Palantir Stock: Buy Before May 5th Earnings Report? A Detailed Look

Table of Contents

Analyzing Palantir's Recent Performance and Financial Trends

Palantir Technologies (PLTR) has carved a significant niche in the big data analytics market, providing powerful software solutions to government agencies and commercial enterprises. Understanding its recent performance is crucial to evaluating a potential Palantir investment before the May 5th earnings report.

Revenue Growth and Key Performance Indicators (KPIs)

Palantir's revenue growth has been a key focus for investors. Analyzing key performance indicators (KPIs) provides a clearer picture of the company's financial health.

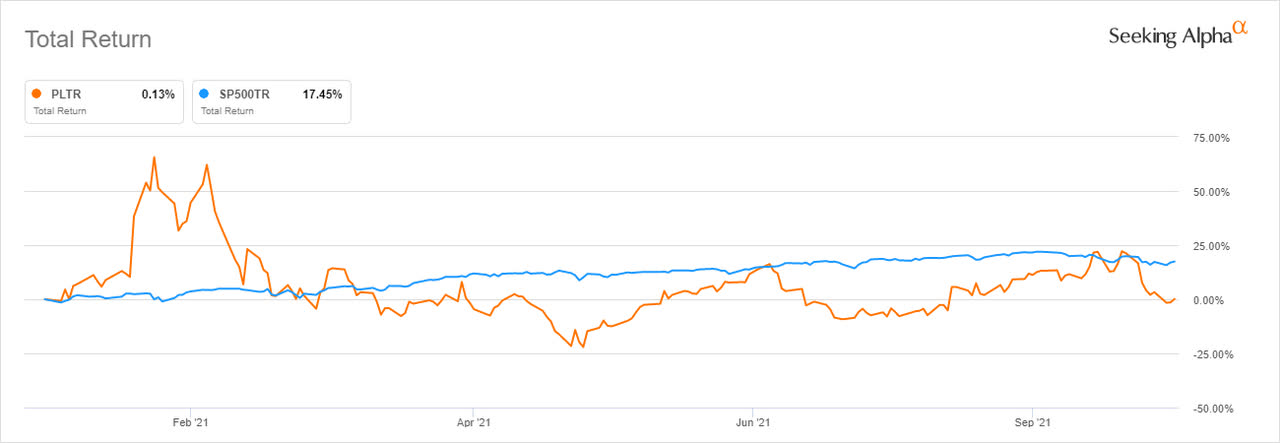

- Q4 2023 exceeded expectations: Palantir's strong finish to 2023 demonstrated resilience in a challenging economic climate. This positive momentum could influence the May 5th earnings report.

- Strong growth in government contracts: Government contracts represent a significant portion of Palantir's revenue. Continued success in this sector is vital for sustained growth.

- Increased adoption of Palantir's Foundry platform: The Foundry platform, Palantir's flagship data integration and analytics platform, is a key driver of revenue. Increased adoption signals strong market demand and potential for future growth.

- Profitability improvement: While Palantir hasn't been consistently profitable, improvements in this area are crucial for long-term investor confidence and could influence the stock price after the May 5th announcement.

Competition and Market Position

Palantir faces stiff competition from established tech giants and emerging data analytics companies. Understanding its competitive landscape is essential for assessing its investment potential.

- Strong government relationships: Palantir's deep ties with government agencies provide a significant competitive advantage, particularly in the defense and intelligence sectors.

- Innovative data analytics platform: Palantir's proprietary technology and its ability to integrate and analyze vast datasets are key differentiators.

- Competition from established tech giants: Companies like Microsoft, Amazon, and Google offer competing data analytics solutions, creating a challenging competitive environment. This competition needs to be considered when evaluating Palantir stock before May 5th.

Assessing the Potential Impact of the May 5th Earnings Report

The May 5th earnings report will be a pivotal moment for Palantir stock. Analyzing expectations and historical trends can help investors gauge the potential impact.

Expectations and Analyst Predictions

Analysts have varying expectations for Palantir's Q1 2024 earnings report. Understanding the range of predictions can help manage expectations.

- Consensus estimate for revenue growth: The general consensus among analysts points to a particular range of revenue growth for Q1 2024. Be aware that these are just estimates.

- Projected earnings per share (EPS): Projected EPS figures offer insight into profitability and will heavily influence investor sentiment after the May 5th report.

- Potential surprises or risks: Unforeseen events, such as unexpected contract wins or delays, could significantly impact the results and the subsequent stock price movement.

Historical Earnings Report Trends

Analyzing Palantir's past earnings reports reveals patterns that can inform future expectations.

- Consistent revenue growth over the past few quarters: Consistent growth suggests a healthy trajectory, but it's crucial to consider the rate of growth and its sustainability.

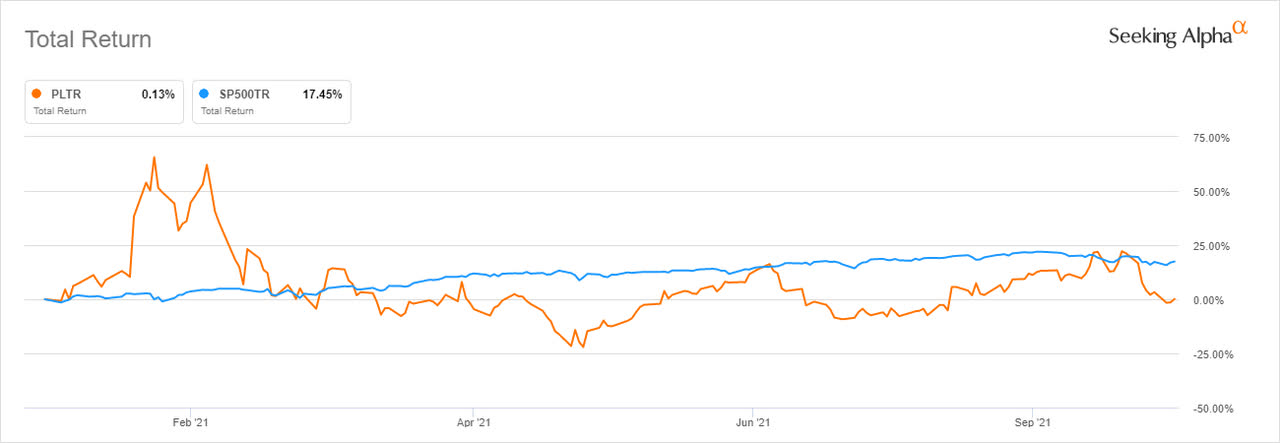

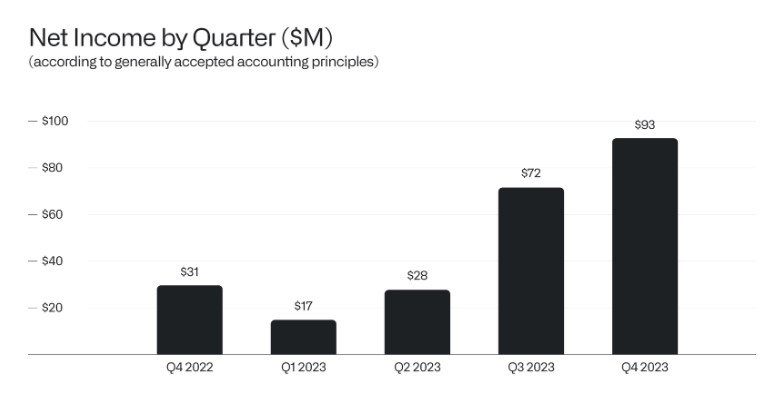

- Historical volatility following earnings releases: Palantir stock has historically shown significant price fluctuations following earnings announcements. This volatility is a key risk factor to consider.

- Impact of past earnings announcements on stock price: Examining how the stock price reacted to previous earnings reports provides valuable insights into potential market responses to the May 5th announcement.

Risk Factors and Investment Considerations

Investing in Palantir stock, before or after May 5th, involves inherent risks. A thorough assessment is crucial for responsible investment decisions.

Market Volatility and Geopolitical Risks

External factors can significantly impact Palantir's stock price.

- Overall market downturn: A broader market downturn could negatively affect Palantir's stock price, regardless of its financial performance.

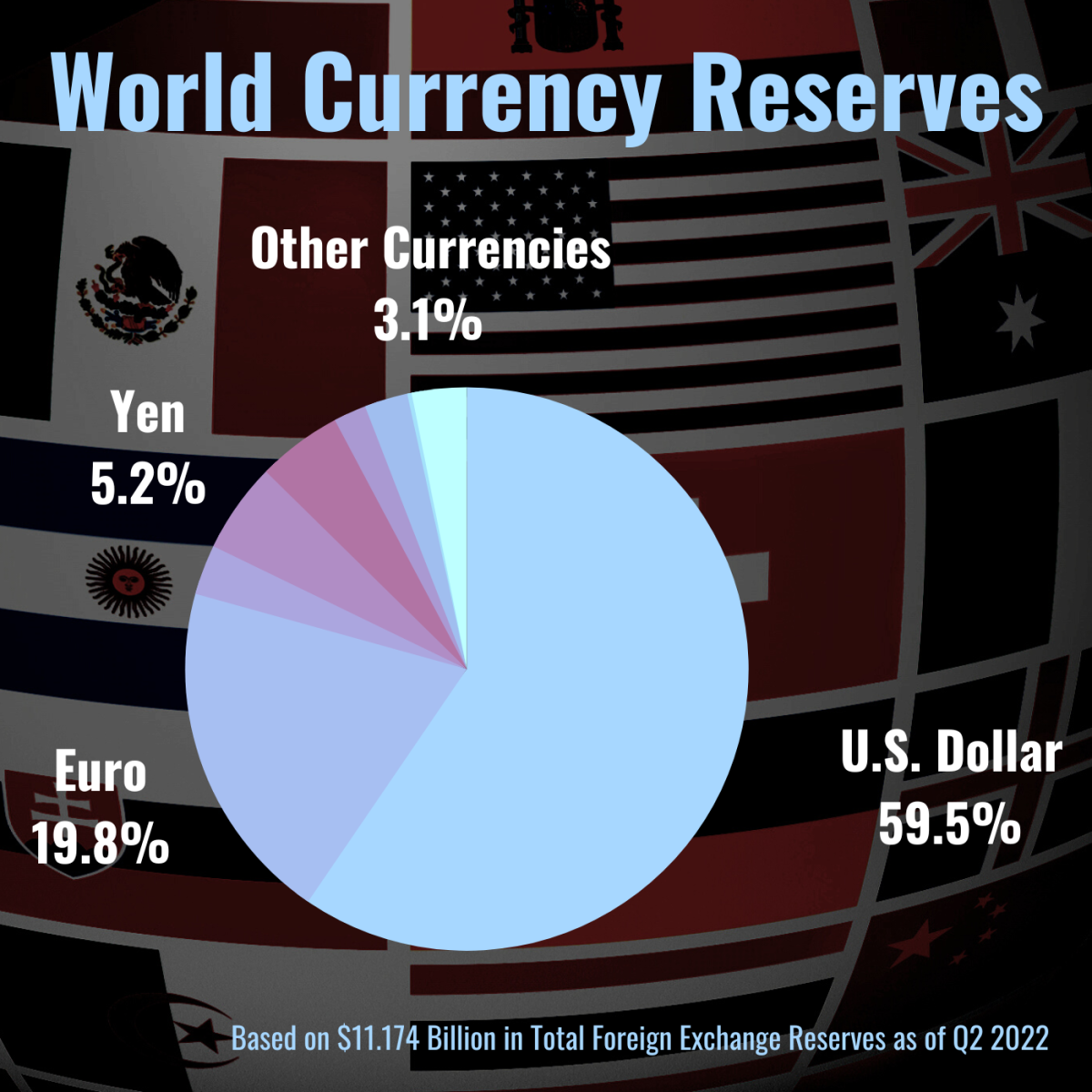

- Changes in government spending: Changes in government priorities or budget cuts could impact Palantir's government contracts, a substantial portion of its revenue.

- Global economic uncertainty: Economic instability can affect business confidence and investment decisions, impacting Palantir's stock.

Palantir's Long-Term Growth Potential

Despite the risks, Palantir operates in a rapidly growing market with significant long-term potential.

- Expansion into new industries: Palantir continues to expand into new sectors, broadening its revenue streams and reducing reliance on any single industry.

- Development of new technologies: Continuous innovation is key to Palantir's competitiveness. New technologies can drive future growth and attract new clients.

- Growing demand for data analytics solutions: The demand for sophisticated data analytics solutions is expected to increase substantially, offering significant growth opportunities for Palantir.

Conclusion: Should You Buy Palantir Stock Before May 5th?

The decision of whether to buy Palantir stock before the May 5th earnings report is complex. While Palantir exhibits strong growth potential and innovative technology, significant risks remain, including market volatility and competition. The upcoming earnings report could significantly influence the stock price. Weighing the potential upside against the risks is critical. Thorough research, considering the factors discussed, and potentially seeking professional financial advice are essential before making any investment decisions. Ultimately, the decision to buy Palantir stock before the May 5th earnings report is a personal one. By carefully considering the factors discussed above and conducting further independent research, you can make a more informed decision about your Palantir investment strategy.

Featured Posts

-

Should You Invest In Palantir Stock Before May 5th

May 10, 2025

Should You Invest In Palantir Stock Before May 5th

May 10, 2025 -

Three Actions To Show Allyship On International Transgender Day Of Visibility

May 10, 2025

Three Actions To Show Allyship On International Transgender Day Of Visibility

May 10, 2025 -

Ukraine Conflict Putin Announces Victory Day Ceasefire

May 10, 2025

Ukraine Conflict Putin Announces Victory Day Ceasefire

May 10, 2025 -

Death Of Pioneering Nonbinary American A Tragedy

May 10, 2025

Death Of Pioneering Nonbinary American A Tragedy

May 10, 2025 -

Two Year Low For Indonesias Reserves Analyzing The Rupiahs Role

May 10, 2025

Two Year Low For Indonesias Reserves Analyzing The Rupiahs Role

May 10, 2025