Palantir Stock Price Prediction And Investment Strategy

Table of Contents

Understanding Palantir's Business Model and Growth Potential

Palantir's success hinges on its two core platforms: Gotham and Foundry. These platforms provide powerful data analytics capabilities to diverse clients.

Core Business Segments:

- Palantir Gotham: Primarily serves government agencies and intelligence communities, offering sophisticated data integration and analysis tools for national security and defense applications.

- Strengths: Strong relationships with government clients, substantial recurring revenue streams from long-term contracts, access to sensitive data and unique insights.

- Weaknesses: Dependence on government contracts, potential impact from changes in government priorities or budget cuts, regulatory scrutiny.

- Palantir Foundry: Targets commercial clients across various sectors (finance, healthcare, energy), offering a more flexible and adaptable platform for data integration and analysis.

- Strengths: Broader market reach, potential for faster growth compared to Gotham, opportunity to leverage advancements in cloud computing and AI.

- Weaknesses: Increased competition from established tech giants, longer sales cycles, proving ROI to commercial clients.

Key words: Palantir Gotham, Palantir Foundry, government contracts, commercial clients, data analytics, big data.

Assessing Growth Prospects:

Palantir's historical growth has been impressive, driven by strong demand for its data analytics capabilities. However, assessing future growth requires considering several factors:

- Growth Drivers:

- Increasing adoption of cloud computing

- Expansion into new commercial markets and industries

- Successful product launches and continuous innovation in data analytics

- Strategic partnerships and acquisitions

- Potential Roadblocks:

- Intense competition from established players like Microsoft, AWS, and Google

- Economic downturns that may impact government spending or commercial investment

- Challenges in scaling operations and managing rapid growth

Keywords: Palantir growth, market share, competition analysis, technological advancements, cloud computing.

Analyzing Factors Influencing Palantir Stock Price

Several factors significantly influence the price of PLTR stock, impacting the accuracy of any Palantir stock price prediction.

Financial Performance:

Analyzing Palantir's financials is crucial for any investment strategy. Key metrics to examine include:

- Revenue Growth: Consistent and substantial revenue growth signals a healthy and expanding business.

- Earnings Per Share (EPS): Indicates profitability and the company's ability to generate returns for shareholders.

- Cash Flow: Provides insights into the company's liquidity and financial health.

- Debt Levels: High debt can increase financial risk.

- Valuation Metrics: Metrics such as Price-to-Earnings (P/E) ratio provide a comparative valuation of the stock. Analyzing these metrics against competitors aids in assessing PLTR's valuation relative to its growth prospects.

Keywords: PLTR financials, revenue growth, earnings per share, profitability, valuation metrics.

Market Sentiment and Investor Confidence:

News, analyst ratings, and overall market conditions heavily influence investor sentiment and PLTR's stock price volatility.

- News Impact: Positive news (e.g., large contract wins, strategic partnerships) typically boosts the stock price, while negative news (e.g., missed earnings expectations, regulatory issues) can lead to price declines.

- Analyst Ratings: Upgrades or downgrades from prominent analysts can significantly affect investor confidence and the stock price.

- Short Selling: High levels of short-selling activity can indicate skepticism among some investors and may contribute to price volatility.

Keywords: Market sentiment, investor confidence, analyst ratings, news impact, stock volatility.

Geopolitical Factors:

Global events and geopolitical risks can significantly impact Palantir's business and stock price.

- Government Spending: Changes in government budgets or priorities can directly affect Palantir's government contracts and revenue.

- International Relations: Geopolitical instability can disrupt operations and impact client relationships, particularly in international markets.

Keywords: Geopolitical risks, international relations, government spending, global economy.

Developing a Palantir Investment Strategy

Investing in PLTR requires a well-defined strategy that accounts for the inherent risks.

Risk Assessment:

Investing in Palantir stock involves significant risk due to its high volatility and growth uncertainties.

- High Volatility: PLTR's stock price is known for its substantial swings, making it a riskier investment compared to more stable stocks.

- Growth Uncertainty: While Palantir shows strong growth potential, its ability to sustain this growth remains uncertain.

- Risk Mitigation: Diversification (spreading investments across different asset classes) is crucial to mitigate risk. Investors should also assess their own risk tolerance before investing in PLTR.

Keywords: Investment risk, risk management, diversification, portfolio management.

Investment Timing and Strategies:

Several strategies can be employed depending on investment goals and risk tolerance:

- Long-Term Buy-and-Hold: A suitable approach for long-term investors who believe in Palantir's growth potential.

- Short-Term Trading: High-risk strategy for experienced traders seeking to capitalize on short-term price fluctuations.

- Dollar-Cost Averaging: Reduces the risk associated with market timing by investing a fixed amount at regular intervals.

- Technical Analysis: Studying price charts and patterns to predict future price movements.

- Fundamental Analysis: Evaluating a company's financial performance and intrinsic value to determine fair market value.

Keywords: Investment timing, buy and hold, day trading, dollar cost averaging, technical analysis, fundamental analysis.

Conclusion: Making Informed Decisions about Palantir Stock

Predicting the Palantir stock price accurately is challenging due to its sensitivity to various factors, including its business model, financial performance, market sentiment, and geopolitical events. Thorough research and risk assessment are paramount before investing in PLTR. Developing a personalized Palantir investment strategy aligned with your individual financial goals and risk tolerance is crucial. Conduct further research, develop a well-informed Palantir stock price prediction and Palantir investment strategy based on your own analysis and risk profile. Remember, responsible investing involves understanding your risk tolerance and diversifying your portfolio.

Featured Posts

-

Roberts Reaction To Being Mistaken For Former Gop House Leader

May 10, 2025

Roberts Reaction To Being Mistaken For Former Gop House Leader

May 10, 2025 -

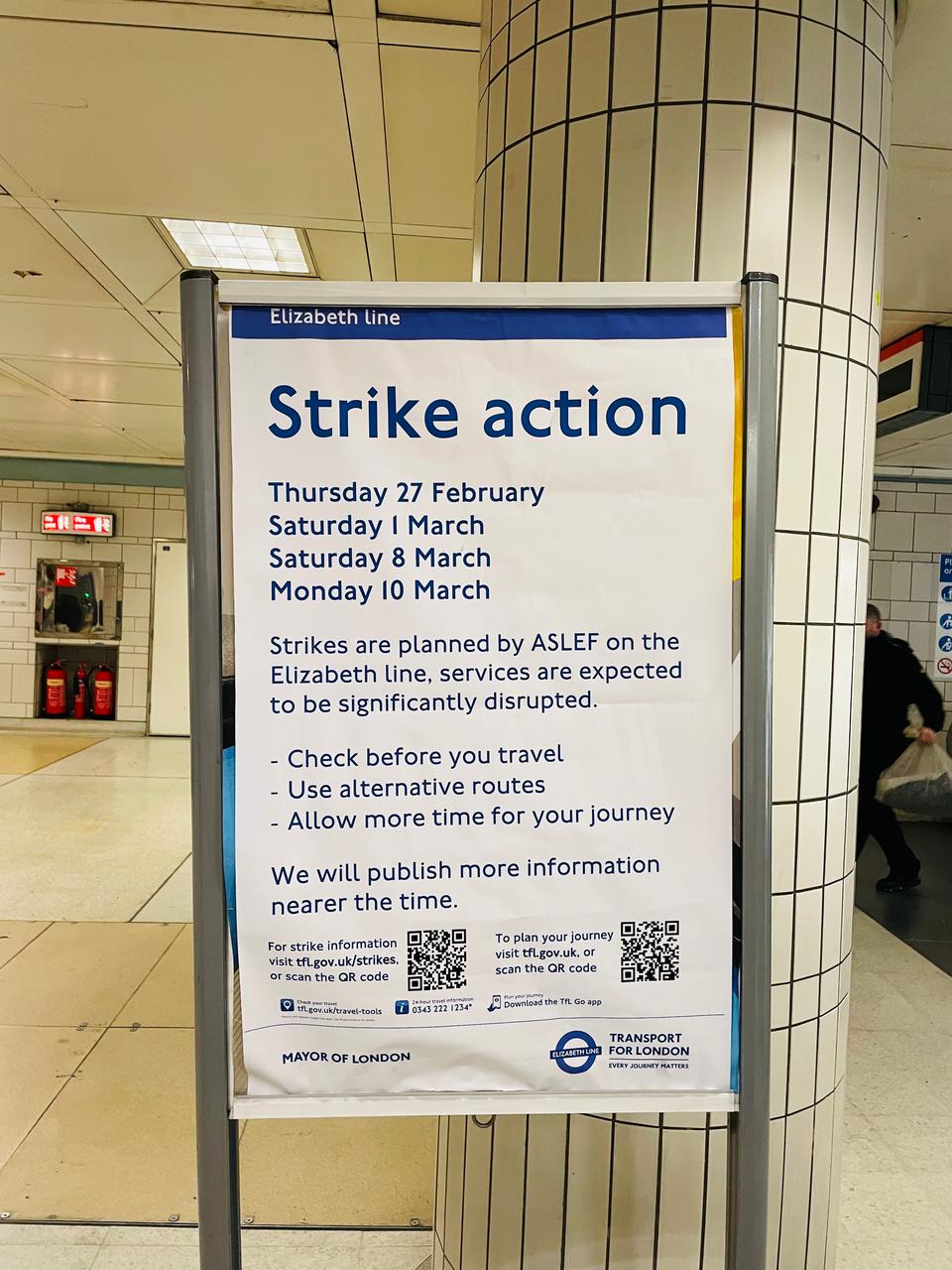

Planned Elizabeth Line Strikes Updated Service Information For February And March

May 10, 2025

Planned Elizabeth Line Strikes Updated Service Information For February And March

May 10, 2025 -

Aocs Sharp Criticism Of Pro Trump Fox News Anchor

May 10, 2025

Aocs Sharp Criticism Of Pro Trump Fox News Anchor

May 10, 2025 -

Nyt Strands Game 374 Solutions And Hints For Wednesday March 12

May 10, 2025

Nyt Strands Game 374 Solutions And Hints For Wednesday March 12

May 10, 2025 -

Palantir Stock Prediction 2025 Should You Invest Now

May 10, 2025

Palantir Stock Prediction 2025 Should You Invest Now

May 10, 2025