Oil Production In Focus: OPEC+ To Decide On July Output Quotas

Table of Contents

Current Global Oil Supply and Demand

The current state of global oil supply and demand is a complex interplay of several factors. Post-pandemic recovery has led to a surge in energy consumption, particularly in Asia and other developing economies. This increased global oil demand is placing pressure on existing oil supplies. Simultaneously, sanctions imposed on Russian oil production following the Ukraine conflict have created a significant supply disruption, impacting the overall availability of crude oil in the global market.

- Current Crude Oil Inventories: Global crude oil inventories are currently being closely monitored. While some regions report healthy levels, others are experiencing tighter supplies, contributing to price volatility. The level of these inventories will heavily influence the OPEC+ decision.

- Impact of Russian Sanctions: The sanctions on Russian oil production have undeniably reduced the global supply, creating a supply gap that OPEC+ is being pressured to fill. However, finding a balance between filling this gap and maintaining price stability is a key challenge.

- Alternative Energy Sources: The growing adoption of alternative energy sources like solar, wind, and hydroelectric power is slowly but surely impacting the long-term demand for crude oil. However, the transition is gradual, and oil remains the dominant energy source for now.

- Future Demand Projections: Economic forecasts suggest continued growth in global energy demand, though the rate of growth might vary across regions. Accurately projecting this future demand is critical for OPEC+ in determining appropriate production levels.

OPEC+ Member Nation Dynamics and Internal Conflicts

OPEC+ comprises a diverse group of nations with varying economic needs and geopolitical priorities. This internal diversity often leads to disagreements regarding optimal oil production levels. Saudi Arabia, as the de facto leader, and Russia, a significant oil producer, play crucial roles in shaping the final decision. Their positions often influence the overall outcome of the OPEC+ meetings.

- Differing Economic Needs: Member nations have different economic dependencies on oil revenues. Some heavily rely on oil exports for their national budgets, while others have more diversified economies. This difference in economic reliance leads to varied perspectives on production targets.

- Geopolitical Tensions: Geopolitical events and tensions, such as the ongoing conflict in Ukraine, significantly impact the dynamics within OPEC+. These factors can lead to unpredictable shifts in production strategies and alliances.

- Past Disagreements: History shows instances of significant disagreements within OPEC+ regarding production quotas, resulting in periods of market volatility. Understanding these past conflicts provides valuable insight into potential outcomes of the July meeting.

- Compromise and Strategies: Reaching a consensus often involves complex negotiations and compromises among member states. The ability to find a mutually acceptable solution will be crucial for maintaining stability in the global oil market.

Factors Influencing OPEC+'s July Decision

The OPEC+ decision for July will be influenced by a multitude of factors, each carrying significant weight. Current oil prices are a primary consideration, along with the global economic outlook, inflation rates, and geopolitical uncertainties. The interplay of these factors necessitates a careful and strategic approach from OPEC+.

- Impact of Inflation: High inflation rates globally can dampen economic growth and, consequently, reduce energy consumption, influencing the demand for crude oil. This is a key factor OPEC+ needs to consider.

- Geopolitical Instability: The war in Ukraine and other geopolitical instabilities contribute to market uncertainty, potentially impacting both supply and demand, forcing OPEC+ to adopt a cautious approach.

- Global Economic Growth: The rate of global economic growth directly influences oil demand. Strong economic growth usually translates to higher oil consumption, whereas a slowdown could lead to reduced demand.

- Speculative Trading: Speculative trading in the oil market can introduce significant volatility, adding another layer of complexity to the decision-making process for OPEC+.

Potential Outcomes and Market Implications

The OPEC+ meeting could result in several outcomes: an increase in production quotas, a decrease, or a maintenance of the current levels. Each scenario carries distinct implications for the global oil market.

- Increased Production: Increased production could lead to lower oil prices, potentially benefiting consumers but impacting the revenues of oil-producing nations.

- Decreased Production: Conversely, a decrease in production could drive up oil prices, impacting inflation and potentially slowing economic growth.

- Unchanged Production: Maintaining current production levels seeks to strike a balance, aiming for price stability while catering to existing market demands.

- Impact on Oil Prices and Market Volatility: Regardless of the decision, the announcement is likely to trigger significant market volatility, impacting both oil prices and related commodities. The magnitude of the volatility will depend on the specific decision and market expectations.

Conclusion

The OPEC+ decision on July's oil production quotas holds significant implications for the global energy market and the world economy. Understanding the interplay of global supply and demand, internal OPEC+ dynamics, and influencing economic factors is crucial for predicting the outcome and its subsequent impact on oil prices and market stability. Stay informed on this crucial decision affecting oil production and monitor the announcements closely to adapt to the changing energy landscape. Continue to follow our coverage for insightful analysis and updates on OPEC+ oil output and its influence on global crude oil supply.

Featured Posts

-

Whats App On I Pad Finally Available After 15 Years

May 29, 2025

Whats App On I Pad Finally Available After 15 Years

May 29, 2025 -

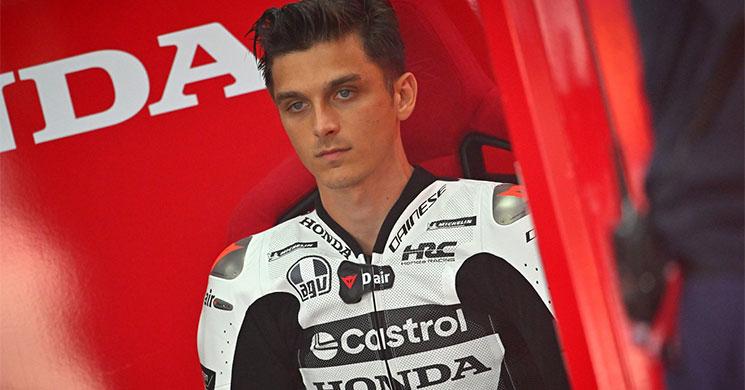

Joan Mirs And Luca Marinis Ambitions High At Circuit Of The Americas

May 29, 2025

Joan Mirs And Luca Marinis Ambitions High At Circuit Of The Americas

May 29, 2025 -

Harry Potter Remake Addressing Fan Concerns

May 29, 2025

Harry Potter Remake Addressing Fan Concerns

May 29, 2025 -

Dodelijk Verkeersongeval A67 Venlose Man Overleden Na Botsing Met Drie Autos

May 29, 2025

Dodelijk Verkeersongeval A67 Venlose Man Overleden Na Botsing Met Drie Autos

May 29, 2025 -

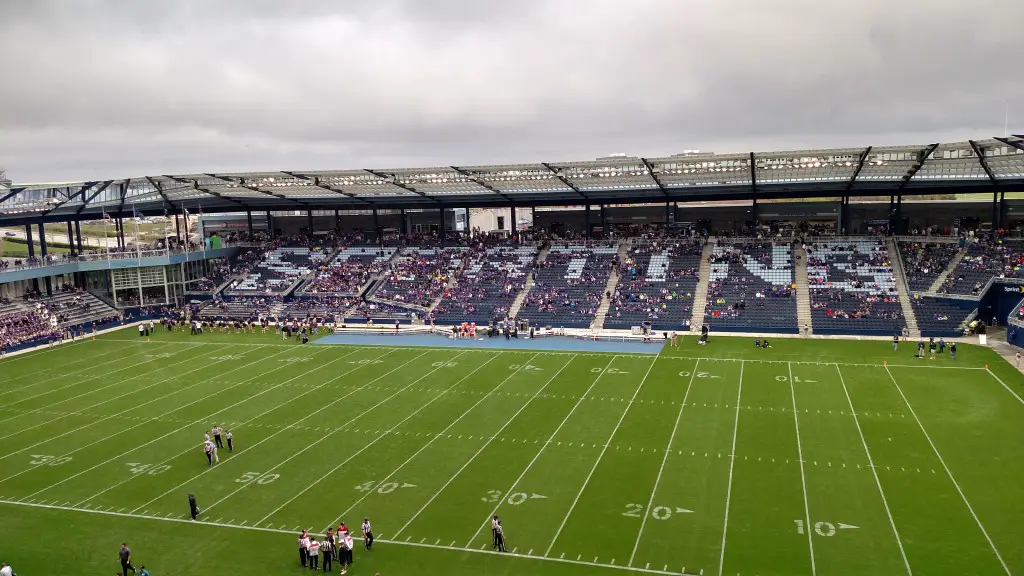

Spring Valley Dominates Spring Mills 88 36 Victory

May 29, 2025

Spring Valley Dominates Spring Mills 88 36 Victory

May 29, 2025