Onex Fully Recoups WestJet Investment With Sale Of Stake

Table of Contents

Onex's Initial Investment in WestJet: A Strategic Overview

Onex's acquisition of a significant stake in WestJet began in 2019, marking a major move in the Canadian airline market. The private equity firm saw considerable potential for growth in WestJet, recognizing its strong brand recognition and established market position within Canada and beyond. Onex's investment was driven by a belief in WestJet's ability to expand its operations, improve efficiency, and increase profitability.

- Investment Size: While the exact figures weren't publicly disclosed, it represented a substantial investment for Onex.

- Partnership Details: The acquisition involved a partnership with existing WestJet shareholders and management, ensuring a collaborative approach to growth.

- Expected Returns: Onex undoubtedly projected significant returns based on WestJet's growth potential and anticipated market share gains.

WestJet's Performance Under Onex Ownership: Growth and Challenges

During Onex's ownership, WestJet experienced a period of both growth and challenges. The airline navigated economic headwinds, intense industry competition, and the unprecedented disruption caused by the COVID-19 pandemic. Despite these hurdles, WestJet achieved several notable milestones under Onex's guidance.

- Revenue Growth Percentages: Although exact figures vary year to year, WestJet demonstrated positive revenue growth in several years prior to the pandemic, showcasing the airline's resilience.

- Market Share Changes: WestJet maintained a substantial market share in the Canadian airline industry, indicating its competitive strength.

- Significant Operational Improvements: Onex likely implemented strategies to enhance operational efficiency, potentially including cost reduction measures and route optimization.

The Sale of Onex's WestJet Stake: Details of the Divestment

Onex's decision to sell its stake in WestJet represented a strategic exit from a successful investment. The divestment process culminated in the sale of Onex's shares, resulting in a complete recoupment of its initial investment and a substantial profit.

- Buyer of the Stake: [Insert Buyer's Name and Details Here – if publicly available].

- Sale Price and Valuation: [Insert Sale Price and Valuation Details Here – if publicly available].

- Total Return on Investment (ROI) for Onex: Onex achieved a complete return on its investment, demonstrating a successful private equity strategy.

Implications of Onex's Successful WestJet Exit for Private Equity

Onex's complete return on its WestJet investment provides a compelling case study for private equity firms. It highlights the importance of thorough due diligence, a well-defined exit strategy, and the ability to navigate both growth opportunities and unforeseen challenges. This successful exit has significant implications for future investment decisions within the airline and travel sectors.

- Successful Exit Strategy Model: This investment showcases a successful model for private equity firms looking to invest in and divest from large-scale businesses.

- Potential Impact on Future Investments: The success of this investment could lead to increased private equity interest in the airline industry.

- Implications for Other Private Equity Firms: This case study provides a benchmark for successful private equity investments and demonstrates the potential for significant returns in the right circumstances.

Conclusion: Onex's Complete Return on WestJet Investment – A Case Study in Successful Private Equity

Onex's complete recoupment of its WestJet investment stands as a testament to its strategic investment acumen and effective management of a significant asset. This successful exit strategy underscores the potential for substantial returns in the private equity market, particularly within the dynamic airline industry. By carefully analyzing Onex's investment returns and strategic decision-making, other private equity firms can learn valuable lessons applicable to their own portfolios. To learn more about Onex Corporation's investment strategies and successful divestments, exploring their website and financial news articles dedicated to analyzing Onex's investment returns is recommended. Understanding how Onex successfully recouped its investment capital provides crucial insight into successful private equity investments.

Featured Posts

-

Colombia Otorga Asilo A Ricardo Martinelli Analisis De La Decision

May 12, 2025

Colombia Otorga Asilo A Ricardo Martinelli Analisis De La Decision

May 12, 2025 -

Manfred Anticipates Massive Crowd At Bristol Motor Speedway

May 12, 2025

Manfred Anticipates Massive Crowd At Bristol Motor Speedway

May 12, 2025 -

Manon Fiorot Her Pursuit Of The Ufc Championship

May 12, 2025

Manon Fiorot Her Pursuit Of The Ufc Championship

May 12, 2025 -

Uruguay The Next Big Location For Film Shoots

May 12, 2025

Uruguay The Next Big Location For Film Shoots

May 12, 2025 -

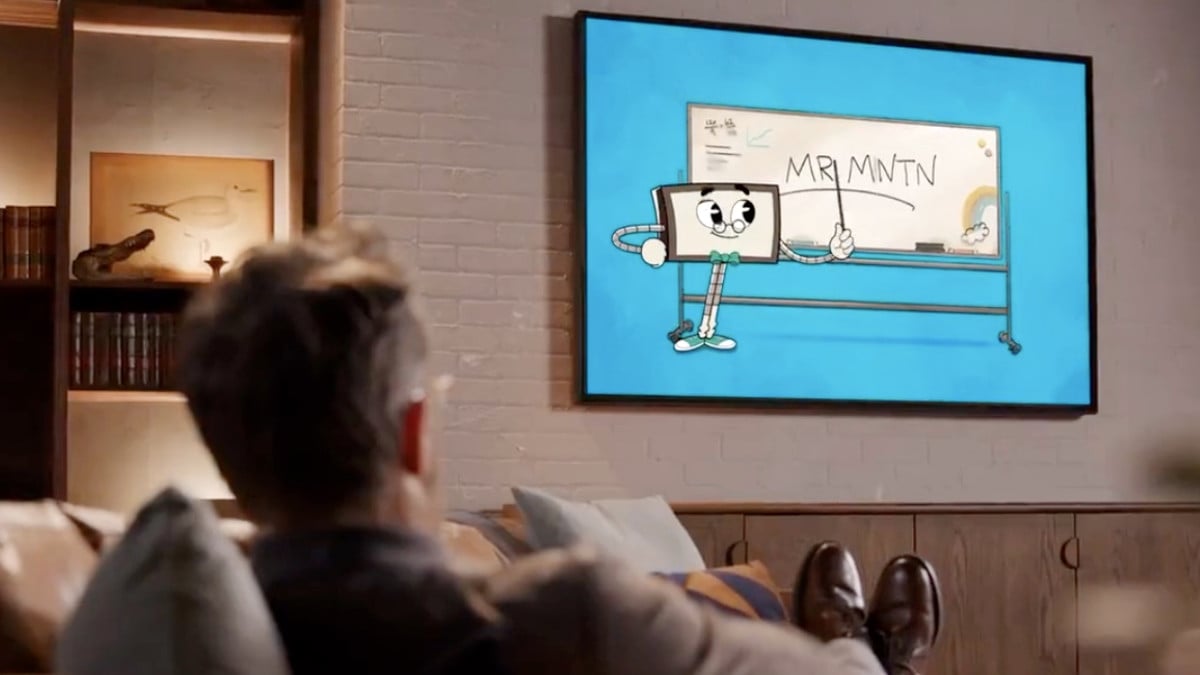

Mntn Ipo Ryan Reynolds Company Eyes Next Week Launch

May 12, 2025

Mntn Ipo Ryan Reynolds Company Eyes Next Week Launch

May 12, 2025