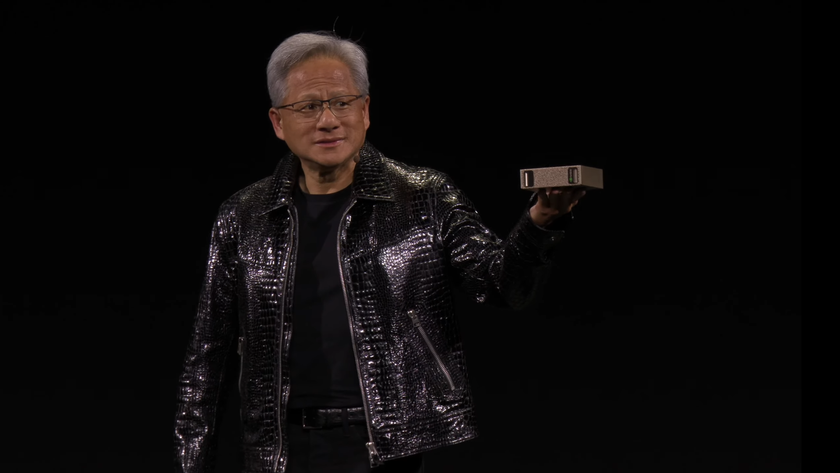

Nvidia's Huang: US Export Controls A Failure, Trump Praised

Table of Contents

Huang's Criticism of Current US Export Controls

Nvidia, a cornerstone of the AI revolution, finds itself directly in the crosshairs of current US export controls. These regulations restrict the sale of advanced chips, particularly those with applications in high-performance computing and AI, to specific countries, primarily China. This impacts not only Nvidia's bottom line but also the global availability of crucial technology.

The negative consequences of these restrictive measures are significant:

- Exacerbated Chip Shortages: Restricting the flow of advanced chips globally exacerbates existing shortages, impacting various industries from automotive manufacturing to consumer electronics.

- Undermining US Technological Leadership: By limiting access to advanced technologies, the US risks losing its competitive edge in the global technology race. Other countries might develop their own advanced technologies, potentially reducing US influence and innovation.

- Economic Hardship for American Companies: Nvidia and other American semiconductor companies face decreased revenue and reduced market share due to these restrictions. This directly impacts job creation and economic growth.

- Stunted AI Development: The restrictions on high-performance computing chips hamper the progress of AI development and deployment, potentially setting back advancements in critical areas such as healthcare, climate change, and national security.

Huang's comments reflect this concern. While specific quotes require verification from official transcripts, his general sentiment underscores the detrimental effects of these controls on Nvidia's operations and the broader technological landscape. He likely argued for alternative strategies focusing on targeted sanctions against specific entities rather than broad restrictions on entire technologies. This could involve stricter monitoring of end-users and enhanced collaboration with allied nations to ensure responsible technology transfer.

Positive Assessment of the Trump Administration's Approach

In contrast to the current administration's approach, Huang likely viewed the Trump administration's policies on technology export controls as more favorable. While the Trump administration also implemented some export restrictions, their approach might have been less restrictive and more focused on strategic competition with specific adversaries.

Key differences could include:

- Less Restrictive Regulations: The Trump administration may have had a more lenient approach to licensing and approvals, allowing for greater flexibility in international technology trade.

- Strategic Competition Focus: Instead of broad restrictions, the focus might have been on targeting specific entities or technologies deemed a direct threat to national security, rather than imposing blanket bans.

- Improved Relations with Key Technology Partners: A potentially more collaborative international approach could have fostered stronger partnerships with key technology players, smoothing the path for technological advancements.

While the Trump administration's approach had its own controversies and criticisms, Huang's preference might stem from a belief that it struck a better balance between national security and fostering innovation and economic growth. Again, referencing specific quotes and verifiable reports will strengthen this section. However, any potential downsides or controversies surrounding the Trump administration's approach should be acknowledged for balance.

The Broader Implications for the Semiconductor Industry

The implications of US export controls extend far beyond Nvidia. The global semiconductor supply chain is deeply interconnected, and these restrictions create ripple effects throughout the industry.

- Geopolitical Tensions: The controls significantly affect US relations with China, creating tension and potentially triggering retaliatory measures. This escalates the technological competition between the two superpowers.

- Retaliatory Measures: Other countries may respond with their own restrictions on US technology exports, creating a cycle of protectionism that ultimately harms global innovation.

- Long-Term Competitiveness: Overly restrictive policies could weaken the long-term competitiveness of the US semiconductor industry, potentially leading to a loss of technological leadership and economic dominance.

- Alternative Perspectives: It's crucial to acknowledge that there are varying perspectives on US export controls. Some argue that robust restrictions are necessary to safeguard national security, even if it comes at an economic cost. A balanced approach is crucial, balancing national security with the need for international technological collaboration.

Conclusion: Navigating the Future of US Export Controls and Nvidia's Role

Jensen Huang's criticisms highlight the significant challenges faced by Nvidia and the broader tech sector due to current US export control policies. He likely favored the Trump administration's potentially less restrictive approach, believing it better balanced national security concerns with the need for global technological collaboration and economic growth. Overly restrictive export controls create chip shortages, harm US technological leadership, and stifle AI development. Finding a better balance – perhaps through targeted sanctions rather than broad restrictions – is essential.

Understanding the complexities of Nvidia's challenges with US export controls is crucial. Learn more about the ongoing debate and share your thoughts on finding a better balance between national security and technological innovation.

Featured Posts

-

The Goldbergs Why The Show Resonates With Audiences

May 22, 2025

The Goldbergs Why The Show Resonates With Audiences

May 22, 2025 -

Core Weave Stock Performance A Current Analysis

May 22, 2025

Core Weave Stock Performance A Current Analysis

May 22, 2025 -

Mas Alla Del Arandano El Mejor Aliado Para Prevenir Enfermedades Cronicas

May 22, 2025

Mas Alla Del Arandano El Mejor Aliado Para Prevenir Enfermedades Cronicas

May 22, 2025 -

Abn Amro Rapporteert Heffingen Halveren Voedselexport Naar Vs

May 22, 2025

Abn Amro Rapporteert Heffingen Halveren Voedselexport Naar Vs

May 22, 2025 -

The Untold Story Of Peppa Pigs Name A Fans Revelation

May 22, 2025

The Untold Story Of Peppa Pigs Name A Fans Revelation

May 22, 2025