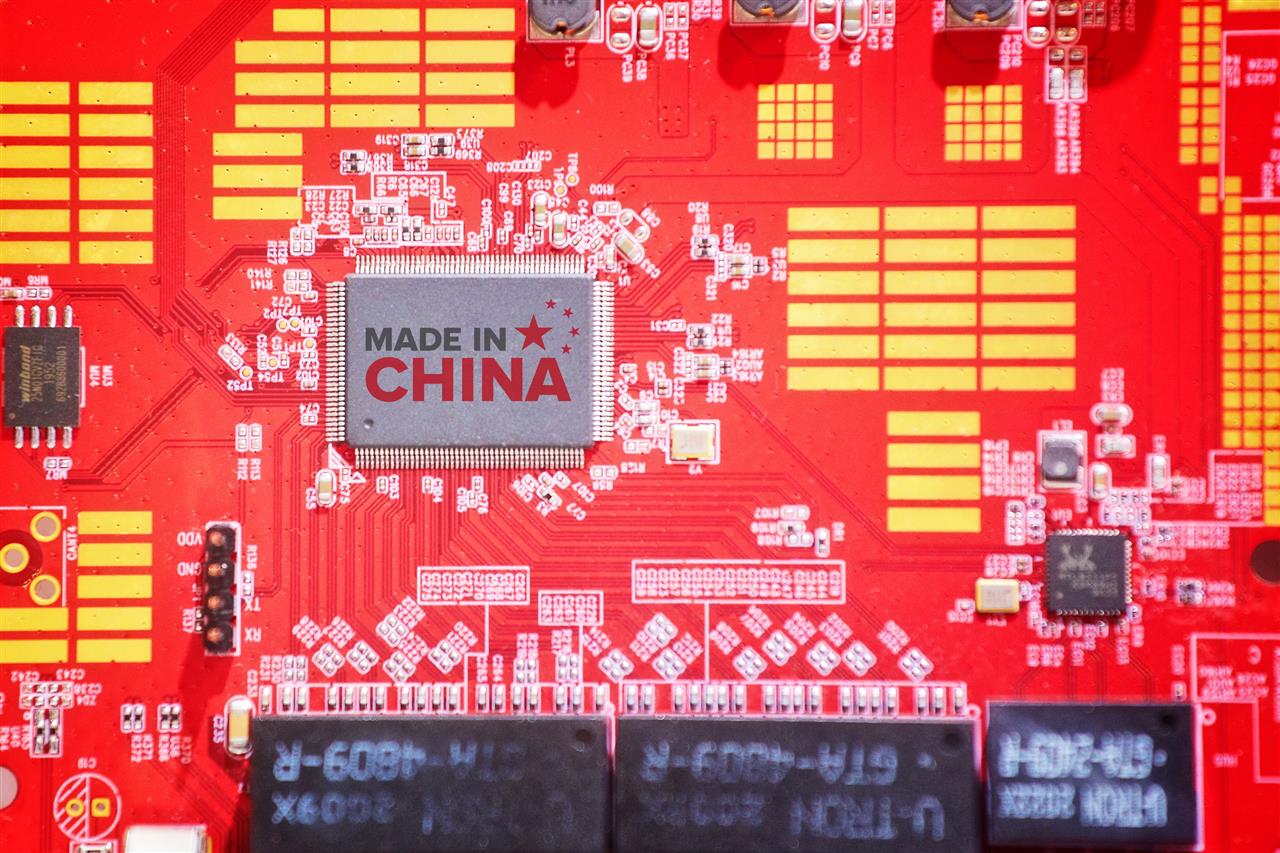

While the US-China trade war remains a significant factor, Nvidia's concerns extend to a wider geopolitical landscape. The escalating technological competition between the US and China creates a volatile environment for businesses operating globally.

<h3>Increased US-China Tech Tensions</h3>

The ongoing tech war between the US and China presents substantial challenges for Nvidia. Export controls, implemented by the US government, restrict the sale of certain high-performance chips to China, significantly impacting Nvidia's revenue. Further restrictions remain a possibility, creating uncertainty and potentially leading to substantial revenue losses.

- Export Controls: The US government’s increasing restrictions on the export of advanced chips to China directly impact Nvidia’s sales and profitability.

- Potential for Further Restrictions: The ongoing geopolitical tensions suggest a continued risk of further limitations on chip exports to China, creating further uncertainty for Nvidia.

- Impact on Revenue: China represents a significant market for Nvidia. Any restrictions on sales to this region directly affect the company's bottom line; for example, a significant portion of Nvidia’s data center revenue comes from China. [Insert Data Point on Nvidia’s revenue from China if available].

- Countermeasures from China: China is actively working to develop its own domestic chip industry, potentially leading to reduced reliance on foreign suppliers like Nvidia and impacting future market share.

<h3>Supply Chain Diversification Challenges</h3>

Nvidia, like many tech companies, relies on complex global supply chains. Geopolitical instability introduces significant risks, affecting manufacturing, logistics, and overall production.

- Complexities of Moving Production: Shifting manufacturing to different regions involves substantial costs and logistical challenges, impacting production timelines and potentially increasing the price of Nvidia's products.

- Potential Cost Increases: Diversifying supply chains inherently increases costs due to logistical complexities, increased transportation expenses, and the need for additional infrastructure.

- Risk of Disruptions: Geopolitical instability can easily disrupt supply chains, causing delays, shortages, and ultimately impacting Nvidia’s ability to meet market demand.

- Near-shoring and Regionalization: Nvidia, like other companies, might consider strategies like near-shoring (moving production closer to home) or regionalization to mitigate these risks, though these approaches also come with considerable costs.

<h2>Competition and Market Saturation</h2>

While Nvidia currently holds a commanding market share, increased competition and the potential for market saturation pose significant challenges.

<h3>Growing Competition from AMD and Intel</h3>

AMD and Intel are aggressively pursuing the AI chip market, challenging Nvidia’s dominance. Both companies are investing heavily in research and development, aiming to compete with Nvidia's cutting-edge technology.

- Technological Comparison: While Nvidia currently leads in certain AI chip technologies, AMD and Intel are rapidly closing the gap, offering competitive alternatives in terms of performance and price.

- Impact of Price Wars: Increased competition could trigger price wars, squeezing profit margins and potentially impacting Nvidia’s overall profitability.

- Market Share Erosion: The success of AMD and Intel's offerings could gradually erode Nvidia's market share, impacting its revenue and long-term growth.

- Emerging Competitors: Beyond established players, new companies are entering the AI chip market, further intensifying competition and fragmenting the market.

<h3>Market Maturity and Future Growth</h3>

Certain segments of the AI chip market are showing signs of maturity, requiring Nvidia to innovate and explore new market opportunities.

- Diversification into New Technologies: Nvidia is already diversifying into areas such as the metaverse and robotics to ensure long-term growth and reduce reliance on any single market segment.

- Long-Term Growth Potential: The overall AI chip market has substantial growth potential driven by increasing adoption of AI across diverse industries; however, the rate of this growth is subject to various economic and technological factors.

<h2>Ethical and Regulatory Concerns</h2>

The increasing power of AI technology brings ethical and regulatory concerns to the forefront, posing challenges for Nvidia and the entire industry.

<h3>AI Ethics and Responsible Development</h3>

The ethical implications of AI are under increasing scrutiny, impacting the development and deployment of AI systems.

- Bias in AI Algorithms: Concerns about bias in AI algorithms leading to unfair or discriminatory outcomes require careful consideration in the development process.

- Misuse of AI Technology: The potential misuse of AI technology for malicious purposes necessitates responsible development and deployment strategies.

- Need for Responsible AI Development: The industry needs to establish clear ethical guidelines and standards to ensure the responsible development and use of AI.

- Potential Regulations: Governments worldwide are exploring regulations to govern the development and deployment of AI, potentially impacting Nvidia's products and operations.

<h3>Data Privacy and Security</h3>

Data privacy and security are paramount concerns in the age of AI. The use of large datasets to train AI models raises significant privacy and security implications.

- Data Breaches: The risk of data breaches and cyberattacks impacting AI systems is constantly increasing, requiring robust security measures.

- Cybersecurity Threats: AI systems are increasingly vulnerable to cyberattacks, necessitating constant vigilance and advanced security protocols.

- Compliance Requirements: Nvidia must comply with various data privacy regulations, such as GDPR and CCPA, adding complexity and cost to its operations.

<h2>Conclusion: Navigating Nvidia's Concerns</h2>

Nvidia faces a complex array of challenges, extending far beyond the immediate impact of the China trade war. Geopolitical risks, intensified competition, and mounting ethical and regulatory concerns all pose significant threats to its future performance and profitability. Understanding these "Nvidia's concerns" is crucial for investors and industry observers alike. The company's ability to navigate this multifaceted landscape will determine its continued success in the rapidly evolving AI chip industry. Further research into Nvidia’s strategic responses to these challenges and the broader trends within the AI industry is highly recommended.

Featured Posts

-

Cruises Com Launches Innovative Points Based Rewards Program

May 01, 2025

Cruises Com Launches Innovative Points Based Rewards Program

May 01, 2025 -

Six Nations Englands Daly Scores Late To Defeat France

May 01, 2025

Six Nations Englands Daly Scores Late To Defeat France

May 01, 2025 -

Kamala Harris Broadway Speech A Rambling Word Salad

May 01, 2025

Kamala Harris Broadway Speech A Rambling Word Salad

May 01, 2025 -

Nashville News Anchor Nikki Burdine Leaves Wkrn After Seven Years

May 01, 2025

Nashville News Anchor Nikki Burdine Leaves Wkrn After Seven Years

May 01, 2025 -

Ryys Shbab Bn Jryr Yudan Ma Hy Althm Almwjht Ilyh

May 01, 2025

Ryys Shbab Bn Jryr Yudan Ma Hy Althm Almwjht Ilyh

May 01, 2025