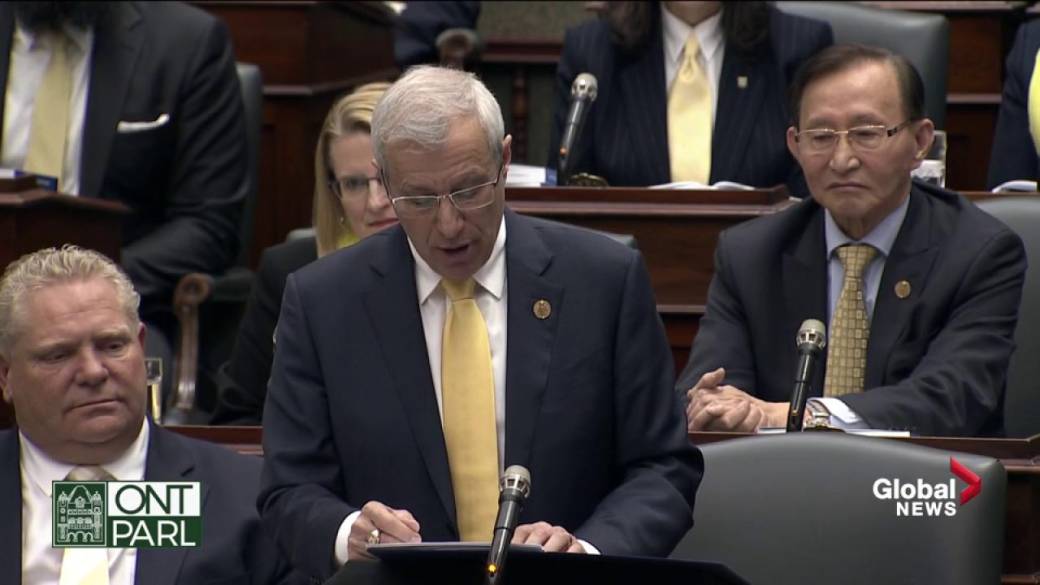

Ontario Government To Make Gas Tax Cut Permanent, Eliminate Highway 407 East Tolls?

Table of Contents

Permanent Gas Tax Cut in Ontario

A permanent reduction in the Ontario gas tax would have far-reaching consequences. Let's examine the economic impact and the challenges of long-term funding.

Economic Impact of a Permanent Reduction

Lowering gas prices directly impacts consumer spending. A permanent reduction could lead to increased disposable income, potentially boosting economic growth across various sectors. This could mean more money available for other purchases, stimulating businesses and creating a ripple effect throughout the Ontario economy.

- Reduced costs for commuters, businesses, and farmers: Lower fuel costs translate to savings for everyone who relies on vehicles for transportation and work.

- Increased disposable income: Consumers can allocate more money towards other goods and services, stimulating various sectors of the economy.

- Potential boost to the provincial economy: Increased consumer spending can lead to higher employment rates and overall economic growth.

However, the impact on inflation needs careful consideration. A sudden surge in consumer spending could lead to price increases in other areas, negating some of the benefits of lower gas prices. Moreover, the reduced gas tax revenue would create a significant hole in the provincial budget.

Funding Mechanisms and Sustainability

The government needs to identify sustainable funding mechanisms to offset the revenue loss from a permanent gas tax cut. Several options exist, but each has its own set of challenges and potential drawbacks.

- Increased taxes on other goods/services?: This could shift the tax burden to other sectors, potentially sparking public backlash.

- Changes to provincial spending?: Cutting back on other government programs could lead to criticism and potential service disruptions.

- Public-private partnerships?: These could offer alternative funding streams, but require careful negotiation and oversight.

Finding a sustainable funding model is crucial for the long-term success of a permanent gas tax cut.

Highway 407 East Toll Elimination

Eliminating tolls on the eastern extension of Highway 407 would be another significant change to Ontario's transportation infrastructure, with both advantages and disadvantages.

Financial Implications for the Province

The most immediate consequence is the significant loss of revenue for the provincial government. The Highway 407 tolls represent a substantial source of income, and eliminating them would necessitate finding alternative funding sources to avoid budget deficits.

- Revenue losses for the provincial government: This could necessitate cuts to other programs or an increase in other taxes.

- Potential for increased traffic congestion: Free access to the highway might lead to increased traffic volume, particularly during peak hours.

- Need for alternative funding mechanisms: The province needs to identify new revenue streams to offset the lost toll revenue.

Impact on Drivers and Commuters

For drivers using the Highway 407 East, toll elimination would mean substantial savings. However, increased traffic congestion is a likely consequence.

- Reduced commute times (potentially): For some drivers, the removal of tolls might lead to quicker commutes.

- Increased accessibility: More drivers might choose this route, potentially improving accessibility to certain areas.

- Potential for increased traffic congestion and pollution: Higher traffic volume could lead to longer commute times and increased greenhouse gas emissions.

Political Ramifications and Public Opinion

The proposals for a permanent gas tax cut and Highway 407 East toll elimination have significant political implications.

Public Response and Political Analysis

Public opinion is generally favorable towards lower gas prices and reduced tolls. However, the government needs to carefully manage the public's expectations and address concerns about potential negative consequences.

- Public support for lower gas prices: This is likely a popular policy among voters.

- Political considerations influencing the decision: The government might be balancing fiscal responsibility with electoral considerations.

- Potential electoral impact: The outcome of these policy decisions could significantly influence the upcoming provincial elections.

Conclusion

The Ontario government's consideration of a permanent gas tax cut and the elimination of Highway 407 East tolls represents a significant shift in transportation policy. While these measures could offer considerable benefits to drivers and the economy, careful consideration must be given to the long-term financial implications and potential unintended consequences. Understanding the complexities of these proposals—from their economic impact to their political ramifications—is crucial. Stay informed about the unfolding debate surrounding the Ontario gas tax and Highway 407 tolls to ensure your voice is heard as the government makes its final decision. Learn more and voice your opinion on this crucial change to Ontario transportation policy.

Featured Posts

-

Androids Modern Design Language A Comprehensive Guide

May 16, 2025

Androids Modern Design Language A Comprehensive Guide

May 16, 2025 -

Nba Prediction Hornets Vs Celtics Analysis And Betting Odds

May 16, 2025

Nba Prediction Hornets Vs Celtics Analysis And Betting Odds

May 16, 2025 -

Atlanta Braves Vs San Diego Padres Predicting The Winner

May 16, 2025

Atlanta Braves Vs San Diego Padres Predicting The Winner

May 16, 2025 -

Celtics Vs Cavaliers Predicting The Outcome Of The Crucial Matchup

May 16, 2025

Celtics Vs Cavaliers Predicting The Outcome Of The Crucial Matchup

May 16, 2025 -

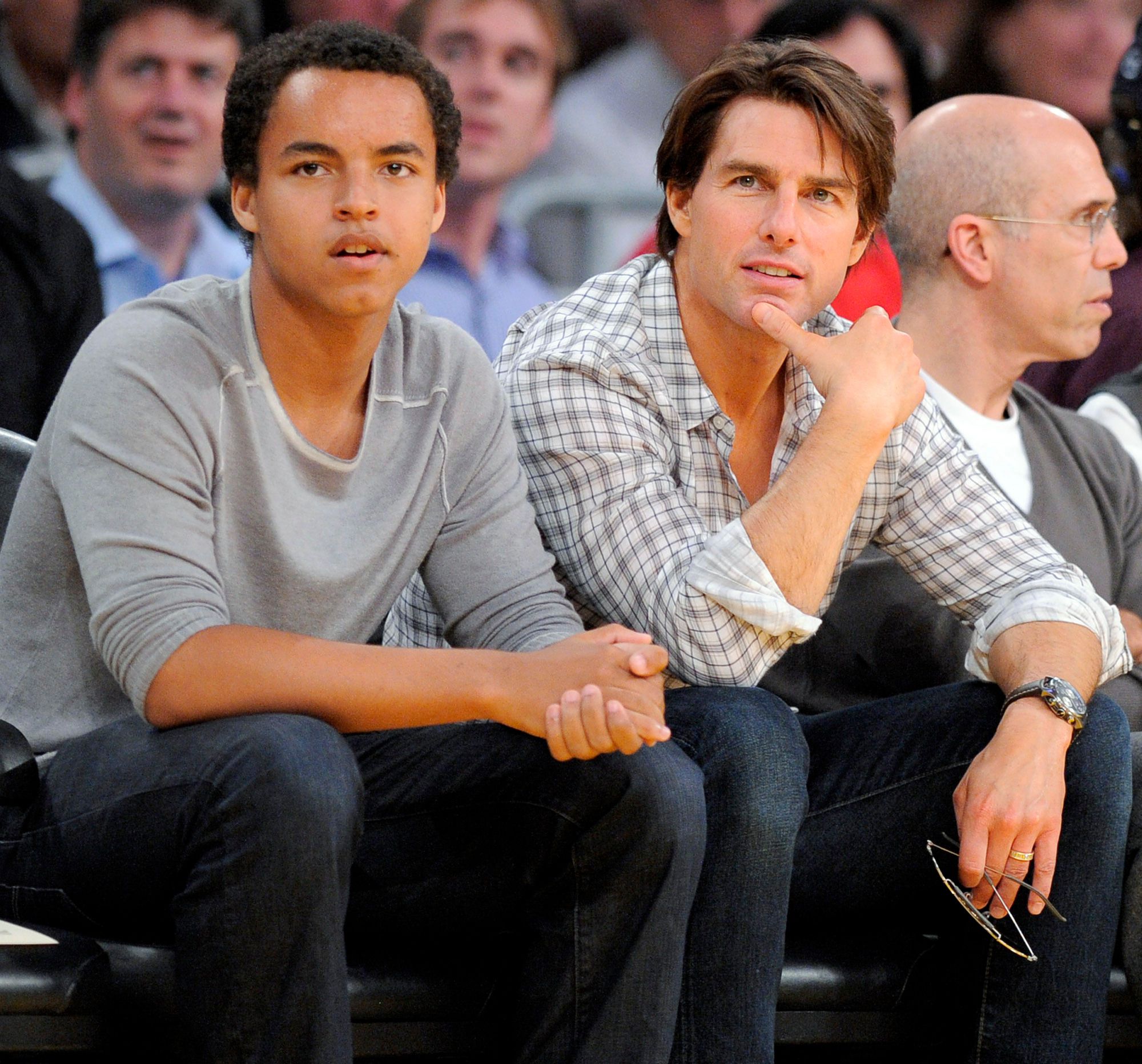

Tom Cruise And His Significant Others A Comprehensive Overview

May 16, 2025

Tom Cruise And His Significant Others A Comprehensive Overview

May 16, 2025