Nvidia's Global Challenges: A Deeper Dive Than Just China

Table of Contents

Geopolitical Risks Beyond China

Nvidia's global dominance exposes it to a complex web of geopolitical risks that extend far beyond the well-documented challenges posed by China.

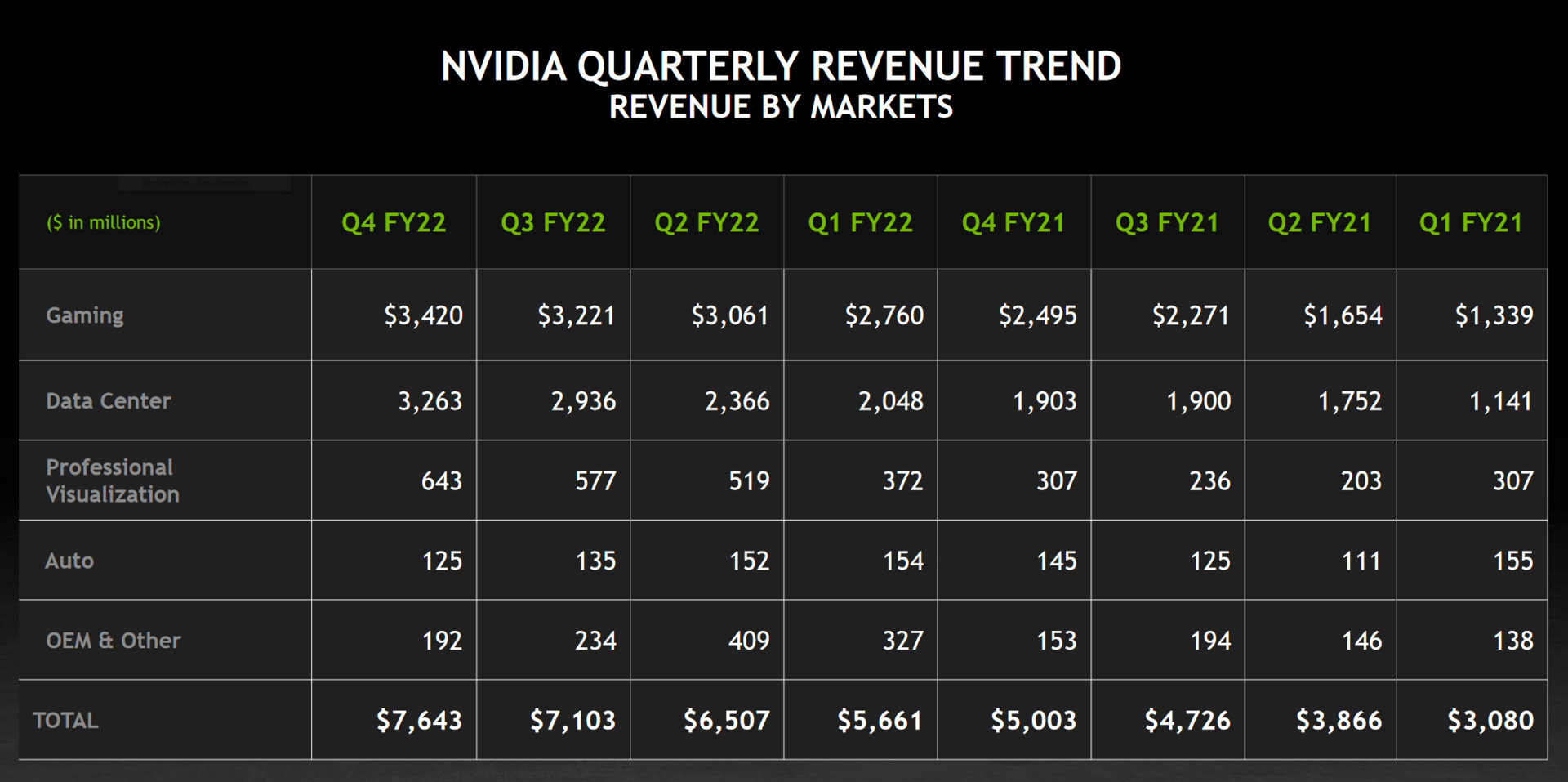

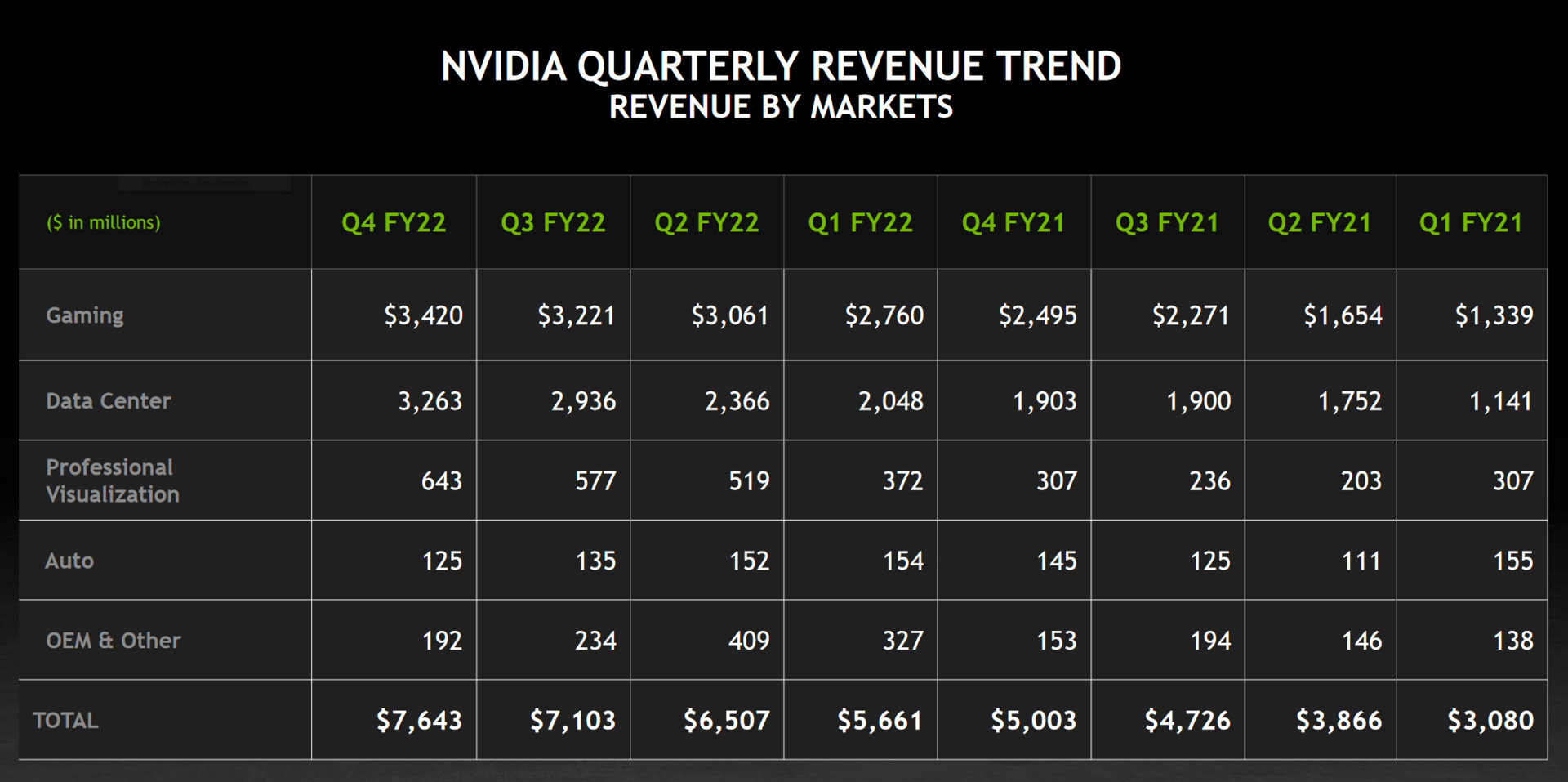

US-China Tech War's Broader Implications

The US-China technological rivalry casts a long shadow, impacting Nvidia's operations globally. Export controls and trade restrictions, initially focused on China, create ripples across the global landscape.

- Impact on Specific Product Lines: High-performance computing (HPC) GPUs, crucial for AI and supercomputing applications, are particularly affected by export restrictions, impacting sales and revenue projections.

- Potential for Regulatory Hurdles in Other Countries: The US-China tech war's spillover effects are felt in the EU and other regions, where similar regulations or scrutiny of advanced technology exports might emerge, creating further hurdles for Nvidia.

- Diversification Strategies: Nvidia is actively exploring diversification strategies, including establishing new manufacturing facilities and partnerships outside the US and China, to mitigate the impact of geopolitical instability and potential future restrictions.

Emerging Market Instability

Operating in emerging markets introduces additional geopolitical risks. Political instability, abrupt regulatory changes, and the potential for sanctions create uncertainty and threaten Nvidia's operations.

- Examples of Specific Regions: Regions experiencing political turmoil or facing sanctions present significant challenges for Nvidia's supply chains and market access.

- Associated Risks (e.g., sanctions, nationalization): The risk of nationalization of assets or the imposition of unexpected sanctions significantly impacts profitability and operations.

- Mitigation Strategies: Careful due diligence, strategic partnerships with local entities, and robust risk assessment are vital for mitigating these risks.

Supply Chain Vulnerabilities and Diversification

Nvidia's success hinges on a complex, globally dispersed supply chain. However, this very complexity creates significant vulnerabilities.

Reliance on Specific Manufacturing Hubs

Nvidia relies heavily on specific geographic regions for chip manufacturing, creating a concentration risk. Diversifying manufacturing geographically is challenging and expensive.

- Geographical Concentration of Manufacturing: The concentration of manufacturing in specific regions increases vulnerability to natural disasters, political instability, and other unforeseen events.

- Potential Disruptions due to Natural Disasters or Political Instability: Events like earthquakes, pandemics, or geopolitical conflicts can severely disrupt production.

- Cost Implications of Diversification: Building new manufacturing facilities and establishing alternative supply chains involves substantial upfront investments and ongoing operational costs.

Securing Key Components

Obtaining essential raw materials and components, especially advanced semiconductors and rare earth minerals, poses another significant challenge.

- Specific Components Crucial for Nvidia's Production: Advanced semiconductors, specialized memory chips, and other components are crucial for Nvidia's high-performance GPUs.

- Geopolitical Issues Related to Sourcing These Components: Geopolitical tensions and trade disputes can impact the availability and pricing of these critical components.

- Strategies to Secure Supply Chains: Nvidia is pursuing strategies like strategic partnerships, vertical integration, and diversification of suppliers to enhance supply chain resilience.

Competitive Pressures and Technological Innovation

The GPU market is becoming increasingly competitive, with established players and new entrants vying for market share.

AMD and Intel's Growing Competition

AMD and Intel, long-time competitors, are aggressively challenging Nvidia's dominance.

- AMD and Intel's Key Competitive Advantages: Both companies are investing heavily in R&D to improve their GPU offerings, focusing on performance, efficiency, and features.

- Market Share Analysis: The market share is shifting, with AMD and Intel gradually gaining ground in specific segments.

- Technological Innovation in the GPU Space: Rapid advancements in GPU technology necessitate continuous innovation to maintain a competitive edge.

The Rise of Chinese Competitors

The emergence of Chinese GPU manufacturers, backed by government support and significant investment, presents a growing threat to Nvidia's market leadership.

- Examples of Chinese Competitors: Several Chinese companies are making strides in developing competitive GPU technologies.

- Their Strengths and Weaknesses: While Chinese competitors are rapidly advancing, they still lag behind Nvidia in certain areas, such as overall performance and software ecosystem.

- The Potential Impact on Nvidia's Market Share: The long-term impact of Chinese competition on Nvidia's market share remains to be seen.

Conclusion: Navigating Nvidia's Global Challenges

Nvidia faces a complex array of global challenges extending far beyond China, encompassing geopolitical instability, supply chain vulnerabilities, and escalating competitive pressures. Successfully navigating these challenges requires diversification, robust risk management, and relentless technological innovation. Understanding Nvidia's global challenges is crucial for investors and industry analysts alike. Continue exploring the complexities of Nvidia's global strategy to gain a comprehensive understanding of this technology giant's future.

Featured Posts

-

Ayksprys Ardw Shh Rg Kb Tk Zlm Ka Nshanh Bne Gy

May 01, 2025

Ayksprys Ardw Shh Rg Kb Tk Zlm Ka Nshanh Bne Gy

May 01, 2025 -

This Shocking Food Is Worse Than Smoking Says Doctor

May 01, 2025

This Shocking Food Is Worse Than Smoking Says Doctor

May 01, 2025 -

Teleurstelling In Oostwold Definitieve Beslissing Over Verdeelstation

May 01, 2025

Teleurstelling In Oostwold Definitieve Beslissing Over Verdeelstation

May 01, 2025 -

Dragon Den Shock Businessman Rejects Investors Accepts Risky Deal

May 01, 2025

Dragon Den Shock Businessman Rejects Investors Accepts Risky Deal

May 01, 2025 -

Nypd Investigating Harassment Of Woman By Pro Israel Mob Details Emerge

May 01, 2025

Nypd Investigating Harassment Of Woman By Pro Israel Mob Details Emerge

May 01, 2025