Partnership: Deutsche Bank Leverages FinaXai For Tokenized Fund Services

Table of Contents

finaXai's Technology and its Role in Tokenization

finaXai's core technology lies at the heart of this innovative partnership. Their platform leverages blockchain's distributed ledger technology to securely and efficiently tokenize fund assets. This process transforms traditional, illiquid assets into easily transferable digital tokens, representing fractional ownership. The advantages of utilizing finaXai's platform are numerous:

- Increased Efficiency: Automating processes such as issuance, transfer, and management of tokenized funds significantly streamlines operations and reduces manual intervention.

- Enhanced Transparency: The immutable nature of the blockchain provides unparalleled transparency, allowing investors to track assets and transactions with complete clarity.

- Cost Reduction: By automating processes and reducing intermediaries, tokenization significantly lowers transaction costs, ultimately benefiting both issuers and investors.

Specific features of finaXai's platform include:

- A secure and regulated tokenization platform, adhering to the highest industry standards.

- A streamlined process for the issuance and management of tokenized funds, minimizing complexities.

- Improved liquidity and accessibility for investors, enabling easier trading and fractional ownership.

- Seamless integration with Deutsche Bank's existing infrastructure, ensuring a smooth transition.

Benefits for Deutsche Bank and its Clients

This partnership significantly enhances Deutsche Bank's capabilities in the rapidly expanding digital asset space. By offering tokenized fund solutions, Deutsche Bank positions itself at the forefront of financial innovation. The benefits for Deutsche Bank's clients, particularly institutional investors, are substantial:

- Access to a wider range of investment opportunities: Tokenization opens doors to alternative asset classes previously inaccessible or difficult to manage.

- Improved investment efficiency and lower transaction costs: Automated processes and reduced intermediaries lead to significant cost savings and faster transaction times.

- Enhanced transparency and security: Blockchain’s inherent security and transparency provide increased confidence and accountability.

- Fractional ownership of alternative assets: Investors can gain exposure to high-value assets with smaller investments thanks to fractional ownership enabled by tokenization.

This strategic move solidifies Deutsche Bank's position as a leader in the evolving financial landscape, attracting new clients and strengthening its competitive advantage.

Impact on the Tokenized Fund Market

The Deutsche Bank and finaXai partnership will have a significant impact on the growth of the tokenized fund market. It signals a growing acceptance of blockchain technology and digital assets by major financial institutions, paving the way for broader adoption by institutional investors. This collaboration will:

- Increase the accessibility and liquidity of tokenized funds, making them more attractive to a wider range of investors.

- Drive innovation and accelerate the development of new tokenized fund products and services.

- Increase regulatory clarity and standardization within the tokenized fund space.

Addressing Challenges and Future Outlook

Despite the immense potential, the tokenized fund market faces challenges, including regulatory uncertainty and the need for increased market education. Deutsche Bank and finaXai will likely address these challenges through:

- Proactive engagement with regulators to establish clear guidelines and frameworks.

- Investment in educational resources to increase awareness and understanding of tokenized funds among investors.

- Continuous technological advancements to improve the platform’s security and efficiency.

The future of tokenized fund services is bright. The partnership between Deutsche Bank and finaXai is a significant step towards a more efficient, transparent, and accessible financial ecosystem. We can expect to see further innovations and wider adoption of this transformative technology in the years to come.

Deutsche Bank and finaXai: Shaping the Future of Tokenized Fund Services

The partnership between Deutsche Bank and finaXai represents a pivotal moment in the evolution of fund management. By leveraging finaXai's cutting-edge blockchain technology, Deutsche Bank offers its clients enhanced efficiency, transparency, and access to a wider range of investment opportunities in the realm of tokenized funds. This collaboration delivers significant benefits to both institutional investors and the broader financial industry, driving increased market liquidity and innovation. Learn more about how Deutsche Bank and finaXai are revolutionizing the world of tokenized fund services and access new investment opportunities today!

Featured Posts

-

Who Wins Paddy Pimbletts Prediction For Jones Vs Aspinall Heavyweight Fight

May 30, 2025

Who Wins Paddy Pimbletts Prediction For Jones Vs Aspinall Heavyweight Fight

May 30, 2025 -

Programma Tileoptikon Metadoseon Savvatoy 15 3

May 30, 2025

Programma Tileoptikon Metadoseon Savvatoy 15 3

May 30, 2025 -

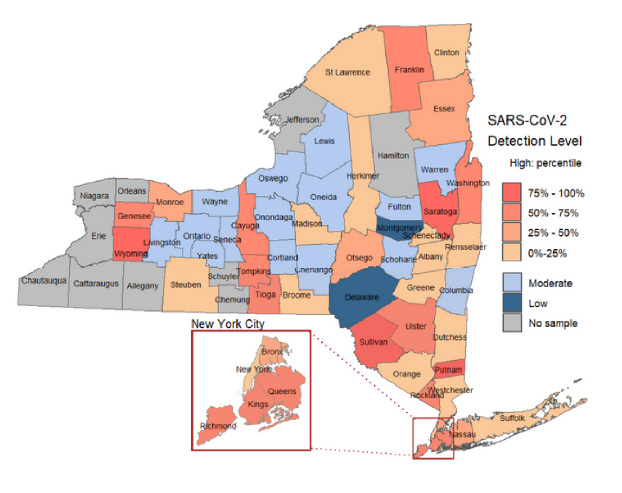

Confirmation Of Measles In Sacramento County Wastewater Health Department Response

May 30, 2025

Confirmation Of Measles In Sacramento County Wastewater Health Department Response

May 30, 2025 -

Persistent Measles Strategies For Effective Eradication

May 30, 2025

Persistent Measles Strategies For Effective Eradication

May 30, 2025 -

Optakt Til Fodboldkampen Danmark Mod Portugal

May 30, 2025

Optakt Til Fodboldkampen Danmark Mod Portugal

May 30, 2025