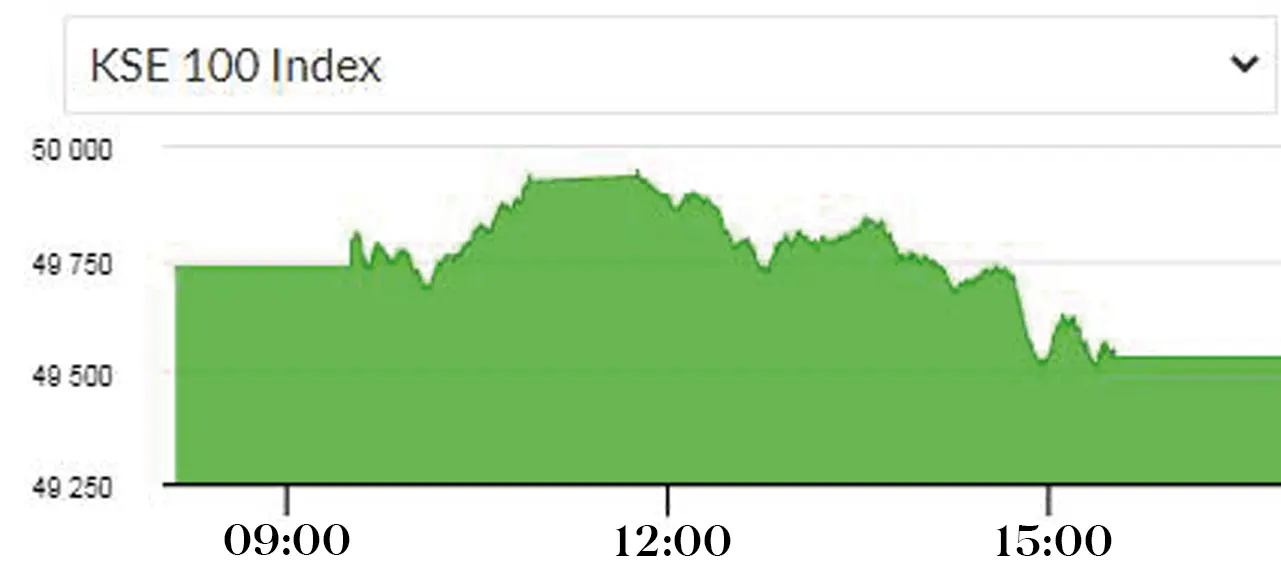

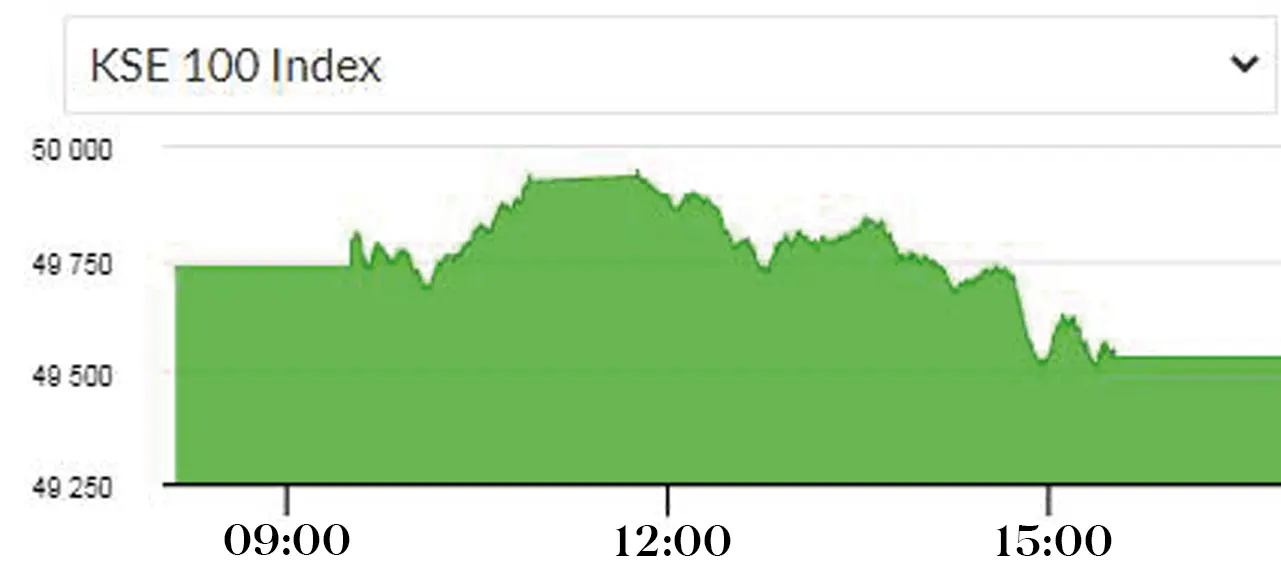

Pakistani Market Instability Causes Stock Exchange Portal Outage

Table of Contents

The Root Causes of the Pakistani Stock Exchange Outage

The outage wasn't an isolated incident; it was a culmination of several interconnected factors stemming from the current instability in the Pakistani market.

Market Volatility and High Trading Volume

Recent economic uncertainty has led to a surge in trading activity, putting immense strain on the stock exchange's systems. Investors, anxious about inflation, currency fluctuations, and political instability, are rapidly buying and selling, overwhelming the existing infrastructure.

- Inflation: Soaring inflation rates erode purchasing power and create uncertainty, driving increased trading volume.

- Currency Fluctuations: The volatile Pakistani Rupee against major currencies increases market unpredictability, prompting reactive trading.

- Political Instability: Political uncertainty often translates into economic uncertainty, further fueling market volatility and increased trading activity.

While precise data on the trading volume increase during the period leading up to the outage may not be publicly available immediately following the event, anecdotal evidence from market analysts and news reports points to a significant surge in activity. This heightened trading pressure exposed the limitations of the existing infrastructure.

Technical Infrastructure Limitations

The Pakistani stock exchange's infrastructure, in terms of its age and capacity, is demonstrably inadequate to handle the increased demands of a volatile market. Several key limitations played a role in the outage:

- Server Capacity: Insufficient server capacity to handle the peak trading volumes resulted in system overload and eventual failure.

- Bandwidth Limitations: Limited bandwidth hindered the smooth flow of data, leading to delays and ultimately, the outage.

- Outdated Technology: A lack of investment in upgrading the core technological infrastructure has left the system vulnerable to failure under pressure.

The failure to proactively invest in modernizing the technology exposed the Pakistani stock exchange's vulnerability to even moderate increases in trading volume.

Cybersecurity Threats and Potential Attacks

While the primary cause appears to be infrastructural limitations, the possibility of a cyberattack, such as a Distributed Denial of Service (DDoS) attack, cannot be entirely ruled out. The investigation into the outage needs to thoroughly examine this aspect.

- DDoS Attacks: These attacks flood servers with traffic, rendering them unavailable to legitimate users.

- Robust Cybersecurity: The lack of robust cybersecurity measures could have made the system more vulnerable to such attacks.

- Proactive Security: The absence of proactive security audits and well-defined incident response plans left the exchange unprepared to manage a crisis.

Impact of the Pakistani Stock Exchange Outage on Investors and the Economy

The outage had far-reaching consequences for investors and the overall economy.

Financial Losses and Investor Confidence

The inability to trade during the outage resulted in potential financial losses for many investors. Missed opportunities and forced holding of assets at unfavorable prices are significant concerns.

- Missed Opportunities: Investors may have lost out on profitable trades due to the unavailability of the platform.

- Eroded Confidence: The outage severely eroded investor confidence in the market's stability and reliability.

- Foreign Investment Impact: The incident could deter foreign investment, crucial for Pakistan's economic growth.

Reputational Damage to the Pakistani Stock Exchange

The outage caused significant reputational damage to the Pakistani Stock Exchange, both domestically and internationally.

- Domestic Perception: The event undermined public trust in the reliability of the national stock exchange.

- International Implications: The outage negatively impacted Pakistan's image as a stable and reliable investment destination.

- Transparency and Accountability: A lack of transparency in handling the situation further exacerbated the damage.

Solutions and Future Preparedness for the Pakistani Stock Exchange

Preventing future Pakistani Stock Exchange outages requires a multi-pronged approach focusing on infrastructure upgrades, enhanced cybersecurity, and improved regulatory oversight.

Investing in Modern Infrastructure

Significant investment is needed to modernize the exchange's infrastructure:

- Upgrading Systems: This includes boosting server capacity, increasing bandwidth, and adopting more resilient hardware.

- Cloud Solutions: Migrating to cloud-based solutions offers greater scalability and resilience.

- Regular Maintenance: Implementing a robust maintenance schedule is essential to prevent system failures.

Strengthening Cybersecurity Measures

Implementing robust cybersecurity protocols is paramount:

- Advanced Security Protocols: Adopting advanced security protocols and intrusion detection systems is crucial.

- Regular Security Audits: Conducting regular security audits and penetration testing can identify vulnerabilities.

- Staff Training: Investing in cybersecurity training for staff is vital for preventing and mitigating cyber threats.

Regulatory Oversight and Transparency

Stronger regulatory oversight and transparent communication are essential:

- Regulatory Role: Regulatory bodies must play a proactive role in ensuring the stability and security of the exchange.

- Transparency in Reporting: Greater transparency in reporting incidents and preventative measures will build trust.

- Investor Communication: Improved communication with investors during and after outages is crucial.

Conclusion

The Pakistani stock exchange outage underscores the critical need for improved infrastructure, robust cybersecurity, and transparent regulatory oversight. The instability within the Pakistani market amplified the impact of this outage, highlighting the interconnectedness of economic factors and technological vulnerabilities. Addressing the vulnerabilities exposed by this Pakistani Stock Exchange Outage is crucial for restoring investor confidence and ensuring the long-term stability and growth of the Pakistani economy. Investing in modern infrastructure and enhancing cybersecurity measures are paramount to preventing future outages and protecting the financial interests of all stakeholders. We need a stronger and more resilient Pakistani stock exchange.

Featured Posts

-

The Jeffrey Epstein Files Release Weighing The Impact Of Attorney General Bondis Decision

May 09, 2025

The Jeffrey Epstein Files Release Weighing The Impact Of Attorney General Bondis Decision

May 09, 2025 -

I Control You Analyzing Jack Doohan And Briatores Drive To Survive Scene

May 09, 2025

I Control You Analyzing Jack Doohan And Briatores Drive To Survive Scene

May 09, 2025 -

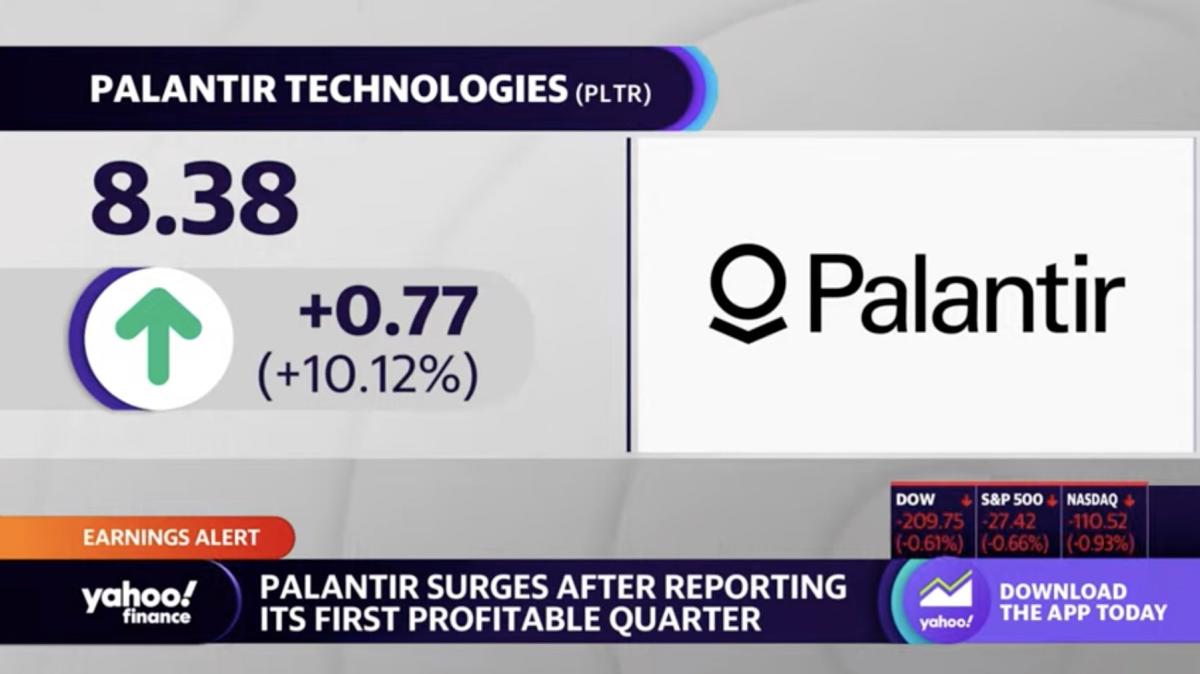

Is Palantir Stock A Buy Right Now A Comprehensive Analysis

May 09, 2025

Is Palantir Stock A Buy Right Now A Comprehensive Analysis

May 09, 2025 -

Ukraine War Putin Announces Ceasefire For Victory Day

May 09, 2025

Ukraine War Putin Announces Ceasefire For Victory Day

May 09, 2025 -

Uy Scuti Album Young Thug Drops Release Date Clue

May 09, 2025

Uy Scuti Album Young Thug Drops Release Date Clue

May 09, 2025

Latest Posts

-

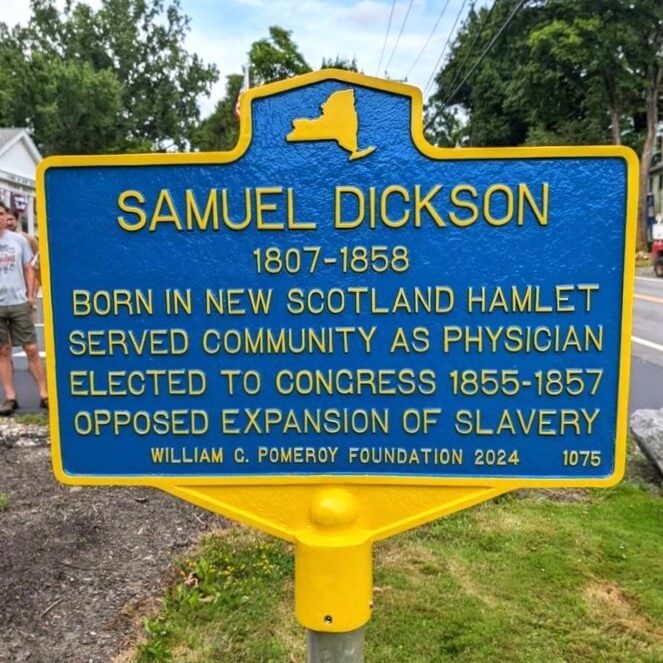

Exploring The Business Acumen Of Samuel Dickson A Canadian Lumber Industry Pioneer

May 09, 2025

Exploring The Business Acumen Of Samuel Dickson A Canadian Lumber Industry Pioneer

May 09, 2025 -

A Fast Flying Farce At St Albert Dinner Theatre Review And Details

May 09, 2025

A Fast Flying Farce At St Albert Dinner Theatre Review And Details

May 09, 2025 -

Olly Murs Massive Music Festival At Historic Castle Near Manchester

May 09, 2025

Olly Murs Massive Music Festival At Historic Castle Near Manchester

May 09, 2025 -

Ghettoisation Concerns Rise As Caravans Flood Uk City

May 09, 2025

Ghettoisation Concerns Rise As Caravans Flood Uk City

May 09, 2025 -

The Life And Times Of Samuel Dickson A Canadian Industrialist

May 09, 2025

The Life And Times Of Samuel Dickson A Canadian Industrialist

May 09, 2025