Nvidia's Geopolitical Risks: Beyond The China Factor

Table of Contents

The US-China Tech War and its Impact on Nvidia

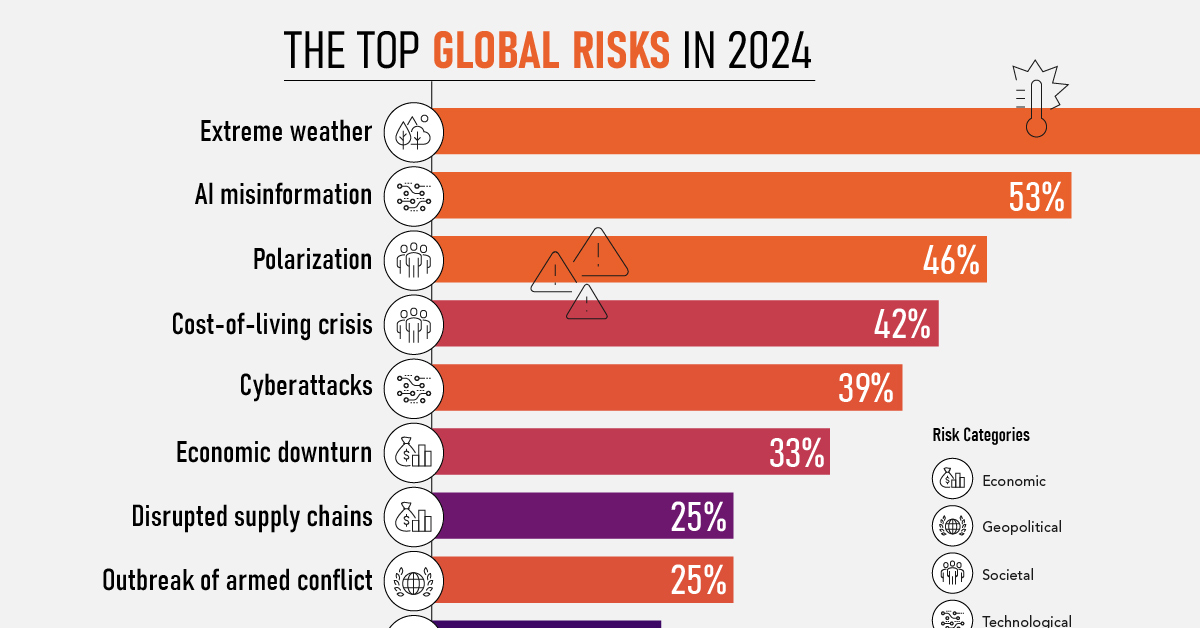

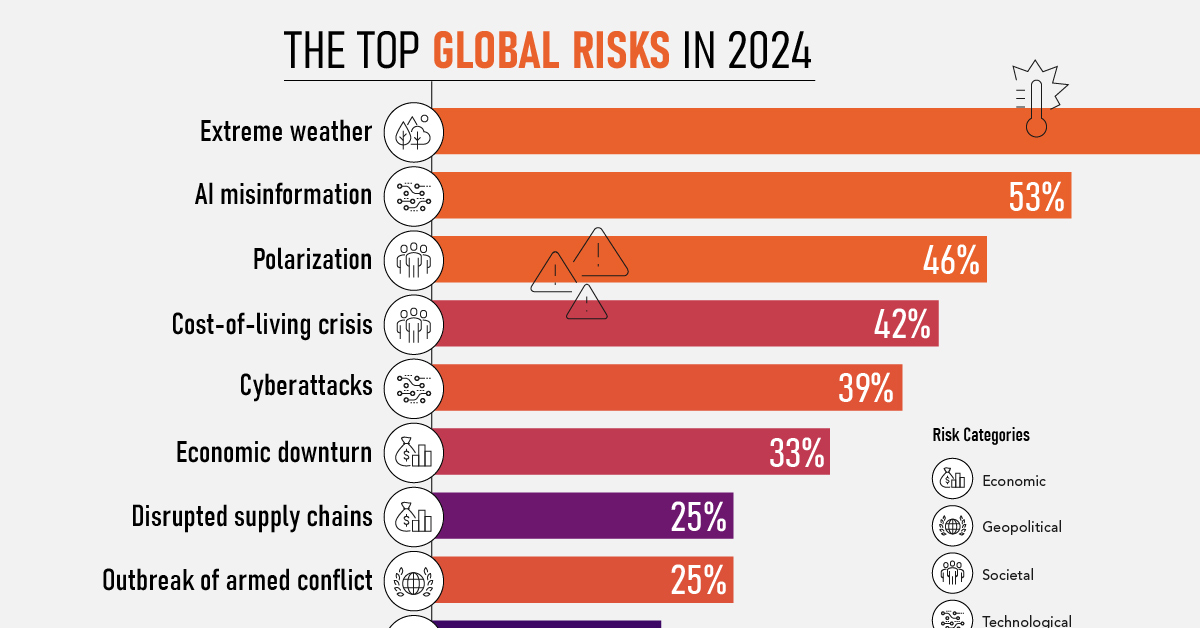

The ongoing US-China tech war significantly impacts Nvidia's operations and profitability. This conflict goes beyond simple trade disputes; it represents a broader struggle for technological dominance, with Nvidia squarely in the crosshairs.

Export Controls and Supply Chain Disruptions

US export controls severely restrict Nvidia's ability to sell its high-end GPUs, particularly those with advanced capabilities crucial for AI development, to Chinese customers. This has led to:

- Specific examples of export restrictions: Restrictions on the sale of A100 and H100 GPUs to Chinese entities involved in AI development and supercomputing.

- Potential revenue losses: Significant revenue loss for Nvidia, impacting its overall financial performance. Analysts have offered varying estimates of the financial hit, but it’s undoubtedly substantial.

- Alternative market strategies: Nvidia has responded by developing alternative chips, like the A800, designed to comply with export restrictions while still offering competitive performance. However, this requires significant R&D investment and might not fully offset losses in the high-end market.

These export controls highlight the vulnerability of companies operating in a globalized tech landscape subject to shifting geopolitical realities. The "US-China tech war," "export controls," and the resulting "supply chain" disruptions pose a constant threat to Nvidia's growth strategy.

Geopolitical Uncertainty and Investment Risk

The unpredictable nature of US-China relations creates significant geopolitical uncertainty, impacting investor confidence in Nvidia. This uncertainty translates into:

- Fluctuations in Nvidia's stock price: Nvidia's stock price is sensitive to news related to US-China relations, reflecting investor anxieties about future earnings.

- Investor concerns about future earnings: Uncertainty surrounding future export restrictions and access to the Chinese market directly impacts investor sentiment and predictions for Nvidia's future profitability.

- The role of geopolitical risk assessments in investment decisions: Investment firms are increasingly incorporating geopolitical risk assessments into their decision-making processes, factoring in the potential impact of trade wars and sanctions on Nvidia's performance. This adds a layer of complexity for investors already navigating the volatile tech sector.

Regional Conflicts and Global Chip Shortages

Nvidia's operations are not solely affected by the US-China dynamic. Global instability in other regions also poses significant challenges.

Impact of Global Instability

The Russia-Ukraine war, for example, illustrates how regional conflicts can disrupt Nvidia's supply chain and manufacturing processes:

- Dependence on specific materials or manufacturing locations: Nvidia, like other semiconductor companies, relies on a global network of suppliers for raw materials and manufacturing services. Conflicts can disrupt these supply chains, leading to shortages and price increases.

- Potential price increases for raw materials: Geopolitical instability often leads to volatile pricing of essential raw materials, increasing Nvidia's production costs and potentially affecting its profitability.

- Diversification strategies to mitigate risk: To mitigate these risks, Nvidia is likely investing in diversifying its supply chains, exploring alternative sources for raw materials and potentially expanding manufacturing capabilities in different regions.

The "global chip shortage" exacerbated by geopolitical instability further emphasizes the importance of robust supply chain management and diversification.

The Growing Importance of Semiconductor Manufacturing

Securing a reliable and stable supply of semiconductors is crucial for Nvidia's long-term success. This necessitates significant investment in:

- Nvidia's investment in manufacturing capabilities: While Nvidia primarily designs chips, it's increasingly important for the company to secure its manufacturing capacity through partnerships and potentially direct investment.

- Partnerships with foundries: Nvidia relies heavily on foundries like TSMC for manufacturing. Geopolitical factors influencing these foundries, including government regulations and trade restrictions, directly impact Nvidia's production capabilities.

- The impact of geopolitical factors on the global semiconductor industry: The global semiconductor industry is highly concentrated geographically, making it vulnerable to geopolitical risks. Events impacting key regions can disrupt the entire industry, directly affecting Nvidia.

Data Security and National Security Concerns

Nvidia's powerful AI chips are at the forefront of AI development, raising significant ethical and national security concerns.

Nvidia's Role in AI Development and National Security

The immense processing power of Nvidia's GPUs is attractive to both civilian and military applications, raising ethical and national security considerations:

- Potential misuse of AI technology: The potential for misuse of AI technology, including in autonomous weapons systems or surveillance technologies, is a major concern. Governments worldwide are grappling with the ethical implications of AI development and its potential impact on society.

- Concerns about AI development in authoritarian regimes: The potential for Nvidia's technology to be used by authoritarian regimes for oppressive purposes is a significant concern, leading to calls for increased regulation and oversight.

- Government regulation and oversight: Governments are increasingly implementing regulations and oversight mechanisms to ensure the responsible development and deployment of AI technologies, potentially impacting Nvidia's operations.

International Data Privacy Regulations

Nvidia's operations are subject to varying international data privacy regulations, including GDPR in Europe:

- Compliance challenges: Complying with diverse and evolving data privacy regulations across different jurisdictions poses significant challenges for Nvidia, requiring substantial investment in compliance programs.

- Potential fines for non-compliance: Non-compliance with data privacy regulations can result in substantial fines, potentially impacting Nvidia's financial performance.

- Impact on international business operations: Stricter data privacy regulations can create barriers to market entry and complicate Nvidia's international business operations.

Conclusion

Nvidia's geopolitical risks extend far beyond its reliance on the Chinese market. The US-China tech war, regional conflicts, global chip shortages, and concerns around data security and national security all pose significant threats to the company's long-term success. Understanding these diverse risks is crucial for investors and industry analysts alike. These factors must be carefully considered when evaluating Nvidia's future prospects. Understanding Nvidia's geopolitical risks—beyond the China factor—is crucial for navigating the complexities of the global technology landscape. Stay informed and analyze these factors to make well-informed decisions regarding investment and industry trends. Continued monitoring of Nvidia's geopolitical risks is paramount.

Featured Posts

-

Peace Bridge Duty Free Receivership Amidst Travel Decline

Apr 30, 2025

Peace Bridge Duty Free Receivership Amidst Travel Decline

Apr 30, 2025 -

Data Breach Settlement T Mobile To Pay 16 Million

Apr 30, 2025

Data Breach Settlement T Mobile To Pay 16 Million

Apr 30, 2025 -

Charles Barkleys Unexpected Ru Pauls Drag Race Revelation Stuns Fans

Apr 30, 2025

Charles Barkleys Unexpected Ru Pauls Drag Race Revelation Stuns Fans

Apr 30, 2025 -

The Chocolate Bar That Conquered The World And Caused Inflation

Apr 30, 2025

The Chocolate Bar That Conquered The World And Caused Inflation

Apr 30, 2025 -

Feltri E Il Simbolismo Del Venerdi Santo Un Opinione Controversa

Apr 30, 2025

Feltri E Il Simbolismo Del Venerdi Santo Un Opinione Controversa

Apr 30, 2025