Offshore Wind Farm Development: Challenges Of High Capital Expenditure

Table of Contents

Financing the Leviathan: Securing Funding for Offshore Wind Projects

Offshore wind farm projects represent some of the largest infrastructure projects globally, demanding billions in upfront capital. This significantly exceeds the investment needed for onshore projects, making securing financing a critical challenge.

The Scale of Investment:

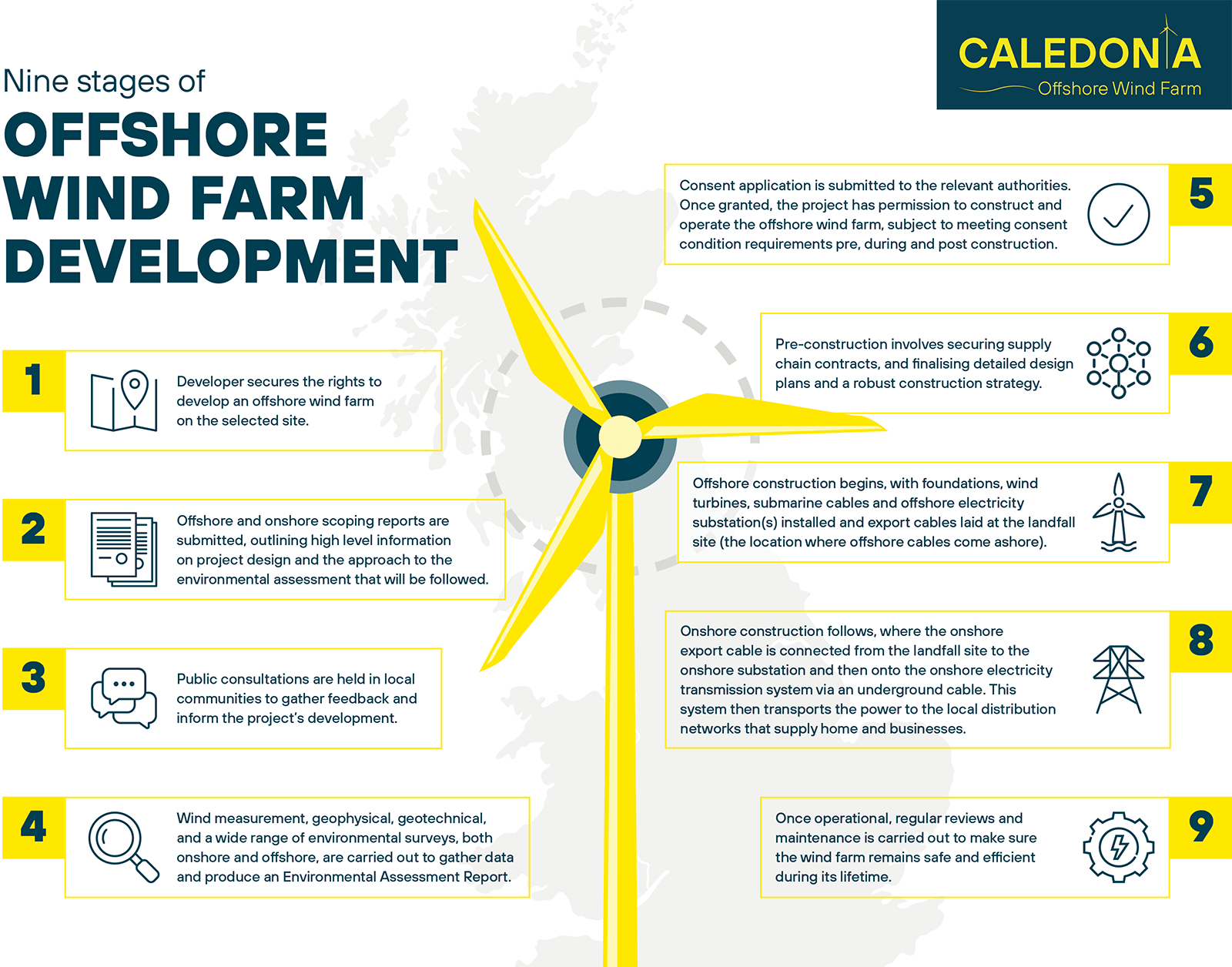

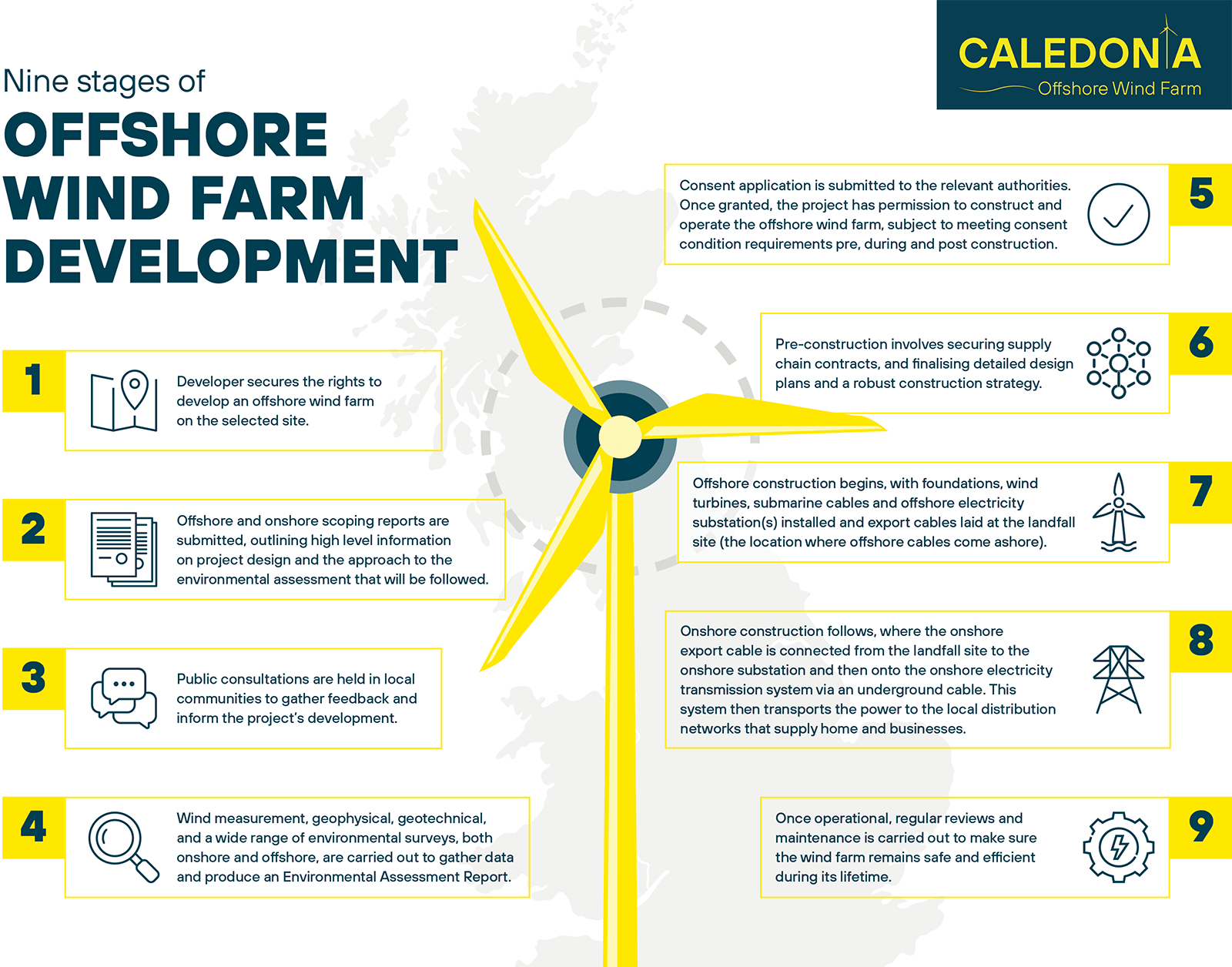

Offshore wind farm development requires a massive upfront investment. This is due to several factors:

- Higher initial costs compared to onshore wind farms: The complexities of offshore construction, including specialized vessels and equipment, significantly inflate initial costs.

- Need for long-term financing solutions: Securing long-term financing, such as project finance and equity investment from pension funds and other large investors, is crucial due to the extended development and operational lifecycles.

- Increased risk perception affecting investor confidence: The inherent risks associated with offshore projects, including unpredictable weather conditions and potential delays, can make investors hesitant. This translates to higher interest rates and increased difficulty in securing loans.

The Role of Government Subsidies and Incentives:

Government support, in the form of subsidies, tax breaks, and Renewable Energy Certificates (RECs), is often crucial to mitigate financial risk and attract private investment into High Capital Expenditure Offshore Wind Farms. However, reliance on these incentives presents its own set of challenges:

- Variations in government support across different regions: The level of government support varies considerably across countries and regions, creating uncertainty for developers.

- Dependence on Renewable Energy Certificates (RECs) and other subsidies: Fluctuations in REC prices and potential changes in government policy regarding subsidies can significantly impact project viability.

- Impact of fluctuating energy prices on project viability: The profitability of offshore wind farms is sensitive to changes in electricity prices, impacting investor returns and the attractiveness of such projects.

Managing Financial Risk and Uncertainty:

Large-scale projects, by nature, carry a high degree of risk. Unforeseen costs and delays are common occurrences, making robust risk assessment and mitigation crucial for successful offshore wind farm development.

- Geological surveys and site assessments: Detailed site investigations are crucial to identify potential geological challenges and ensure project feasibility.

- Regulatory approvals and permitting processes: The complex regulatory environment surrounding offshore development can lead to lengthy delays and additional costs.

- Supply chain management and material costs: Securing materials, such as specialized turbines and subsea cables, from a reliable supply chain is vital to avoid cost overruns and project delays.

Technological Hurdles and Cost Optimization Strategies for Offshore Wind Farms

The technology underlying offshore wind farms is sophisticated and expensive, representing a significant portion of the high capital expenditure.

Technological Complexity and Costs:

Offshore wind turbine technology is advanced and requires specialized expertise and equipment. This leads to substantial costs across various aspects:

- Turbine manufacturing and installation costs: Manufacturing large-scale turbines for offshore environments requires advanced technologies and specialized facilities. Installation at sea adds considerable complexity and expense.

- Subsea cable installation and grid connection costs: Laying and protecting subsea cables to connect the wind farm to the electricity grid is a costly and technically challenging undertaking.

- Maintenance and operational expenses: Regular maintenance and repair of offshore turbines require specialized vessels and personnel, contributing significantly to long-term operational costs.

Innovation and Cost Reduction Initiatives:

The industry is actively pursuing innovation to reduce costs and improve efficiency:

- Larger turbine sizes and increased capacity: Larger turbines generate more power per unit, reducing the overall number of turbines required and lowering costs.

- Improved construction techniques and automation: Implementing innovative construction methods and automation can streamline the installation process and minimize labor costs.

- Advanced energy storage solutions: Integrating energy storage systems can improve grid stability and allow for more efficient use of generated electricity, reducing the need for costly grid upgrades.

Supply Chain Challenges and their Impact on Capital Expenditure:

Global supply chains play a crucial role in offshore wind farm development. Disruptions can significantly impact project costs and timelines:

- Material shortages and price volatility: Demand for specialized materials can lead to shortages and price volatility, increasing project expenses.

- Transportation and logistics issues: Transporting large components to offshore locations is complex and costly, susceptible to logistical delays.

- Geopolitical factors impacting component availability: International relations and geopolitical events can impact the availability of key components and manufacturing capacity.

Environmental Considerations and their Financial Implications

Environmental considerations are paramount in offshore wind farm development. However, fulfilling environmental requirements adds to the substantial capital expenditure.

Environmental Impact Assessments and Mitigation Costs:

Thorough environmental impact assessments (EIAs) are crucial to identify and mitigate potential environmental risks. These assessments require substantial financial investments:

- Marine life impact studies: Studies to assess the impact on marine ecosystems, including birds, marine mammals, and fish, are vital but expensive.

- Mitigation measures for noise and visual pollution: Measures to minimize noise and visual impacts on marine life and nearby communities are necessary but contribute to overall project costs.

- Compensation for environmental damage: Compensation for potential environmental damage, either through restoration efforts or financial payments, may be required.

Regulatory Compliance and Permitting Costs:

Strict regulatory requirements and lengthy permitting processes add significantly to the financial burden:

- Environmental impact statement preparation: Preparing detailed environmental impact statements complying with stringent regulatory requirements is a time-consuming and costly process.

- Obtaining necessary permits and licenses: Securing the various permits and licenses required for construction and operation adds layers of complexity and expense.

- Navigating regulatory changes and appeals: Regulatory changes and potential appeals can further delay projects and add to the overall cost.

Conclusion:

The high capital expenditure required for offshore wind farm development presents significant challenges. Securing adequate financing, managing technological complexities, and addressing environmental concerns are all crucial for project success. However, despite these hurdles, the long-term benefits of clean, renewable energy outweigh the initial financial investment. Continued innovation, government support, and efficient risk management are essential to unlock the full potential of High Capital Expenditure Offshore Wind Farms and accelerate the global transition to sustainable energy. Investors and policymakers alike must carefully consider these challenges when evaluating future projects and developing strategies to mitigate financial risks while advancing the vital goal of clean energy generation.

Featured Posts

-

Is This Christina Aguilera Fans Question Heavily Edited Photoshoot Images

May 03, 2025

Is This Christina Aguilera Fans Question Heavily Edited Photoshoot Images

May 03, 2025 -

Fan Falls From Wrigley Field Outfield Wall During Cubs Pirates Game

May 03, 2025

Fan Falls From Wrigley Field Outfield Wall During Cubs Pirates Game

May 03, 2025 -

Reform Uk Police Action Following Bullying Allegations Against Rupert Lowe

May 03, 2025

Reform Uk Police Action Following Bullying Allegations Against Rupert Lowe

May 03, 2025 -

England Vs Spain Womens World Cup Match Preview And Predictions

May 03, 2025

England Vs Spain Womens World Cup Match Preview And Predictions

May 03, 2025 -

Manchester United Community Grieves With Poppys Family

May 03, 2025

Manchester United Community Grieves With Poppys Family

May 03, 2025