Palantir Stock: Buy The Dip After 30% Fall? Analysis And Outlook.

Table of Contents

Understanding Palantir's Recent Stock Performance

The 30% drop in Palantir's stock price wasn't a sudden event; it unfolded over several weeks, influenced by a confluence of factors. The timeline shows a gradual decline punctuated by periods of sharper falls, often triggered by specific news events. Recent earnings reports, while showing revenue growth, fell short of overly optimistic analyst expectations, contributing significantly to the sell-off. Furthermore, broader market trends, including a general tech sector downturn and rising interest rates, have also negatively impacted Palantir's valuation. Increased competition in the data analytics space, with established players and new entrants vying for market share, adds another layer of complexity.

- Negative news: Disappointing earnings reports, slower-than-expected commercial customer growth, and concerns about the sustainability of government contracts.

- Positive developments (often overlooked): Continued expansion into new sectors, strategic partnerships, and advancements in Palantir's core technologies.

- Competitor comparison: Palantir faces stiff competition from established players like Microsoft and Amazon Web Services (AWS), as well as emerging startups specializing in AI-driven analytics. Their performance relative to these competitors is crucial in determining future stock performance.

Analyzing the Fundamentals of Palantir

Despite the recent stock price decline, Palantir's fundamentals reveal a company with significant growth potential. While profitability remains elusive, the company is demonstrating consistent revenue growth, driven largely by its robust government contracts. Palantir's high-value contracts with government agencies and large corporations position it as a leader in the big data analytics sector. However, the concentration of revenue in government contracts represents a risk.

- Key Metrics: While revenue growth is impressive, the operating margin remains under pressure. The debt-to-equity ratio needs monitoring to assess its financial leverage.

- Government Contracts: These contracts provide stability but also limit the company's diversification. Future growth will depend on securing new contracts and expanding into the commercial sector.

- Commercial Customer Acquisition: Palantir is actively working to expand its commercial customer base. Success in this area is essential for sustained long-term growth and a reduced reliance on government contracts.

Evaluating the Risks and Rewards of Investing in Palantir

Investing in Palantir carries significant risk, primarily due to its high valuation relative to earnings and its dependence on government contracts. The competitive landscape is also a factor; established players with deep pockets could aggressively challenge Palantir's market share. Geopolitical uncertainties affecting the government contracts could also impact future revenue.

- Risks: High valuation multiples, intense competition from established tech giants and new entrants, geopolitical risks impacting government contracts, and slower-than-anticipated commercial adoption.

- Rewards: Potential for significant long-term growth, first-mover advantage in several key markets (especially government and defense), and the potential for increasing profitability as the company scales its operations.

- Risk-Reward Ratio: The risk-reward ratio is clearly skewed towards the risk side for risk-averse investors. However, for investors with a higher risk tolerance and a long-term investment horizon, the potential rewards could outweigh the risks.

Predicting the Future Outlook for Palantir Stock

Predicting Palantir's future stock price is inherently challenging, given the volatility of the market and the company's growth trajectory. However, based on our analysis, a cautiously optimistic outlook seems reasonable.

- Short-term predictions (next 3-6 months): The stock price may remain volatile, potentially experiencing further dips or small gains depending on market sentiment and news events. A clear trend may not emerge within this timeframe.

- Long-term predictions (next 1-3 years): Continued growth in the commercial sector and successful execution of its strategic initiatives could lead to a significant increase in the stock price. However, failure to secure new contracts or increased competition could negatively impact growth.

- Factors impacting the stock price: New government contracts, successful expansion into new commercial markets, technological breakthroughs, and overall market trends will significantly influence the stock price.

Conclusion

Palantir's stock performance has been volatile, but the company's fundamental strengths and long-term growth potential are undeniable. While the recent 30% drop raises concerns, it also presents a potential buying opportunity for investors with a high-risk tolerance and a long-term investment horizon. However, the risks are substantial, and a thorough understanding of Palantir's business model and competitive landscape is crucial before making any investment decisions. Whether you believe Palantir stock is a good buy after its recent fall depends on your risk tolerance and investment horizon. Conduct thorough due diligence before making any investment decisions. Continue to monitor Palantir stock and its performance closely to inform your investment strategy. Consider the factors discussed in this analysis before making a decision on whether to buy the dip in Palantir stock.

Featured Posts

-

Deborah Taylor Leading Nottingham Attack Inquiry After Becker Case

May 09, 2025

Deborah Taylor Leading Nottingham Attack Inquiry After Becker Case

May 09, 2025 -

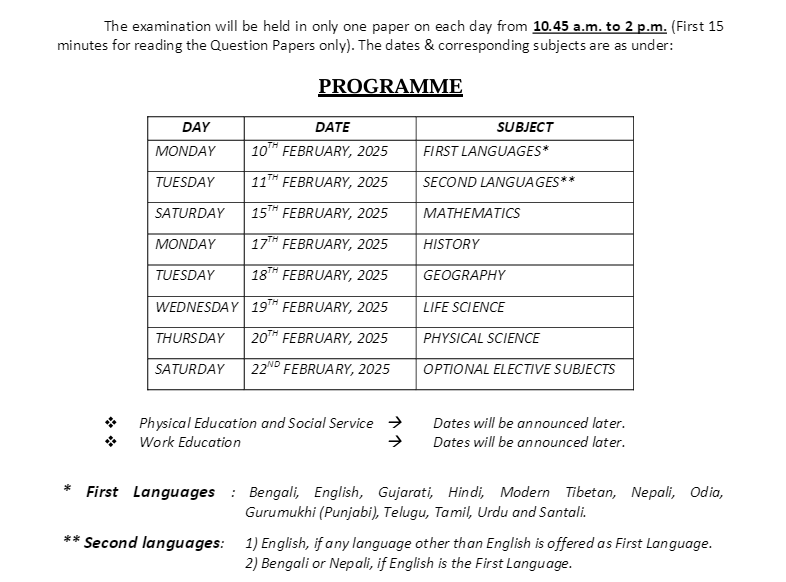

Madhyamik Exam 2025 Expected Merit List Release Date

May 09, 2025

Madhyamik Exam 2025 Expected Merit List Release Date

May 09, 2025 -

Nyt Strands Saturday Puzzle April 12th Solutions And Clues

May 09, 2025

Nyt Strands Saturday Puzzle April 12th Solutions And Clues

May 09, 2025 -

The High Cost Of Childcare One Mans Experience With Babysitting And Daycare

May 09, 2025

The High Cost Of Childcare One Mans Experience With Babysitting And Daycare

May 09, 2025 -

Invest In Stocks Easily The Jazz Cash And K Trade Collaboration

May 09, 2025

Invest In Stocks Easily The Jazz Cash And K Trade Collaboration

May 09, 2025