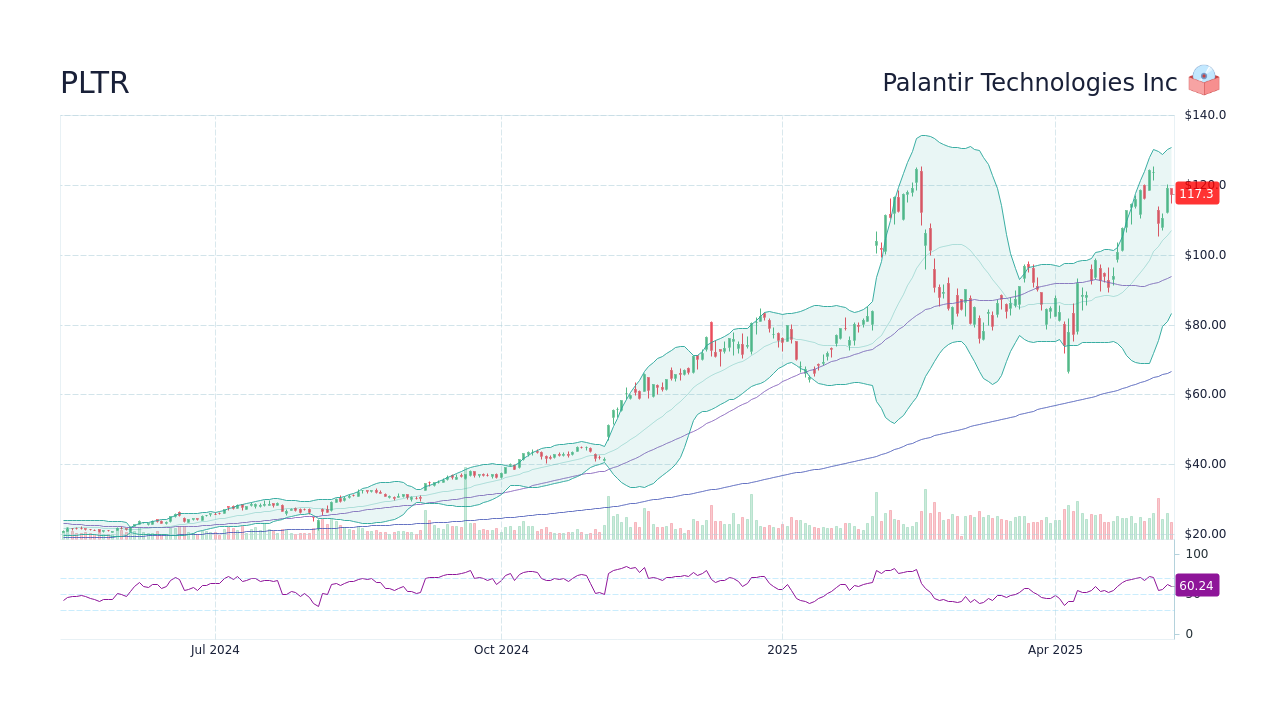

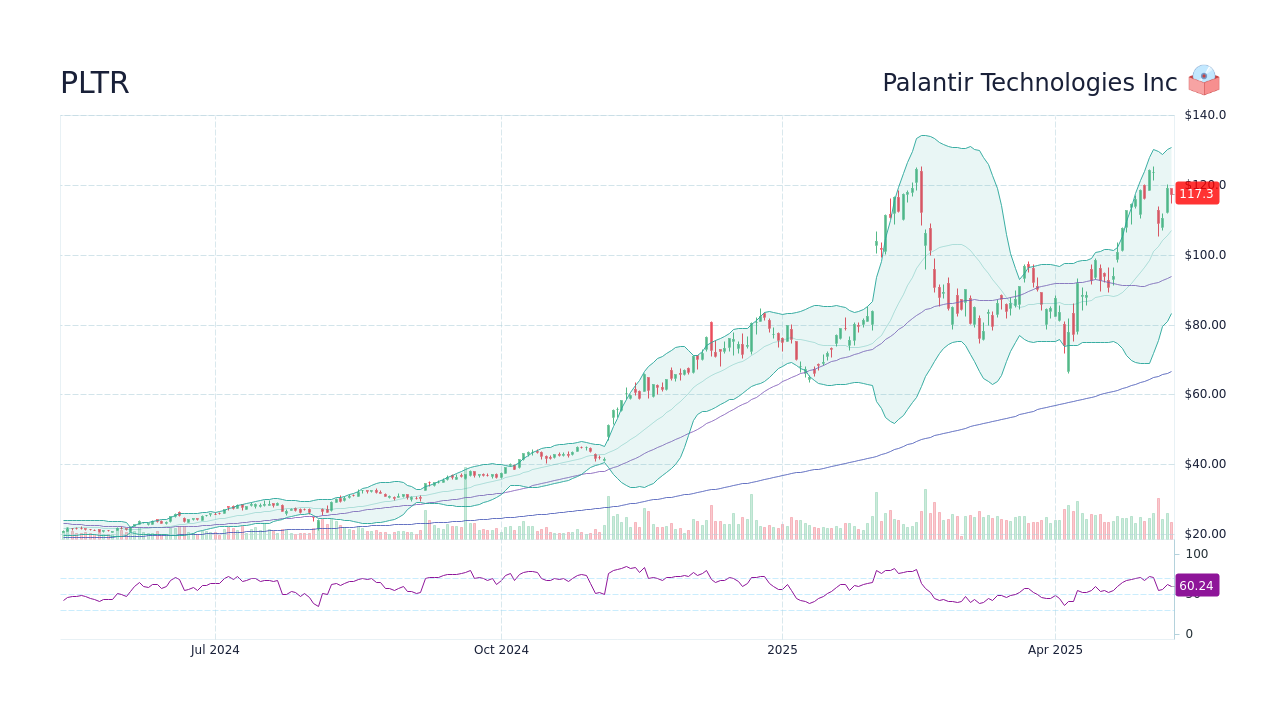

Palantir Stock Prediction 2025: Is A 40% Increase Realistic?

Table of Contents

Palantir's Current Financial Performance and Growth Trajectory

Palantir's financial health is a crucial factor in predicting its future stock price. Analyzing its revenue growth, profitability, and strategic partnerships provides valuable insights into its potential for a 40% surge by 2025.

Revenue Growth and Profitability Analysis

- Year-over-Year Revenue Growth: Examining Palantir's recent financial reports reveals consistent year-over-year revenue growth, although profitability remains a key area of focus for investors. Analyzing these trends is crucial for projecting future revenue streams.

- Profitability Trends: Palantir's journey to profitability is ongoing. Tracking its operating margins and net income is essential for assessing its financial strength and sustainability. A sustained increase in profitability will likely boost investor confidence and drive stock price appreciation.

- Significant Contracts and Partnerships: Securing large government and commercial contracts is vital for Palantir's growth. Analyzing the value and duration of these contracts provides insight into future revenue streams. High-value partnerships can significantly impact the Palantir stock prediction.

Government vs. Commercial Revenue Streams

Palantir operates in both the government and commercial sectors. Understanding the contribution of each to its overall revenue is critical.

- Government Contracts: Government contracts offer a degree of stability, but their renewal and expansion are subject to budgetary constraints and political shifts. Analyzing the potential for future government spending on data analytics is key to any Palantir stock prediction.

- Commercial Sector Growth: The commercial sector presents significant growth potential but is also more competitive. Palantir's success in penetrating this market will heavily influence its overall growth trajectory and any Palantir stock prediction.

- Sectoral Risks: It's crucial to consider the risks associated with each sector. For instance, changes in government priorities or increased competition in the commercial market could impact revenue projections and the overall Palantir stock prediction.

Key Partnerships and Strategic Alliances

Strategic partnerships significantly influence a company's growth. Palantir's collaborations enhance its market reach and technological capabilities.

- Major Partnerships: Identifying and analyzing Palantir's key partnerships – who they are collaborating with, and the nature of these partnerships – helps to gauge their potential impact on revenue and stock valuation.

- Benefits and Risks: Each partnership carries both benefits (e.g., increased market access, technological advancements) and risks (e.g., potential conflicts of interest, dependence on a single partner). A realistic Palantir stock prediction requires a balanced assessment of both.

- Contribution to Future Revenue: Assessing the potential contribution of these partnerships to Palantir's future revenue streams is paramount in formulating a reliable Palantir stock prediction 2025.

Market Trends and Industry Outlook

Understanding the broader market context is vital for any accurate Palantir stock prediction.

The Big Data and AI Market

Palantir operates in the rapidly expanding big data and artificial intelligence market. Its growth potential is intrinsically linked to the overall growth of this sector.

- Market Size Projections: Analyzing market size projections for big data and AI provides a crucial benchmark against which to gauge Palantir's potential market share and revenue growth.

- Market Drivers: Understanding the key factors driving growth in this market (e.g., increasing data volumes, rising demand for AI-powered solutions) allows for a more accurate estimation of Palantir's future prospects.

- Competitive Landscape: Analyzing the competitive landscape, including major players and their market strategies, is crucial for assessing Palantir's competitive advantages and potential challenges.

Government Spending on Data Analytics and Security

Government investment in data analytics and cybersecurity heavily influences Palantir's government sector revenue.

- Government Budgets: Monitoring government budgets allocated to data analytics and security provides insight into potential future contract opportunities and overall market demand.

- Geopolitical Factors: Geopolitical events and shifts in global priorities significantly affect government spending on these areas, creating both opportunities and risks.

- Potential Opportunities: Identifying potential government initiatives and projects in data analytics and security helps to understand the potential for Palantir's future growth in this crucial sector.

Competition and Technological Advancements

The competitive landscape and technological advancements significantly affect Palantir's future prospects.

- Key Competitors: Identifying key competitors and analyzing their strengths and weaknesses is essential to understanding the competitive pressure on Palantir.

- Disruptive Technologies: Evaluating the potential impact of emerging technologies on Palantir’s business model is crucial for a nuanced Palantir stock prediction.

- Competitive Advantages: Assessing Palantir’s unique strengths and competitive advantages, such as its proprietary technology and strong relationships with government agencies, is critical for formulating a realistic prediction.

Factors that Could Influence Palantir's Stock Price in 2025

Several factors beyond Palantir's direct control can influence its stock price.

Successful Product Launches and Innovation

New product releases and technological advancements directly impact Palantir's market position and stock valuation.

- Upcoming Product Launches: Analyzing anticipated product launches and their potential market impact is vital for forecasting future revenue growth.

- Innovative Technologies: Highlighting Palantir’s commitment to innovation and its development of cutting-edge technologies is important for assessing its long-term competitiveness.

- Market Impact: Evaluating how successfully these new offerings are adopted by the market will significantly affect the accuracy of any Palantir stock prediction.

Macroeconomic Factors and Market Volatility

Broader economic conditions significantly influence stock market performance, including Palantir's.

- Interest Rates: Changes in interest rates affect investor sentiment and investment decisions, potentially influencing Palantir's stock valuation.

- Inflation: Inflationary pressures can impact consumer spending and corporate profitability, potentially affecting Palantir's growth trajectory.

- Market Sentiment: Overall market sentiment (bullish or bearish) significantly affects stock prices, regardless of a company's individual performance.

Geopolitical Risks and Uncertainties

Geopolitical events can create uncertainty and significantly affect Palantir's business, especially its government contracts.

- Potential Risks: Analyzing potential geopolitical risks, such as international conflicts or changes in government policies, is crucial for understanding potential impacts on Palantir's revenue streams.

- Opportunities: Certain geopolitical events can also present opportunities for Palantir's data analytics and security services. This duality needs careful consideration.

- Uncertainty: Acknowledging the inherent uncertainty associated with geopolitical events and their impact on the overall Palantir stock prediction is essential for informed decision-making.

Conclusion: Is a 40% Palantir Stock Increase Realistic by 2025?

Predicting future stock prices is inherently uncertain. While Palantir shows significant potential for growth based on its strong revenue growth, innovative technology, and expanding market, a 40% increase by 2025 is not guaranteed. Several factors, including competition, macroeconomic conditions, and geopolitical events, could significantly impact its stock price. The analysis suggests the possibility of substantial growth, but significant risks remain. While this analysis offers potential insights into Palantir Stock Prediction 2025, remember to conduct your own thorough research before making any investment decisions related to Palantir stock. Consider your personal risk tolerance and investment goals before investing in this or any other stock.

Featured Posts

-

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 09, 2025

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 09, 2025 -

New Young Thug Song A Plea For Forgiveness

May 09, 2025

New Young Thug Song A Plea For Forgiveness

May 09, 2025 -

High Potential On Abc A Risky Finale That Paid Off

May 09, 2025

High Potential On Abc A Risky Finale That Paid Off

May 09, 2025 -

Ray Epps Sues Fox News For Defamation Over January 6th Allegations

May 09, 2025

Ray Epps Sues Fox News For Defamation Over January 6th Allegations

May 09, 2025 -

Recent Tesla Stock Fall Is Elon Musks Influence On Dogecoin To Blame

May 09, 2025

Recent Tesla Stock Fall Is Elon Musks Influence On Dogecoin To Blame

May 09, 2025