OPEC+ To Review Oil Production Quotas: Impact On Global Markets

Table of Contents

Current Global Oil Market Conditions

The global oil market is currently characterized by a complex interplay of supply and demand dynamics. Several factors contribute to the current state of flux. Demand remains robust, particularly in rapidly developing economies, but growth forecasts vary depending on global economic health. The International Energy Agency (IEA) and OPEC itself regularly publish forecasts, which can often differ significantly. Existing inventories are a key factor; high inventories might suggest reduced pressure for production increases, while low inventories might increase the likelihood of production cuts. Geopolitical tensions, particularly those involving major oil-producing and -consuming nations, significantly impact crude oil supply and contribute to price volatility. Sanctions against certain nations also play a critical role in the global supply chain.

- Analysis of current oil prices and price volatility: Oil prices have shown considerable volatility in recent months, influenced by factors like geopolitical instability, economic growth rates, and OPEC+ production decisions. This volatility creates uncertainty for businesses and consumers alike.

- Discussion of global oil demand forecasts: While global oil demand is expected to continue growing, the pace of growth is subject to debate. Economic slowdowns in major consuming nations like the US and China could significantly impact future demand.

- Assessment of existing oil inventories: Current levels of oil inventories in key storage hubs are a crucial indicator of market tightness or looseness. High inventories usually suggest less pressure for production increases, while low inventories signal a tighter market and potentially higher prices.

- Examination of the impact of sanctions and geopolitical instability on oil supply: Geopolitical events and sanctions against oil-producing nations can severely disrupt the global crude oil supply, leading to price spikes and market uncertainty. The ongoing war in Ukraine is a prime example of such disruption.

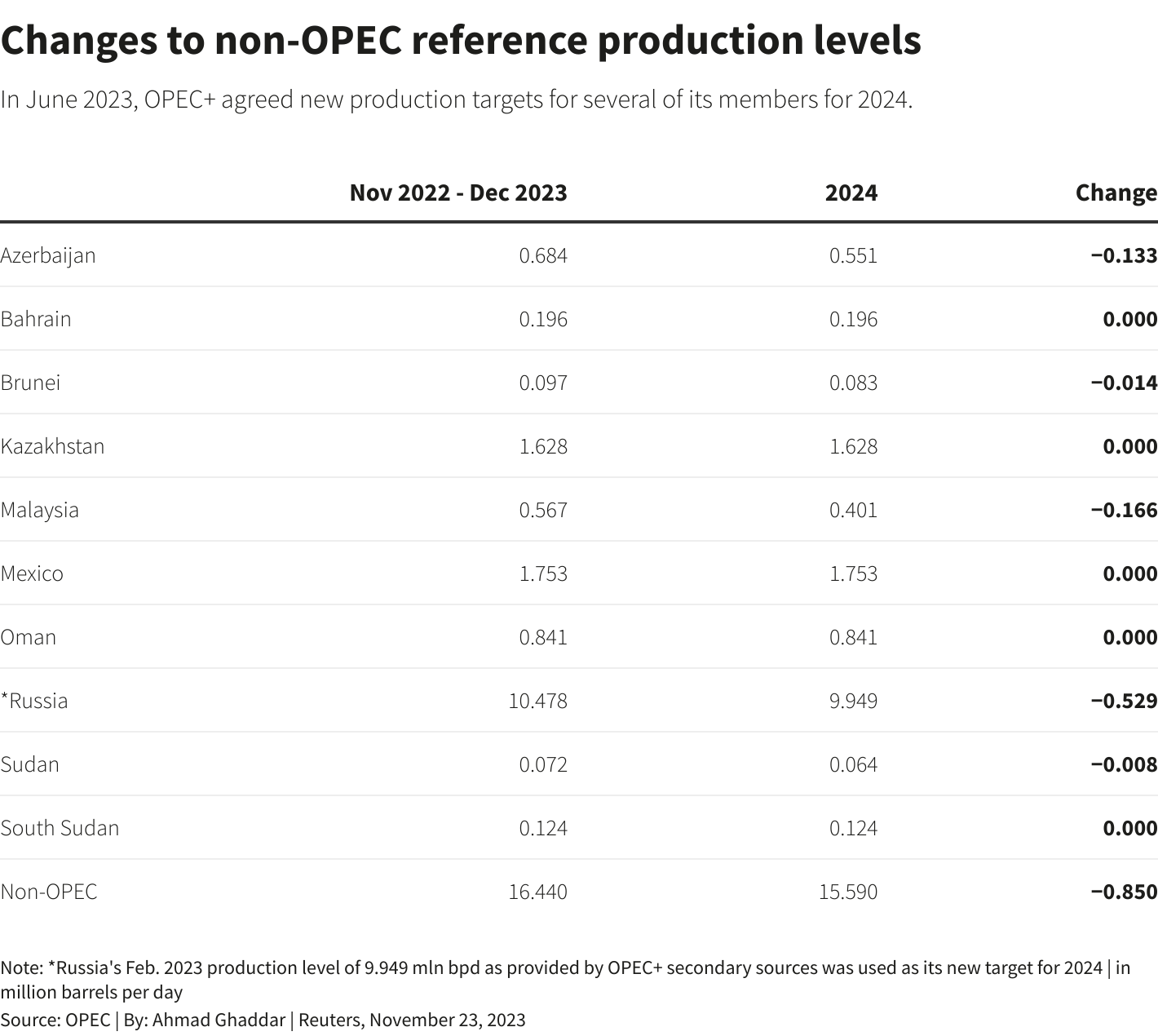

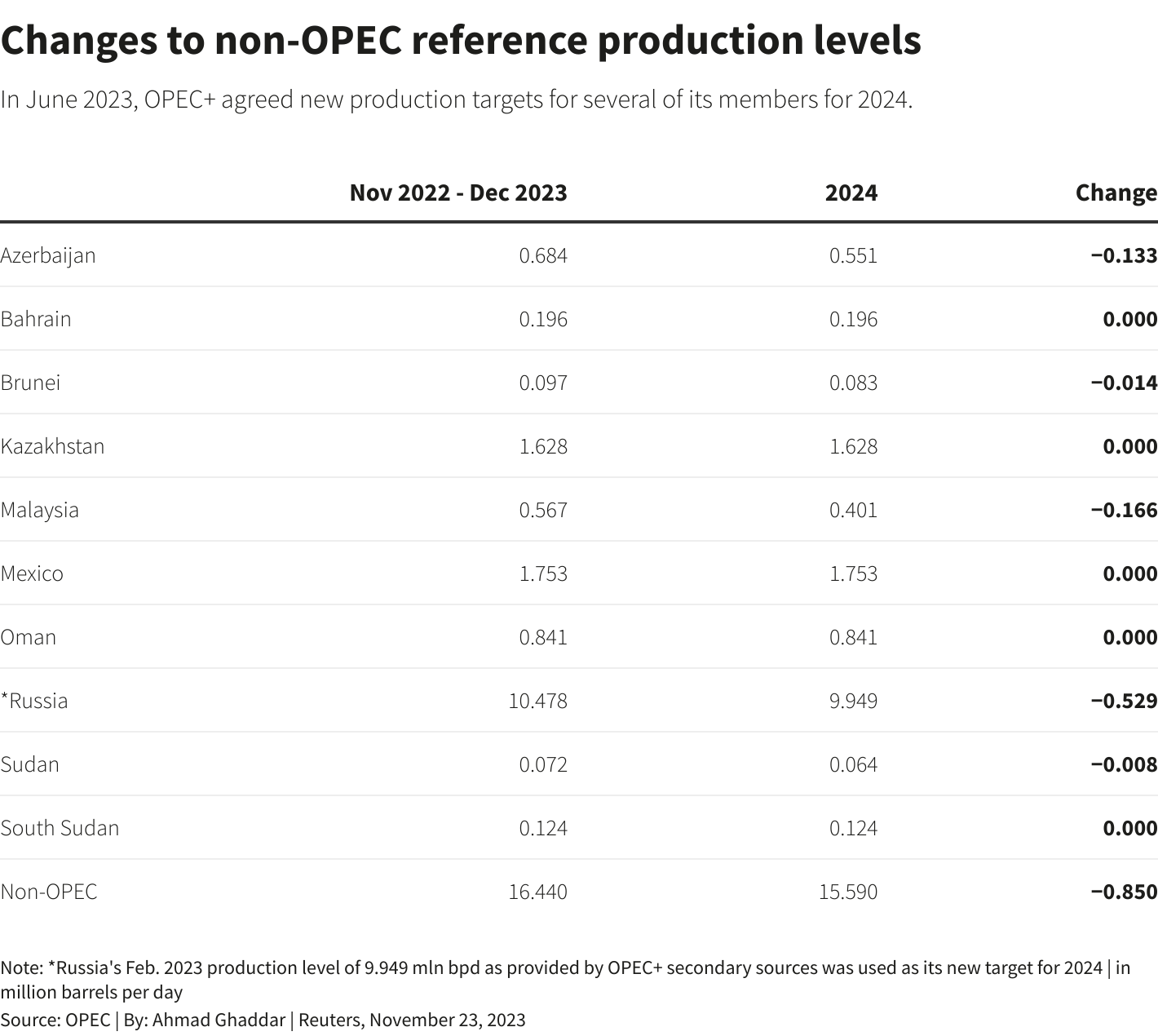

OPEC+ Production Cuts and Their Rationale

OPEC+ (the Organization of the Petroleum Exporting Countries plus other major oil-producing nations) has a history of influencing global oil prices through coordinated production cuts or increases. These decisions are driven by a complex interplay of factors, including the need to maintain price stability, economic pressures on member nations, and strategic geopolitical goals. Past production cuts have demonstrably influenced oil prices, sometimes leading to significant price increases. However, the effectiveness of such measures is often debated, particularly considering the impact on global inflation and economic growth. Internal disagreements amongst OPEC+ members about production levels are also common, highlighting the inherent challenges in coordinating global oil supply.

- Overview of past OPEC+ production decisions and their outcomes: Analyzing past OPEC+ decisions and their subsequent impacts on oil prices provides valuable insights into their influence on the market. Historical data demonstrates the considerable power OPEC+ wields in shaping global oil markets.

- Analysis of the economic incentives for different OPEC+ members: Each OPEC+ member has unique economic incentives and priorities. Understanding these differences is crucial to predicting their stances on production adjustments. Factors like domestic economic needs, budget deficits, and reliance on oil revenues play a key role.

- Discussion of the geopolitical considerations driving production decisions: Geopolitical rivalries and alliances significantly influence OPEC+ decisions. Strategic partnerships and geopolitical tensions can impact production levels and create market instability.

- Examination of differing opinions among OPEC+ members regarding production levels: Disagreements among OPEC+ members concerning production levels are common. These internal conflicts add complexity to the decision-making process and impact the reliability of market forecasts.

Potential Outcomes of the OPEC+ Review and Their Market Impact

The OPEC+ review could result in several scenarios: increased production, maintained production levels, or further cuts. Each scenario will have different implications for the global economy.

- Scenario 1: Increased production – impact on prices, inflation, and economic growth: Increased production would likely lead to lower oil prices, potentially easing inflationary pressures and boosting economic growth, particularly in oil-consuming nations.

- Scenario 2: Maintained production – impact on market stability and price volatility: Maintaining current production levels could stabilize oil prices in the short term, but the market would still remain vulnerable to external shocks and price volatility.

- Scenario 3: Further production cuts – impact on prices, inflation, and potential economic recession: Further production cuts would likely push oil prices higher, exacerbating inflationary pressures and potentially slowing down global economic growth or even leading to a recession in some regions.

- Examination of the potential impact on different market segments (e.g., gasoline prices, airline fuel costs): Changes in OPEC+ oil production quotas directly impact various sectors. The transportation industry (airlines, trucking), manufacturing, and consumers (gasoline prices) are among the most affected.

Impact on Specific Industries

The airline industry, heavily reliant on jet fuel, is particularly vulnerable to oil price fluctuations caused by changes in OPEC+ oil production quotas. Similarly, the transportation sector, including trucking and shipping, faces significant cost implications. Manufacturing industries, which rely on oil-derived products, will also experience adjustments in their input costs, impacting production and pricing strategies.

Conclusion

The OPEC+ decision on oil production quotas will have a significant impact on global oil markets and the broader global economy. The uncertainty surrounding the outcome underscores the need for continuous monitoring of the situation. The potential for increased prices, heightened inflation, or even recessionary pressures necessitates a cautious outlook.

Call to Action: Stay informed about upcoming OPEC+ announcements and analyze the impact of their oil production quota decisions on global markets. Understanding the intricacies of OPEC+ oil production quotas and their influence on global energy markets is crucial for informed decision-making. Monitor the situation closely and conduct thorough research to fully grasp the implications of their actions.

Featured Posts

-

Radares Fijos Moviles Y De Tramo En Zaragoza Informacion 2025

May 29, 2025

Radares Fijos Moviles Y De Tramo En Zaragoza Informacion 2025

May 29, 2025 -

Antisipasi Curah Hujan Tinggi Prakiraan Cuaca Jawa Barat 26 Maret

May 29, 2025

Antisipasi Curah Hujan Tinggi Prakiraan Cuaca Jawa Barat 26 Maret

May 29, 2025 -

Jest Decyzja Ws Dywidendy Pcc Rokita Co To Oznacza Dla Akcjonariuszy

May 29, 2025

Jest Decyzja Ws Dywidendy Pcc Rokita Co To Oznacza Dla Akcjonariuszy

May 29, 2025 -

Space X Starship Launch Faa Advises Aircraft To Stay Clear

May 29, 2025

Space X Starship Launch Faa Advises Aircraft To Stay Clear

May 29, 2025 -

Analyzing Live Nation Entertainment Lyv Options For Smart Investors

May 29, 2025

Analyzing Live Nation Entertainment Lyv Options For Smart Investors

May 29, 2025