Omada Health IPO: Venture Capital Backing Fuels Public Market Debut

Table of Contents

Omada Health's Business Model and Market Position

Chronic Disease Management through Digital Platforms

Omada Health's core offering centers on virtual programs designed for the prevention and management of chronic conditions. These programs leverage digital therapeutics and telehealth to provide personalized support to individuals struggling with diabetes, hypertension, and other prevalent health issues.

- Remote Patient Monitoring: Continuous monitoring of vital signs and health data through connected devices.

- Personalized Coaching: One-on-one support from certified health coaches to provide guidance and motivation.

- Medication Adherence Support: Tools and strategies to help patients maintain consistent medication schedules.

- Educational Resources: Access to comprehensive information and resources to improve health literacy.

Omada's target market encompasses a broad spectrum, including employers seeking to improve employee wellness, health plans aiming to reduce healthcare costs, and individuals actively managing their chronic conditions. The market for chronic disease management is substantial and growing rapidly, fueled by an aging population and rising prevalence of chronic illnesses. This presents significant growth opportunities for Omada Health. Keywords: Digital therapeutics, telehealth, remote patient monitoring, chronic disease management, virtual care, digital health solutions.

Competitive Landscape and Differentiation

Omada Health operates within a dynamic and competitive digital health landscape. Key competitors include established players like Teladoc and Livongo, each offering various telehealth and chronic disease management solutions. However, Omada differentiates itself through several key advantages:

- Program Efficacy: Omada's programs have demonstrated clinically significant improvements in patient outcomes, providing strong evidence of their effectiveness.

- Strategic Partnerships: Collaborations with major employers and health plans provide access to a wider patient base.

- Focus on Specific Conditions: Omada's specialization in key chronic diseases allows for deeper expertise and tailored interventions.

Despite its competitive advantages, Omada faces challenges. Intense competition requires ongoing innovation and a robust marketing strategy to maintain market share. The evolving regulatory landscape for digital health also presents hurdles that require careful navigation. Keywords: Teladoc, Livongo, digital health competition, market share, competitive advantage, telehealth platforms.

The Role of Venture Capital in Omada Health's Success

Funding Rounds and Investor Interest

Omada Health's journey to the IPO was fueled by significant venture capital investments. The company secured substantial funding across several rounds, attracting major investors who recognized the potential of its digital health approach.

- Series A: [Insert Funding Amount and Key Investors]

- Series B: [Insert Funding Amount and Key Investors]

- Later Funding Rounds: [Insert Funding Amount and Key Investors]

This substantial venture capital funding played a crucial role in Omada's rapid growth, enabling the development of its technology platform, expansion into new markets, and the recruitment of top talent. Investor interest reflects a growing confidence in the digital health sector and the potential for Omada to disrupt traditional healthcare models. Keywords: Venture capital, Series A, Series B, funding rounds, investor relations, private equity, digital health funding.

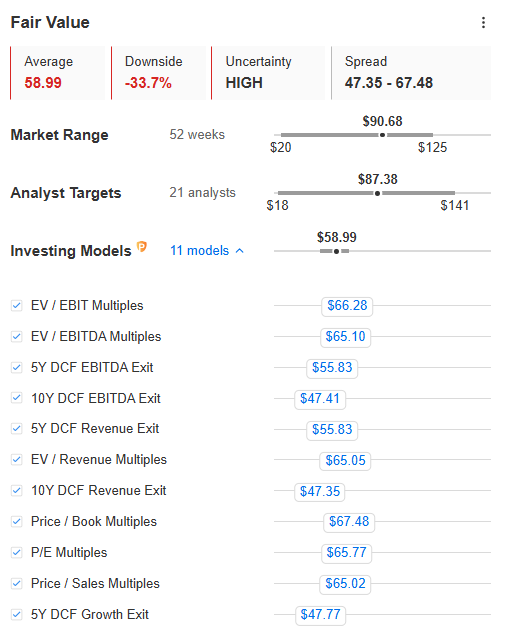

IPO Valuation and Market Expectations

Omada Health's IPO valuation reflects market expectations for its future growth and profitability. [Insert IPO price, number of shares offered, and total funds raised]. Analyst projections vary, but generally indicate a positive outlook for the company, reflecting investor confidence in its business model and market potential. However, the initial stock price and subsequent performance will be influenced by a number of factors, including overall market conditions, competitive pressures, and the company’s ability to meet its financial targets. Keywords: IPO valuation, market capitalization, stock price, initial public offering, share price, stock market performance.

Implications of the Omada Health IPO for the Digital Health Sector

Increased Investor Confidence in Digital Health

Omada Health's successful IPO sends a strong signal to investors, boosting confidence in the digital health sector. This success could trigger a wave of similar IPOs from other digital health companies, further fueling innovation and investment in the industry.

- Increased Funding: More venture capital and private equity may flow into the digital health space.

- Accelerated Innovation: Companies will be incentivized to develop and commercialize new digital health technologies.

- Market Expansion: The wider adoption of digital health solutions could lead to greater access to care for patients.

Keywords: Digital health investment, market trends, industry growth, technological innovation, digital health startups.

Future Growth and Challenges for Omada

As a publicly traded company, Omada Health faces both significant opportunities and challenges. Sustaining its growth trajectory requires a strategic approach to navigate a competitive market.

- Competition: The ongoing need to differentiate from competitors through innovation and strategic partnerships.

- Regulatory Compliance: Adherence to evolving regulations for digital health technologies and data privacy.

- Profitability: Demonstrating sustainable profitability and strong financial performance to satisfy investor expectations.

- Market Expansion: Targeting new patient populations and expanding geographic reach.

Omada's long-term success depends on its ability to execute its strategic plan, adapt to market dynamics, and maintain its commitment to improving patient outcomes through innovative digital health solutions. Keywords: Future growth prospects, market challenges, regulatory compliance, financial performance, long-term strategy, digital health future.

Conclusion

The Omada Health IPO represents a significant milestone for the digital health industry, showcasing the potential of venture capital-backed companies to disrupt traditional healthcare delivery. While facing competitive pressures and inherent market challenges, Omada's success hinges on its ability to continue innovating and effectively managing chronic diseases via its digital platforms. The long-term trajectory of the Omada Health IPO and its impact on the digital health sector remain to be seen, but its debut signals a potentially transformative shift in how healthcare is delivered and accessed. Stay informed about the future of the Omada Health IPO and its implications for the digital health landscape. Further research into the Omada Health IPO details will be crucial for investors and industry stakeholders alike.

Featured Posts

-

Proposed Uk Visa Restrictions Impact On International Applicants

May 10, 2025

Proposed Uk Visa Restrictions Impact On International Applicants

May 10, 2025 -

Nnpc Petrol Price Hike Dangotes Role And Market Impact Thisdaylive

May 10, 2025

Nnpc Petrol Price Hike Dangotes Role And Market Impact Thisdaylive

May 10, 2025 -

Uk Tightens Visa Rules Overstay Concerns Prompt Stricter Measures For Nigerians

May 10, 2025

Uk Tightens Visa Rules Overstay Concerns Prompt Stricter Measures For Nigerians

May 10, 2025 -

Palantir Stock 30 Down Investment Strategy Considerations

May 10, 2025

Palantir Stock 30 Down Investment Strategy Considerations

May 10, 2025 -

Britannian Kruununperimysjaerjestys 2024 Ketkae Ovat Seuraavaksi Valtaistuimella

May 10, 2025

Britannian Kruununperimysjaerjestys 2024 Ketkae Ovat Seuraavaksi Valtaistuimella

May 10, 2025