Palantir Stock: 40% Upside By 2025? Analyzing The Investment Opportunity

Table of Contents

Palantir's Financial Performance and Growth Projections

Analyzing Palantir's financial health is crucial to assessing the viability of a 40% increase in Palantir stock value. Recent financial reports reveal a company experiencing substantial growth, though profitability remains a key area of focus. Examining key performance indicators (KPIs) provides a clearer picture.

- Revenue growth rate (YoY): Consistent year-over-year revenue growth demonstrates Palantir's ability to attract and retain clients in a competitive market. Analyzing this trend is vital in predicting future performance. A consistent upward trajectory suggests a healthy trajectory for Palantir stock.

- Profit margin expansion: Improving profit margins indicate increased efficiency and pricing power. Tracking this metric is crucial for determining Palantir's long-term financial sustainability. Strong margin expansion directly impacts Palantir stock valuation.

- Free cash flow generation: Positive and growing free cash flow demonstrates Palantir's ability to generate cash after covering operating expenses and capital expenditures. This is a critical indicator of a company's financial strength, offering insights into the potential for future dividends or share buybacks, all beneficial to Palantir stock.

- Debt levels: Maintaining manageable debt levels is essential for long-term financial health. High debt can constrain a company's flexibility and increase risk, impacting Palantir stock's stability.

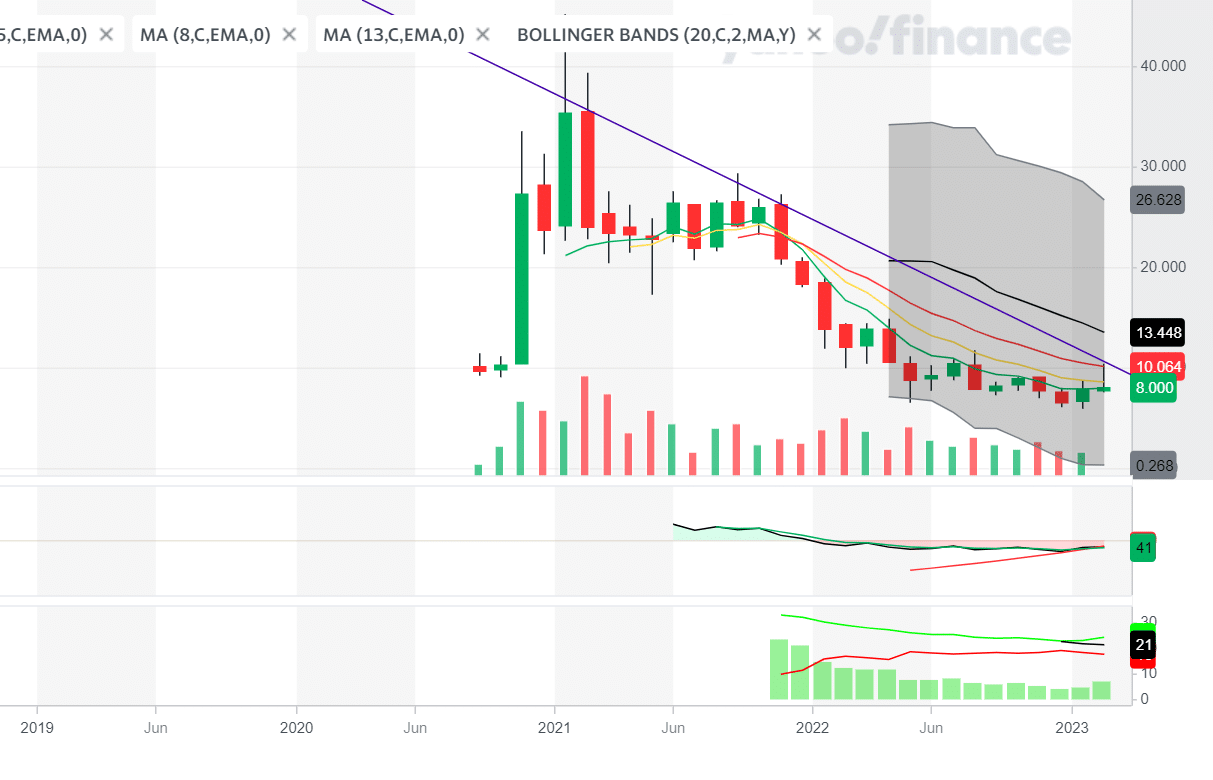

[Insert chart here showing Palantir's revenue growth, profit margin, free cash flow, and debt levels over time. Alt text: "Chart depicting Palantir's key financial metrics from [Start Date] to [End Date], showcasing revenue growth, profit margin expansion, free cash flow generation, and debt levels."]

Analyst forecasts for Palantir's future revenue and earnings vary, but generally reflect optimistic growth projections, further bolstering the case for Palantir stock’s potential.

Market Opportunity and Competitive Landscape

The big data analytics market is booming, presenting a significant growth opportunity for Palantir. Palantir's proprietary technology and strong customer relationships give it a competitive edge. However, understanding the competitive landscape is vital. Key competitors include companies like Microsoft, Amazon Web Services (AWS), Google Cloud Platform (GCP), and Databricks.

- Market size and growth projections: The global big data analytics market is projected to expand significantly in the coming years, creating a vast addressable market for Palantir's solutions. This market growth is a major driver of the potential upside in Palantir stock.

- Palantir's market share and competitive position: While Palantir holds a significant market share in specific niches, particularly government contracts, competition from established tech giants remains intense.

- Key differentiators compared to competitors: Palantir's focus on complex data integration and its strong relationships with government and enterprise clients provide crucial differentiators. These are significant factors in valuing Palantir stock.

- Potential for market disruption: Palantir's continued innovation and expansion into new markets could lead to significant market disruption, impacting the valuation of Palantir stock positively.

Key Risks and Challenges

Investing in Palantir stock carries inherent risks. The company's dependence on government contracts makes it vulnerable to changes in government spending and policy. Geopolitical risks also pose a threat. Furthermore, competition from established tech players is relentless.

- Government contract risk: A significant portion of Palantir's revenue comes from government contracts, making it sensitive to changes in government priorities and budgets. This is a crucial risk factor when assessing Palantir stock.

- Competition from established players: The big data analytics market is crowded, with major tech companies fiercely competing for market share. Competition is a key risk factor when examining Palantir stock's potential.

- Economic sensitivity: As a technology company, Palantir's business is sensitive to economic downturns, potentially impacting demand and investor sentiment concerning Palantir stock.

- Regulatory hurdles: Navigating the complex regulatory landscape is a challenge for Palantir, and potential regulatory changes could negatively impact Palantir stock.

Valuation and Potential Upside

Analyzing Palantir's current valuation using metrics like the price-to-sales ratio (P/S) and price-to-earnings ratio (P/E) is essential. Comparing its valuation to its peers helps determine if Palantir stock is fairly valued or potentially undervalued.

- Current valuation metrics: Palantir's current valuation should be compared to its historical valuations and to those of its peers.

- Peer comparison: A comparative analysis against competitors helps determine if Palantir stock is priced fairly relative to its growth prospects and risk profile.

- Upside potential scenarios: Considering various scenarios – optimistic, neutral, and pessimistic – helps assess the potential for a 40% upside in Palantir stock by 2025.

- Sensitivity analysis: A sensitivity analysis helps understand the impact of changes in key assumptions on the overall valuation of Palantir stock.

Conclusion: Is Palantir Stock a Smart Investment?

Our analysis suggests that Palantir stock holds significant potential for growth, driven by the expanding big data analytics market and Palantir's strong competitive position. However, the risks associated with government contract dependence, competition, and economic sensitivity must be carefully considered. The potential for a 40% upside by 2025 is plausible under optimistic scenarios, but this is not guaranteed. Therefore, while Palantir stock presents an interesting investment opportunity, it's crucial to understand the risks involved. Do your own due diligence before investing in Palantir stock, and consider if this potential investment aligns with your risk tolerance. Remember, investing in Palantir stock, like any investment, involves risk.

Featured Posts

-

Trumps 10 Tariff Threat Baseline Unless Exceptional Offer Received

May 10, 2025

Trumps 10 Tariff Threat Baseline Unless Exceptional Offer Received

May 10, 2025 -

Upcoming France Poland Treaty Strengthening Bilateral Ties

May 10, 2025

Upcoming France Poland Treaty Strengthening Bilateral Ties

May 10, 2025 -

Putins Ceasefire Declaration Will It Hold

May 10, 2025

Putins Ceasefire Declaration Will It Hold

May 10, 2025 -

Palantir Stock A Pre May 5th Investment Strategy

May 10, 2025

Palantir Stock A Pre May 5th Investment Strategy

May 10, 2025 -

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Landscape Of Gambling

May 10, 2025

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Landscape Of Gambling

May 10, 2025