Personal Loan Interest Rates: Current Low Rates

Table of Contents

Keywords: Personal loan interest rates, low interest rates, personal loan rates, best personal loan rates, cheap personal loan, affordable personal loan, loan interest rates, current loan rates.

Securing a personal loan can be a smart financial move, whether for debt consolidation, home improvements, or unexpected expenses. But navigating the world of personal loan interest rates can feel overwhelming. With lenders offering varying rates, finding the best deal requires careful planning and research. This guide explores current low personal loan interest rates, empowering you to make informed decisions and secure the most affordable financing for your needs.

Understanding Personal Loan Interest Rates

Understanding the factors that influence personal loan interest rates is the first step towards securing a favorable loan. Several key elements determine the rate you'll receive.

Factors Influencing Interest Rates:

-

Credit Score: Your credit score is the most significant factor. Lenders use your FICO score (Fair Isaac Corporation score), a widely used credit scoring model, and your credit report to assess your creditworthiness. A higher credit score (typically 700 or above) demonstrates a history of responsible borrowing and significantly increases your chances of qualifying for lower personal loan interest rates. Conversely, a lower credit score usually results in higher rates or even loan denial.

-

Loan Amount: The amount you borrow also impacts the interest rate. While not always a direct correlation, larger loan amounts can sometimes lead to slightly higher interest rates, especially with some lenders. This is because larger loans present a higher risk to the lender.

-

Loan Term: The length of your loan term (the time you have to repay the loan) directly affects your monthly payments and the total interest you pay. Longer loan terms generally result in lower monthly payments but significantly higher total interest paid over the life of the loan. Shorter terms mean higher monthly payments but lower overall interest costs. Choosing the right term balances affordability with minimizing overall interest expense.

-

Debt-to-Income Ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, is a crucial indicator of your ability to manage debt. A lower DTI (typically below 43%) demonstrates better financial health and makes you a less risky borrower, potentially securing you a lower interest rate.

-

Lender Type: Different lenders offer different rates. Banks, credit unions, and online lenders each have their own lending criteria and rate structures. Banks often have a broader range of options, while credit unions frequently offer lower rates to their members. Online lenders often provide a streamlined application process but may have stricter requirements. Comparing rates across all three is essential.

-

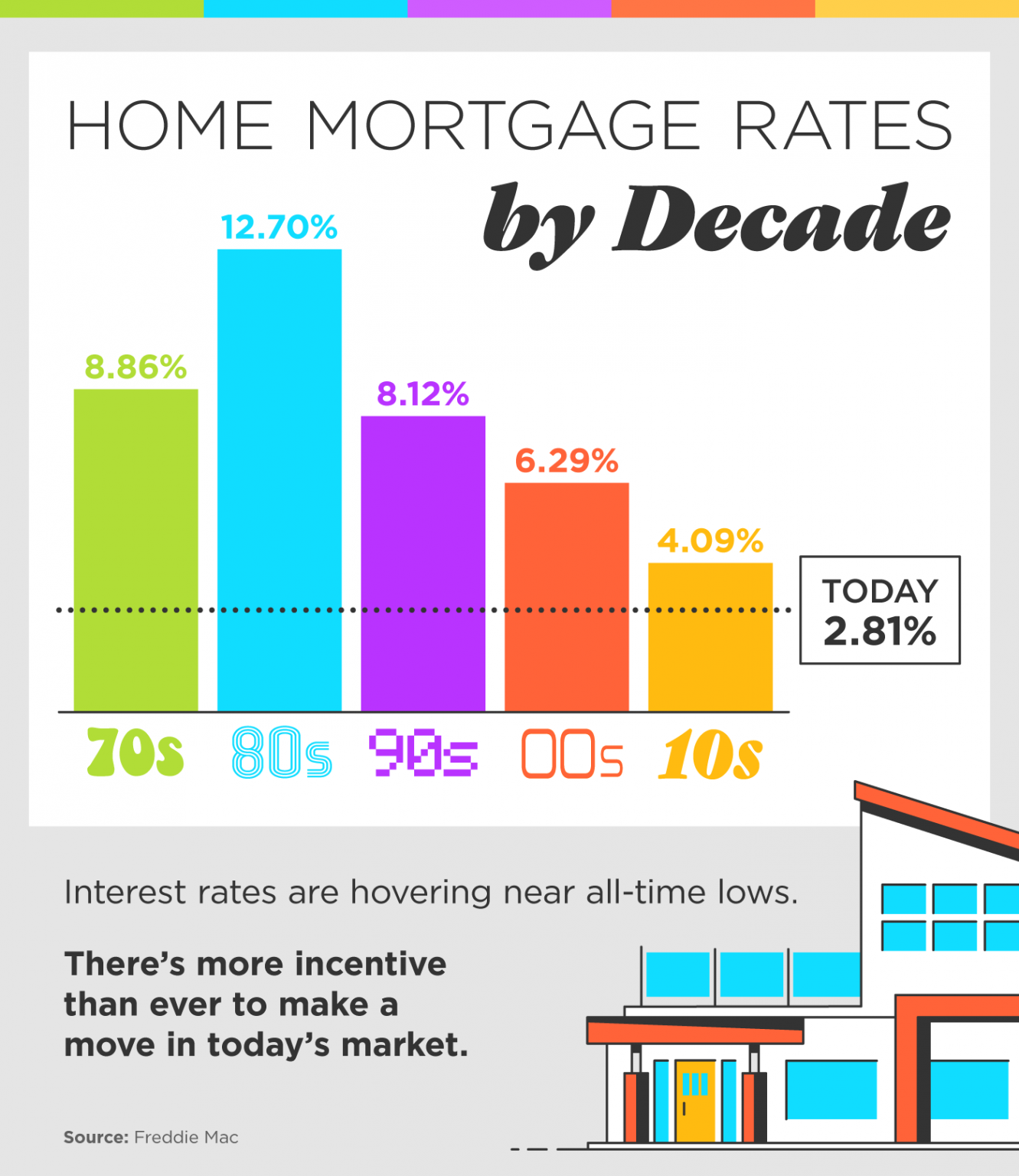

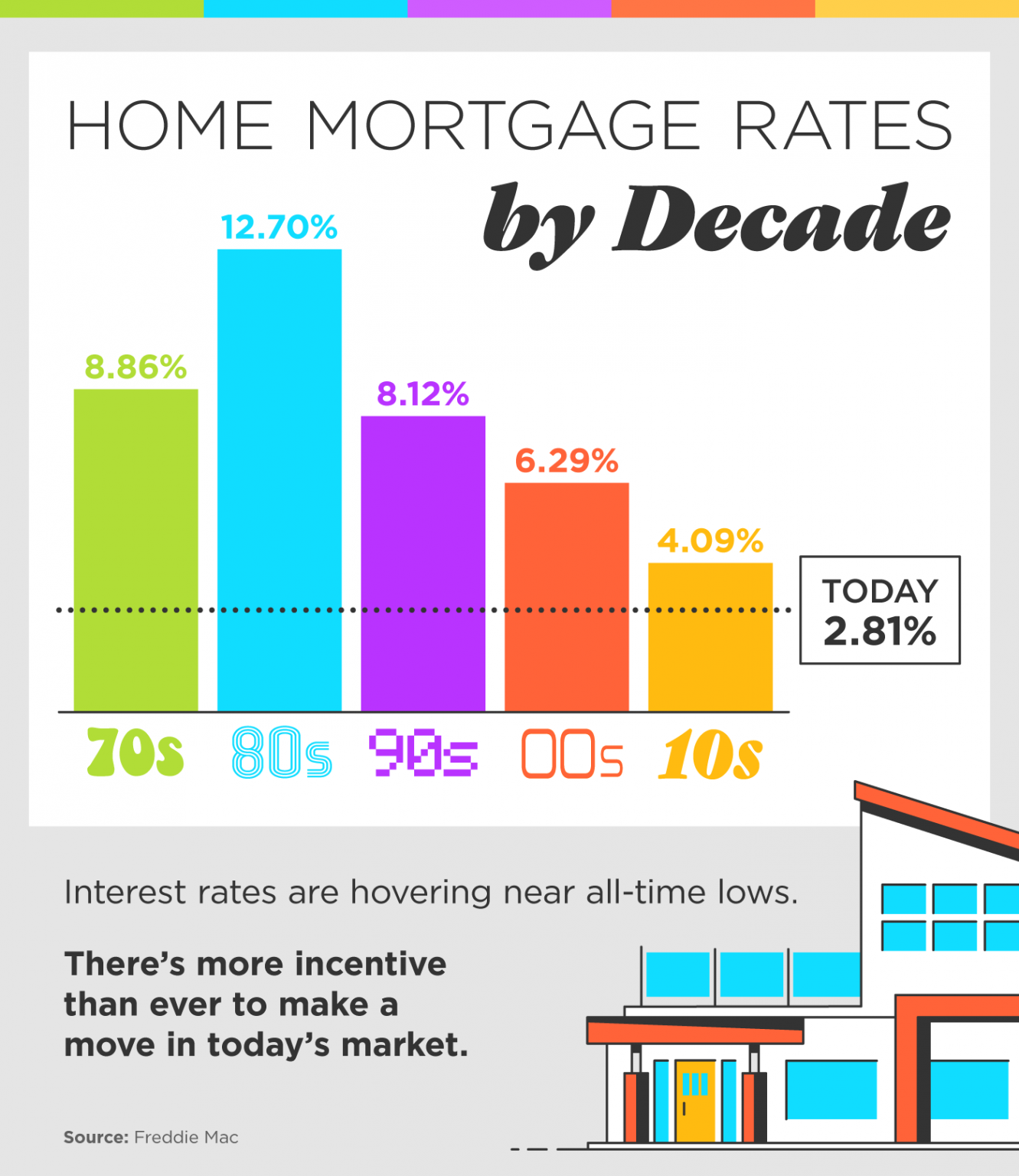

Current Economic Conditions: Prevailing interest rates in the broader economy significantly influence personal loan rates. When interest rates are generally low, personal loan rates tend to be lower as well, and vice versa. Keeping an eye on economic indicators can provide context for current loan rates.

How to Find the Best Personal Loan Rates:

-

Check your credit report: Review your credit report for any errors and work on improving your score before applying for a loan. A higher score translates directly to better loan rates.

-

Compare rates from multiple lenders: Use online comparison tools to easily compare offers from different banks, credit unions, and online lenders. Don't limit yourself to just one lender.

-

Shop around: Don't settle for the first offer you receive. Comparing rates from at least three to five different lenders ensures you're getting the best deal on your personal loan interest rates.

-

Consider pre-qualification: Pre-qualifying with several lenders allows you to see potential rates without impacting your credit score. This helps you narrow down your options before committing to a formal application.

-

Understand all fees: Pay attention to origination fees, late payment fees, and other associated charges to accurately compare the total cost of the loan.

-

Read the fine print: Before signing any loan agreement, carefully review all the terms and conditions to avoid unexpected surprises.

Current Trends in Personal Loan Interest Rates

Staying informed about current trends in personal loan interest rates is critical for securing the best possible deal.

Average Interest Rates:

Average personal loan interest rates vary significantly depending on creditworthiness and loan terms. As of [Insert Date], average rates generally range from [Insert Realistic Range, e.g., 6% to 25% APR] for borrowers with good to excellent credit. Those with less-than-perfect credit may face rates at the higher end of this range or even higher. (Source: [Cite a reputable source for interest rate data, such as a financial news website or consumer finance organization])

Recent Rate Changes:

[Discuss any recent increases or decreases in personal loan interest rates. Provide specific examples and sources. E.g., "In the last quarter, we've seen a slight decrease in average rates for borrowers with excellent credit due to [reason, e.g., decreased federal interest rates]."] (Source: [Cite your source]).

Predictions for Future Rates:

Predicting future personal loan interest rates with certainty is impossible. However, based on current economic indicators, [offer a cautious prediction, e.g., "a modest increase is anticipated in the coming months due to [reason, such as expected inflation]".] It's crucial to monitor interest rates continuously before applying for a loan.

Tips for Securing the Lowest Personal Loan Interest Rate

While you can't always control the market, you can significantly improve your chances of obtaining a low personal loan interest rate through proactive steps.

Improve Your Credit Score:

-

Pay bills on time: Timely payments consistently demonstrate responsible credit management and boost your credit score.

-

Keep credit utilization low: Maintaining a low credit utilization ratio (the percentage of available credit you're using) signifies better financial discipline. Aim for under 30%.

-

Avoid opening too many new accounts: Opening numerous accounts in a short period can negatively affect your credit score.

-

Monitor your credit report regularly: Review your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) annually to catch and correct any errors.

Negotiate with Lenders:

With a strong credit score and a solid financial profile, negotiating a lower interest rate is sometimes possible. Approach lenders with confidence and highlight your financial strength.

Consider a Shorter Loan Term:

While a shorter loan term leads to higher monthly payments, it significantly reduces the total interest you'll pay over the loan's life. Weigh the benefits of paying less overall versus the potential strain of higher monthly payments.

Conclusion:

Finding the best personal loan interest rates requires diligent research, careful planning, and smart comparison shopping. By understanding the influential factors, proactively improving your credit health, and thoroughly comparing lender offers, you can substantially lower your borrowing costs. Remember to compare current personal loan rates from various lenders and leverage any opportunities to negotiate. Don't delay – secure the lowest personal loan interest rate today and achieve your financial goals efficiently!

Featured Posts

-

Rainfall Changes In Western Massachusetts A Climate Change Perspective

May 28, 2025

Rainfall Changes In Western Massachusetts A Climate Change Perspective

May 28, 2025 -

Social Housing Rent Freeze Private Landlords Exempt

May 28, 2025

Social Housing Rent Freeze Private Landlords Exempt

May 28, 2025 -

How To Prevent And Treat Bali Belly During Your Trip To Bali

May 28, 2025

How To Prevent And Treat Bali Belly During Your Trip To Bali

May 28, 2025 -

Investigation Underway After Truck Explosion Propane Leak Suspected

May 28, 2025

Investigation Underway After Truck Explosion Propane Leak Suspected

May 28, 2025 -

Foinikiko Sxedio I Tainia Poy K Safniase Tis Kannes

May 28, 2025

Foinikiko Sxedio I Tainia Poy K Safniase Tis Kannes

May 28, 2025