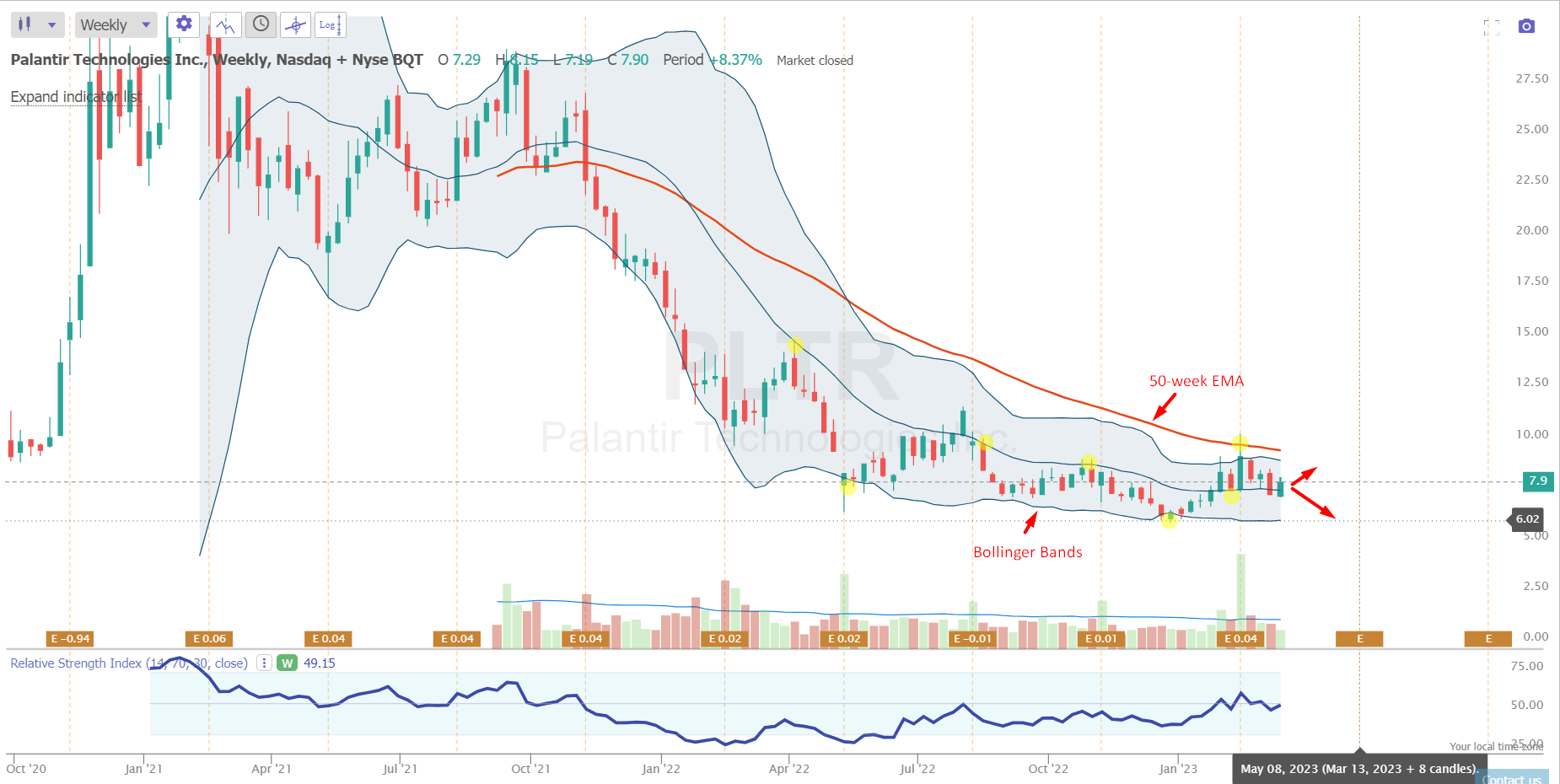

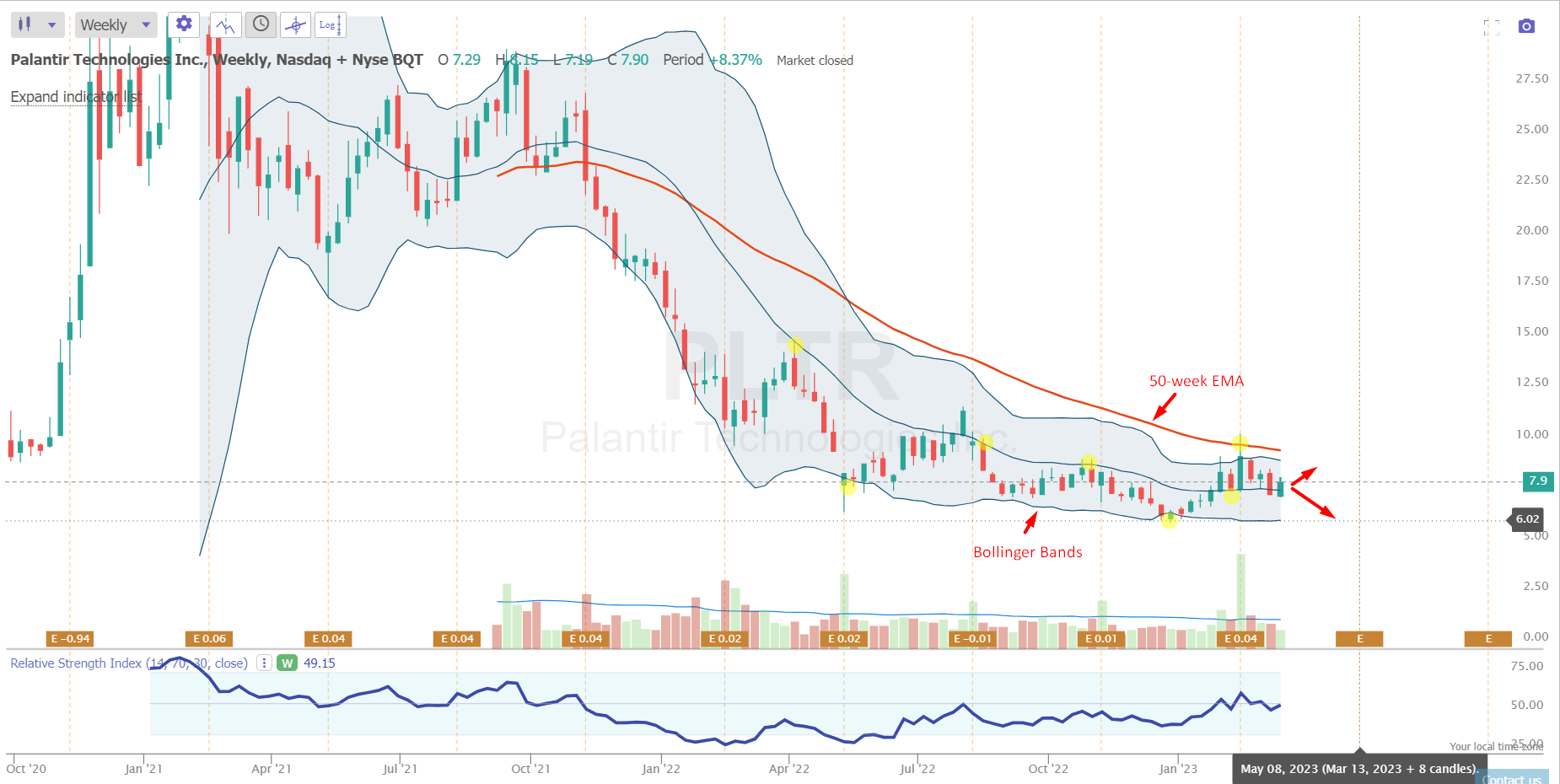

Palantir Stock Decline: A Detailed Analysis And Investment Recommendation

Table of Contents

Macroeconomic Factors Contributing to the Palantir Stock Decline

The recent decline in Palantir's stock price isn't solely attributable to company-specific issues; broader macroeconomic headwinds have played a significant role.

Impact of Rising Interest Rates

Rising interest rates have significantly impacted growth stocks like Palantir. These hikes directly affect investor sentiment and valuation.

- Increased borrowing costs: Higher interest rates make borrowing more expensive for companies like Palantir, potentially hindering expansion and investment in research and development.

- Reduced investor appetite for growth stocks: Investors often shift towards safer, more stable investments during periods of rising interest rates, leading to a decreased demand for high-growth, but potentially riskier, tech stocks.

- Shift towards safer investments: The allure of higher returns from fixed-income securities makes them a more attractive option compared to growth stocks with uncertain future returns, particularly in a volatile market.

The Federal Reserve's aggressive interest rate hikes throughout 2022 and into 2023 have demonstrably impacted the technology sector, with many growth stocks experiencing significant corrections. This trend has undoubtedly contributed to the Palantir stock decline.

Geopolitical Uncertainty and its Influence

Global instability significantly impacts investor confidence and market sentiment. Geopolitical uncertainties create volatility and risk aversion.

- Reduced government spending: International conflicts and economic instability often lead to reduced government spending on non-essential areas, impacting companies like Palantir that rely heavily on government contracts.

- Supply chain disruptions: Global events can disrupt supply chains, impacting production, delivery, and ultimately, a company's bottom line.

- Uncertainty in global markets: Overall market volatility due to geopolitical events creates uncertainty, leading investors to seek safer havens and reduce their exposure to riskier assets.

The ongoing war in Ukraine, for example, has created significant economic uncertainty globally, affecting investor sentiment towards technology companies like Palantir.

Palantir's Company-Specific Challenges

While macroeconomic factors contribute to the overall market environment, Palantir faces several company-specific challenges contributing to its stock decline.

Revenue Growth and Profitability Concerns

Palantir's financial performance has been a subject of scrutiny. While the company shows growth, concerns remain about its profitability and the sustainability of its revenue growth.

- Comparison with industry benchmarks: Palantir's financial metrics need to be compared to those of its competitors to understand its performance relative to the market.

- Analysis of key financial metrics (e.g., EPS, revenue growth rate): A thorough analysis of key financial indicators is crucial to evaluate the company's financial health and future prospects. A slowdown in revenue growth and pressure on profitability margins are key concerns.

- Discussion of any missed earnings targets: Failure to meet earnings expectations can significantly impact investor confidence and contribute to a stock price decline.

Analyzing Palantir's financial reports reveals a mixed picture, with revenue growth showing promise but profitability lagging behind expectations.

Competition and Market Saturation

The data analytics market is becoming increasingly competitive, posing a challenge to Palantir's market share.

- Key competitors: Companies like AWS, Microsoft, and Google Cloud Platform are major competitors offering similar services.

- Market share analysis: Analyzing Palantir's market share compared to its competitors helps understand its competitive position.

- Potential for market saturation: The increasing number of players in the market raises concerns about potential market saturation, making it harder for Palantir to maintain growth.

The competitive landscape necessitates Palantir to continuously innovate and differentiate itself to maintain its market position.

Dependence on Government Contracts

A significant portion of Palantir's revenue comes from government contracts. This dependence presents inherent risks.

- Percentage of revenue from government contracts: A high percentage of revenue from government contracts makes Palantir vulnerable to changes in government spending priorities.

- Potential changes in government spending: Changes in government policy or budget cuts can significantly impact Palantir's revenue stream.

- Risks associated with contract renewals: The uncertainty surrounding the renewal of government contracts introduces substantial risk to the company's future financial performance.

Diversification into the commercial sector is crucial for Palantir to reduce its reliance on government contracts and mitigate this risk.

Future Outlook and Investment Recommendation for Palantir Stock

Despite the challenges, Palantir possesses long-term growth potential.

Long-Term Growth Potential

Palantir's innovative technology and expanding market presence offer opportunities for future growth.

- Potential for growth in specific market segments: Expansion into new market segments can unlock substantial growth opportunities.

- Innovative technologies developed by Palantir: Continued investment in research and development can lead to groundbreaking technologies and further market penetration.

- Strategic partnerships and acquisitions: Strategic partnerships and acquisitions can accelerate growth and enhance Palantir's market position.

The company's focus on artificial intelligence and its expanding commercial customer base present promising avenues for growth.

Investment Recommendation

Given the current market conditions and Palantir's specific challenges, along with its long-term potential, we recommend a hold strategy for Palantir stock.

- Buy, sell, or hold recommendation: Hold.

- Justification for the recommendation: The current valuation reflects many of the existing risks. The long-term potential requires patience and acceptance of short-term volatility.

- Risk assessment: The stock is inherently risky due to its dependence on government contracts and competitive pressures.

- Potential return on investment: Long-term returns are possible, but require a tolerance for considerable risk.

Disclaimer: This is not financial advice. Conduct your own research and consult with a financial advisor before making any investment decisions.

Conclusion: Navigating the Palantir Stock Decline and Making Informed Decisions

The Palantir stock decline is a complex issue driven by a confluence of macroeconomic factors and company-specific challenges. While the company faces significant headwinds, including rising interest rates, geopolitical uncertainty, and competitive pressures, its long-term growth potential remains. Our "hold" recommendation acknowledges these risks and opportunities. Remember to conduct thorough due diligence before investing in Palantir or any other stock. Stay informed about the Palantir stock decline and its potential recovery by following our analysis and exploring other relevant resources. Learn more about navigating the complexities of Palantir stock investment.

Featured Posts

-

Combating Visa Fraud The Uks Strengthened Immigration Policies

May 10, 2025

Combating Visa Fraud The Uks Strengthened Immigration Policies

May 10, 2025 -

R5 1078

May 10, 2025

R5 1078

May 10, 2025 -

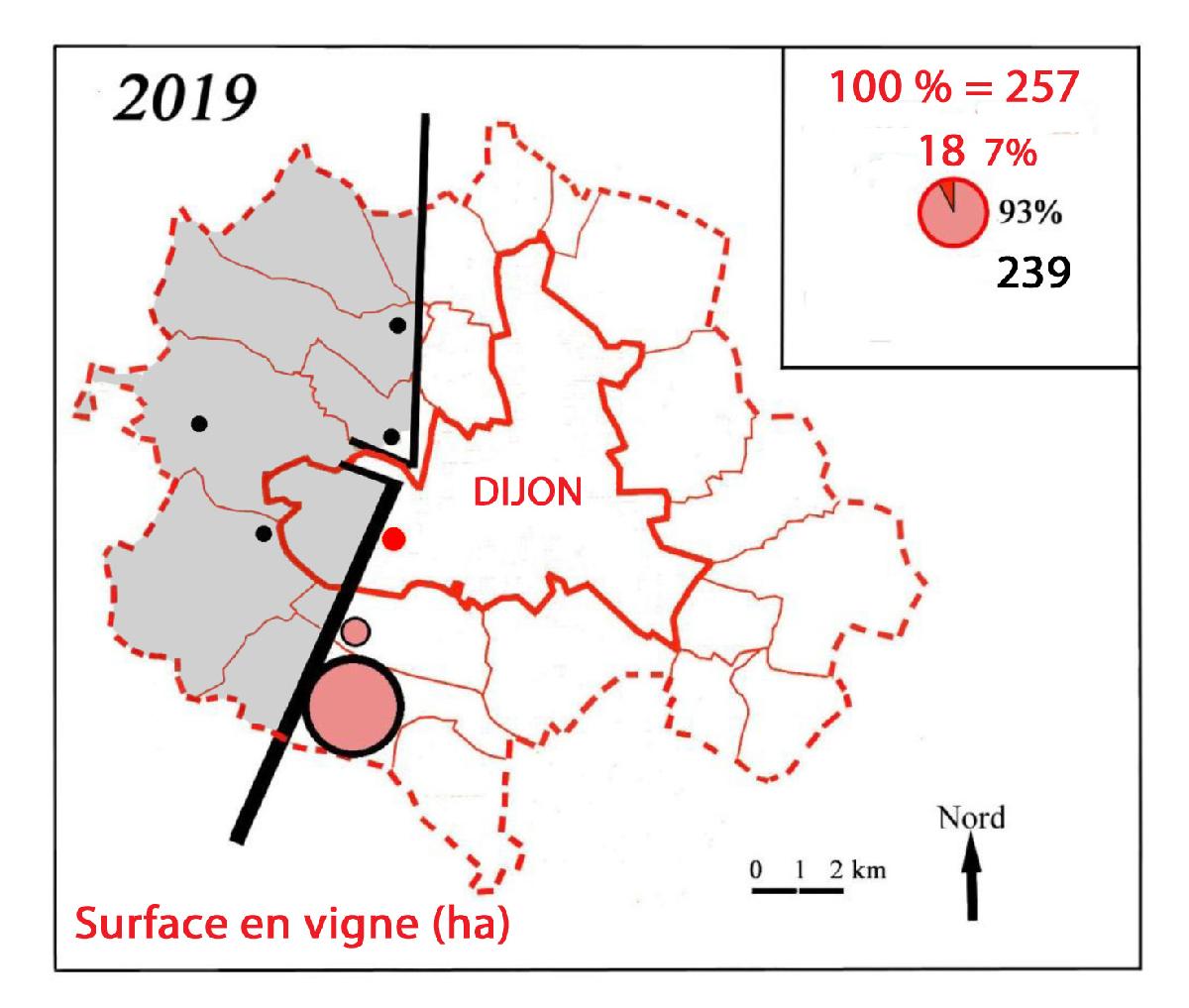

Projet Viticole A Dijon 2 500 M Aux Valendons

May 10, 2025

Projet Viticole A Dijon 2 500 M Aux Valendons

May 10, 2025 -

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025 -

Wynne Evans Addresses Strictly Come Dancing Return Calls

May 10, 2025

Wynne Evans Addresses Strictly Come Dancing Return Calls

May 10, 2025