Parkland Acquisition: Shareholder Vote Scheduled For June

Table of Contents

Understanding the Parkland Acquisition Proposal

The proposed acquisition involves [Company Name being acquired], a [Industry] company with a strong presence in [Geographic Location(s)]. Parkland aims to acquire [Company Name] for an agreed price of [Acquisition Price], a strategic move intended to bolster Parkland's position within the market. The rationale behind this acquisition centers on several key strategic objectives:

- Key terms of the acquisition agreement: [Detail key terms like payment structure, completion date, conditions precedent, etc.]

- Benefits to Parkland (synergies, market expansion, etc.): The acquisition is expected to generate significant synergies through [explain synergies, e.g., operational efficiencies, combined market share, access to new technologies]. Market expansion into [new geographic markets or product lines] is also a key anticipated benefit.

- Potential risks and challenges associated with the acquisition: Potential risks include integration challenges, potential regulatory hurdles, and the possibility of unforeseen financial liabilities associated with the acquired company. A thorough due diligence process is crucial to mitigate these risks.

The June Shareholder Vote: What to Expect

The shareholder vote on the Parkland acquisition is scheduled for [Date] at [Time] [Location/Virtual Meeting Details]. Shareholders will need to cast their vote to either approve or reject the proposed acquisition. The voting process will primarily be conducted via [Proxy Voting/In-Person Voting/Electronic Voting – specify the method]:

- Information on how to register to vote: Shareholders can register their vote by [Details of registration process – e.g., online portal, mail-in ballot, etc.].

- Resources available to help shareholders understand the proposal: Parkland has made available a detailed informational package including [mention resources like presentations, Q&A documents, financial statements] to aid shareholders in their decision-making.

- Deadlines for submitting votes: The deadline for submitting votes is [Date]. Ensure your vote is received before this date to ensure it is counted.

Analyzing the Potential Impacts of the Parkland Acquisition

The Parkland acquisition holds the potential for both significant positive and negative impacts on the company's future. A careful analysis is crucial before casting your vote.

Potential Positive Impacts:

- Increased market share and revenue streams.

- Enhanced profitability due to synergies and economies of scale.

- Expanded product and service offerings, leading to diversification.

- Access to new technologies and talent.

Potential Negative Impacts:

-

Increased debt levels, impacting the company's financial health.

-

Challenges in integrating the acquired company's operations and culture.

-

Potential regulatory hurdles and antitrust concerns.

-

Potential job losses or restructuring within the combined entity.

-

Financial projections and forecasts: [Include a brief summary of the financial projections, highlighting key figures like revenue growth, profitability, and return on investment.]

-

Expert opinions on the likely outcome of the acquisition: [Mention any relevant analyst reports or expert opinions on the acquisition's success probability.]

-

Potential long-term effects on Parkland’s stock price: The outcome of the vote could significantly influence Parkland's stock price, both in the short and long term.

Key Arguments For and Against the Parkland Acquisition

Management's case for the acquisition centers around the significant strategic benefits, including [summarize key pro-acquisition arguments]. However, several counterarguments and concerns have been raised by shareholders and analysts:

- Summary of pro-acquisition arguments: [List the main arguments in favor, focusing on strategic benefits and financial projections].

- Summary of anti-acquisition arguments: [List the main arguments against, including potential risks, costs, and concerns about integration].

- Analysis of the strengths and weaknesses of each side's position: [Provide a balanced assessment of both sides, highlighting the key strengths and weaknesses of their arguments].

Conclusion: Making Your Voice Heard in the Parkland Acquisition Shareholder Vote

The June shareholder vote on the Parkland acquisition is a critical decision that will shape the company's future. Understanding the details of the acquisition, the potential impacts, and the arguments for and against it is crucial to making an informed decision. Your participation is vital. Don't miss the crucial Parkland shareholder vote in June. Make your informed decision on the Parkland acquisition and participate in shaping Parkland's future. Exercise your shareholder rights and ensure your voice is heard. Make sure you understand the voting process and submit your vote before the deadline. Participate in the Parkland acquisition vote and have your say.

Featured Posts

-

Karate Kid 6 Ralph Macchios Return And Another Films Potential Revival

May 07, 2025

Karate Kid 6 Ralph Macchios Return And Another Films Potential Revival

May 07, 2025 -

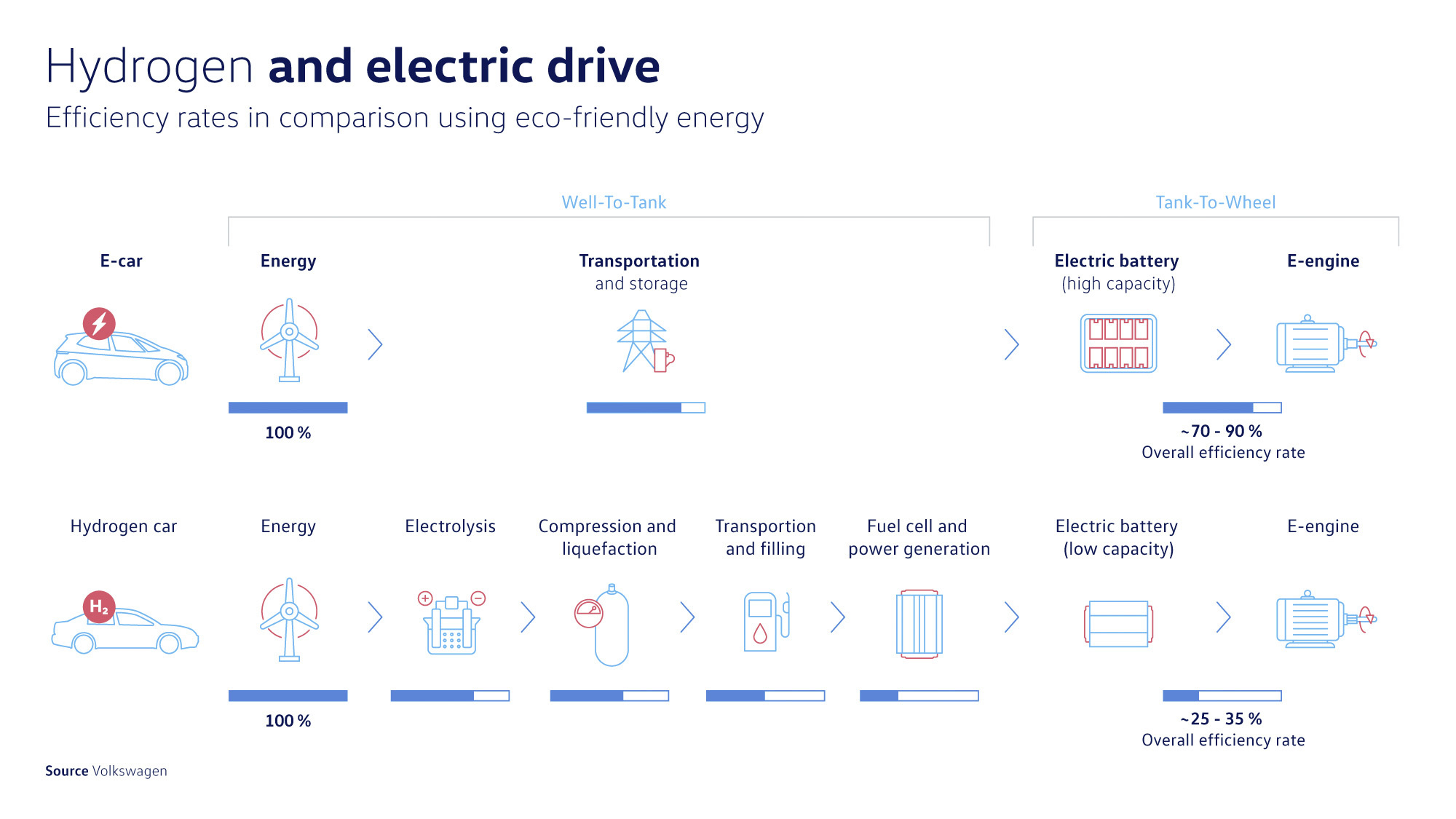

Battery Electric Vs Hydrogen Fuel Cell Buses The Economics Of European Public Transit

May 07, 2025

Battery Electric Vs Hydrogen Fuel Cell Buses The Economics Of European Public Transit

May 07, 2025 -

Capitals Ovechkin Reunites With Orlov In Miami Amidst 4 Nations Tournament

May 07, 2025

Capitals Ovechkin Reunites With Orlov In Miami Amidst 4 Nations Tournament

May 07, 2025 -

Impact De La Decentralisation Du Repechage Sur La Lnh

May 07, 2025

Impact De La Decentralisation Du Repechage Sur La Lnh

May 07, 2025 -

Atfaqyt Shhn Jdydt Byn Laram Walsyn Walmghrb Walbrazyl

May 07, 2025

Atfaqyt Shhn Jdydt Byn Laram Walsyn Walmghrb Walbrazyl

May 07, 2025