Palantir's Elevated Valuation: A Risk Assessment

Table of Contents

Factors Contributing to Palantir's High Valuation

Several factors contribute to Palantir's elevated valuation, making it a compelling – yet risky – investment.

Government Contracts and Data Analytics Expertise

Palantir holds a dominant position in government contracts, particularly within the defense and intelligence sectors. Its advanced data analytics capabilities are crucial for national security, providing insights from massive datasets that would be impossible to analyze manually. This strong government presence ensures a consistent revenue stream, fueling its high valuation. Future growth in this sector is largely dependent on continued government spending and contract renewals.

- Examples of significant government contracts: Palantir has secured multi-year contracts with various government agencies, including the CIA and the Department of Defense. These contracts represent a significant portion of their overall revenue.

- Revenue projections based on contract renewals: Analysts predict continued growth in government revenue based on anticipated contract renewals and expansion into new government initiatives.

- Analysis of Palantir's competitive advantage in this market: Palantir's proprietary technology and deep expertise in data analytics provide a significant competitive advantage in this highly specialized market.

Growth in Commercial Markets

Beyond government contracts, Palantir is aggressively expanding into commercial sectors, including financial services and healthcare. Their Gotham and Foundry platforms are being adopted by large enterprises to improve operational efficiency, manage risk, and gain a competitive edge through data-driven decision-making. While showing promise, this commercial expansion still presents challenges.

- Examples of successful commercial partnerships: Palantir has secured partnerships with major players in finance and healthcare, demonstrating the market's acceptance of its platforms.

- Market share analysis: While still a relatively small player in the broader commercial market, Palantir's market share is steadily increasing as it gains traction with large enterprises.

- Future growth potential in commercial sectors: The potential for growth in the commercial market is substantial, but it also faces stiff competition from established tech giants.

Technological Innovation and Future Potential

Palantir's significant investment in research and development (R&D) focuses on cutting-edge technologies like AI and machine learning. These advancements are essential for maintaining its competitive edge and driving future growth. However, investing in emerging technologies also carries inherent risks.

- Recent technological advancements: Palantir regularly releases updates and improvements to its platforms, showcasing its commitment to innovation.

- Planned product launches: Future product launches incorporating AI and machine learning will be key to sustaining its growth trajectory and justifying its valuation.

- Assessment of the competitive landscape in AI and machine learning: The AI and machine learning landscape is highly competitive, with established tech giants and emerging startups vying for market share.

Potential Risks Associated with Palantir's Valuation

Despite the positive factors, several risks are associated with Palantir's elevated valuation that investors must consider.

Dependence on Government Contracts

Palantir's significant reliance on government contracts exposes it to risks associated with fluctuating government budgets, changing political priorities, and geopolitical instability. A reduction in government spending could severely impact its revenue and profitability.

- Historical data on government spending: Historical data shows fluctuations in government spending, highlighting the inherent volatility of this revenue stream.

- Analysis of potential future budget changes: Future budget cuts or shifts in government priorities could negatively impact Palantir's revenue from government contracts.

- Evaluation of key competitors: Competition in the government contracting space is intensifying, potentially reducing Palantir's market share.

High Valuation Multiple

Palantir's current price-to-earnings (P/E) ratio is significantly higher than many of its competitors. This high valuation multiple reflects investor expectations for significant future growth, but it also makes the stock vulnerable to a market correction or a decline in investor sentiment.

- Comparison of P/E ratios with competitors: A comparison with competitors shows Palantir's P/E ratio is considerably higher, suggesting a premium valuation.

- Historical stock price fluctuations: Analyzing historical stock price fluctuations reveals the volatility inherent in investing in high-growth technology companies.

- Analysis of market sentiment: Changes in market sentiment can significantly impact the stock price, especially for companies with high valuations.

Competition and Market Saturation

The data analytics sector is becoming increasingly competitive, with established tech giants and numerous startups vying for market share. Market saturation poses a significant risk to Palantir's long-term growth prospects.

- Analysis of key competitors: Analyzing key competitors reveals a growing number of players offering similar data analytics solutions.

- Market share estimates: Estimating Palantir's future market share requires careful consideration of the competitive landscape and potential market saturation.

- Assessment of potential competitive threats: Emerging technologies and innovative business models pose significant potential competitive threats to Palantir's dominance.

Conclusion

Palantir's elevated valuation reflects its strong position in government contracts and its ambitions in the commercial sector. However, a thorough risk assessment reveals potential downsides, including dependence on government contracts, a high valuation multiple, and increasing competition. Investors should carefully weigh these factors before investing in Palantir. Understanding the nuances of Palantir's elevated valuation is crucial for making informed investment decisions. Further research into Palantir's financial reports and future projections is recommended before committing to this potentially high-risk, high-reward investment opportunity. Conduct your own thorough due diligence before making any investment decisions related to Palantir's elevated valuation.

Featured Posts

-

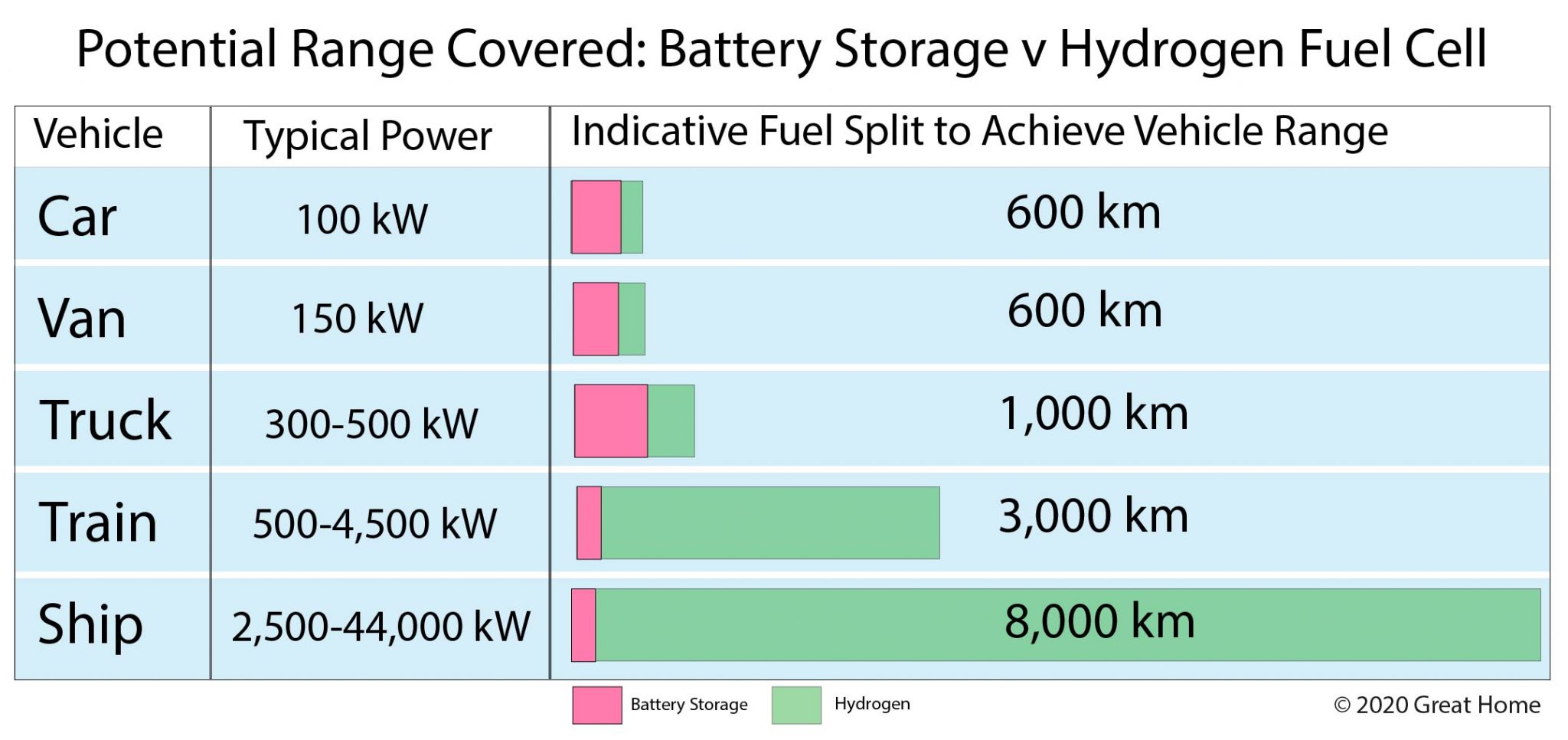

European Public Transport A Deep Dive Into Hydrogen And Battery Bus Technologies

May 07, 2025

European Public Transport A Deep Dive Into Hydrogen And Battery Bus Technologies

May 07, 2025 -

55 Points D Avance Les Cavaliers Etablissent Un Nouveau Record Nba Face Au Heat

May 07, 2025

55 Points D Avance Les Cavaliers Etablissent Un Nouveau Record Nba Face Au Heat

May 07, 2025 -

Rihannas Engagement The Ring And The Red Heels

May 07, 2025

Rihannas Engagement The Ring And The Red Heels

May 07, 2025 -

The Risque Dress Uncovering The Truth Behind Princess Dianas Met Gala Gown Alteration

May 07, 2025

The Risque Dress Uncovering The Truth Behind Princess Dianas Met Gala Gown Alteration

May 07, 2025 -

Las Vegas Aces Megan Gustafson Faces Indefinite Absence Due To Leg Injury

May 07, 2025

Las Vegas Aces Megan Gustafson Faces Indefinite Absence Due To Leg Injury

May 07, 2025