Palantir Stock Before May 5th: A Prudent Investment?

Table of Contents

Palantir's Recent Financial Performance and Growth Trajectory

Analyzing Palantir's recent financial performance is crucial to assessing its investment potential before May 5th. We need to look beyond headline numbers and delve into the details of their Q4 2022 and subsequent earnings reports. Key indicators like revenue growth, profitability, and customer acquisition rates paint a clearer picture of the company's health and future prospects.

-

Specific revenue figures and year-over-year growth percentages: Palantir's revenue growth needs careful examination. While the company has shown growth, the rate of that growth and its sustainability are key questions for potential investors considering Palantir stock. Analyzing year-over-year comparisons reveals trends in revenue generation and market penetration.

-

Analysis of operating margins and profitability trends: Examining operating margins helps determine Palantir's efficiency and ability to translate revenue into profit. Trends in operating margins highlight the company's ability to manage costs and improve profitability over time. A shrinking margin might signal concerns about increasing expenses outpacing revenue growth.

-

Discussion of customer acquisition and retention rates: Palantir's ability to attract and retain customers is critical for long-term growth. High customer churn could indicate issues with product-market fit or customer satisfaction, negatively impacting the Palantir stock performance. Conversely, strong customer retention suggests a robust business model.

-

Mention any significant contracts or partnerships secured: Large contracts, particularly with government agencies and significant private sector clients, can significantly boost Palantir's revenue and provide a positive outlook for Palantir stock. Analyzing these partnerships sheds light on the company's strategic direction and its ability to secure high-value deals. These are important factors to consider when evaluating Palantir's future growth trajectory and the potential for Palantir stock to increase in value.

Market Sentiment and Analyst Predictions for Palantir Stock

Understanding the overall market sentiment towards Palantir and the technology sector is vital for a comprehensive investment analysis before May 5th. This involves analyzing both general market trends and specific opinions on Palantir stock. Analyst ratings and price targets offer valuable insights into the expectations of market professionals.

-

Mention specific analyst firms and their recommendations (buy, hold, sell): Examining recommendations from reputable analyst firms, such as Goldman Sachs, Morgan Stanley, or others, provides valuable perspective on Palantir stock. A consensus of buy ratings could suggest a positive outlook, whereas a predominance of sell ratings may warrant caution.

-

Include a range of price targets and their justifications: Analyst price targets provide a range of potential future prices for Palantir stock. Understanding the underlying justifications for these price targets, which consider factors like revenue growth and market conditions, helps to determine the validity of these projections.

-

Analyze the consensus view and any divergence of opinions: While consensus is helpful, it's equally important to identify divergences in analyst opinions. Understanding the reasons behind differing viewpoints allows for a more nuanced analysis and a better understanding of the risks involved in investing in Palantir stock.

Risks and Potential Downsides of Investing in Palantir Before May 5th

While Palantir presents opportunities, it's crucial to acknowledge the inherent risks before investing. A realistic assessment of potential downsides is essential for a prudent investment decision before May 5th.

-

Competition from other data analytics companies: Palantir faces stiff competition from established players and emerging startups in the data analytics market. This competition could put pressure on pricing and margins, impacting Palantir's profitability and affecting the price of Palantir stock.

-

Dependence on government contracts and potential budget cuts: A significant portion of Palantir's revenue comes from government contracts. Potential budget cuts or changes in government priorities could negatively impact the company's financial performance.

-

Valuation concerns and potential market corrections: Palantir's valuation has been a subject of debate. A market correction or a reassessment of the company's valuation could lead to a decline in Palantir's stock price.

-

Geopolitical risks and their potential impact: Geopolitical instability and international tensions can significantly impact technology companies like Palantir, particularly those involved in government contracts and data analytics.

Considering the Macroeconomic Environment

The broader macroeconomic environment plays a significant role in influencing investor sentiment and market valuations. Factors such as interest rates, inflation, and recessionary fears can all impact the price of Palantir stock.

-

Explain how macroeconomic factors could affect investor sentiment towards tech stocks: Rising interest rates, for instance, often lead to decreased investment in growth stocks, potentially impacting Palantir's stock price.

-

Assess the potential impact of these factors on Palantir's growth prospects: A recessionary environment could reduce government spending and private sector investment, directly affecting Palantir's revenue and growth potential.

Conclusion

Whether Palantir stock is a prudent investment before May 5th depends on a careful analysis of its recent financial performance, market sentiment, and potential risks. While Palantir shows growth and has secured notable contracts, the company faces competition and is vulnerable to macroeconomic fluctuations. Understanding these factors is crucial before investing.

Call to Action: Ultimately, whether Palantir stock represents a prudent investment before May 5th depends on your individual risk tolerance and investment goals. Conduct thorough due diligence and consider consulting with a financial advisor before making any investment decisions regarding Palantir stock. Remember to carefully evaluate your own risk tolerance before investing in Palantir stock.

Featured Posts

-

Analysis Trumps Possible Tariffs On Aircraft And Engine Imports

May 10, 2025

Analysis Trumps Possible Tariffs On Aircraft And Engine Imports

May 10, 2025 -

Recent Nnpc Petrol Price Changes The Dangote Factor Thisdaylive

May 10, 2025

Recent Nnpc Petrol Price Changes The Dangote Factor Thisdaylive

May 10, 2025 -

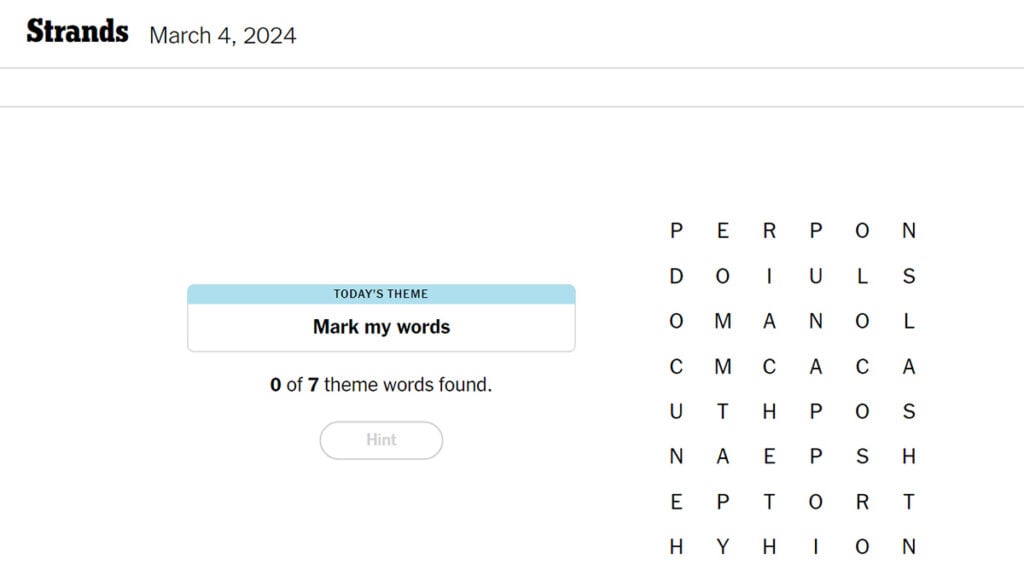

Solve The Nyt Strands April 9 2025 Puzzle With Our Comprehensive Guide

May 10, 2025

Solve The Nyt Strands April 9 2025 Puzzle With Our Comprehensive Guide

May 10, 2025 -

The Snl Impression That Left Harry Styles Dejected

May 10, 2025

The Snl Impression That Left Harry Styles Dejected

May 10, 2025 -

Jeffrey Epstein Files Release Should We Vote On Ag Pam Bondis Decision

May 10, 2025

Jeffrey Epstein Files Release Should We Vote On Ag Pam Bondis Decision

May 10, 2025