Nvidia's Growth Outlook: Balancing Positive Forecast With China Concerns

Table of Contents

Nvidia's Positive Forecast: Drivers of Growth

Nvidia's positive forecast is underpinned by several key factors driving robust growth across multiple sectors.

Booming AI Market: The Fueling Engine

The explosive growth of the artificial intelligence market is undeniably the primary driver of Nvidia's success. Nvidia's GPUs (graphics processing units) are indispensable for AI development, providing the immense processing power needed for deep learning and machine learning applications. This has led to:

- Increased demand for GPUs in data centers: The insatiable hunger for computing power to train and deploy AI models is fueling a massive surge in data center GPU deployments.

- Cloud computing adoption: The shift to cloud computing is further accelerating demand, as cloud providers require massive GPU infrastructure to meet the needs of their AI clients.

- Expansion into AI software: Nvidia isn't just selling hardware; it's also expanding its software offerings, creating a more comprehensive and lucrative ecosystem for AI developers. This diversification strengthens their market position.

Gaming Market Resilience: A Consistent Contributor

While AI is the undisputed star, Nvidia's gaming segment continues to demonstrate resilience and contribute significantly to the positive forecast. This stems from:

- New game releases: The consistent release of high-profile games requiring powerful graphics cards maintains a steady demand.

- Improved graphics cards: Nvidia's ongoing innovations in graphics card technology, such as the RTX series, attract gamers seeking the best visual experience.

- Competitive pricing strategies: Strategic pricing adjustments ensure accessibility for a broad spectrum of gamers.

- Esports growth: The booming esports industry fuels demand for high-performance gaming hardware, further benefiting Nvidia's gaming segment.

Automotive and Professional Visualization Markets: Emerging Growth Areas

Beyond AI and gaming, Nvidia is making significant strides in other sectors, contributing to the overall positive outlook. These include:

- Autonomous vehicle development: Nvidia's technology is integral to the development of self-driving cars, a rapidly expanding market with enormous future potential.

- Growth in professional visualization tools: Design and engineering firms increasingly rely on Nvidia's powerful GPUs for complex simulations and visualizations, leading to consistent demand in this niche.

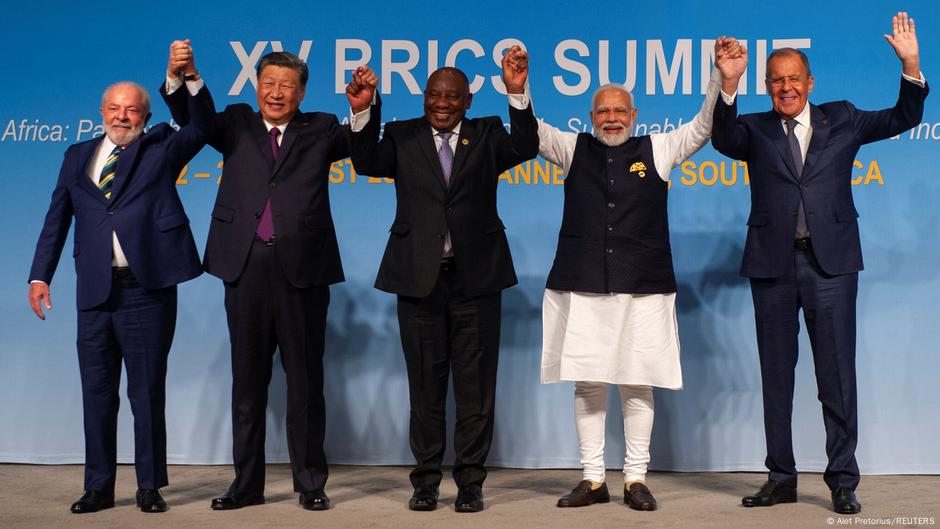

China Concerns: A Significant Geopolitical Risk

Despite the positive forecast, the evolving geopolitical situation with China presents considerable challenges for Nvidia.

Geopolitical Tensions and Trade Restrictions: A Looming Threat

The ongoing tensions between the US and China, particularly regarding trade and technology, pose a significant risk. Potential export controls and sanctions could severely impact Nvidia's operations in China, including:

- Impact of sanctions: Restrictions on exporting specific technologies to China could cripple Nvidia's ability to supply its Chinese customers.

- Potential for supply chain disruptions: Disruptions to the global supply chain due to geopolitical instability could hinder Nvidia's production and distribution capabilities.

- Alternative market exploration: Nvidia may need to aggressively pursue alternative markets to mitigate potential losses in China.

Competition from Chinese Companies: A Growing Challenge

The rapid development of the domestic Chinese semiconductor industry presents a formidable challenge to Nvidia's market share. This includes:

- Development of indigenous technologies: Chinese companies are investing heavily in developing their own GPU technologies, aiming to reduce reliance on foreign suppliers.

- Government support for domestic chipmakers: The Chinese government provides substantial subsidies and support to domestic chipmakers, fostering competition and potentially eroding Nvidia's market share.

- Potential market share erosion: Continued advancements by Chinese competitors could lead to a decline in Nvidia's market share within China.

Economic Slowdown in China: A Macroeconomic Headwind

A potential economic slowdown in China could further dampen demand for Nvidia's products, impacting:

- Reduced demand for Nvidia's products: A weaker Chinese economy could reduce consumer and enterprise spending on Nvidia's GPUs.

- Impact on overall global demand: China's economic health significantly influences global demand, and a slowdown could have wider repercussions.

Strategies for Mitigating China Risks

Nvidia needs to proactively implement strategies to mitigate the risks associated with its China operations.

Diversification of Markets: Reducing Reliance on a Single Region

Diversifying its customer base and geographic reach is crucial for reducing reliance on the Chinese market. This involves:

- Focus on growth in other regions: Investing heavily in markets like Europe and North America to reduce dependence on China.

- Strategic partnerships: Collaborating with companies in other regions to expand market access and strengthen its global presence.

Technological Innovation: Maintaining a Competitive Edge

Maintaining a technological edge is vital for Nvidia to stay competitive. This necessitates:

- Investment in R&D: Continued investment in research and development to stay ahead of the curve and develop cutting-edge technologies.

- Development of cutting-edge technologies: Innovation is paramount to maintaining market leadership and ensuring that Nvidia's products remain in high demand.

- Patents and intellectual property: Strong intellectual property protection is crucial for maintaining a competitive advantage.

Conclusion: Nvidia's Future: Navigating the Growth Outlook and China Concerns

Nvidia's growth outlook remains positive, primarily fueled by the burgeoning AI market and its strong position in GPU technology. However, the geopolitical landscape, particularly the challenges posed by China concerns, presents significant hurdles. The key takeaways are the strong positive growth drivers, the substantial risks stemming from the complex China situation, and the importance of mitigation strategies like market diversification and technological innovation. To stay abreast of Nvidia's progress and understand how the company navigates these challenges, keep following developments in Nvidia's growth outlook and how the company addresses China concerns. This dynamic interplay of opportunity and risk will define Nvidia's future trajectory.

Featured Posts

-

Carlos Alcaraz Wins 6th Masters 1000 Title In Monte Carlo

May 30, 2025

Carlos Alcaraz Wins 6th Masters 1000 Title In Monte Carlo

May 30, 2025 -

Novo Nordisk And Ozempic Examining A Loss Of Market Leadership In Weight Management

May 30, 2025

Novo Nordisk And Ozempic Examining A Loss Of Market Leadership In Weight Management

May 30, 2025 -

Globalnoto Zatoplyane Ekstremni Goreschini Zasyagat Nad Polovinata Ot Svetovnoto Naselenie Prez 2024 G

May 30, 2025

Globalnoto Zatoplyane Ekstremni Goreschini Zasyagat Nad Polovinata Ot Svetovnoto Naselenie Prez 2024 G

May 30, 2025 -

Entradas Bad Bunny Consigue Tus Tickets En Preventa Ticketmaster And Live Nation

May 30, 2025

Entradas Bad Bunny Consigue Tus Tickets En Preventa Ticketmaster And Live Nation

May 30, 2025 -

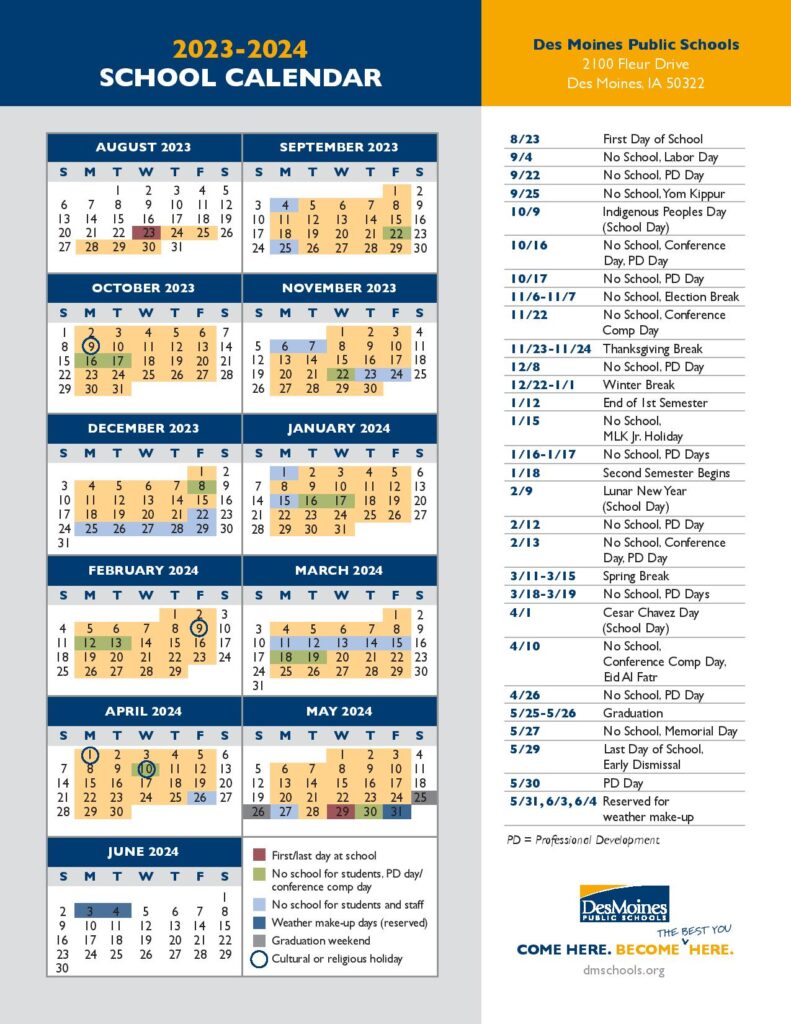

Find Your Memorial Day Fun Des Moines Events And Activities

May 30, 2025

Find Your Memorial Day Fun Des Moines Events And Activities

May 30, 2025