Palantir Stock Outlook: Investment Considerations Before May 5th

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Revenue Growth and Profitability

Palantir's recent financial reports reveal a mixed bag. While the company has demonstrated consistent revenue growth, profitability remains a key area of focus. Let's examine some key performance indicators (KPIs):

- Revenue Growth: [Insert recent quarterly and annual revenue figures and year-over-year growth percentages]. While showing growth, the rate of increase needs to be considered against the overall market trends and the company's projections.

- Operating Margins: [Insert data on operating margins, highlighting trends]. Improving operating margins are crucial for demonstrating increasing efficiency and profitability.

- Net Income: [Insert data on net income, highlighting trends]. Consistent profitability is a positive sign, however, investors should consider the path to sustained profitability.

- Comparison to Competitors: Compared to competitors like [mention competitors like Databricks, Snowflake etc.], Palantir's growth trajectory and profitability need further assessment to determine its competitive positioning.

Government vs. Commercial Contracts

Palantir's revenue streams are broadly categorized into government and commercial sectors. Understanding the contribution of each is vital for assessing risk and growth potential:

- Government Sector: [Insert percentage of revenue from the government sector]. This sector offers a degree of stability but is subject to government budgeting cycles and potentially slower growth compared to the commercial sector.

- Commercial Sector: [Insert percentage of revenue from the commercial sector]. This sector offers higher growth potential but may also involve greater competition and shorter sales cycles.

- Growth Projections: Analysts project [insert growth projections for each sector, citing sources]. The balance between these sectors and their projected growth will significantly influence Palantir's overall performance. The reliance on large government contracts presents a potential risk if these contracts are not renewed.

Future Growth Drivers

Several factors could drive Palantir's future growth:

- New Product Launches: Palantir's continued investment in R&D and the launch of new products like [mention specific new products or services] could significantly expand its market reach and revenue streams.

- Expansion into New Markets: Geographical expansion into new markets and penetrating new industries will be key to further growth. Success in these areas will depend on adapting products to meet local needs and navigating the competitive landscape.

- Strategic Partnerships: Collaborations with key players in the industry could unlock new opportunities and accelerate market penetration. The success of these collaborations will be a major factor influencing future growth.

Assessing Palantir's Valuation and Risks

Price-to-Earnings Ratio (P/E) and Other Valuation Metrics

Palantir's valuation is a critical aspect to consider before making any investment decision.

- P/E Ratio: Palantir's current P/E ratio is [insert current P/E ratio]. This needs to be compared to its historical performance and to the average P/E ratio of its peers to assess whether it is overvalued or undervalued.

- Other Valuation Metrics: Other important metrics to consider include the Price-to-Sales (P/S) ratio and other relevant metrics [insert data and analysis]. A comprehensive analysis of these metrics provides a clearer picture of the company’s valuation.

Potential Risks and Challenges

Several risks could impact Palantir's future performance:

- Competition: The big data analytics market is becoming increasingly competitive with established players and new entrants constantly emerging.

- Regulatory Hurdles: Palantir operates in a regulated industry, and changes in regulations could affect its business operations.

- Customer Concentration: Palantir's reliance on a relatively small number of large clients poses a risk, making it vulnerable to the loss of key contracts.

Macroeconomic Factors

The broader macroeconomic environment also plays a role:

- Interest Rate Hikes: Rising interest rates can impact Palantir's valuation and growth potential, particularly in the context of its current profitability.

- Inflation: High inflation can affect both costs and customer demand for Palantir's services.

- Recessionary Fears: A potential recession could significantly impact the demand for its services and lead to reduced investment.

Alternative Investment Strategies for Palantir

Buy, Hold, or Sell Recommendation

Based on the analysis presented, our recommendation is [state buy, hold, or sell recommendation – justify with key arguments, considering risk tolerance]. [Expand on the reasoning, mentioning specific factors and metrics that support the recommendation].

Options Trading Strategies

For investors with a higher risk tolerance, options trading strategies may be considered. [Discuss potential options strategies, highlighting the risk/reward profile of each. Include a disclaimer about the risks involved in options trading.]

Diversification within your Portfolio

It's crucial to diversify your portfolio to mitigate risk. Investing solely in Palantir could expose you to significant losses if the company underperforms. Consider diversifying into other tech stocks, asset classes, or sectors to balance the risk. [Suggest alternative investments].

Conclusion: Making Informed Decisions on Palantir Stock Before May 5th

This analysis of Palantir stock provides key insights into the company's performance, valuation, and potential risks before May 5th. Remember that this is not financial advice; the recommendation provided is based on the current analysis and may change with new information. While Palantir shows potential for growth, its valuation, profitability, and reliance on specific clients pose significant risks. Before making any investment decisions regarding Palantir stock, conduct thorough due diligence, considering your personal risk tolerance and investment goals. Make an informed decision on whether to invest in Palantir, hold your existing Palantir stock, or potentially consider selling your shares. Develop a robust Palantir stock investment strategy before May 5th to navigate the complexities of this dynamic market.

Featured Posts

-

Snls Impression Of Harry Styles The Singers Disappointing Response

May 10, 2025

Snls Impression Of Harry Styles The Singers Disappointing Response

May 10, 2025 -

Dakota Johnson And Melanie Griffiths Chic Spring Style

May 10, 2025

Dakota Johnson And Melanie Griffiths Chic Spring Style

May 10, 2025 -

Who Is Kimbal Musk Exploring Elons Brother And His Business Ventures

May 10, 2025

Who Is Kimbal Musk Exploring Elons Brother And His Business Ventures

May 10, 2025 -

Nottingham Attacks Survivors Voices A Journey Of Healing And Recovery

May 10, 2025

Nottingham Attacks Survivors Voices A Journey Of Healing And Recovery

May 10, 2025 -

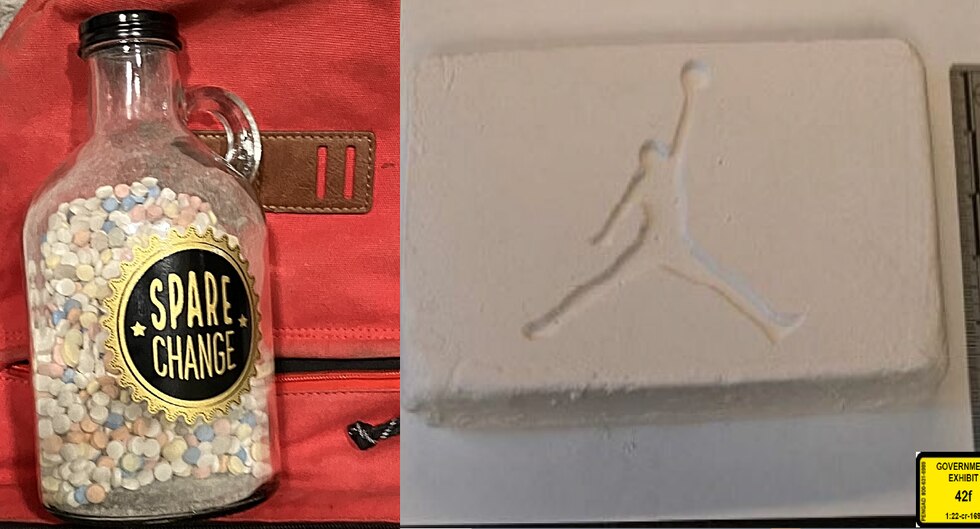

Largest Fentanyl Seizure In Us History Pam Bondis Announcement

May 10, 2025

Largest Fentanyl Seizure In Us History Pam Bondis Announcement

May 10, 2025