Onex Fully Exits WestJet Investment After Sale Of 25% Stake

Table of Contents

Details of the 25% Stake Sale

The sale of Onex's remaining 25% stake in WestJet represents a key milestone in the company's investment strategy. While the exact sale price remains undisclosed publicly, sources indicate the transaction involved a significant financial return for Onex. Understanding the specifics of this divestment requires looking at several key factors.

- Buyer: While the identity of the buyer hasn't been officially revealed, industry speculation points towards [Insert speculated buyer if available, otherwise remove this bullet point and adjust the text accordingly. e.g., "a consortium of investors"]. Further details are expected to emerge in the coming weeks.

- Transaction Timeline: The sale process reportedly spanned several months, involving detailed negotiations and regulatory approvals. The finalization of the deal marks the successful completion of a complex transaction in a highly regulated industry.

- Regulatory Approvals: Given the size and significance of the stake, the sale likely required thorough scrutiny and approval from relevant regulatory bodies, including the Canadian Competition Bureau. Securing these approvals would have been a crucial step in the completion of the transaction.

- Financial Impact for Onex: While precise figures remain confidential, the divestment is expected to generate a substantial return for Onex, contributing to their overall investment portfolio performance. This successful exit further reinforces Onex's reputation for identifying and capitalizing on growth opportunities within diverse sectors.

Onex's Overall Investment in WestJet

Onex's investment in WestJet spanned several years, significantly impacting the airline's trajectory. This long-term involvement allowed Onex to actively shape WestJet's strategic direction.

- Investment History: Onex's initial investment in WestJet dates back to [Insert year of initial investment]. The initial stake acquired was [Insert percentage].

- Management Involvement: During their investment period, Onex representatives served on WestJet's board, providing valuable expertise and strategic guidance, influencing key decisions related to expansion, fleet modernization, and operational efficiency.

- Return on Investment (ROI): Although the exact ROI isn't publicly disclosed, the successful full divestment strongly suggests a profitable outcome for Onex. The divestment's timing likely reflects a strategic decision to capitalize on WestJet's current market position and future growth potential.

- Investment Strategy: This divestment aligns with Onex's strategy of deploying capital into promising businesses, fostering growth, and realizing value through strategic exits.

Impact on WestJet and the Airline Industry

The complete exit of Onex from WestJet will undoubtedly shape the airline's future trajectory and impact the competitive landscape of the Canadian airline industry.

- WestJet's Future Plans: With Onex's divestment, WestJet will likely pursue an independent strategic path, potentially focusing on specific growth areas such as expanding its network, upgrading its fleet, and enhancing customer experience.

- Competitive Landscape: This change in ownership will undoubtedly influence WestJet's competitive positioning against Air Canada and other players in the Canadian airline market. The shift might lead to new strategic alliances or a recalibration of its competitive strategies.

- Industry Trends: The transaction mirrors broader industry trends, such as the cyclical nature of private equity investment in mature sectors and the ongoing consolidation within the global airline industry. This highlights the continuous evolution of the airline sector.

- Future Investments in WestJet: While Onex is no longer involved, the possibility of future private equity investments in WestJet remains open. The airline's value proposition and growth potential will attract the attention of various potential investors.

Future Outlook for Onex's Investment Portfolio

Onex's divestment from WestJet provides insights into their evolving investment strategy and future portfolio diversification plans.

- Future Investments: Onex will likely continue to identify and invest in businesses across various sectors, focusing on opportunities that offer strong growth potential and alignment with their investment criteria.

- Shift in Investment Focus?: While this divestment doesn't necessarily signal a complete shift in investment focus, it could indicate a reallocation of capital towards other promising sectors.

- Potential Future Investments: Onex's future investments may include other sectors where they see strong growth prospects, possibly including other transportation or logistics-related companies.

Conclusion

Onex's complete divestment from WestJet marks a significant development in both the private equity and airline industries. The successful sale of its remaining 25% stake concludes a chapter in Onex's investment history, offering insights into their investment strategies and the dynamics of the Canadian aviation sector. The long-term implications for WestJet's future and the competitive landscape of the Canadian airline market warrant further observation.

Call to Action: Stay informed about the latest developments in Onex's investment activities and the dynamic landscape of the airline industry. Follow us for future updates on Onex's investment decisions and other key transactions in the private equity market. Learn more about Onex's investment strategies and the future developments at WestJet.

Featured Posts

-

Mackenzie Mc Kee Pregnant Announcing Baby With Khesanio Hall

May 11, 2025

Mackenzie Mc Kee Pregnant Announcing Baby With Khesanio Hall

May 11, 2025 -

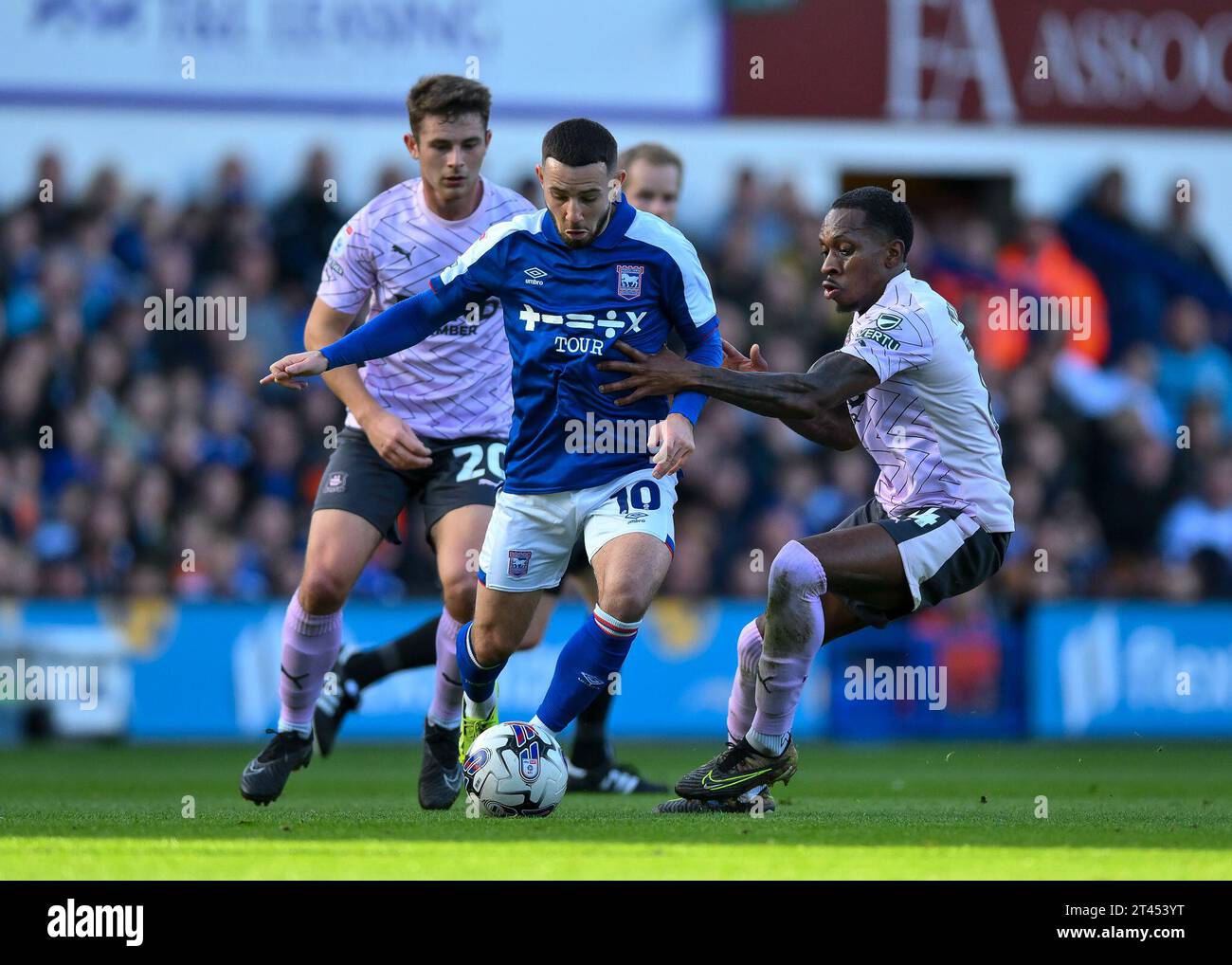

Chaplins Crucial Victory For Ipswich Town

May 11, 2025

Chaplins Crucial Victory For Ipswich Town

May 11, 2025 -

Colton Herta Seeks Qualifying Pace At Barber

May 11, 2025

Colton Herta Seeks Qualifying Pace At Barber

May 11, 2025 -

Chaplins Winning Goal Ipswich Town Triumph

May 11, 2025

Chaplins Winning Goal Ipswich Town Triumph

May 11, 2025 -

Billetera Virtual Uruguaya Cuentas Gratuitas Para Argentinos

May 11, 2025

Billetera Virtual Uruguaya Cuentas Gratuitas Para Argentinos

May 11, 2025